Where Can I Find My Taxpayer Identification Number

The most important question you might ask yourself when starting your tax return may well be: What is my TIN, and where can I find it? The above sections should have clarified what a taxpayer identification number is, and in the following we will look at where to find it.

Your taxpayer identification number will either have been issued by the Social Security Administration or by the IRS this depends on what kind of TIN is required for your tax return . The SSA will issue social security numbers , and the IRS is responsible for issuing all other taxpayer identification numbers. Knowing this, youll look for the right document; theres no use looking for mail from the SSA when the number you really need came from the IRS. Your TIN may be found on a variety of documents, including tax returns and also any forms filed with the IRS. Your SSN will be found on a social security card issued by the Social Security Administration. But how do you even get issued these crucial numbers in the first place?

Where To Find Your Ssn

The SSN is your personal tax ID number. Generally, it’s used for tax and identification purposes, loan applications, background checks and more. You may also need this unique identifier to enroll in college or apply for Social Security benefits. Banks and other financial institutions may use it to check your credit history, notes Whitman College.

If you have a forgot tax ID number moment, simply check your Social Security card. Your SSN is listed above your name and has nine digits. In case you don’t find your SSN card, you may request a new one from the Social Security Administration. You can also find your SSN on bank account statements, tax returns, pay stubs and other financial documents. Another option is to ask your employer about it.

Non-resident aliens and other individuals without a Social Security Number are assigned an Individual Taxpayer Identification Number, or ITIN. Unlike the SSN, this nine-digit identifier is used for tax processing purposes only. If you lose or misplace your ITIN, check your tax returns or call the IRS at 800-829-1040 to ask for help.

How To Get A Tax Id Number For Your Business

If you need to learn how to get a tax ID number, there are several options. You can apply online through the Internal Revenue Service ;directly or a third-party service, or fax an application using Form SS-4. International applicants can apply by phone, but if you prefer to mail in an application, that is a slower;alternative.

Read Also: How Long Can You Wait To File Taxes

Finding Property Tax Id Numbers

If the ID number you need to find is for a property you own, you may already have the number in your files. Look on your last tax bill, the deed to your property, a title report or perhaps even on the appraisal report of your property to locate the property ID number. If you cant readily put your hands on any of this paperwork, or if the ID number you need to find is for a property you do not own, you have other search options.

Visit your local tax assessors website and search for the property by its address or, in some cases, the owners name. For some municipalities, you may also find this information on record at your courthouse. If youre unable to find the property ID number with these searches, call the tax assessors office for this information.

Minnesota Unemployment Insurance Employer Account Number

All business entities, other than sole proprietorships, single member limited liability companies, partnerships without employees or corporations and limited liability companies with no employees other than owner/officers with 25 percent or more ownership share, must register with the Department of Employment and Economic Development, Unemployment Insurance Program.

The Unemployment Insurance Program issues identification numbers that are different from those issued by the Minnesota Department of Revenue and the Internal Revenue Service. Register at Employers and Agents. Employers may contact the Unemployment Insurance Program at 651-296-6141, option 4. The UI Program requests that businesses not register for a UI Employer account number until wages have actually been paid.

You May Like: How To Pay Federal And State Taxes

Option : Call The Irs To Locate Your Ein

You should be able to track down your EIN by accessing one or more of the documents listed above; but if you’re still not having any luck, the IRS can help you with federal tax ID lookup. You can call the IRSs Business and Specialty Tax Line, and a representative will provide your EIN to you right over the phone. The Business and Specialty Tax Line is open Monday through Friday from 7 a.m. to 7 p.m. ET. This should be your last resort, however, because call wait times can sometimes be very long.

Before you call, keep in mind that the IRS needs to prove youre actually authorized to retrieve your business tax ID number. For example, youll need to prove you are a corporate officer, a sole proprietor, or a partner in a partnership. The IRS representative will ask you questions to confirm your identity.

Don’t get frustrated: This is simply a precaution to help protect your businesss sensitive data. After all you wouldn’t want the IRS to give out your social security number to anyone who called, would you?;Once you’ve found your business tax ID number, we suggest putting the number in a safe placelike a locked file cabinet or secure cloud storage so you won’t have to go through these steps again.

How To Find Your Lost Tax Id Number

Imagine you’re filling out a form when you suddenly realize that you forgot your tax ID number. First of all, don’t panic this kind of situation is more common than you think. Locating a forgotten or misplaced tax ID number is quite simple and should only take a few minutes. Chances are, you can find this information on previously filed tax returns, bank statements or pay stubs.

Tip

First, determine whether you need to find your Social Security Number , Employer Identification Number or Individual Taxpayer ID Number . Any of these numbers will be listed on your tax returns, but you may need to call the IRS or the Social Security Administration to ask for help.

Recommended Reading: How Do You File An Amendment To Your Tax Return

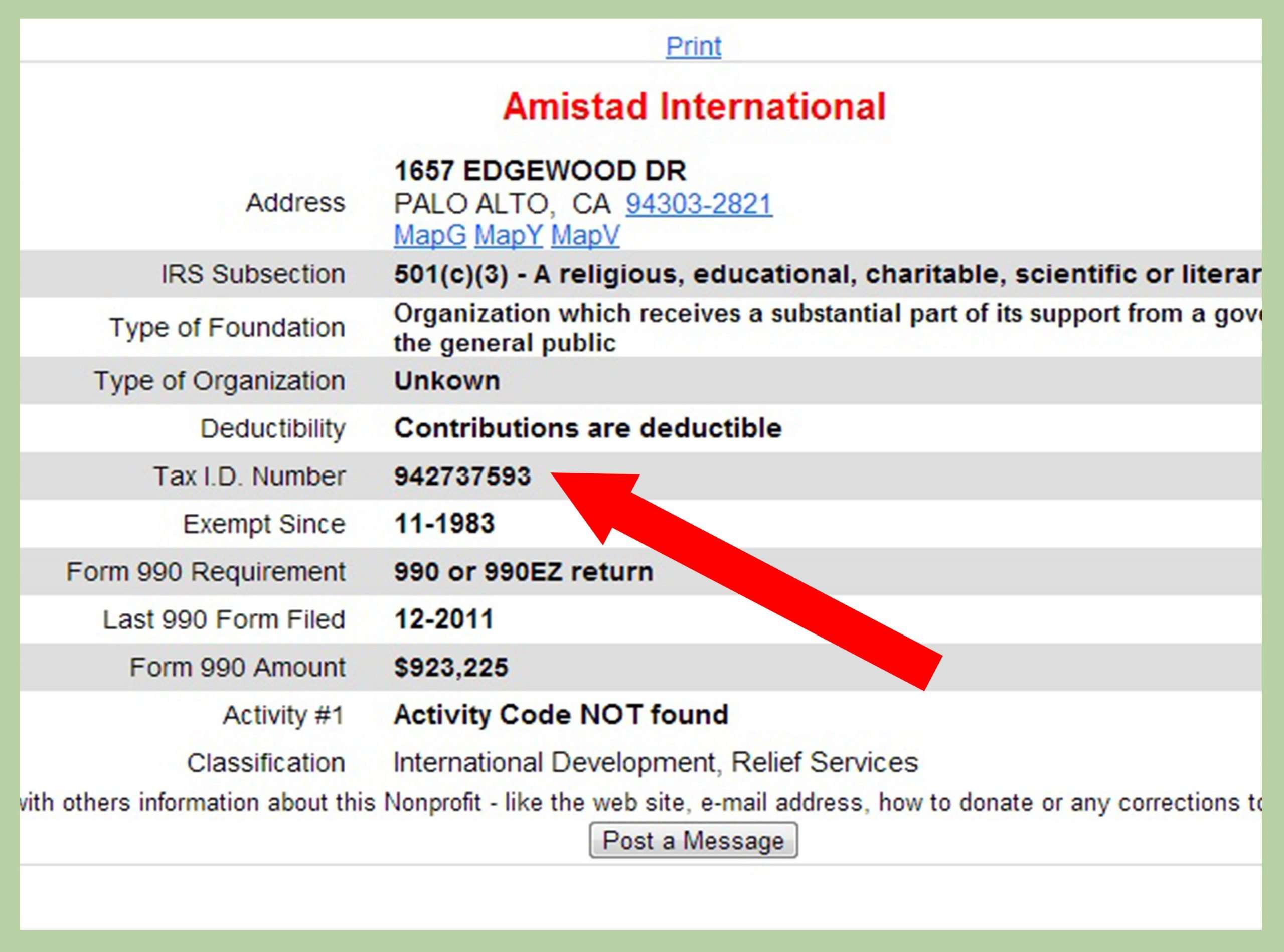

Use Melissa Database For Nonprofits

The Melissa Database provides free federal tax ID lookup for nonprofit organizations.

If you have a legitimate need to find the EIN for another business, then you can use one of these options to look up the number. Just be sure to keep your own EIN secure. Only share the number with a limited subset of peoplelenders, prospective suppliers, bankers, etc. You should guard your business’s EIN just like you would guard your social security number.

Electronic Data Gathering Analysis And Retrieval System

Using the Electronic Data Gathering, Analysis, and Retrieval System is the easiest way to search for a federal tax ID number.

Maintained by the SEC, the EDGAR system is a database that includes information about for-profit companies. This online service is completely free.

The EDGAR database includes several forms that may contain a business’s EIN, including the 8-K, 10-K, and 10-Q forms.

Before you start your EDGAR search, you should keep in mind that searching just the first few letters of a business’s name will provide you better results, as many businesses are not listed under their full names.

Don’t Miss: How Much Do I Get Back In Taxes

How To Get A Tax Id

You must register your address . Around 2 weeks later, you will get a tax ID by post1, 2. It will be a letter from the Bundeszentralamt für Steuern. It looks like this.

If you want your tax ID faster, go to the Finanzamt, and ask for it1, 2. You can do this a few days after you register your address. You don’t need an appointment.

If you are homeless, you can get a tax ID at your local Finanzamt.

Answer Five Short Questions

The first question requires you to select the type of EIN you are applying for such as a sole proprietorship, corporation, LLC, partnership or estate. You then need to choose the option that best describes why you are applying for an EIN. This can be to start a new business, for banking purposes or for a range of other reasons. The online questionnaire then requests your name and Social Security number before you can finish your application.

Also Check: When Can I Expect My Unemployment Tax Refund

Ein Lookup: How To Find Your Business Tax Id Number

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

This article has been reviewed by tax expert Erica Gellerman, CPA.

A business tax ID number, also called an employer identification number or federal tax ID, is a unique nine-digit number that identifies your business with the IRS. Owners of most types of business entities need a business tax ID number to file taxes, open a business bank account, obtain a business license, or apply for a business loan.

Most people know their social security number by heart, but not all business owners know their business tax ID number. Your EIN isn’t something that you use on a day-to-day basis, so keeping this number top of mind isn’t as easy as;remembering your company’s phone number or address.

However, your EIN is essential for some very important business transactions, like filing business taxes and obtaining small business loans. Accuracy and speed matter in those situations. Not having your business tax ID can prevent you from getting crucial funding for your business or meeting a business tax deadline.

How to find your business tax ID number:

Check your EIN confirmation letter

Check other places your EIN could be recorded

Federal Employer Identification Number

Sole proprietors who do not have employees, who are not required to file information returns, who do not have a retirement plan for themselves, and who are not required to pay federal excise taxes in connection with their business generally may use their social security number as their federal employer identification number ). Single-member limited liability companies that have elected to be taxed as a sole proprietorship may follow that rule, too.

All other business entities are required to obtain a federal employer identification number by filing Form SS-4 with the Internal Revenue Service. Note also that an independent contractor doing commercial or residential building construction or improvements in the public or private sector is considered to be, for workers compensation purposes, an employee of any person or entity for whom or which that independent contractor performs services unless, among other things, that independent contractor has a federal employer identification number.

Form SS-4 may be obtained from the Internal Revenue Service by calling the IRS at the telephone number listed in the Resource Directory section of this Guide. The form and instructions can also be printed directly from the IRS website at Forms and Publications, go to Forms, Instructions & Publications.

To obtain a federal employer identification number from the Internal Revenue Service :

You May Like: How To Pay Taxes For Free

Finding An Individual Tax Id

Though there are pros and cons to doing it, if you have a Social Security number, you can use that as your tax ID, even in business. If you work for someone else as an employee, you get a W-2 no later than Jan. 31 of each year, and the SSN is;there at the top. If you need a copy of a form from a previous year, you can get it from the employer who issued it. Employers must keep these for at least four years after you leave the company.;Your tax return, like the;1040, the 1040A, or the 1040EZ;lists your SSN at the top of the first page.

If you don’t have a Social Security number, but you have filed taxes in the past, you may have used an Individual Tax Identification Number on the forms in the space where the SSN usually goes. That number is valid if used in 2013 or later unless the IRS has notified you that you need to renew. If you do need to renew, use form W-7 to ask for a new ITIN. That process takes about seven weeks. If you have a valid ITIN, but you cannot find it, call 1-800-908-9982 from within the United States for help.

If you lose your Social Security card, you can apply for a new one online if you have a driver’s license or another form of state identification. You can also fill out a paper form and turn it in to the local Social Security Administration office; you’ll need to take your birth certificate and a photo ID.

When Does A Sole Proprietorship Need An Ein

A sole proprietor normally uses their own personal social security number for their business but even they must obtain an EIN to hire employees or files excise taxes. Learn more in our Does a Sole Proprietor Need an EIN guide.

Single-member LLCs should also generally obtain an EIN number and operate using their EIN number in order to maintain their corporate veil.

You May Like: Where To Find Real Estate Taxes Paid

Individual Taxpayer Identification Number

The IRS issues the Individual Taxpayer Identification Number to certain nonresident and resident aliens, their spouses, and their dependents when ineligible for SSNs. Arranged in the same format as an SSN , the ITIN begins with a 9. To get an individual tax id number, the applicant must complete Form W-7 and submit documents supporting his or her resident status. Certain agenciesincluding colleges, banks, and accounting firmsoften help applicants obtain their ITIN.

Understanding The Tax Identification Number

A tax identification number is a unique set of numbers that identifies individuals, corporations, and other entities such as nonprofit organizations . Each person or entity must apply for a TIN. Once approved, the assigning agency assigns the applicant a special number.

The TIN, which is also called a taxpayer identification number, is mandatory for anyone filing annual tax returns with the IRS, which the agency uses to track taxpayers. Filers must include the number of tax-related documents and when claiming benefits or services from the government.

TINs are also required for other purposes:

- For credit: Banks and other lenders require Social Security numbers on applications for credit. This information is then relayed to the to ensure the right person is filling out the application. The also use TINsnotably SSNsto report and track an individual’s .

- For employment: Employers require an SSN from anyone applying for employment. This is to ensure that the individual is authorized to work in the United States. Employers verify the numbers with the issuing agency.

- For state agencies: Businesses also require state identification numbers for tax purposes in order to file with their state tax agencies. State taxing authorities issue the I.D. number directly to the filer.

Read Also: Will I Get Any Money Back From My Taxes

Your Companys Ein And Business Identity Theft Issues

Its easy for someone to get your business EIN, and they might be able to use it to steal your business identity. The IRS recognizes that a companys EIN may be the target of hackers and identity thieves. It suggests some ways to be watchful for identity theft related to taxes. Your business may have been hacked if:

- You receive tax notices about fictitious employees

- Your business tax return is accepted, but you havent file for that year yet

- You receive bills for a line of credit or a credit card that you dont have

The best way to check for business identity theft is to get a copy of your business credit report. Check it in detail for unexplained creditors and inaccurate or out-of-date information.

Can I Look Up A Business Ein Number

Unfortunately, no. The only way to obtain your Tax ID number is from your accountant or from/on certain documentation you have for your business such as your tax return, SS4 letter, EIN confirmation letter, or 1099.

If you dont have access to any of that, youll need to contact the IRS directly, who can provide you an EIN number as well as send you a copy of your SS4 letter.

Recommended Reading: How To File 2 Different State Taxes

Check Anywhere Your Ein Could Be Recorded

Doing a tax ID or EIN lookup should be simple since it should be stamped all over your documents. First, check to see if you received an email or physical letter from the IRS confirming your EIN when you first applied.

Second, check your prior tax returns, loan applications, permits or any documents that your EIN would’ve been printed on. Assuming this isn’t the first time that you’ve had to use your EIN, it should be on most official government forms youve filled out. If you have a hard time finding your documents, it could be time to organize them.

If you used your EIN to open a business bank account or apply for state or local licenses, the IRS suggests contacting your bank or government agency to find EIN on your account. Performing a tax ID or EIN lookup isnt difficult; you dont need to hire a service to find your EIN on your behalf.