State Taxes On Capital Gains

Some states also levy taxes on capital gains. Most states tax capital gains according to the same tax rates they use for regular income. So, if you’re lucky enough to live somewhere with no state income tax, you won’t have to worry about capital gains taxes at the state level.

New Hampshire and Tennessee don’t tax income but do tax dividends and interest. The usual high-income tax suspects have high taxes on capital gains, too. A good capital gains calculator, like ours, takes both federal and state taxation into account.

What Converting A Percent To A Decimal Means

The percent symbol is used to tell you something about the number it sits beside. Percent means parts per hundred. So if a percent sign sits beside a 6, it really means 6 parts per 100. You dont need to know this to calculate sales tax but it might help you to understand why you need to convert the percent to a decimal to begin with. 6% tells us that we need to multiply our item price by 6 pieces of a hundred .

Do you remember what the decimal places mean? The first decimal place is the tenths place and the second is the hundredths place. This is why when we convert our percent we have to move two place.

How To Determine The Tax Percentage In Your Paycheck

The simple question, “How much are you paying in taxes?” doesn’t have a simple answer. Your paycheck includes a variety of deductions for federal and state taxes and perhaps local taxes as well. It also includes deductions that may not be clearly labeled as taxes. You must identify all the tax deductions on your paycheck to calculate the percentage of taxes you pay.

Review a copy of your pay stub or earnings statement, and locate the itemized list of amounts deducted from your gross salary.

Add the deductions listed as tax. These are likely to include an item for federal tax and state tax and may list other taxes, such as county or city tax.

Add other listed deductions that you identify as tax payments, such as Medicare and Social Security . Social Security and Medicare combined payments are sometimes listed as FICA.

Add up all your tax payments and divide this amount by your gross pay to determine the percentage of tax you pay. For example, if your gross pay is $4,000 and your total tax payments are $1,250, then your percentage tax is 1,250 divided by 4,000, or 31.25 percent.

Tips

-

There is no standard language for how items are listed on a pay stub or earnings statement. Check with your payroll office if you are uncertain about a given item.

References

Don’t Miss: Do I Pay Taxes On Stimulus Check

Capital Gains Taxes On Property

If you own a home, you may be wondering how the government taxes profits from home sales. As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller’s basis.

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains. When you sell your primary residence, $250,000 of capital gains are exempted from capital gains taxation. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale.

If you inherit a home, you don’t get the $250,000 exemption unless you’ve owned the house for at least two years as your primary residence. But you can still get a break if you don’t meet that criteria. When you inherit a home you get a “step up in basis.”

Nice, right? Stepped-up basis is somewhat controversial and might not be around forever. As always, the more valuable your family’s estate, the more it pays to consult a professional tax adviser who can work with you on minimizing taxes if that’s your goal.

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

Read Also: Is Doordash Worth It After Taxes

How To Stay In A Lower Tax Bracket

You can reduce your tax bill with tax deductions and tax credits. Another way to reduce your taxable income, and thus stay in a lower tax bracket, is with pre-tax deductions.

A pre-tax deduction is money your employer deducts from your wages before withholding money for income and payroll taxes. Some common deductions are:

- Contributions to a 401 plan

- Contributions to a Flexible Spending Account

Returning to the example above, lets say you decide to participate in your employers 401 plan and contribute $1,500 per year to your account. Now, your taxable income is $39,000 contribution + $1,700 in other income $12,500 standard deduction). You remain in the 12% tax bracket while saving for retirement. Its a win-win.

For 2020, you can contribute up to $19,500 to a 401 plan. If youre age 50 or above, you can contribute an additional $6,500 in catch-up contributions, for a total of $26,000.;In 2021, the contribution limit will remain at $19,500, or $26,000 if youre age 50 or older.

If youre self-employed or dont have access to a 401 plan at work, you can still reduce your taxable income while saving for retirement by contributing to a Traditional IRA or through a broker or robo-advisor like SoFi Invest. These contributions reduce your AGI because they are above-the-line deductions .

For 2020, you can contribute up to $6,000 to a Traditional IRA . The contribution limits are the same for 2021.

Significance Of Effective Tax Rate

Effective tax rate is one ratio that investors use as a profitability indicator for a company. This amount can fluctuate, sometimes dramatically, from year to year. However, it can be difficult to immediately identify why an effective tax rate jumps or drops. For instance, it could be that a company is engaging in asset accounting manipulation to reduce its tax burden, rather than a managerial or process change reflecting operational improvements.

Also,;keep in mind that companies often prepare two different financial statements; one is used for reporting, such as the income statement. The other is used for tax purposes. Expenses that are allowed as deductions or for tax purposes may cause variances in these two documents. If a company is effectively utilizing tax deductions and credits, then its effective tax rate will be lower than a company that is not effectively using these strategies.

Recommended Reading: Can You File Missouri State Taxes Online

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

How To Calculate Sales Taxes From Receipt Totals

Related

Anyone whos been shopping in the United States knows that the price on an item isnt always the total amount you have to pay. Most states have their own sales tax, which can vary from state to state, and sometimes between cities and counties as well. If youre traveling, it can be hard to predict how much things will cost from at each destination. For businesses, its necessary to keep track of sales tax charged, because you’re responsible for the collection and remittance of these taxes.

Don’t Miss: When Was Income Tax Started

Add 100 Percent To The Tax Rate

Add 100 percent to the sales tax rate. The 100 percent represents the whole, entire pre-tax price of the item in question; when you add it to the tax rate, you get a total percentage that represents the pre-tax price plus the tax. So if the sales tax in your area is 8 percent, you have:

100 + 8 = 108 percent

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000, but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Read Also: How Do I Paper File My Taxes

How Do You Find Out The Percentage

1. How to calculate percentage of a number. Use the percentage formula: P% * X = Y

Capital Gains Tax Calculation

Total Capital GainTotal Capital GainTaxable Capital GainTaxable Capital GainCapital Gain Tax

Olivia is a student living in Ontario and her taxable income for 2019 is $30,000. She bought stocks at the beginning of 2019 using $100,000 of inheritance and sold these stocks at the end of the year for $107,020. How much does Olivia pay in capital gains tax?

Oliviaâs trading fees were $20, so her proceeds of disposition less outlays and expenses is $107,000. Oliviaâs total capital gain is $7,000. Since the inclusion rate is 50%, her taxable capital gain is $3,500. This would bring her to a taxable income of $33,500. Olivia is in the lowest income tax bracket, so she will pay 15% in federal income tax and 5.05% in provincial income tax for a total of 20.05% as her income tax rate. Therefore, her capital gain tax will be $702.

Don’t Miss: Are Property Taxes Paid In Advance

States Without Sales Tax

Most states within the United States charge a sales tax. However, there are a few exceptions. For instance, Alaska, Delaware, Montana, New Hampshire and Oregon all do not charge a sales tax. Also, state laws can change at any time, so it’s possible that your state either no longer charges a sales tax or has implemented one. The best thing to do is to examine the current state sales tax rate in your area and to stay up to date on any changes.

Things Worth Remembering If You Havent Filed 2020 Taxes

Some items and notes for those who havent filed taxes on income they earned or received in 2020:

- The tax filing deadline has been moved from April 15 to May 15, 2021. The deadline extension only applies to federal taxes.

- Income from stimulus checks is not taxable.

- Income for the first $10,200 of unemployment compensation is not taxable for people whose modified adjusted gross income is less than $150,000. Unemployment compensation over $10,200 is taxable.

- The penalties and fines that normally accompany taxes filed late, will not be applied as long as you meet the May 17 deadline.

- You can ask the IRS for a filing extension to Oct. 15 by filing form 4868 before May 17.

- Even if you receive an extension, you still must pay taxes owed by May 17.

Don’t Miss: When Are Delaware State Taxes Due

Choose Your Calculation Method

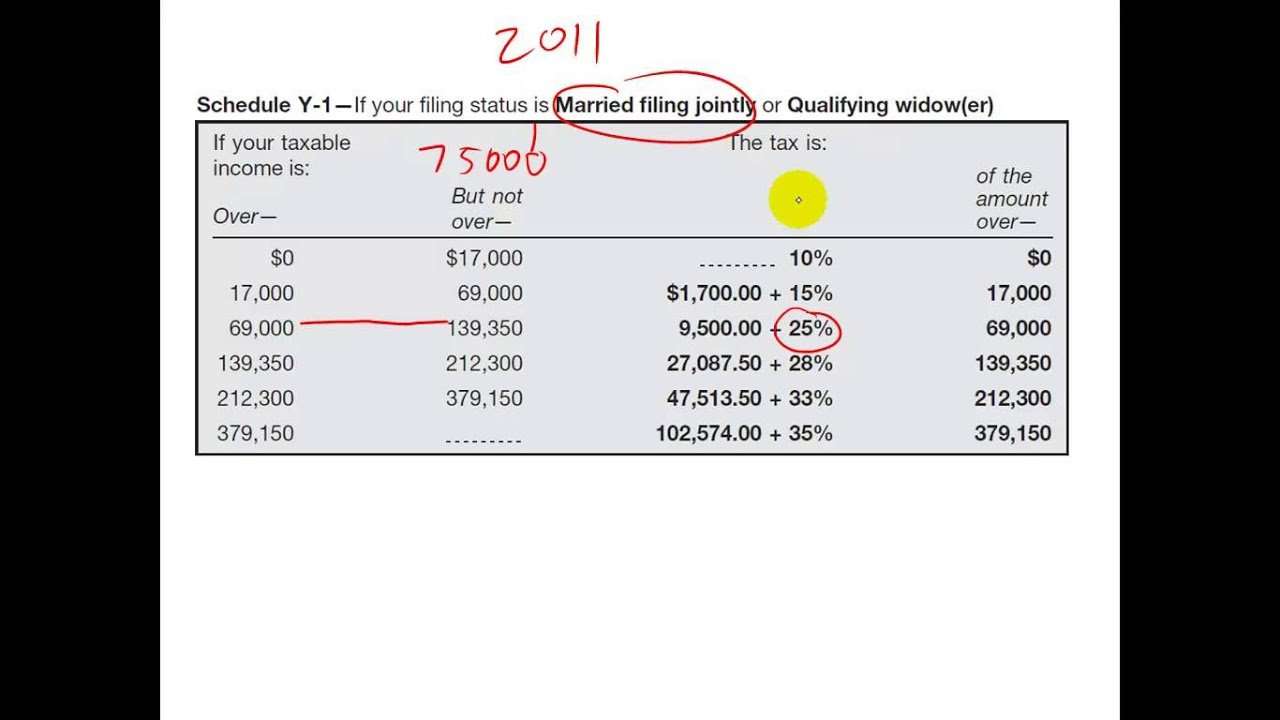

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

- The Wage Bracket Method: The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.;

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

Earned Vs Unearned Income

Why the difference between the regular income tax and the tax on long-term capital gains at the federal level? It comes down to the difference between earned and unearned income. In the eyes of the IRS, these two forms of income are different and deserve different tax treatment.

Earned income is what you make from your job. Whether you own your own business or work part-time at the coffee shop down the street, the money you make is earned income.

Unearned income comes from interest, dividends and capital gains. It’s money that you make from other money. Even if you’re actively day trading on your laptop, the income you make from your investments is considered passive. So in this case, “unearned” doesn’t mean you don’t deserve that money. It simply denotes that you earned it in a different way than through a typical salary.

The question of how to tax unearned income has become a political issue. Some say it should be taxed at a rate higher than the earned income tax rate, because it is money that people make without working, not from the sweat of their brow. Others think the rate should be even lower than it is, so as to encourage the investment that helps drive the economy.

Don’t Miss: Who Can I Call About My Tax Refund

Net Investment Income Tax

Under certain circumstances, the net investment income tax, or NIIT, can affect income you receive from your investments. While it mostly applies to individuals, this tax can also be levied on the income of estates and trusts. The NIIT is levied on the lesser of your net investment income and the amount by which your modified adjusted gross income is higher than the NIIT thresholds set by the IRS. These thresholds are based on your tax filing status, and they go as follows:

- Single: $200,000

- Qualifying widow with dependent child: $250,000

- Head of household: $200,000

The NIIT tax rate is 3.8%. The tax only applies for U.S. citizens and resident aliens, so nonresident aliens are not required to pay it. According to the IRS, net investment income includes interest, dividends, capital gains, rental income, royalty income, non-qualified annuities, income from businesses that are involved in the trading of financial instruments or commodities and income from businesses that are passive to the taxpayer.

Exemptions From Sales Tax

Most states do not charge sales taxes on items sold by or to charitable organizations. Schools, churches and wholesalers often also enjoy this tax break. If you believe that your purchase or sales may fall within one of the tax exempt categories, contact your local tax agency. Your state, county and city tax authority will explain the specific provisions that an item must comply with to avoid sales tax.

You May Like: How To Find Out Your Tax Rate

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee choose to claim, the less federal tax their employer deducted from their pay.;

Withholding allowances are no longer used on the 2020 W-4 form.

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe; they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Recommended Reading: How To Pay Taxes For Free