Know The Standard Deduction

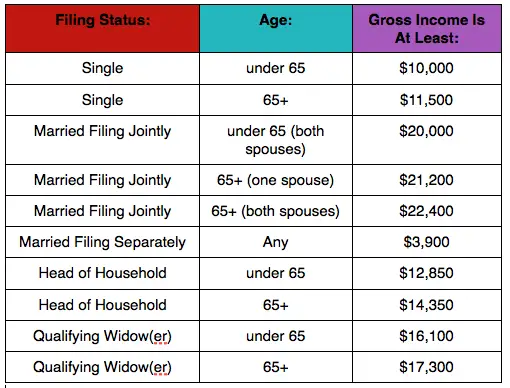

In general, you DONT need to file a tax return if your income was less than the standard deduction.For 2021, the standard deduction was $12,550 for those filing single. The standard deduction reduces taxable income. For someone making less than the standard deduction, their taxable income would be reduced to below $0.00. Obviously, that means there are no taxes due since there is no income to tax. The standard deduction does vary with filing status:

|

Standard Deduction 2021 Tax Year |

|

|---|---|

|

Single |

|

|

Qualifying Widow |

$25,100 |

For those over 65 years of age, the standard deduction increases depending on your filing status:

|

Over 65 Increase in Standard Deduction 2021 Tax Year |

|

|---|---|

|

Single or HoH |

|

|

$1,300 |

|

|

$2,600 |

Because of the higher standard deduction, someone over 65 can make more than someone less than 65 and still end up paying less in taxes or even no taxes.

For those who are legally blind, the standard deductions are:

|

Legally Blind Increase in Standard Deduction 2021 Tax Year |

|

|---|---|

|

Single or HoH |

|

|

$1,300 |

|

|

$2,600 |

With the standard deduction covered, lets look at filing income thresholds.

Filing To Report Self

Your child can report income from self-employment using Form 1040 and Schedule C . If your child has a net self-employment income of $400 or more , the child must file a tax return.

To determine if your child owes self-employment taxes , use Schedule SE. Your child may have to pay self-employment taxes of 15.3%, even if no income tax is owed.

The Tax Code Has Specific Rules About Who Needs To File A Federal Income Tax Return If You Didnt Earn A Lot Of Money You May Be Below The Minimum Income To File Taxes

While youre generally not required to file a federal income tax return if you earn less than the filing threshold, it could still be in your benefit to file. For example, if your employer withheld federal income tax from your wages, filing a return is the only way to get that money back. And you may be eligible for refundable tax credits like the earned income tax credit but you have to file a return to claim them.

Lets look at some things to consider before you decide to skip the filing process.

Read Also: Is Doordash Taxable Income

Learn The Rules About When A Child Must File A Tax Return Because Of Earned And Unearned Income

By Stephen Fishman, J.D.

Sometimes one or more of your children will need to file their own tax returns. This can be true even though they are still your dependents for tax purposes. Generally, a child is responsible for filing his or her own tax return and paying any tax, penalties, or interest on that return. However, if your child does not pay the tax due on this income, the parents may be liable for the tax. Moreover, if a child cannot file his or her return for any reason, such as age, the child’s parent or guardian is responsible for filing a return on the child’s behalf.

When A Dependent May Need To File A Tax Return

Taxpayers who are claimed as a dependent on someone’s tax return are subject to different IRS filing requirements, regardless of whether they are children or adults. A tax return is necessary when their earned income is more than their standard deduction.

The standard deduction for single dependents who are under age 65 and not blind is the greater of:

- $1,100 in 2021

- Or the sum of $350 + the person’s earned income, up to the standard deduction for an unclaimed single taxpayer which is $12,550 in 2021.

A dependent’s income can be “unearned” when it comes from sources such as dividends and interest. When a dependent’s unearned income is greater than $1,100 in 2021, the dependent must file a tax return.

Recommended Reading: Is Plasma Donation Money Taxable

Filing For Educational Purposes

Filing income taxes can teach children how the U.S. tax system works while helping them create sound filing habits for later in life. In some cases, it also can help children start saving money or earning benefits for the future as noted above.

Even if your child doesn’t qualify for a refund, wants to earn Social Security credits, or opens a retirement account, learning how the tax system works is important enough to justify the effort.

What Parents Need To Know

When it comes to helping your child file their income taxes, you should know the following:

- Legally, your child bears primary responsibility for filing and signing their own income tax returns. This responsibility can begin at any age, perhaps well before your child becomes eligible to vote.

- According to IRS Publication 929, “If a child can’t file his or her own return for any reason, such as age, the child’s parent, guardian, or another legally responsible person must file it for the child.”

- Your child can receive tax deficiency notices and even be audited. If this happens, you should immediately notify the IRS that the action concerns a child.

- According to IRS Publication 929, “The IRS will try to resolve the matter with the parent or guardian of the child consistent with their authority.”

You May Like: Do You Pay Taxes On Donating Plasma

Depending On Your Earnings As A Us Taxpayer You May Not Have To Submit A Tax Return Here’s A Breakdown Of The Income Requirements For Filing Taxes

Depending on your earnings, as a US taxpayer you may not have to submit a tax return. However, it may be in your best interest to file even if you arent required to.

In March 2021, Democrats passed a sweeping covid-19 relief and stimulus bill, the American Rescue Plan, which enhanced several tax provisions. Those changes could benefit a large swath of the American public, especially those who struggle to make ends meet.

Protecting You From Scams And Fraud

We recognize that there are significant effects on victims of scams, fraud, and identity theft and we are doing our best to protect Canadians and ensure they receive the benefits to which they are entitled.

It is important to protect yourself from scams, and to know when and how the CRA might contact you. The Slam the scam webpage provides information about how to protect yourself from fraud and understand the ways in which the CRA will contact you.

The CRA also provides information to Canadians on securing their CRA accounts. As fraud prevention measures, we encourage you to:

- Use unique and complex passwords. Always use unique passwords for your CRA and online banking accounts. Do not reuse the same password for different systems.

- Create a PIN. We suggest you set up a personal identification number in My Account or with the help of one of our call centre agents, to help confirm your identity for future calls with the CRA.

- Sign up foremail notifications. We recommend you enable Email notifications. This service notifies taxpayers by email if their address or direct deposit information have been changed on CRA records. These notifications can act as an early warning for potential fraudulent activity.

- Monitor your account for suspicious activity. Check your online CRA accounts regularly for any suspicious activity. This includes unsolicited changes to your address and direct deposit information, or benefit applications made on your behalf.

You May Like: Is Doordash 1099

Filing To Open An Individual Retirement Account

It might seem a little premature for your child to consider opening an individual retirement account the IRS calls it an individual retirement arrangementbut it is perfectly legal if they have earned income. By the way, earned income can come from a job as an employee or through self-employment.

If you can afford to, consider matching your child’s contributions to that IRA. The total contribution must be no more than the child’s total earnings for the year. That lets your child start saving for retirement but keep more of their own earnings. It also teaches them about the idea of matching funds, which they may encounter later if they have a 401 at work.

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2021 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $33,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $66,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

You May Like: Doordash Mileage Taxes

Tax Credit For Seniors

Even if you must file a tax return, there are ways you can reduce the amount of tax you have to pay on your taxable income. As long as you are at least 65 years old and your income from sources other than Social Security is not high, then the tax credit for the elderly or disabled can reduce your tax bill on a dollar-for-dollar basis.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

How Can I Reduce My Taxable Income

One way to reduce taxable income is by topping up your retirement savings with traditional IRAs and 401s, up to the maximum allowable contribution.

Contributions to Health Savings Accounts and Flexible Spending Accounts are another way to shrink your taxable income.

You could potentially earn thousands of dollars before paying taxes. However, even when your income falls below the cut-off level and you do not have to pay taxes, you need to file to taxes to get a refund check.

RELATED ARTICLES

You May Like: Ct Tsc Ind

How Much Money Do You Have To Make To File Taxes

My name is Timothy Sheardy and I am tax and accounting professional from the Metro Detroit area. I have completed my Masters of Science in Taxation specializing in small business and self-employed and Bachelors of Arts in Accounting. As of 2020, I have been preparing taxes for 9 years and also have 10 years accounting experience with 6 of the using QuickBooks both desktop and online and 9 using Sage Peachtree I pride my business on working with clients. I believe a knowledgeable client will make better business decisions. The success of them and their business is most important.

Contents

What If My Teen Worked A Side Gig

If your teen worked a side gig, where they were paid as a 1099 contractor instead of as a W-2 employee, they must claim that money on tax returns if the total income exceeds $400. Your teen will need to file a Schedule SE with their 1040 tax form and pay self-employment taxes on that income.

If they earned $600 or more from any single source, your teen should receive a 1099-NEC form from the company that contracted the work. If your teen worked a gig in 2021, it might be wise to speak with a tax expert specializing in small businesses and independent contractors to help calculate any expenses they might be able to deduct from their income to reduce their tax bill.

Read Also: How To Report Plasma Donation On Taxes

Maximum Earnings Before Paying Taxes

The most significant help to seniors is the fact that unearned income is taxed a little different than earned income. Unearned income covers your Social Security payments, any pension payouts and other money you already have coming. Earned income includes the money you make at a present job if, say, youre working part-time to bring in additional money.

If the income you bring in is solely unearned, you may not need to file at all. The key is finding out if your earnings exceed the limit. A good rule of thumb is to add half of your Social Security income to the amount you acquired from other sources, your work earnings and earned income, including non-taxable interest. If this limit tops the IRSs maximum for the year in question, also called a base amount, you are required to file. If you are 65 and older and filing as single, you can earn up to $11,950 in work-related income before filing. If a couple that is married and filing jointly, the earned income maximum is $23,300 if both are over 65 or older and $22,050 if only one of you is 65.

You Can Claim Refundable Tax Credits

Refundable tax credits are particularly valuable for low-income taxpayers because they can provide a refund beyond what you paid for the year via withholding or estimated tax payments.

In other words, if its worth more than the tax you owe, the IRS will issue you a refund for the difference. Refundable credits include:

You May Like: Doordash Dasher Taxes

How To Claim Your Money If You Had A Newborn Or Adopted Since Last Filing Taxes

If you had a baby by the end of December — or adopted one — you’ll be eligible for up to $3,600 for that child when you file your taxes. That includes back pay for the July through December advance payments and the chunk coming with your refund.

You should get that money when you claim your child on your tax return, which will let the IRS know about your household changes.

These Situations May Require A Tax Return

You might also be required to file for reasons other than, such as if youre:

- Self-Employed and earned at least $400

- Received payment on a 1099-MISC or 1099-NEC form

- Bought health insurance from a state or federal marketplace

Just like the tax code, trying to determine if you make enough income to file a tax return can get involved. If you are unsure, its best to speak with a tax professional or use DIY tax software to see if it makes sense to file.

Also Check: Dasher Tax Form

What Are Other Reasons You May Be Required To File

There may be other situations in which youre required to file. The IRS specifically calls these out in the 1040 instructions.

- Special taxes If youll owe the alternative minimum tax, tax on a retirement plan, household employment taxes, Social Security or Medicare taxes on income you didnt report, write-in taxes , or you have to repay a tax credit you received in a previous year

- You received distributions from a health savings account, Archer MSA or Medicare Advantage MSA

- Youre self-employed and had net earnings from self-employment of $400 or more

- A church or qualified church-controlled organization paid you wages of $108.28 or more

- You, your spouse or a dependent were enrolled in a marketplace insurance plan and you received advance payments of the tax credit intended to help pay your premiums

- You, your spouse or a dependent received an advance payment of the health coverage tax credit

- Income under section 965, which deals with foreign income

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that you’re eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction.

For example, in 2021, you don’t need to file a tax return if all of the following are true for you:

- Under age 65

- Don’t have any special circumstances that require you to file

- Earn less than $12,550

Recommended Reading: Are You Self Employed With Doordash

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information