Capital Gains Tax On An Investment Property

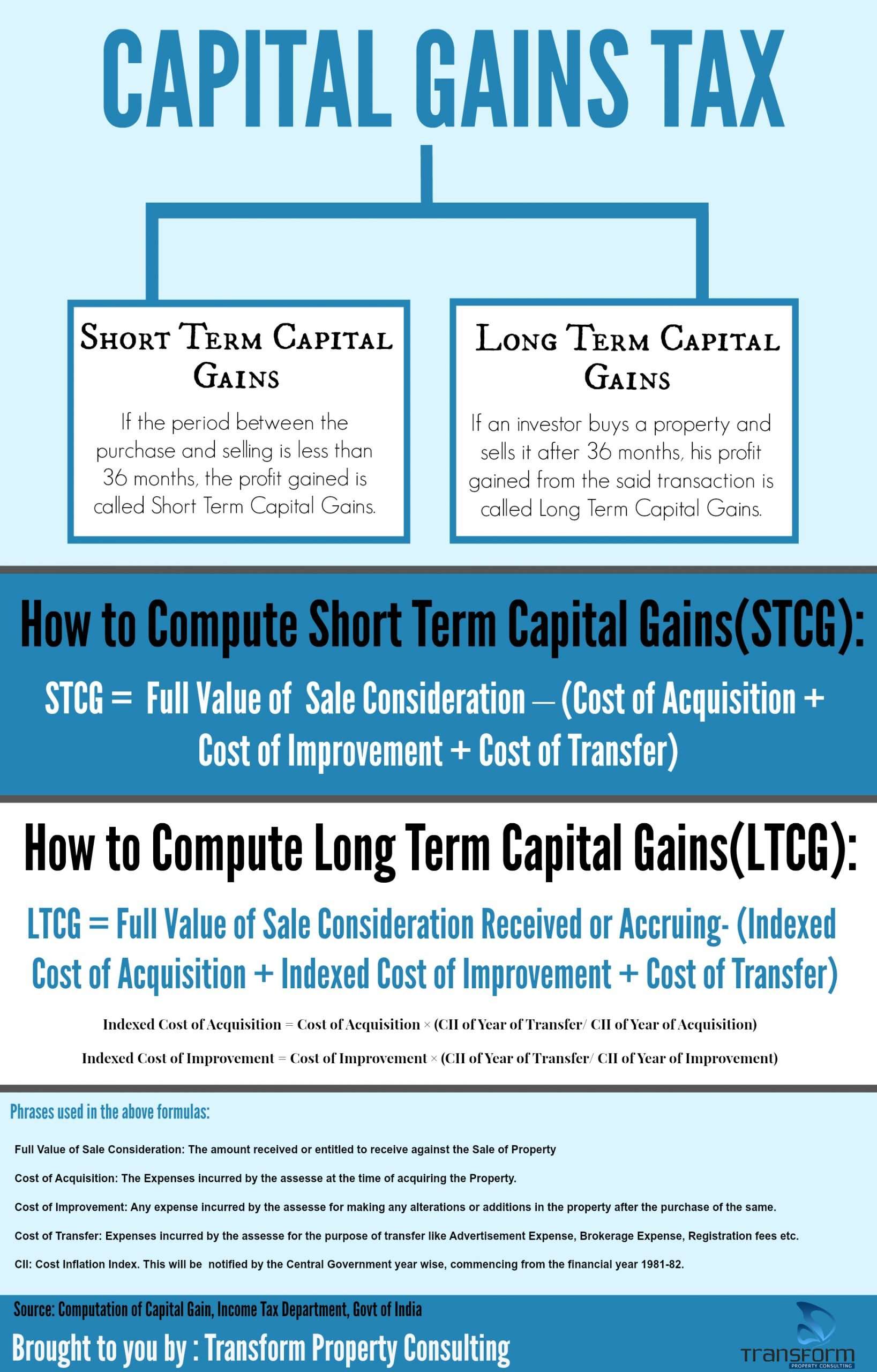

When you sell an investment property, there are two types of tax that you need to worry about.

First, if you sell the property for a net profit relative to your cost basis, youll have to pay capital gains tax.

In addition, if youve claimed depreciation expenses on the property during your holding period , the cumulative amount youve deducted will be considered taxable income when you sell. This concept is known as depreciation recapture.

Consider this example. Lets say that your cost basis in a duplex is $250,000 and that youve owned it for 10 years. Over the 10-year ownership period, youve claimed a total of $90,900 in depreciation expense. If you sell the property now for net proceeds of $350,000, youll owe long-term capital gains tax on your $100,000 net profit plus depreciation recapture on $90,900, which is taxed at your marginal tax rate.

What Is A Capital Gain Or Capital Loss

In simple terms, a capital gain is an increase in the value of an investment or real estate holding from the original purchase price. If the value of the asset increases, you have a capital gain and you need to pay tax on it. That might sound bad but trust us, making money on your investments is never a bad thing.

Capital gains can be realized or unrealized. A realized capital gain occurs when you sell the investment or real estate for more than you purchased it for. An unrealized capital gain occurs when your investments increase in value, but you havent sold them. The good news is you only pay tax on realized capital gains. In other words, until you lock in the gain by selling the investment, it’s only an increase on paper.

A capital loss occurs when the value of your investment or real estate holding decreases in value. If the current value of the investment or holding is less than the original purchase price, you have a capital loss. Capital losses can be used to offset capital gains and reduce the overall tax you will pay. You can carry capital losses back 3 years or forward into future years.

If you have investments in registered plans such as a Registered Retirement Savings Plan , Registered Retirement Plan or Registered Education Savings Plan , you dont have to worry about capital gains and losses because the investments are tax-sheltered. That means your investments can grow and you dont have to worry about changes in value until you withdraw the funds.

What Are Capital Gains Taxes

If you sell an investment property for more than you paid for it, you have whats called a capital gain. There are two types of capital gains — short-term and long-term — and theyre treated differently at tax time.

Short-term capital gains happen when you sell an investment property you held for one year or less. These gains are taxed as ordinary income. That means you pay the same tax rate on short-term gains as you would on wages from your job. For 2019, there are seven tax brackets that range from 10% to 37%.

Profits on flipped houses are treated as short-term gains since investors tend to get in and out of these investments quickly. In general, most other types of investment properties are held for at least a year, which allows investors to take advantage of the lower long-term capital gains tax rates.

If you hold the property for at least a year, its considered a long-term capital gain. These gains are taxed at a lower rate: 0%, 15%, or 20%, depending on your income and filing status. Heres a look at long-term capital gains tax rates for 2019:

| Filing Status |

|---|

| Over $244,425 |

Data source: IRS.

If youre a higher-income investor an additional 3.8% net investment income tax may apply. Thats true whether you have a short-term or long-term gain. Youll owe the tax if you have net investment income and your modified adjusted gross income is over:

Also Check: How Much Is New York State Sales Tax

When In Doubt Ask For Help

As a final point, its important to emphasize that there is no way I can go over every potential real estate sale situation in this article, and theres admittedly some gray area in the tax code. For example, maybe you made a certain repair/improvement during your ownership and you arent sure whether it should be added to the propertys cost basis.

In situations like this, its important to seek the advice of a qualified professional, such as a tax attorney or a reputable and experienced tax professional. Ideally, look for one who specializes in real estate issues. High-dollar tax issues, like real estate capital gains have the potential to be, are closely watched by the IRS, so its not only important to seek advice to make sure you maximize your tax breaks, but to make sure youre doing it correctly.

Capital Gain Tax Rates

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than $80,000.

A capital gain rate of 15% applies if your taxable income is $80,000 or more but less than $441,450 for single; $496,600 for married filing jointly or qualifying widow; $469,050 for head of household, or $248,300 for married filing separately.

However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate.

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

Read Also: Can You Refile Your Taxes

How Is Holding Period Calculated On Sale Of An Under

There are few scenarios every person aware off i.e. date on which the property was booked/Allotted agreement has been done date of registration and its possession date.

Lets take an Example for clear picture:

Scenario A

Lets say you have booked a house property by paying the required down-payment or initial booking amount on 01 March 2013, on the same day you have received the allotment letter from the builder. The agreement is executed with the builder on 15 August 2013. The Property is under construction and you have decided to resale your under-construction property on 11 September 2019.

In this case, as soon as you pay the booking amount the builder issue allotment letter, in that case, the holding period is considered and can be calculated from the Date of Allotment of property.

So as per the above example, the duration is which comes to be Long Term Capital Gain .

There can be instances where the builder can clearly state in the Allotment letter that it does not confer you any ownership right. In such circumstances, the date of the Agreement can be considered for holding-period calculation.

Scenario B

You have booked a house property by paying the required down-payment or initial booking amount on 01 March 2013, on the same day you have received the allotment letter from the builder. The agreement is executed with the builder on 15 August 2013, You have paid all your installment according to the payment plan.

Scenario C

Section 5: Tax Treatment For The Buyer

Section 56, tighten up hands of buyer too If the buyer purchases the property below circle rate he is also liable to calculate the tax under stamp duty rates.

The difference amount comes under income from other sources for the buyer.

This way both are liable to pay tax if transaction executed below stamp duty, The only purpose of the introduction of his section is to discourage these kinds of transactions of the Government to make every transaction transparent.

Also Check: How To Pay Federal And State Taxes

What Is A Flow

You are a member of, or investor in, a flow-through entity if you own shares or units of, or an interest in, one of the following:

Betting On The House: Rules For Property Sales

Real estate agent Shelley Bridge vividly recalls how a love affair once cost a young man more than $20,000 in federal taxes.

The man, with Bridges help, had previously bought a house for around $200,000. Having fallen in love several years later, he moved in with his girlfriend and put his house up for rent.

Three years passed. He decided it was time to sell his housenow worth roughly $350,000and contacted Bridge, owner of a Re/Max office in Denver. Knowing about his living arrangement, she asked how long it had been since the house had been his primary residence. “Three years last month,” came the answer. Oh, you just missed the window, she informed him.

Because of his three-year absence, he would have to pay tax of more than $20,000 on the sale, because of the appreciated value of his home. Had he sold the house a month earlier, he would have only owed tax on the profit equal to the depreciation he deducted in the years in which he rented out the house.

Knowing the tax lawsin this case, that if you live in a house for two of the previous five years, you owe little or no taxes on its salecan make a considerable difference in the tax picture when you sell a building, whether its your residence or property that was previously your residence.

The man in this example could have moved back into the house for two years and sold it with a much smaller tax burden, but his girlfriend, now his wife, wasnt up for it.

Don’t Miss: How To Calculate Quarterly Taxes

What Is The Tax Impact Of Selling Your Investment Property

Do you need to estimate the tax-related consequences of selling your investment property?

The bad news is that it’s complicated with several variables affecting the equation.

However, the good news is this Capital Gains Tax Calculator will help you find the result as well as estimate the financial value of deferring those taxable gains through a 1031 like-kind exchange.

Below is more information about the capital gains tax and how to use this calculator.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

How Much Can You Exclude

Now, there’s more good news. Based upon IRS Section 121 exclusion, if;you sell the main home you live in,;the IRS lets you exclude;– not be taxed on — up to $250,000 of capital gains on real estate if you’re single. If you’re married, and file your tax return jointly, the IRS is even more generous, letting you exclude typically up to $500,000 in capital gains. That’s thanks to a Taxpayer Relief Act of 1997.;You’re eligible for the exclusion if you have owned and used;the home as your main home for a period totaling;at least two years out of the five years prior to its date of sale.

Let’s say you bought a home 10 years ago for $200,000 and sold it now for $500,000. You made $300,000. If you’re married and filing jointly, none of that gain would be typically subject to the capital gains tax. If, however, you sold it for, say, $800,000, up to $500,000 of your gain would be excluded, but you’d possibly be subject to paying capital gains on the $100,000 of that gain — the amount over $500,000.

However, a number of factors could make it so you can’t take the exclusion allowed when selling your home. Items that disqualify you from taking the normal exclusion on your capital gains include if you’re subject to expatriate tax; the house or real estate you sold wasn’t your principal residence ; you owned it for less than two years in the five-year period before you sold it ; or you didn’t live there for at least two years in the 5-year period before you sold it.

Also Check: What Tax Bracket Are You In

Invest In Distressed Communities

The 2017 Tax Cuts and Jobs Act created a new tax benefit allowing investors to defer and minimize capital gains taxes when reinvesting their capital gains into a Qualified Opportunity Fund. QOFs invest in distressed communities throughout the U.S., and this tax break is meant to help create jobs and propel economic growth in these areas.

Some rules do apply. The taxpayer must reinvest capital gains into a QOF within 180 days. The longer the QOF investment is held, the more tax benefits apply:

-

Holding for at least five years excludes 10% of the original deferred gain.

-

Holding for at least seven years excludes 15% of the original deferred gain.

-

Holding for at least 10 years can eliminate most, if not all, of the deferred gains.

Capital Gains Tax On A Second Home

A second home is generally defined as a property that you live in for part of the year, and that isnt primarily a rental property. For example, if you have a condo at the beach that you live in for two months every summer and also rent out for a month during the summer season, it is likely considered to be a second home.

Note that you can have more than one property that meets the definition of a “second home.” For example, if you have a beach condo and mountain cabin that you live in at certain times during the year, but you also maintain a primary residence, both properties can be considered second homes for tax purposes.

Since a second home doesnt meet the IRS definition of a primary residence, it is not entitled to the capital gains exclusion. In a nutshell, any net capital gain you make upon the sale of a second home is taxable at the appropriate rate . This also applies to a primary home that you lived in or owned for fewer than two years.

Recommended Reading: Where Can I Find My Property Tax Bill

How Do I Avoid Capital Gains Tax

Some of the ways through which you can enjoy an exemption on the payment of capital gain tax are given below:

For long term capital gains tax:

- Under Section 54, if you sell a property and reinvest the money in another property by buying or constructing at least two houses, then you will be exempted from paying the capital gain tax. However, in order to enjoy the exemption, the capital gains on the sale of the property must not exceed Rs.2 crore. You can avail this benefit only once in your life.

- You can also get an exemption on the payment of capital gain tax by investing your capital gains in Capital Gains Account Scheme .

- Even if you have availed a home loan, tax on capital gains is exempted from being taxed if you used the amount to repay your loan.

- Under Section 54EC of the Indian Income Tax Act, 1961, you can enjoy an exemption on the payment of capital gain tax. The maximum amount that you can invest is up to Rs.50 lakh. In order to claim the exemption, you will have to invest in this type of scheme before the final date of the filing of your income tax returns.

For short-term capital gain tax:

What Are Rule Exceptions

The above-stated rates and calculator can be applied to most assets, however, there are a few exceptions to the rule. Collectible Assets such as coins, metals, and fine art are taxed at 28% as their long-term capital gains tax rate. The short-term capital gains tax rate is determined using the income tax rate.

Recommended Reading: Can You File Missouri State Taxes Online

Tax Exemptions On Capital Gains

Government provides a number of exemptions which can be claimed on capital profits made. Here is a list of all the exemptions that can be claimed with respect to gains from capital assets.

For tax computations, capital losses can be used to offset the effect of tax on capital gains. However, long-term capital losses can be set off against long-term gains only. Short-term capital losses can be set off against short-term as well as long-term capital gains.

Quick Tip:Long-term capital losses can be carried forward to a maximum of 8 years and set off against long-term capital gains.

Watch Your Holding Periods

Remember that a security must be sold after more than a year to the day in order for the sale to qualify for treatment as a long-term capital gain. If you are selling a security that was bought about a year ago, be sure to check the actual trade date of the purchase.

You might be able to avoid its treatment as a short-term capital gain by waiting for only a few days.

These timing maneuvers matter more with large trades than small ones, of course. The same applies if you are in a higher tax bracket rather than a lower one.

Read Also: How To Calculate Payroll Tax Expense