How Do I Know When I Should File Payroll Taxes

Its not easy to keep track of all of the filing dates and requirements the IRS has regarding payroll taxes. Form filing dates vary from deposit dates, and as an employer, its your responsibility to keep track of all of it.

The best place to start is the Employment Taxes page on the IRS website, which provides a list of filing requirements, including due dates and electronic filing information.

What Payments Are Not Considered Compensation

Compensation does not include:

Barbers And Hairdressers Taxi Drivers And Drivers Of Other Passenger

If these workers are your employees, you have to deduct;Canada Pension Plan contributions, employment insurance premiums, and income tax as you would for regular employees.

When the workers have an interruption in earnings, you generally have five calendar days after the end of the pay period in which an employees interruption of earnings occurs to issue an electronic Record of Employment .

Note

A different deadline may apply if you file;the ROE on paper.

If these workers are not your employees, the following special rules apply and you have to report the gross earnings of barbers and hairdressers, taxi drivers, and drivers of other passenger-carrying vehicles on their T4 slip. For reporting instructions, see Guide RC4120, Employers Guide; Filing the T4 Slip and Summary.

Barbers and hairdressers

This class of workers is restricted to barbers or hairdressers who provide their services in an establishment that offers barbering and hairdressing services.

CPP contributions and income tax

For CPP and income tax purposes, we consider individuals who are not employed under a contract of service to be self-employed. They are responsible for paying their CPP;contributions and income tax when they file their income tax and benefit returns. Do not deduct;CPP or income tax from these workers.

EI premiums

There are two ways to determine the insurable earnings for a week, depending on whether you know the workers actual weekly earnings and expenses:

CPP contributions and income tax

Recommended Reading: How Are Property Taxes Calculated In Texas

State Disability Insurance Tax

The SDI program provides temporary benefit payments to workers for non-work-related illness, injury, or pregnancy. SDI tax also provides Paid Family Leave benefits. PFL is a component of SDI and extends benefits to individuals unable to work because they need to care for a seriously ill family member or bond with a new child.

SDI is a deduction from employeesâ wages. Employers withhold a percentage for SDI on a portion of wages. View current SDI rates.

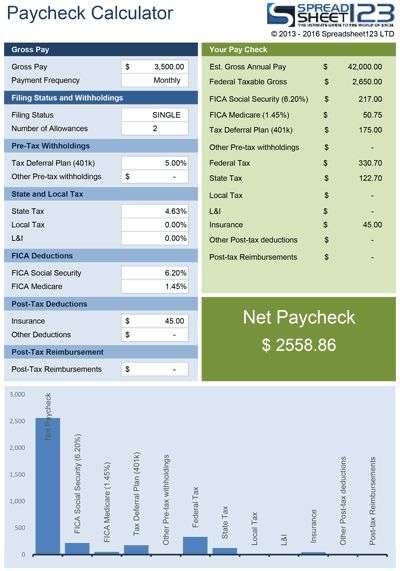

Usage Of The Payroll Calculator

Please note that the calculator on this site is for informative purposes only and is not intended to replace professional advice.

If you want to use the tax calculator instead, .

Also Check: Can You Change Your Taxes After Filing

Penalties Interest And Other Consequences

Failure to deduct

If you fail to deduct the required CPP contributions or EI;premiums from the amounts you pay your employee, you are responsible for these amounts even if you cannot recover the amounts from the employee. We will assess you for both the employers share and the employees share of any contributions and premiums owing. We will also assess a penalty and interest as described below. For more information, see Recovering CPP contributions;and Recovering EI premiums.

If you failed to deduct the required amount of income tax from the amounts you pay your employee, you may be assessed a penalty as described below. As soon as you realize you did not deduct the proper amount of income tax, you should let your employee know. Your employee can either pay the amount when they file their income tax and benefit return or they can ask you to deduct more income tax at source. For more information, see Request for more tax deductions from employment income.

Penalty for failure to deduct

We can assess a penalty of 10% of the amount of CPP, EI, and income tax you did not deduct.

If you are assessed this penalty more than once in a calendar year, we will apply a 20% penalty to the second or later failures if they were made knowingly or under circumstances of gross negligence.

Failure to remit amounts deducted

Penalty for failure to remit and remitting late

We can assess a penalty when either of the following applies:

The penalties are as follows:

Note

Interest

How Do I Know How Much Income Tax To Withhold From My Employee

All of your employees need to fill out IRS Form W-4. This form determines how much money you need to withhold from your employees paychecks. If youre calculating payroll taxes manually, you can use the withholding tables provided by the IRS. If youre using payroll software, your payroll service will calculate this amount, and all other payroll taxes, for you.

Recommended Reading: How Much Tax Do You Have To Pay On Stocks

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky and penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

We highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time, to handling pesky withholding calculations and payroll taxes.

When it comes time to record payroll costs on your books, Bench can take care of that for you. Learn more about how we are saving small business owners hours of admin every month.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Read Also: Will I Get Any Money Back From My Taxes

Is The $7 Million Exemption Threshold Per Quarter Or Per Year And Is This Threshold Based On The Currentyear Or The Prior Years Compensation

The $7 million exemption threshold is based on the prior year’s compensation paid to Seattle employees. For example, to determine if an employer is subject to the payroll expense tax in 2021, an employer will use its 2020 compensation paid to Seattle employees to determine if they have met the $7 million or more in payroll expense threshold. However, businesses must use the current year’s compensation paid in Seattle to determine the payroll expense tax due for the year. For example, in 2021, businesses that had $7 million or more in Seattle payroll expenses in 2020 would apply the tax rates based on their 2021 Seattle payroll expense of employees with annual compensation of $150,000 or more.;

Form Td1x Statement Of Commission Income And Expenses For Payroll Tax Deductions

Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out this form in addition to Form TD1. They can estimate their income and expenses by using one of the following two figures:

- their previous years figures, if they were paid by commission in that year

- the current years estimated figures

Employees who choose to fill out Form;TD1X have to give you the form by one of the following dates:

- on or before January;31 if they worked for you last year

- within one month of the date their employment starts

- within one month of the date their personal tax credits have changed

- within one month of the date any change occurs that will substantially change the estimated remuneration or expenses previously reported

Note

There is only one Form;TD1X for federal, provincial, and territorial tax purposes. For an employee in Quebec, see Employment in Quebec.

Tax deductions from commission remuneration

If an employee is paid on commission or receives a salary plus commission, you can deduct tax in one of the following ways:

Employees who earn commissions without expenses

Employees who earn commissions with expenses

To calculate the amount of tax to deduct, you can use the Payroll Deductions Online Calculator , the;Payroll Deductions Formulas , or the manual calculation method found in;Section A of the Payroll Deductions Tables .

Note

Don’t Miss: How To Buy Tax Lien Properties In California

Employees Profit Sharing Plan

An employees profit sharing plan is an arrangement that allows an employer to share profits with all or a designated group of employees. Under an EPSP, amounts are paid to a trustee to be held and invested for the benefit of the employees who are beneficiaries of the plan.

Each year, the trustee is required to allocate to such beneficiaries all employer contributions, profits from trust property, capital gains and losses, and certain amounts in respect of forfeitures.

Report payments from;EPSPs on a T4PS;slip instead of a T4;slip. You must show on the T4PS;slip if the employee is a specified employee: one who is dealing with the employer in a non-arms length relationship, or who has a significant equity interest in their employer or a company related to their employer. If the amount paid to the specified employee is more than 20% of that employees total income for the year from employment with the employer, a tax will apply to the exceeding amount.

For more information, go to Employees profit sharing plan .

Overview Of Tax Returns And Deposits

Employers have the responsibility to file employment-related tax returns and deposit employment taxes according to set deadlines. If they fail to do so, they may be subject to failure to file and failure to pay penalties. What’s more, “responsible persons” in the company who fail to deposit trust fund taxesamounts withheld from employees’ paychecksmay be subject to a 100% personal liability. This;trust fund recovery penalty;is triggered when a person with the authority to make payment decisions willfully fails to deposit the taxes. The possibility of these penalties means employers must get things right.

Don’t Miss: How To Reduce Income Tax

Changes To Your Business Entity

If your business stops operating or the partner or proprietor dies

If your business stops operating or the partner or proprietor dies, you should do the following:

To find out how to fill out and file the T4;or T4A slips and Summary, you can do one of the following:

- see Guide;RC4157, Deducting Income Tax on Pension and Other Income, and Filing the T4A Slip and Summary

If you change your legal status, restructure, or reorganize

If you change your legal status, restructure, or reorganize, we consider you to be a new employer. You may need a new business number and a new payroll program account. Call 1-800-959-5525to let us know if your business status has changed or will change in the near future.

Note

Amalgamations have different rules. For more information, see the next section, If your business amalgamates.

The following are examples of changes to a business status:

- You are the sole proprietor of a business and you decide to incorporate.

- You and a partner own a business. Your partner leaves the business and sells their half interest to you, making you a sole proprietor.

- A corporation sells its property division to another corporation.

- One corporation transfers all of its employees to another corporation.

If the;situation just described does not apply, you must continue to deduct CPP/QPP, EI, and PPIP. You cannot take into consideration any deductions taken by the previous employer.

If your business amalgamates

Calculating Payroll Tax In Canada: A Guide For Small Businesses

Doug Bonderud is an award-winning writer with expertise in technology and business innovation. He is dedicated to equipping Canadian small business owners with essential advice.

Its easy for Canadian small business owners to get caught up in payroll complexity. According to a recent government report, approximately 90,000 small businesses shut down every year in Canada as a result, effectively managing payroll is critical to ensure long-term business success. Weve put together a guide the tells you all you need to know in order to effectively calculate payroll tax in Canada.

So lets dive in: What are your specific obligations as an employer? What steps are required for calculating payroll tax Canada? Do you need a bookkeeper or accountant to ensure payroll accuracy? Lets start with a quick definition.

Read Also: Can I File Old Taxes Online

Bringing It All Together

Calculating payroll taxes can be very complicated, and it is important to send out payments on time to avoid penalties and late fees. Federal tax payments may be made either online through the Electronic Federal Tax Payment System , or through banks authorized to accept federal payments. If you use the latter method, each payment should be accompanied by Form 8109, which can be obtained by calling the IRS at 1-800-829-4933 or from the IRS website.

FUTA taxes are usually paid quarterly and income and FICA taxes are deposited semi-monthly or monthly. The IRS usually sends business owners a notice at the end of each year detailing which method to use for the upcoming year.

In general, the timeliness of a deposit is determined by the date it is received. However, a mailed deposit received after the due date will be considered timely if you can establish that it was mailed at least two days before the due date. To learn more about small-business employers’ payroll duties, go to or call the IRS live help line for businesses at 1-800-829-4933.

Who Pays State Unemployment Taxes

State unemployment taxes are usually paid solely by the employer and are calculated based on an employees wages.

Employees in Alaska, New Jersey, and Pennsylvania are subject to state unemployment tax withholding as well. If you employ workers in any of these three states, you will be required to withhold the tax from their wages and remit these funds directly to the state.

Don’t Miss: How Much Money Is Taken Out Of Paycheck For Taxes

How Is A Businesss Payroll Expense Determined

Payroll expense means compensation paid in Seattle to employees. Compensation has the same meaning for purposes of the payroll expense tax as it does for the Washington State Family and Medical Leave program. Compensation includes all payments for personal services, including commissions and bonuses and the cash value of all earnings paid in any medium other than cash.

How To Calculate Payroll Tax For An Employer

Even small businesses with just a few employees are required to calculate and collect payroll taxes. In most cases a business will contract payroll processing out to a specialized service if it isn’t large enough to justify the administrative cost of doing payroll internally. However, if you run or manage a small business, you still need to know how payroll taxes for your employees are calculated, even if you never have to pick up a calculator and do the job manually.

1

Determine the employee’s gross pay. Include hourly wages or salary plus tips, commissions and other taxable compensation. You should not include mileage or other reimbursements for business expenses.

2

Multiply the number of withholding allowances the employee has claimed on his W4 form by the amount of one allowance for his filing status and the length of the pay period. For example, if his filing status is single with two allowances claimed and your pay period is weekly, you have 2 X $70.19 for a total of $140.38. Subtract this amount from the gross wages. In addition, subtract any tax deductions, such as contributions to a tax-deferred retirement plan. The remainder is the employee’s federal taxable income.

3

4

5

6

References

Read Also: Who Can I Call About My Tax Refund

Starting And Stopping Cpp Deductions

There might be special situations where you may have to start or stop deducting CPP in the year for a particular employee. In these situations, you also have to prorate the maximum CPP contribution for the year to make sure you have deducted the correct amount.

Note

In some cases, the requirements are different for the Quebec Pension Plan. For information, see Guide;TP-1015.G-V, Guide for Employers: Source Deductions and Contributions, which you can get from Revenu Québec;.

Special situations

Your employee turns 18 in the year

Start deducting CPP contributions in the first pay dated in the month after the employee turns 18. When you prorate, use the number of months after the month the employee turns 18 .

Your employee turns 70 in the year

Deduct CPP contributions up to and including the last pay dated in the month in which the employee turns 70. When you prorate, use the number of months up;to and including the month the employee turns 70 .

Your employee gives you a completed Form;CPT30

Stopping CPP contributions

In certain situations, an employee can elect to stop contributing to the CPP. In order to be eligible for this election, the employee must meet all the following conditions:

- the employee is at least 65;years of age, but under 70

- the employee receives a CPP or QPP retirement pension

- the employee is receiving, or will receive, pensionable employment earnings that require CPP contributions

Note

Restarting CPP contributions

Note

Note

Your employee dies in the year