Personal And Real Property Taxes

In general, taxes are not assessed on personal property. Personal household effects, licensed vehicles, registered aircraft, certain personal property warehoused in the state and business personal property that is not depreciated for federal income tax purposes are exempt from the property tax.

Real property tax rates vary substantially and depend on the type of property and its location.

New Mexicos property tax division helps local governments in the administration and collection of ad valorem, or property, taxes, which constitute a large portion of the annual budgets for local governments and schools.

Residents age 65 or older as of the 1st of the year and who meet income thresholds may be eligible for a valuation limitation. This means the current assessed value of your property cannot be raised as long as you qualify for the limitation. You must file an application each year to qualify.

Business Guide To Sales Tax In New Mexico

Phone:

So, you need to know about sales tax in The Land of Enchantment. Look no further!

Whether youâve fully set up shop in New Mexico, or simply ship there once in a while, itâs important you know whether your business is liable to their sales taxes. This guide will tell you everything you need to know, plus direct you to the right places for handling any sales tax responsibility you may have.

When You Need To Collect New Mexico Gross Receipts Tax

In New Mexico, a gross receipts tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities. The seller acts as a de facto collector.

To help you determine whether you need to collect gross receipts tax in New Mexico, start by answering these three questions:

If the answer to all three questions is yes, youre required to register with the state tax authority, collect the correct amount of gross receipts tax per sale, file returns, and remit to the state.

Also Check: How Do You Add Sales Tax

How To Register For A Gross Receipts Tax Permit In New Mexico

A gross receipts tax permit can be obtained by registering for a;CRS Identification Number online or submitting the paper form;ACD-31015.

After registering, the business will be issued a Combined Reporting System Number, sometimes known as a New Mexico Tax Identification Number.

Information needed to register includes the:

- Business name

- Doing Business As;name

- Employer Identification Number; from the IRS, or owners Social Security Number if a sole proprietorship with no employees

- Business address, phone, and email

- Type of legal structure: Sole Proprietorship, Partnership, Corporation, Limited Liability Company

- Date business activity started or anticipated to start

- Business registration number from the New Mexico Secretary of State

- Filing status

- Names, address, SSN of owners/officers/members

- Method of accounting

- Description of what products or services are being sold

Which Agencies In New Mexico Do I Need To Additionally Register With

You may need to apply to some of the following agencies:

This definitely requires some investigation on your end. Since every business is unique, there are different rules, regulations, and laws that may apply.

We suggest contacting to the New Mexico Department of Taxation and Revenue to verify which government agencies you will be required to register with.

Youre set!

You are now prepared to register for your CRS Identification Number and Gross Receipts License in New Mexico.

Lets summarize where we reviewed:

- Have all the required information easily accessible before registering online

- Acquire a tax ID or EIN before registering for a CRS Identification Number and Gross Receipts License.

- Look into what other agencies you may have to additionally register with.

Registering for your CRS Identification Number and Gross Receipts License will be stress free as long as you are prepared. I recommend organizing all the essential information in a folder, preferably using a system like Box.com or Dropbox.

Read Also: Do You Have To Claim Social Security On Taxes

New Mexico Sales Tax Faq

Once you have the license to collect and remit gross receipts taxes in New Mexico, you will probably be asking yourself two questions:

- When do I charge a gross receipts tax in New Mexico?

- What good are subject to gross receipts taxes in New Mexico?

We are going to go over some common questions that our clients have asked. I believe these questions will help you appreciate the nuances of taxable goods so you can be confident in fulfilling your tax obligations.

Lets start with the first question

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Read Also: How To Review My Tax Return Online

When Are New Mexico Gross Receipts Tax Returns Due

The Taxation and Revenue Department will determine a filing frequency based on the expected sales volume, which will be monthly, quarterly, or semi-annually. Generally, a business collecting over $1,000 in gross receipts tax each month will file monthly.

Filings are due the 25th day of the month following the reporting period, unless the 25th falls on a weekend or federal holiday, which would move to the next business day.

Even if the business had no sales during the reporting period, a filing is still required indicating no sales.

How We Got Here And Where Were Headed

In contrast to how the states revenue is spent which relies on a fairly regimented budgeting process that uses the current state budget as a starting point forming the tax code seems ad hoc, with new policies enacted every year. Some of these policies will bring in more revenue and some of them will mean the state foregoes revenue. Even with the best analysis, it can take years to determine whether a tax change has had the desired effect.

Still, tax policies are enacted with intention, so we can hardly claim that we have no idea how we got to where we are. That our tax system is overly reliant on revenue from oil and gas and makes those earning the lowest income pay the highest rates can come as no surprise to anyone whos been following tax policy over the last 40 years.

The Reagan Administration introduced the nation to the term trickle-down economics, which led to big tax cuts for those at the top of the income scale. The rest of us got promises about how those tax cuts would impact the economy promises that turned out to be quite empty. While tax cuts for the so-called job creators can spur some job growth, they have not been proven to pay for themselves.1 Instead, the trickle-down economic experiment has led to a bigger national debt and the concentration of wealth into fewer and fewer hands. The rich got richer, while the rest of us saw our wages stagnate. States that followed suit New Mexico among them had similar results.

Don’t Miss: What Does Agi Mean For Taxes

Is New Mexico A High Tax State

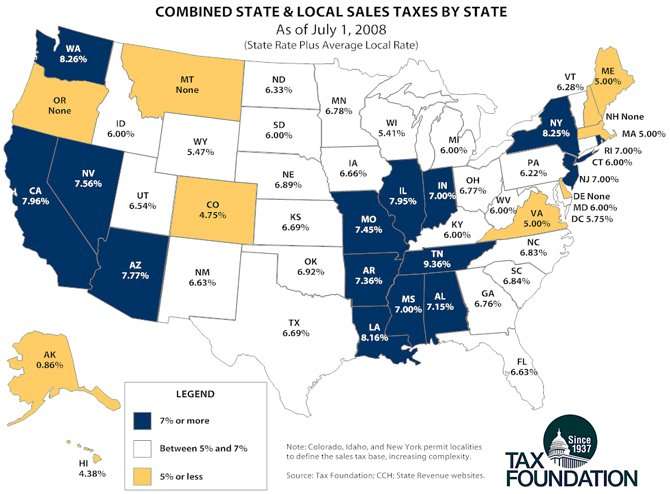

Other New Mexico tax facts noted by Kiplingers: Personal income tax rates top out at 4.9 percent on taxable income over $16,000 for single filers and $24,000 for married couples filing jointly. The average combined local and state sales tax rate is 7.4 percent. Sales taxes on motor vehicle purchases are 3 percent.

New Mexico Documentation Fees

Dealerships may also charge a documentation fee or “doc fee”, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. These fees are separate from the taxes and DMV fees listed above.

The average doc fee in New Mexico is $3301, andNew Mexico law does not limit the amount of doc fees a dealer can charge.Because these fees are set by the dealerships and not the government, they can vary dealership to dealership or even vehicle to vehicle.

1 – Average DMV and Documentation Fees for New Mexico calculated by Edmunds.com

Don’t Miss: How Is Capital Gains Tax Calculated On Sale Of Property

Gross Receipts Tax Holidays

Gross receipts tax holidays exempt specific products from gross receipts tax for a limited period, usually a weekend or a week. Approximately 17 states offer tax holidays every year.;

As of October 2019, New Mexico has the following tax holidays scheduled:

- Back to school, August 79, 2020

- Bookbags, backpacks, maps, and globes priced under $100

- Clothing, footwear, and accessories priced less than $100

- Computers priced up to $1,000

- Computer-related items priced up to $500

- Handheld calculators priced under $200

- School supplies priced under $30

Retailers are not required to participate in the back-to-school tax holiday. Retailers are permitted to absorb the tax on non-qualifying items.

- Small business sales tax holiday, Saturday, November 28, 2020

- Retailers that maintain their primary place of business in New Mexico and employ no more than 10 employees at any one time do not have to charge customers gross receipts tax on qualifying items with a sales price of less than $500

For more information, read about the back-to-school or small business tax holidays.

Filing When There Are No Sales

Once you have a New Mexico seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any gross receipts tax was collected. When no gross receipts tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

You May Like: Can You File Missouri State Taxes Online

General Fund Revenue Sources

This guide focuses on revenues that are deposited in the state general fund, which is the states main pot of money for operating expenses. The revenue sources pie chart shows where the state gets its tax revenue, and how much is expected to be generated for fiscal year 2021 . The largest slice of the pie comes from general sales taxes. This includes gross receipts taxes and compensating taxes. GRT is levied on most goods and services and is often passed along to the consumer. Because services constitute an increasing share of economic activity, while goods constitute a decreasing share, more states are beginning to tax services. Many cities and counties in New Mexico also collect GRT to pay for municipal services, so the rate you pay will vary depending on where you are in the state.

Excise taxes on the sales of tobacco, liquor, motor vehicles, and telecommunications services account for 8%. People often suggest raising so-called sin taxes taxes on alcohol and tobacco products as a way to generate revenue, but as the pie chart shows, such taxes do not amount to a significant share of revenues.

The 17% mineral revenues piece of the revenue pie includes severance taxes on crude oil, natural gas, coal, copper, and other hard minerals that are extracted from the ground, as well as rents and royalties from the sale or lease of mineral-producing land. About 90% of these mineral revenues comes from taxes collected on oil and natural gas extraction.

Technical Terms

Other Taxes And Fees Applicable To New Mexico Car Purchases

In addition to state and local sales taxes, there are a number of additional taxes and fees New Mexico car buyers may encounter. These fees are separate from the sales tax, and will likely be collected by the New Mexico Department of Motor Vehicles and not the New Mexico Tax Compliance Bureau.

Title Fee: Registration Fee: Plate Transfer Fee:

Average DMV fees in New Mexico on a new-car purchase add up to $451, which includes the title, registration, and plate fees shown above.

Recommended Reading: How Much Does H&r Block Cost To File Taxes

Mexico Vat Law For Businesses And Merchants

Businesses in Mexico are required to collect a sales tax of 16.00% on behalf of the government, which they must submit to the applicable Mexico revenue department in a periodical VAT tax return. Unlike the United States’ sales tax, which is only charged on sales to end consumers, the VAT is collected on all sales – even of raw materials.

Businesses may be required to register for a Mexico VAT number or other identifier to enable the government to track and verify VAT tax returns. VAT collection is a responsibility of the merchant, and failure to collect and submit the appropriate tax amounts may result in severe penalties.

What Are The New Mexico Sales Tax Thresholds

There are three thresholds you need to know.

Monthly Liability Threshold: greater than $200.00 average monthly tax liability

Quarterly Liability Threshold: $66.67 – $200.00 average monthly tax liability

Semi-annual Liability Threshold: $0.00 – $66.66 average monthly tax liability

Not sure how to determine your tax filing frequency?

You can review your eCommerce or Point of Sale Software to see the volume of sales you have generated.

Don’t worry though! The state will let you know when your due dates change. 🙂

Watch your mail for a letter from the State of New Mexico so that you don’t miss any deadlines.

You May Like: Do You Have To Do Taxes For Doordash

New Mexico Estate Tax

New Mexicos estate tax has been phased out as of Jan. 1, 2005. There is no estate or inheritance tax in New Mexico.

- The Very Large Array in Socorro County consists of 27 separate radio antennae, each of which weighs more than 200 tons.

- Truth or Consequences, New Mexico is named after a game show from the 1950s.

- Los Alamos, New Mexico has the highest concentration of millionaires of any city in the U.S. More than 10% of households in Los Alamos have a net worth of at least $1 million.

Overview Of New Mexico Taxes

New Mexico has a progressive income tax with rates that rank among the 20 lowest in the country. The states average effective property tax rate is the 18th-lowest rate in the country. The state does not collect a sales tax, but rather a gross receipts tax on businesses that often gets passed to consumers.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2020 – 2021 filing season.

Read Also: How To File Federal Taxes For Free

New Mexico Cigarette Tax

New Mexicos cigarette tax stands at $2.00 per pack. Thats about average for cigarette taxes, ranking as the 22th-highest cigarette tax in the U.S. In addition to the cigarette tax, New Mexico also imposes the Tobacco Products Tax, which applies to the manufacture or purchase of other types of tobacco products. It is equal to 25% of the value of any tobacco product.

Contact The New Mexico Tax Compliance Bureau

The New Mexico Gross Receipts Tax is administered by the New Mexico Tax Compliance Bureau. You can learn more by visiting the sales tax information website at www.tax.newmexico.gov.

Phone numbers for the Gross Receipts Tax division of the Tax Compliance Bureau are as follows:

- Local Phone: 841-6200

- Toll-Free Phone: 809-2335

Read Also: Is Past Year Tax Legit

How Much Are Real Estate Transfer Taxes In New Mexico

A real estate transfer tax is a tax levied on the transfer of title to a property or ownership from one individual or entity to another entity. They are usually charged at the state or local levels. They often tax the transfer of certificates and titles to property and legal deeds from a seller to the buyer.

This can cost thousands of dollars, depending on the value that the property is assessed at. There are only five states in the country that do not have a transfer tax. Lucky for New Mexico home buyers and homesellers, New Mexico is one of them.

But both buyers and sellers in the state should be aware that they may still be subject to local taxes and tariffs. It is also best to discuss real estate tax matters with your realtor or tax advisor.

Mexico Vat Refund For Visitors

Visitors to Mexico may be able to get a refund of the Mexico VAT tax paid on any goods bought for deportation.To get a VAT refund, you must present receipts for the goods purchased to a Mexico VAT refundstation .

Some localities have a minimum purchase price for which a VAT refund can be claimed, or certain purchase types which cannot be made tax-free. AVAT refund of up to 16.00% of your total expenditures may be refunded for qualifying purchases.Regulations on VAT and sales tax refunds vary across countries and by region, so be sure to check ahead before expecting a MexicoVAT refund.

Don’t Miss: What Is The Tax In Georgia

Tax Policy In New Mexico

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in New Mexico |

| Tax rates in 2017 |

New Mexico

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS