If Youve Been Overpaying

Unless youre looking forward to a big refund, try increasing the number of withholding allowances you claim on the W-4.

Note that the IRS requires that you have a reasonable basis for the withholding allowances you claim. It doesnt want you fiddling with its form just to avoid paying taxes until the last minute.

If you dont have enough tax withheld, you could be subject to underpayment penalties.

Bear in mind that you need to have enough tax withheld throughout the year to avoid underpayment penalties and interest. You can do that by making sure your withholding equals at least 90% of your current years tax liability or 100% of your previous years tax liability, whichever is smaller.

Youll also avoid penalties if you owe less than $1,000 on your tax return.

What Happens If I Dont Pay My Taxes

Unfortunately, not paying your taxes doesnt make this debt go away. Assuming you didnt file for an extension, if you dont pay your taxes by the due date, youll end up owing back taxes. Whether its intentional or not, prioritize paying your back taxes as soon as you realize that you owe them.

The IRS should send you a letter explaining how much you owe. If your situation is complicated, you can also consult with a tax professional or financial planner to help you understand your options. The worst thing to do is to not do anything at all. Take action so you can work something out and get your tax bill behind you once and for all.

Kathryn B Hauer Certified Financial Planner

Hi! Thanks for writing! I am not sure if you are asking this question in a broad, rhetorical sense or if it is a question specific to you.

If your question is more general and you are wondering why governments tax their citizens or maybe why states levy income taxes in addition to the federal government doing the same, then my answer would be that taxes are needed to pay for the things and services and assistance that citizens share and need for daily living. Im not a government expert, so I dont really know exactly what items Federal tax money pays for and what each state has to cover but things like roads, schools, benefits, defense, government salaries, protective agencies, etc. Here is a link to check out what Federal income tax dollars are actually spent on . States also need to fund the same kinds of community support programs and services. The states that have no income tax use sales taxes and /or property taxes to fund their governments. Regardless of where the money comes from, each state needs to have some dollars to operate and to serve their residents.

I hope that I was somewhat helpful in answering your question! Please write back if we can answer other questions for you.

You May Like: How To Pay Llc Taxes

No Matter How You File Block Has Your Back

How Will I Know Why I Owe The Irs

Youve now read the answer to why do I owe money on my tax return? and more specifically, why do I owe taxes for 2020 returns?

As part of our commitment to keeping you informed, H& R Block is here to help you understand what could affect your refund or if youll owe tax.

- If you use our online tax filing options, youll be able to see your refund results in real time. Plus, we explain why your results move up or down.

- If you visit one of our tax offices, your tax pro can walk you through each credit and deduction to explain how it affects your refund.

Related Topics

Learn more about tax filing requirements and tax filing information with the experts at H& R Block.

Don’t Miss: What Is The Penalty For Filing Income Tax Late

Why Does The Irs Overestimate Withholding

Ordinarily the IRS writes its withholding tables to overestimate the amount an average taxpayer will owe. This makes economists and personal finance experts unhappy because, as they accurately point out, paying too much in taxes amounts to giving the government an interest-free loan for an entire year.

But most Americans actually love it. The too-high withholding system acts as a sort of forced savings account for most people, one that nets them a check for hundreds, if not thousands, of dollars every year.

This, too, was by design. Instead of making Tax Day the time when everyone cuts the government an enormous check, Congress made April 15 a day when the government pays them. From a political perspective, it really doesnt matter that the IRS is paying people with their own money. Tax refunds are popular.

You May Like: Do I Pay Taxes On Stimulus Check

What Can I Do If I Owe Taxes

If you cant pay your entire tax bill when its due, there are a number of options available to help you avoid serious consequences. Some involve working out payments directly with the IRS, while others involve finding alternative ways to pay your taxes.

Here are some payment options to consider:

- Apply for a full-payment agreement if you can pay your taxes within 120 days

- Sign up for an IRS installment plan

- Make an offer in compromise

- Consider a loan or other financingto make a tax payment

Each of these options comes with different eligibility requirements and consequences. This is especially true when you think about taking out a personal loan, home equity loan or another type of financing to take care of your tax bill.

You May Like: Where To File Tax Return

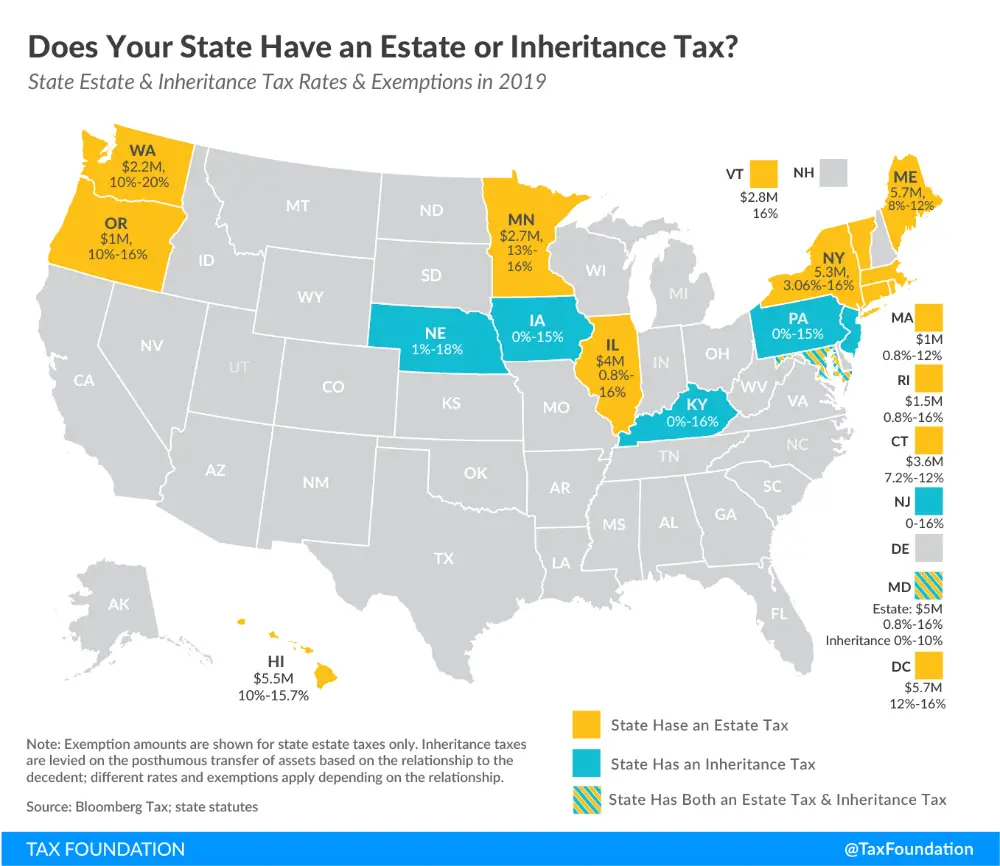

States With Capital Gains Preferences Should Eliminate Them

States that tax capital gains income at a lower rate than wage, salary, and other ordinary income should eliminate this special treatment. Taxing capital gains at the same rate as ordinary income would mitigate the increase in wealth concentration and could raise significant revenues.

Eliminating capital gains preferences in the eight states that had them in 2011 would raise some $500 million per year, the Institute on Taxation and Economic Policy estimates. Rhode Islands elimination of its capital gains preference in 2010 brings in over $50 million in additional revenue per year. Vermont and Wisconsin scaled back their preferences to raise revenue in the wake of the Great Recession. New Mexico reduced, from 50 percent to 40 percent, the share of capital gains that are exempt from taxation in 2019.

Only one state without an income tax currently taxes capital gains at all. Washington State recently enacted a tax on extraordinary profits from the sale of financial assets of over $250,000 per year, which will take effect in 2022. The remaining non-income-tax states could levy a tax on just this type of income.

What Are State Taxes

Taxes are assessed at several levels, including federal, state, and local. At the federal level, your taxes are assessed on your income and are progressive, so that youre taxed at a higher rate when you have more income.

State taxes vary some states dont charge an income tax at all while a state like New Hampshire doesnt charge on salary and wages, but does charge tax on income from interest.

In states that do assess an income tax, they may charge a flat tax or progressive tax. There are currently nine states that use a flat tax where everyone pays the same percentage of tax regardless of their income: Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah. The remaining states generally use a progressive tax, where the more you make the higher tax you pay.

States may also assess other types of taxes beyond income tax, including sales tax, property tax, gasoline tax, and more.

Read Also: Can You Estimate Your Tax Return

Answers To Frequently Asked Questions

Refunds

How do I check the status of my New Jersey Income Tax refund?

You can get information about your New Jersey Income Tax refund online or by phone.

- Phone Inquiry: or 609-826-4400 . This service is available 7 days a week . You will need the Social Security number that was listed first on your return and the amount of the refund requested when you call.

The State of New Jersey issued me a check that was lost, stolen or destroyed, or that can’t be cashed because the cash by date has passed. How do I get a replacement?

Old Checks. If you have the check, send it along with a letter requesting a replacement check to the New Jersey Division of Taxation at the address below. Do not write the word void anywhere on the check. Keep a copy of the check for your records.

NJ Division of Taxation PO Box 266 Trenton NJ 08695-0266

If you do not want to use the mail, you can return the check to one of our Regional Information Centers.

Lost, Stolen, or Destroyed Checks. If you do not receive your check within 30 days of the date the check was issued, or if you received a check that was lost, stolen, or destroyed, you can request a replacement check. Call the Customer Service Center at and speak to a Division Representative. The Division will trace the check.

Filing

I received only one State copy of my W-2, and I have more than one state return to file. What should I do?

New Jersey will accept a photocopy of your W-2 form, as long as the copy is legible.

Income Taxability

Deductions

Do I Have To Pay Taxes On My Income If I Dont Live In That State

It depends on the state. In most states, you must file an income tax return and pay taxes on your income even if you dont live in that state. However, a few states dont require you to file an income tax return if you dont live in the state. You should check with your states Department of Revenue to see if you must pay taxes on your income.

Read Also: Do I Have To File Taxes

Why Else Would I Owe Taxes This Year Heres What To Look For

If youre wondering, why else would I owe taxes this year? The first question you should ask yourself is what other changes were there in my tax situation?

It could be one big change or several changes that made an impact:

- Filing changes But big life changes, such as marriage, divorce, retirement or adding a dependent can affect the your tax situation such as the filing status for which you are eligible and other aspects of how you are taxed. For example, changing from Head of Household to Single will affect your tax bracket and the credits and deductions you can take. If youre married, be sure you understand the difference between the status of .

- Older children To claim the Child Tax Credit, your child must have been under age 18 at the end of the year. If they no longer qualify, you no longer can get the Credit. This significant drop can mean a great deal to your bottom line and may answer the question of why do I owe taxes?

- Other changes in your life can impact your eligibility for various types of credits and deductions. For example, changes in your income might affect whether you qualify for the Earned Income Credit. Or, if youre a college student, maybe you were previously able to claim the American Opportunity Credit, but due to an enrollment status change are no longer eligible.

Capital Gains Tax Breaks Dont Drive State Economic Growth

Proponents of capital gains tax breaks often argue that they spur economic growth by encouraging investment. But historically, there is no obvious connection between tax rates on capital gains and economic growth at the national level, tax policy expert Leonard Burman notes. There is even less reason to expect a state tax break on capital gains to boost a states economy. The companies, bonds, and other assets generating capital gains for a states residents could be located anywhere in the country or the world, so any possible economic benefit wouldnt necessarily go to the state giving the tax break.

Moreover, capital gains taxes generate revenue to support three major building blocks of thriving communities: K-12 and higher education, health care, and transportation. And, by increasing the share of state revenues paid by the wealthy, they allow states to keep taxes lower on people with moderate incomes, who spend a larger share of their incomes to boost local economies.

Read Also: When Do Child Tax Credits Start

Retirement Information Ira Topics Pension Exclusions Social Security Benefits

Q. Im planning to move to Delaware within the next year. I am retired. I am receiving a pension and also withdrawing income from a 401K. My spouse receives social security. What personal income taxes will I be required to pay as a resident of Delaware? I also would like information on real estate property taxes.

A. As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. However, persons 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income . Eligible retirement income includes dividends, interest, capital gains, net rental income from real property and qualified retirement plans , such as IRA, 401 , and Keough plans, and government deferred compensation plans . The combined total of pension and eligible retirement income may not exceed $12,500 per person age 60 or over. If you are under age 60 and receiving a pension, the exclusion amount is limited to $2,000.

Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income.

Also, Delaware has a graduated tax rate ranging from 2.2% to 5.55% for income under $60,000, and 6.60% for income of $60,000 or over.

For information regarding property taxes you may contact the Property Tax office for the county you plan to live in.

Refund Of Erroneous Withholdings

Q. My company moved its office from Delaware to Ohio last year. I had an employment contract and the company paid me according to this contract, although my employment was terminated this year. They have taken Delaware State income tax out of my payments for part of this year. I would like to know under these circumstances why they continue to take out Delaware state tax and what if any tax liability I have, considering I do not live in Delaware and have not worked in Delaware this year. If there is any tax liability, please provide me details of why and tell me how to calculate Schedule W, which clearly shows there is no apportioned Delaware income when no days are worked in Delaware for a non-resident.

A. You must file a non-resident tax return to receive a refund of erroneously withheld Delaware income taxes if you did not live or work in the State of Delaware at any time during the taxable year.

You must attach to your Delaware return certification from your employer that:

You May Like: How To Avoid Taxes On Rmd

Why Are There Federal Taxes

The federal government imposes taxes on income, payroll, property, and goods and services. These taxes help fund important programs and services like Social Security, Medicare, and the military. The federal government also uses these taxes to encourage or discourage certain behaviors. For example, the federal government imposes a tax on gasoline to reduce pollution.

Do I Owe State Income Tax And Federal Sales Tax

No, you only owe state income tax and federal income tax. The state government imposes a state sales tax. It is generally collected by businesses when they sell goods or services. You can find more information about state sales taxes here. The federal government imposes federal sales tax and is generally collected by businesses when they sell goods or services over the internet or by mail order. You can find more information about federal sales taxes here.

Also Check: How Much To Charge For Tax Preparation

How Do I Avoid Owing Taxes In The Future

Its important to research ways to avoid owing taxes in the future. Here are some ways to get started, so next year you wont have to ask, Why do I owe taxes this year?

- Update your W-4 annually or when anything changes your tax situation.

- File your taxes early to avoid underpayment and other penalties.

- Speak to a CPA and a financial advisor to get the big picture of your finances and make sure youre maximizing your deductions.

- Use the IRS Tax Withholding Estimator to estimate how much youll owe next year.

Following these steps each year can help you make sure youre withholding the correct amount in each of your paychecks so you wont get caught off guard when you file your taxes.