Ive Been Offering Short

If youre already operating a short-term rental but youre not collecting short-term rental taxes, you may be in violation of Missouri tax laws. Take the time to review your legal responsibility and understand the risk of continuing to not collect tax.

Short-term rental hosts in Missouri may be able to take advantage of a voluntary disclosure agreement . A VDA offers an opportunity for hosts to proactively disclose prior period tax liabilities in accordance with a binding agreement with the Missouri Department of Revenue. VDAs are offered to encourage cooperation with state tax laws and may result in some or all penalty and interest payments being waived.

Taxes And Your Benefit

PSRS benefits are subject to federal income taxes, and Missouri income taxes if you live in Missouri. We cannot advise you on whether you should have taxes withheld. However, if your tax withholding is not sufficient to meet your tax liability, you may be subject to penalties and interest in addition to your tax obligation.

PSRS/PEERS employees do not offer tax advice. The following information is provided as a reference only. It is recommended that you speak with your tax professional or the Missouri Department of Revenue for tax advice.;

How To Collect Sales Tax In Missouri

If the seller has an in-state location in the state of Missouri, they are legally required to collect sales tax at the tax rate of the area where the seller’s business is located, as Missouri is an origin based sales tax state.If the seller’s location is out of state, then the collection of sales tax gets a bit more difficult. In this case, the seller who has sales tax nexus within the state, is required to collect sales tax at the sales tax rate of the buyer’s location.

Recommended Reading: What Can I Write Off On My Taxes For Instacart

Online Banking & Bill Payment Services

You may be able to pay your taxes through your financial institution’s online bill pay system. Contact your bank to obtain more details on online banking or other bill payment services.

The collector’s office recommends scheduling your payment to be made to our office no later than the 20th day of the month. For payments due December 31, please ensure that your payment will reach our office by December 20.

- Payments not received in our office by December 31 may be subject to applicable late penalties and fees.

- Late penalties and fees will continue to accrue on the first day of each month of delinquency.

Please remit separate payments if you are paying multiple bills through online banking or a bill pay provider.

- Please use Boone County Collector as the Payee/Biller.

- If paying your personal property tax bill, please enter your owner number as the account number.

- If paying your real estate, neighborhood improvement district, community improvement district or levee district tax bill, please enter your parcel number as the account number.

- If you use your bill number as the account number, be sure to enter it exactly as it is shown on your bill. Please update the number to reflect the current bill you are paying.

Payments with postmarks after will be assessed applicable penalties and fees.

It should be noted that not all types of postage are postmarked or canceled by the U.S. Postal Service and the piece may not be postmarked on the same day it was deposited.

Registering With Tax Authorities

Before you can begin collecting taxes on your short-term rental in Missouri, youre legally required to register with the Missouri Department of Revenue. You can register online, and once youve registered, youll receive a sales tax license as well as instructions on filing your lodging taxes.

Depending on your jurisdiction, you may be required to register with your local tax authority and file local lodging tax returns in addition to state registration and filing

Also Check: Where Can I Find My Property Tax Bill

What Is Missouri State Tax

State tax is a tax levied by the state on your income earned within the state or as a resident of Missouri. State income taxes, which vary by state, are a percentage you pay to the state government based on income received within a tax year.

Similar to federal taxes, state income taxes are self-assessed. Yet, the structure of the taxes is different from state to state. In fact, some states have a flat tax rate, marginal tax rate, or no tax at all.

How You Can Affect Your Missouri Paycheck

If you always find yourself facing a big bill during tax season, one option is to have your employer withhold a dollar amount from each of your paychecks. Simply decide on an amount, such as $50, and write that amount on a new W-4. It might not sound enticing to get smaller paychecks all year, but youll be happy you did when you dont have to pay a big bill in April.

If you are comfortable with receiving a smaller paycheck throughout the year, you may want to contribute more of your money to retirement accounts or medical spending accounts. For example, you can increase contributions to a 401 or 403 account if your employer offers them. And if you do contribute to one of these accounts, try to put in enough to at least get any employer matches. In addition to saving money for the future, putting money into these tax-advantaged accounts will actually help you save on taxes. Money you put into these retirement accounts is deducted from your paycheck prior to taxes, so you are actually lowering your taxable income by stashing money there. Furthermore, your money grows tax-free in a 401 until you withdraw it in retirement.

Any contributions you make to a health savings account or flexible spending account are also pre-tax. Just keep in mind that only $500 will roll over in an FSA from one year to the next. If you have more than $500 left in your FSA at the end of the year, you will lose it.

Don’t Miss: Where Can I Find My Real Estate Taxes

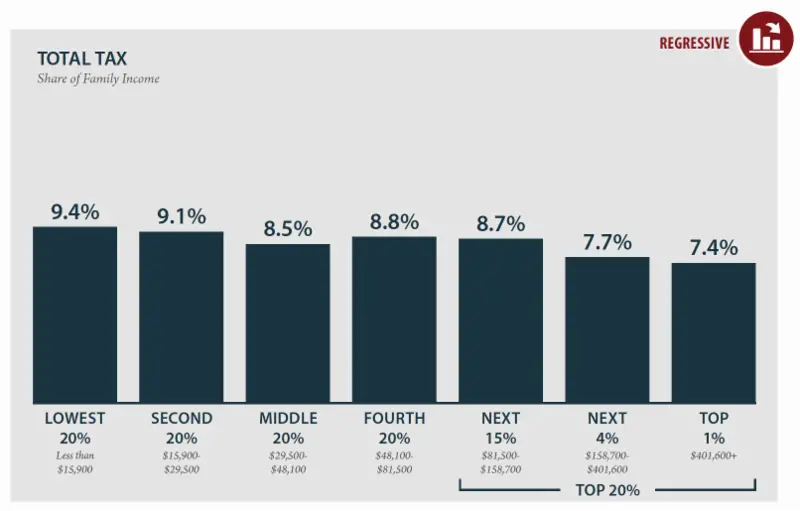

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Can You Pay Missouri State Taxes In Installments

The Missouri state tax payment plan is referred to as the states Internet Installment Agreement program. This program allows you to pay what you owe using digital payments. Any taxpayer who enters into an installment agreement in Missouri should be aware that the program does charge interest. Your interest will be calculated using the states current interest rate. Your personal rate may fluctuate by year. Payment plans last for 36 months.

Read Also: How To Pay Llc Taxes

Changing Your Tax Withholding

You can change your federal or Missouri tax withholding any time by logging into;Web Member Services;or by using the;PSRS Monthly Tax Withholding Authorization;form.

If you need tax advice, contact a tax professional, the IRS at 829-1040 or the Missouri Department of Revenue at 751-3505, or email;.

IRS Form 1099-R

As a benefit recipient, you receive an IRS Form 1099-R from PSRS each January showing the total benefits paid to you during the previous calendar year, the taxable portion, and the amounts withheld. You will need this form when you prepare your income taxes. To view a history of your past 1099-R forms,;log in.

Get Help With Your Taxes In

You need to make an appointment to visit a Taxpayer Assistance Center .

To make an appointment:

Note: In order to receive services, you will be asked to provide a current government-issued photo identification and a Taxpayer Identification Number, such as a Social Security number.

Caution: Many of our offices are in Federal Office Buildings. These buildings may not allow cell phones with cameras.

Virtual Assistance provides a safe, secure environment for taxpayers to get service in a face-to-face setting without visiting a traditional TAC. Virtual assistance involves taxpayers interacting with live assistors located in a different geographic location via an IRS computer. This method of face-to-face service is now available at selected IRS partner locations.

You May Like: Where Can I Get Taxes Done For Free

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

Missouri taxes vehicle purchases after rebates or incentives are applied to the price, which means that the buyer in this scenario will only pay taxes on the vehicle as if it cost $9,000.

What Kind Of Tax Will You Owe On Missouri Business Income

By David M. Steingold, Contributing Author

Most states tax at least some types of business income derived from the state. As a rule, the details of how income from a specific business is taxed depend in part on the business’s legal form. In most states corporations are subject to a corporate income tax, while income from pass-through entities such as S corporations, limited liability companies , partnerships, and sole proprietorships is subject to a state’s tax on personal income. Tax rates for both corporate income and personal income vary widely among states. Corporate rates, which most often are flat regardless of the amount of income, generally range from roughly 4% to 10%. Personal rates, which generally vary depending on the amount of income, can range from 0% to around 9% or more in some states.

Currently, six states Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming do not have a corporate income tax. However, four of those states Nevada, Ohio, Texas, and Washington do have some form of gross receipts tax on corporations. Moreover, five of those states Nevada, South Dakota, Texas, Washington, and Wyoming as well as Alaska and Florida currently have no personal income tax. Individuals in New Hampshire and Tennessee are only taxed on interest and dividend income.

Here’s a brief look at additional details for five of the most common forms of Missouri business: corporations , S corporations, LLCs, partnerships, and sole proprietorships.

Also Check: How Much Tax Do You Have To Pay On Stocks

States With Reciprocal Tax Agreements

What if you live in Milwaukee but you commute every day by Amtrak to Chicago? It just so happens that Wisconsin and Illinois share what is known as a reciprocal tax agreement. Reciprocal agreements allow residents of one state to work in neighboring states without having to file nonresident state tax returns in the state where they work. As a result, your employer would deduct only Wisconsin state taxes from your paycheck, and none for Illinois. Likewise, if you live in Chicago but work in Wisconsin, your employer would only deduct Illinois resident state income taxes from your paycheck. In both instances, you would only be required to file one state income tax return.

Overview Of Missouri Taxes

Missouri has a progressive income tax. There is a statewide sales tax, as well as additional county and city rates. The average effective property tax rate in Missouri is slightly below the national average.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2020 – 2021 filing season.

Read Also: Do You Have To Pay Taxes On Plasma Donations

What Charges Are Taxable

In Missouri, all charges for rooms, meals, and drinks provided as part of the accommodations are taxable. This includes items such as cleaning fees, pet fees, rollaway bed fees, extra person fees, etc. Fees that are refundable, such as damage deposits, are generally not subject to lodging taxes unless the host keeps the deposit.

Additional Tax Payment Website Information

All information provided by this online internet resource is subject to verification by the St. Charles County Collector of Revenues Office. To allow for processing and reconciliation of the previous months payments, online payment services will not be available from 12:01 a.m. on the first day of each month until the third business day. Please allow 5-10 business days for the processing of the payment and the mailing of the paid tax receipt needed for license plate renewal.

You May Like: Are Property Taxes Paid In Advance

Pay Individual Income Taxes Online

If you are a registered MyTax Missouri user please log on to make payments for your Individual Income Taxes.

Note: You will only need to provide your contact information once by signing up for a MyTax Missouri account and you have the option to save your payment information. To register for MyTax Missouri, proceed to Register for MyTax Missouri.

If you are not a registered MyTax Missouri user you can use the links below to make estimated, balance due, or bill payments for your Individual Income Tax debts by electronic check, if you would like to pay by credit card please click here.

This system is available to all personal income tax users and does not require a separate registration. There are, however, additional charges or convenience fees that may apply. Additional technical notes are available.

Payments submitted on this site are made to the Missouri Department of Revenue for state taxes only. Submitting a transaction from this site does not generate a payment for any city, local, or county property or other taxes.

What Happens When My Short

Before collecting any short-term rental taxes from your guests, you need to be aware of whether any taxes have already been collected for you. Some vacation rental marketplaces collect Missouri short-term rental taxes for you when the listing is booked. If taxes arent being collected for you, youre responsible for collecting and remitting them to state tax authorities.

Read Also: Can I Check My Property Taxes Online

Missouri Median Household Income

| St. Louis | 1.00% |

Missouri’s top income tax rate is set to drop to 5.10% over the course of the next few years. This will happen if the state’s revenue meets a certain growth rate or level, resulting in a “triggered” tax cut.

A financial advisor in Missouri can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Note On Multistate Businesses And Nexus

Our primary focus here is on businesses operating solely in Missouri. However, if you’re doing business in several states, you should be aware that your business may be considered to have nexus with those states, and therefore may be obligated to pay taxes in those states. Also, if your business was formed or is located in another state, but generates income in Missouri, it may be subject to Missouri taxes. The rules for taxation of multistate businesses, including what constitutes nexus with a state for the purpose of various taxes, are complicated; if you run such a business, you should consult with a tax professional.

Recommended Reading: How To Buy Tax Lien Properties In California

More Help With Taxes In Missouri

Understanding your tax obligation is important. Whats even more important is how to deduct Missouri tax from your federal taxes as an itemized deduction.

So, get help with H&R Block Virtual! With this service, well match you with a tax pro with Missouri tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with MO taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Missouri sate tax expertise with all of our ways to file taxes.

Looking for more general support? Check out our;online tax filing;options.

Related Topics

Find out how many years you have to file an amended tax return. If you have discovered missing information on your return and need to correct it, H&R Block can help.

How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.;

- Direct Pay. Pay directly from a checking or savings account for free.;

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.;

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.;

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

Don’t Miss: How To Find Out Who Claimed You On Their Taxes