Can I Claim A Tuition Deduction If My Parents Are Paying For My Education But Aren’t Claiming Me As A Dependent

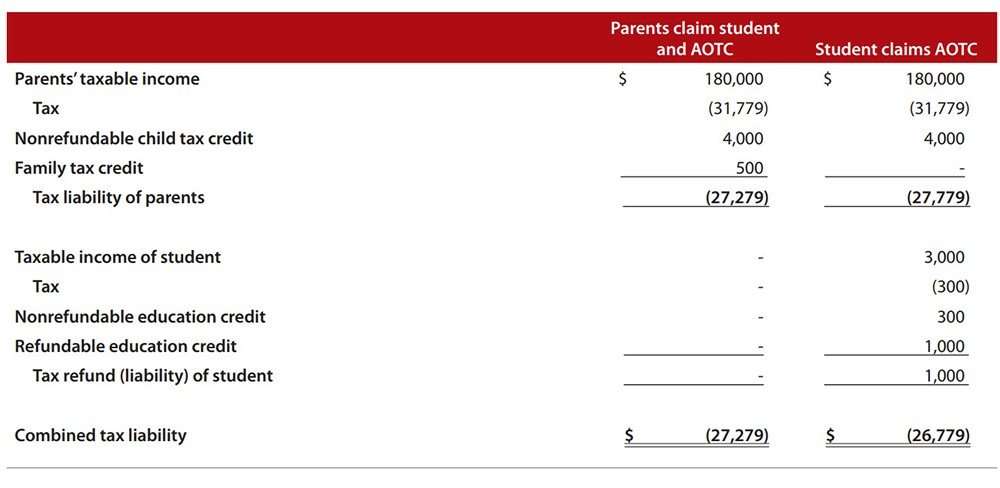

Yes, you may claim a tuition credit, even if your parents paid the tuition. Whether you qualify depends on the circumstances. If your parents don’t qualify for the credit because their income is too high, there is a rule against the student claiming the $1000 refundable portion of the credit, even though they don’t claim you as a dependent.

A student, under age 24, isonly eligible if he supports himself by working . You cannot be supportingyourself on student loans & grants. It is usually best if the parent claims thecredit rather than the student. He/she does not qualify for the $1,000refundable portion of the American Opportunity Credit if items 1, 2, and3 below apply to him.

American Opportunity Credit Vs Lifetime Learning Credit

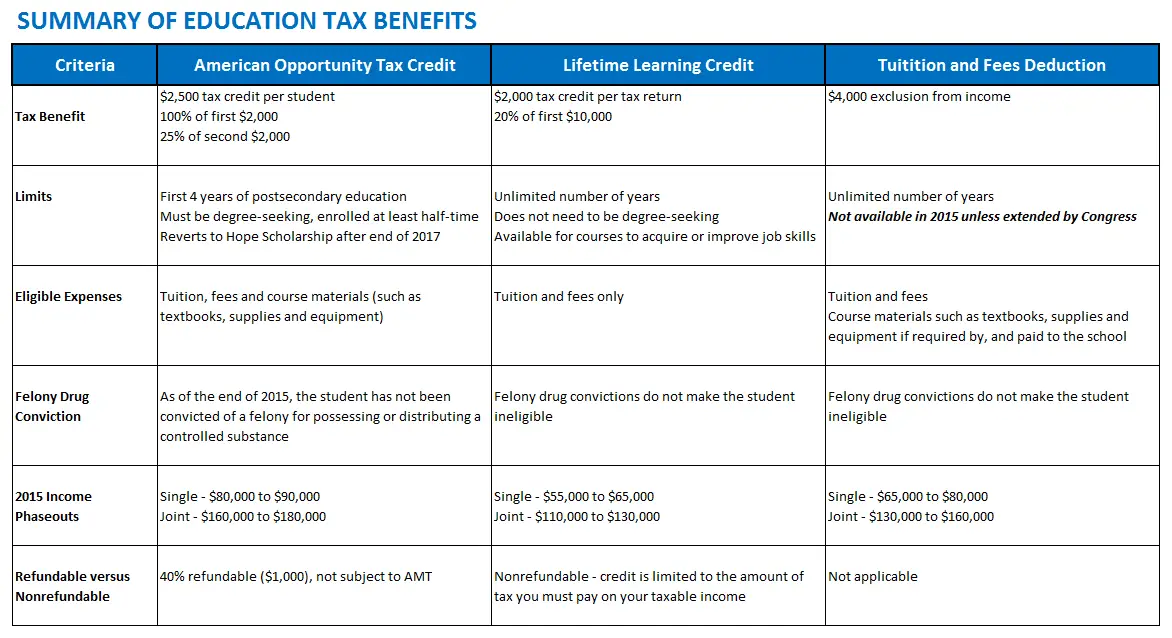

The American Opportunity Credit is similar to the Lifetime Learning Credit , but there are a few important differences. The Lifetime Learning Credit is available to anyone who is not pursuing a degree.

For example, you could be taking career development classes to learn or upgrade job abilities.

You can only claim the American Opportunity Credit once every four years for the same student. The number of years you can claim a Lifetime Learning credit based on the same students expenses is unlimited.

The American Opportunity Credit is partially refundable, whereas the Lifetime Learning Credit is not. It also has a $2,000 yearly cap, compared to the AOCs $2,500.

If you have an option between the two, the AOC is preferred than the LLC for these reasons.

Heres how the Lifetime Learning education tax credit works and who qualifies for it:

Dont Leave Money On The Table

File your taxes to claim your education related credits and deductions. Some students can even file for free with H& R Block Free Online.

Comparison with other educational tax benefits You may have heard of the American Opportunity Tax Credit and the Lifetime Learning Credit . These education credits also can help you reduce the amount of tax you pay, but just in a different way. The difference between a credit and deduction is that a deduction reduces your income and a credit reduces the taxes you owe dollar-for-dollar.

Its important to note that the IRS doesnt let you double up on these benefits. So, which one is the most financially beneficial? That will depend on your specific tax situation. Theres lots to consider there.

For example, the Tuition and Fees Deduction has a higher phaseout than the LLC, which means some taxpayers might not qualify for the lifetime learning credit but could still claim the Tuition and Fees Deduction.

Read Also: How To Buy Tax Liens In California

Education Tax Credits And Deductions You Can Claim For 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you paid for college in the last year, you may be able to claim the American opportunity credit or lifetime learning credit, or the the tuition and fees deduction. The American opportunity credit is generally the most valuable education tax credit, if you qualify.

You can claim these education tax credits and deductions even if you paid for school with a student loan. Parents can take advantage, too, so long as they don’t choose a married filing separately status. Here’s what to know about each option.

» MORE: NerdWallet’s guide to the best tax software

Is College Tuition Tax Deductible

College isnt cheap. However, depending on your situation, you might be eligible to deduct all or a portion of tuition costs when you file your taxes. But, because the tax code contains multiple education tax credits for higher education costs, you need to know how they work to make sure youre maximizing your tax breaks.

Read Also: Highest Paying Plasma Donation Center Near Me

Education Tax Credits: Your Guide On How To Claim Them

Edited byHow Student Loan Hero Gets Paid

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

| The basics |

| Plus: Education tax credits: FAQs |

Finding Information On Form 1098

If you had eligible expenses, you should have received Form 1098-T from the education institution that applies to the deduction.

To claim the deduction, you had to use the amount that appeared in box 1this is what you actually paid. It can be different from the number that appeared in box 2. For instance, you might have paid in advance for expenses incurred in the first three months of the next calendar year, so those extra payments would be reflected in box 1 but not box 2. You needed to enter the information on IRS Form 8917 and on your Form 1040 and submit Form 8917 with your tax return.

Schools also report your qualifying expenses to the IRS on Form 1098-T.

Read Also: Laurie Kazenoff

How Much You Can Deduct

As of 2012, you can deduct a maximum of $4,000 in tuition and fees. That figure is a cumulative total that applies to tuition you paid for everyone — you, your spouse and all eligible relatives. It’s not a per-person figure. Higher-income taxpayers also aren’t eligible for the deduction. As of 2012, single taxpayers could take the deduction if their modified federal adjusted gross income was $80,000 or less. The cutoff for married taxpayers filing jointly was $160,000. Married people filing separate returns could not claim the deduction.

What Edition Of Turbotax Is Right For Me

Answer a few simple questions on our product recommender and we can help guide you to the right edition that will reflect your individual circumstances.

You can always start your return in TurboTax Free, and if you feel the need for additional assistance, you can upgrade to any of our paid editions or get live help from an expert with our Assist & Review or Full Service. But dont worry, while using the online version of the software when you choose to upgrade, your information is instantly carried over so you can pick up right where you left off.

Read Also: Donating Plasma Taxes

Tax Deductions For Interest Payments On Student Loans

By claiming the student loan interest tax deduction, a filer can write off interest payments on student loans as well as other types of credit such as revolving credit lines . You can reduce your taxable income by up to $2,500 with this deduction.

Here are the rules that determine who can claim a deduction for student loan interest.

- You cant be a dependent or use the tax filing status married filing separately. If youre a dependent, you wont be able to write off the student loan interest you pay on your own loans . You also cant claim this deduction if youre married and filing taxes separately from your spouse.

- You must be legally responsible for the student loan. Your parents can only write off payments they made on student loans they own. And you would not be able to claim a deduction for payments you made to parent PLUS loans your parent took out for your education, since these are in your parents name only.

- You must be the person who paid the interest to claim the deduction. If your parents are the ones covering monthly payments on student loans that are only in your name, you cant claim a deduction because you didnt pay the interest. If your parents made payments on your cosigned student loan, however, they could claim a deduction for this debt.

- You must meet income requirements. You cant claim the student loan interest deduction if you earn more than the limit specified amount. This amount can be adjusted every year.

What Is An Education Tax Credit The Basics

If you file taxes in the U.S. and are paying for college, you may be able to use two common types of tax credits the American Opportunity Tax Credit and Lifetime Learning Credit as a form of compensation for what you spend on postsecondary education.

A tax , as opposed to a tax deduction, is a means to boost your tax refund or cut down on the amount of taxes you owe. A deduction, on the other hand, decreases your income amount that the IRS will tax you on.

During the tax season, youll have to choose whether to file for the AOTC or the LLC. The credit you decide to go with may depend on your financial situation. IRS Publication 970 outlines the rules for claiming these deductions and credits.

When it comes to deciding whether the student or the parents of the student receive the education tax credit, it generally comes down to who pays the bills.

- If you provide more than half of your own financial support , you can claim deductions or tax credits for your own education.

- If your parents provide more than half of your support, then they can claim you as a dependent.

The IRS has a questionnaire that can help you find out whether youre a dependent. Additionally, IRS Publication 501 lists the conditions that must be met to qualify as a dependent.

Recommended Reading: Ein Look Up Number

The American Opportunity Tax Credit

The American Opportunity tax credit is based on 100% of the first $2,000 of qualifying college expenses and 25% of the next $2,000, for a maximum possible credit of $2,500 per student.

For 2021, you can claim the American Opportunity Tax Credit of up to $2,500 if:

- Your student is in their first four years of college.

- Your income doesn’t exceed $160,000 if you are .

- Your income doesn’t exceed $80,000 as a single taxpayer.

- Above these income levels, the credit is phased out.

The American Opportunity Tax Credit can be claimed for as many eligible students as you have in your family. For example,

- If you have three kids who are all in their first four years of college, you can potentially qualify for up to $7,500 of American Opportunity Tax Credits.

- $2,500 x 3 = $7,500

Up to 40% of the American Opportunity Tax Credit amount is refundable. That means you can collect at least some of any credit amount that is left over even if your federal income tax bill has been reduced to zero.

Can A Dependent Claim Education Credits

No if someone claims you as a dependent when they file their taxes, you cant claim education tax credits. To be eligible for education tax credits, youll need to make sure your parent/guardian does not claim you as a dependent on their taxes.

Sign up for weekly digest to receive the latest rate updates and refinance news!

Thank you! Keep an

Read Also: Is Freetaxusa Legitimate

Lifetime Learning Tax Credit

The Lifetime Learning Tax Credit is a non-refundable tax credit worth up to $2,000 per taxpayer. The LLTC covers 20% of the first $10,000 in tuition and required fees.

Qualified expenses may include nonacademic fees, such as student activity fees and athletic fees, but only if they must be paid directly to the college as a condition for enrollment or attendance. Qualified expenses are limited to courses of instruction to acquire or improve job skills.

Expenses paid for academic terms that begin in the first three months of the next tax year can be counted as though they were paid during the current tax year.

The tax credit can be claimed for an unlimited number of years.

The LLTC is subject to the following eligibility restrictions:

- The student is not required to be seeking a degree or certificate, so the tax credit can be used for continuing education.

- The student must be enrolled at a college or university that is eligible for Title IV federal student aid.

- The student can be enrolled on a part-time basis.

- The student is eligible even if they were convicted of a federal or state felony drug offense for the sale or possession of a controlled substance.

The Lifetime Learning Tax Credit is often claimed by graduate or professional school students who are no longer eligible for the American Opportunity Tax Credit.

About 2.8 million taxpayers claimed the Lifetime Learning Tax Credit in 2018.

What Is The Tuition And Fees Deduction

The education tuition and fees deduction is an aptly named tax deduction. Taxpayers who pay for tuition or eligible expenses may qualify to deduct up to $4,000 from taxable income from their adjusted gross income. And when you lower your income through tax deductions, you pay less in taxes overall.This particular tax break is an above the line deduction. That means you dont need to itemize your tax deductions to claim it. If you have eligible expenses, the deduction allows you to lower your taxable income by $4,000.

Assuming you have a 24% marginal tax rate, a $4,000 deduction is worth $960 in tax savings. However, it’s important to note that the education tuition and fees deduction is set to expire on December 31, 2020.

That means that you can claim it on your taxes when you file in 2021, but unless Congress extends it, this will be the last year of it.

Related: Effective Tax Rates: How Much You Really Pay In Taxes

Read Also: Appeal Property Tax Cook County

Transferring The Tuition Amount

If there is any amount left over after your child has claimed the tuition amount, they have two choices: transfer it or carry it forward. This comes up a lot since students dont typically earn a lot of income while going to college or university.

Your child can transfer up to $5,000 of the tax credit, less the amount used to reduce tax owing. So if they reduced their tax owing by $1,000, the most that can be transferred is $4,000. The tuition amount can be transferred to their parent, grandparent or spouse/common-law partner.

Income And Your Taxes

You might not need to file a tax return if your income is not above a certain amount depending on your filing status. Use the IRS questionnaire on whether or not you are required to file a tax return.

If you worked during the past tax year, file a Form 1040 and a 1040 Schedule A. If you filled out the FAFSA for financial aid and worked a qualified job on campus as part of work-study, you’ll receive a W-2 and report this on your taxes.

Out-of-state students might have earned income in two states. If you are working at school but maintain a job at home during summer or holiday breaks, you’ll need to file a tax return in both states. According to Minnick, “Out of state students will likely have to file three returns for the host state, the home state, and federal taxes.”

Also Check: How To File Taxes For Doordash

Q23 Can Students With An F

A23. For most students present in the U.S. on an F-1 Student Visa the answer is no. Generally, the time an alien individual spends studying in the U.S. on an F-1 Student Visa doesn’t count in determining whether he or she is a resident alien under the substantial presence test. See Publication 519, U.S. Tax Guide for Aliens for more information.

Whether You’re Saving For College Currently Paying Tuition Or Dealing With Student Loan Debt There’s Probably A Tax Break That Can Help Your Bottom Line

We talk a lot about investing in stocks, bonds, mutual funds, and ETFs here at Kiplinger. But as Ben Franklin once said, “an investment in knowledge always pays the best interest.” And if you’re going to college to further your education and expand your mind, Uncle Sam offers a few tax breaks that can increase the return on your investment.

Some of the tax deductions and credits are for people who are saving for college, while others help to pay for tuition and books while you’re a student. There are also tax breaks that help with student loan debt once your days in the classroom are over. However, the rules can be tricky, and sometimes you can’t take advantage of one tax break if you already claimed another. So, it’s important to be up to date on all the rules all the time. Here’s a breakdown of 12 tax deductions, credits, and exemptions that can help you pay for college. No matter where you are on your quest for knowledge, there’s probably a tax break that can help your bottom line.

Recommended Reading: Does Doordash Take Out Taxes