How Are Property Taxes Calculated In Texas

Tax Ease knows the challenges that many Texans face when property taxes are due. Weve been committed to helping tens of thousands of people across the state overcome those difficulties so they can get back to living life as they know it. Were here to help. So, if youre looking for Texas property tax lien loans that put your needs first, youve come to the right place.

If youre new to the world of property taxes, or never really understood how they work or why you need to pay them, were going to break it down for you. Were also going to cover how property taxes are calculated in Texas. So, keep reading to learn a few things about property taxes and find out how you can get assistance when your property taxes are delinquent.

Putting Property Taxes Into Perspective

Knowing what youll likely be paying in property taxes every year is just as important as knowing what your monthly mortgage payments are going to be. Thats because determining ancillary costseverything from taxes to utility bills to estimated home repair and maintenance costsis necessary for figuring out what you can actually afford. Divide your property taxes by 12 to put them into perspective alongside your monthly mortgage payments, and try to ensure that this total is no more than 25% of your net income every month.

If youre interested in buying a home, consider its attached property taxes to be as instrumental in your decision making as its asking price. You may also want to use property tax rates to guide which counties you look to buy in, since something as simple as moving to the next zip code could mean big tax savings.

Taxable Values Of Similar Properties

Review your county tax assessor’s records for homes in your community that resemble your own. The time and effort can be worth it if you believe that your home is truly over-valued. Focus on homes that have approximately the same square footage as yours and are located in the same neighborhood or a nearby one. If similar homes have a taxable value lower than yours, this is strong evidence that you’re over-assessed.

Consider this example: George and Loren own a three-bedroom ranch-style home in a subdivision with many homes like theirs. The taxable value of their home is $375,000. They check the records for a dozen similar homes in their subdivision and discover that the average taxable value of those homes is $340,000. What’s more, most of the other homes have finished basements, while George and Loren’s doesn’t. The two have good evidence for claiming that the taxable value of their property is too high.

Recommended Reading: When Is Sales Tax Due

Figures Used For Prorated Tax Amounts

In Texas, the exact amount of annual property taxes are unknown until property taxes come due in October. . Therefore, when closing on a home before taxes are due, the prorated taxes at closing come from an estimated tax amount. Using the previous years taxes as a guide provides the estimated amount. However, if the tax bill is due the prorated tax amounts will then be accurate using current bill.

Reconciling Taxes Paid and Credited

When the prorated taxes at closing are based of an estimated tax amount, the buyer and sellers can require the other party to reconcile the difference. This occurs only once the actual tax amount is known at year-end. While certainly a good thought, the vast majority of the time neither party follows through with this. The dollar difference is typically a nominal amount and most folks dont want to waste the time tracking down and hassling a stranger for a few bucks.

Are Property Taxes Deductible

Many states allow certain people and groups to deduct some or all of their property taxes. On the other hand, some states simply lower your tax bills, through tax credits, and donât offer a deduction on your tax return.

People who usually receive lower property tax rates or deductions on their tax returns include low-income individuals, seniors, veterans, and those with disabilities. There are also some homestead exemptions for people facing bankruptcy or situations where someoneâs spouse passes away. Religious organizations often face lower tax rates.

These tax deductions commonly apply to a certain amount of a homeâs assessed value. For example, the first $40,000 of assessed value may be exempt from tax, but all value above that is taxed normally.

Recommended Reading: Are Property Taxes Paid In Advance

Comparable Properties To Determine Property Taxes

The starting point on how county real estate assessors examine in assessing homes is by examining like and similar properties to the subject home.

- This can be a no brainer in a subdivision where there are many similar type model homes

- However, free standing homes not in a subdivision can be more tricky, especially custom homes

- These homes are different than other homes in the area

- There are no two exact same properties

- Homes with the same square footage with the same amount of bedrooms and bathrooms may have unique and distinct features such as brick versus frame, and major material differences in interior and exterior materials used

Applying Property Tax Rates

Once the local appraiser has your homeâs assessed value, they can apply the actual property tax rates. Counties and cities often set property tax rates annually. Check with your stateâs comptroller or tax department to find the local tax rates.

Property tax rates are usually expressed in millage rates or mill rates. A millage rate is the amount of tax you pay per $1,000 of home value. Mills are expressed as tenths of a penny , and one mill equals $1 in tax for every $1,000.

You can calculate your tax bill by multiplying the millage rate by your homeâs assessed value and then dividing by 1,000. Another way of looking at it is to first convert the millage rate to a dollar rate by dividing the mill rate by $1,000.

As an example, letâs say your local millage rate is 7.5 and your homeâs assessed value is $150,000. The millage rate means you will pay $0.0075 in tax for every $1,000 in home value. This rate then applies to your home value. In this case, your tax bill would be $1,125 because $150,000 x $0.0075 = $1,125.

Millage rates are confusing, so itâs understandable if you donât get them at first. The key information is that one mill is one tenth of a penny and a tax rate of one mill is equivalent to $1 in tax for every $1,000 in home value.

Don’t Miss: How To Get Tax Exempt Status

What Is The Taxpayer’s Role

You can play an effective role in the process if you know your rights, understand the remedies available to you, and fulfill your responsibilities as a property owner and taxpayer.

Know Your Rights:

- You have the right to equal and uniform tax appraisals. Your property value should be the same as that placed on other properties that are similar or comparable to yours. Unless your property qualifies for special appraisal, such as for agricultural land, you have the right to have it taxed on its January 1 market value.

- You have the right to receive all tax exemptions or other tax relief for which you apply and qualify.

- You have the right to notices of changes in your property value or in your exemptions.

- You have the right to know about a taxing unit’s proposed tax rate increase and to have time to comment on it.

Understand Your Remedies:

- If you believe your property has been appraised for more than its January 1 market value, or if you were denied an exemption or agricultural appraisal, you may protest to the appraisal review board. If you don’t agree with the review board, you may take your case to court.

- You may speak out at public hearings when your elected officials are deciding how to spend your taxes and setting the tax rate.

- You and your fellow taxpayers may limit major tax increases in an election to roll back or limit the tax rate.

Fulfill Your Responsibilities:

The Lone Star State Supports Your Green Agenda With A Texas Solar Property Tax Exemption

Texas is a state traditionally known for its oil, yet it is now one of the front-runners in the race to provide renewable energy to the nation.

Since 2015, Texas has been one of the net exporters of electricity in the U.S., thanks to a huge investment in solar power. This investment is backed up by property tax incentives for you to convert your home to solar energy.

Texas has no state income tax, so municipalities are forced to generate revenue through exorbitantly high property tax rates. While the U.S. national average sits at 1.07%, there are at least five municipalities in Texas with a property tax of over 2%, and the statewide average is 1.83%.

This is a hard annual blow for many homeowners, so many are looking for whatever ways they can find to lower their tax liability. Converting to solar power is an excellent way of achieving this and going green at the same time.

DoNotPay can help you find the best way to secure a Texas solar property tax exemption by switching to solar power.

Recommended Reading: Do You Have To Claim Social Security On Taxes

Tarrant County Property Tax Rates

The median home value in Tarrant County is $170,300. That may sound low, but Tarrant County property owners pay a relatively hefty median real estate tax amount of $3,581. That makes the average effective property tax rate in Tarrant County quite high at 2.10%.

Property owners in Tarrant County are subject to different taxing units, including their county government, city government and school district. Every September, these taxing units set their budgets for the fiscal year and then establish a property tax rate that will enable them to meet their revenue goals.

Depending on whether you pay in person, by mail, by phone or online, you can pay your property taxes by check or money order, in cash, via e-check or with a debit or credit card. Cash payment is only available in person. Payments made by mail must be postmarked by Jan. 31 to avoid triggering penalty and interest charges. Returned checks will incur a charge of about $25.

A financial advisor in Texas can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, homeownership, retirement and more, to make sure you are preparing for the future.

| City |

|---|

Texas Property Tax Calculator

| Estimate Property Tax |

Our Texas Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States.

To use the calculator, just enter your property’s current market value . For comparison, the median home value in Texas is $125,800.00. If you need to find your property’s most recent tax assessment, or the actual property tax due on your property, contactyour county or city’s property tax assessor.

Please note:

Read Also: How To Calculate Net Income After Taxes

Protest Property Tax In Texas

Paladins property tax advisors in Texas can help you understand the taxation system and exemptions you can avail for reducing your property tax liability. They help you file a well-researched property tax protest based on an individual assessment of your property value, accounting for factors like the economy and values of similar properties in the area. Paladin Property Tax Consultants in Bexar County also offer expert arbitration for properties valued up to $5,000,000.

Property Tax Rates And Assessment

After the appraisal district submits its report on appraised values and tax exemptions, each taxing unit then sets its tax rate and assesses and collects taxes from property owners. The county tax assessor-collector is in charge of this function for county units. In counties with fewer than 10,000 residents, the sheriff serves as the tax assessor-collector unless voters approve the election of a separate tax assessor-collector. The county tax assessor-collector may, by contract, assess and collect taxes for non-county taxing units.

Cities with populations up to 5,000 can assess only $1.50 per $100 of taxable valuation; cities with more than 5,000 residents can assess only $2.50 per $100.;

School districts can collect up to $1.17 per $100 in taxable valuation for maintenance and operations . The base rate for M&O is $1.00, but schools can increase the rate by $0.04 without a vote and by a maximum of $0.13 with voter approval. The 2008 average M&O tax rate for all school districts in Texas was $1.052194. This is much less than the average of $1.478997 in 2005, before the rate was lowered to provide property tax relief. School districts are allowed to assess an additional amount of tax for interest and sinking fund debt service on building projects. The average I&S rate rose 39 percent from 2005 to 2008, when it was $0.157313.

Don’t Miss: Where Can I Find My Real Estate Taxes

How Your Tarrant County Property Tax Bill Works

In Tarrant County, property tax statements are usually mailed in the first week of October. If you dont get a property tax statement, its important to contact the County or print a statement online. If you miss the deadline to pay your property taxes, I never got a statement in the mail will not work as an excuse for non-payment. Penalty and interest will still accrue.

The last day to pay your property taxes without incurring a late penalty is Jan. 31. All payments must be processed on or before 12 a.m. Central Standard Time on that date. If youre late making a property tax payment in Tarrant County, a penalty fee and interest will accrue.

The amount of penalty and interest applied to your bill will depend on how late your payment is. Beginning in February, late bills are subject to a 6% penalty and 1% interest. In March, the penalty jumps to 7% and the interest rate jumps to 2%. Penalty and interest continue to climb as the months tick by. By July, the combination of penalty and interest amounts to 18%. These steep penalties are why it behooves you to get your Tarrant County property tax payments in on time.

If you pay your property tax bill and then the County belatedly approves an exemption application or an appeal of your assessed property value , the County will issue you a refund check. Such property tax corrections can go in the other direction, too. If the County decides that you paid too little it can issue a supplemental tax bill requesting additional money.

Working With The Assessor

If you are present when the assessor appraises your property, you can point out any factors that affect the value of your property and provide any information on recent property sales in your area to make sure the assessment is fair.

Unfair property assessments can be contested or appealed, but this should be your last resort. DoNotPay is here to help you understand the appeal procedure, get the necessary documents together, and lodge your appeal.

You May Like: Can You File Missouri State Taxes Online

What Is Business Property Tax

Business property tax is the tax a business owner is responsible for paying on company-owned property. Just like a homeowner pays property tax on their home, your company needs to pay tax on your property. You must pay business property taxes on the following:

- Land

- Real estate

Business property taxes depend on your locality. In most cases, your property taxes for business are assessed by the city or county where the property is located. Business property taxes typically help fund local schools, public safety, and construction projects .

Your business property tax rate is based on the value of your businesss land or real estate. Your local tax department determines the value of your business property and the amount of annual property taxes you must pay.

Additionally, you may need to pay property taxes when it comes to buying or selling business property. For example, you likely have to pay property taxes when youre buying or selling a business. Some localities split the property tax between the buyer and the seller, depending on how long each person owned the property during the tax year.

On top of paying business property tax for buildings and land, you may also be required to pay another type of tax called business personal property tax.

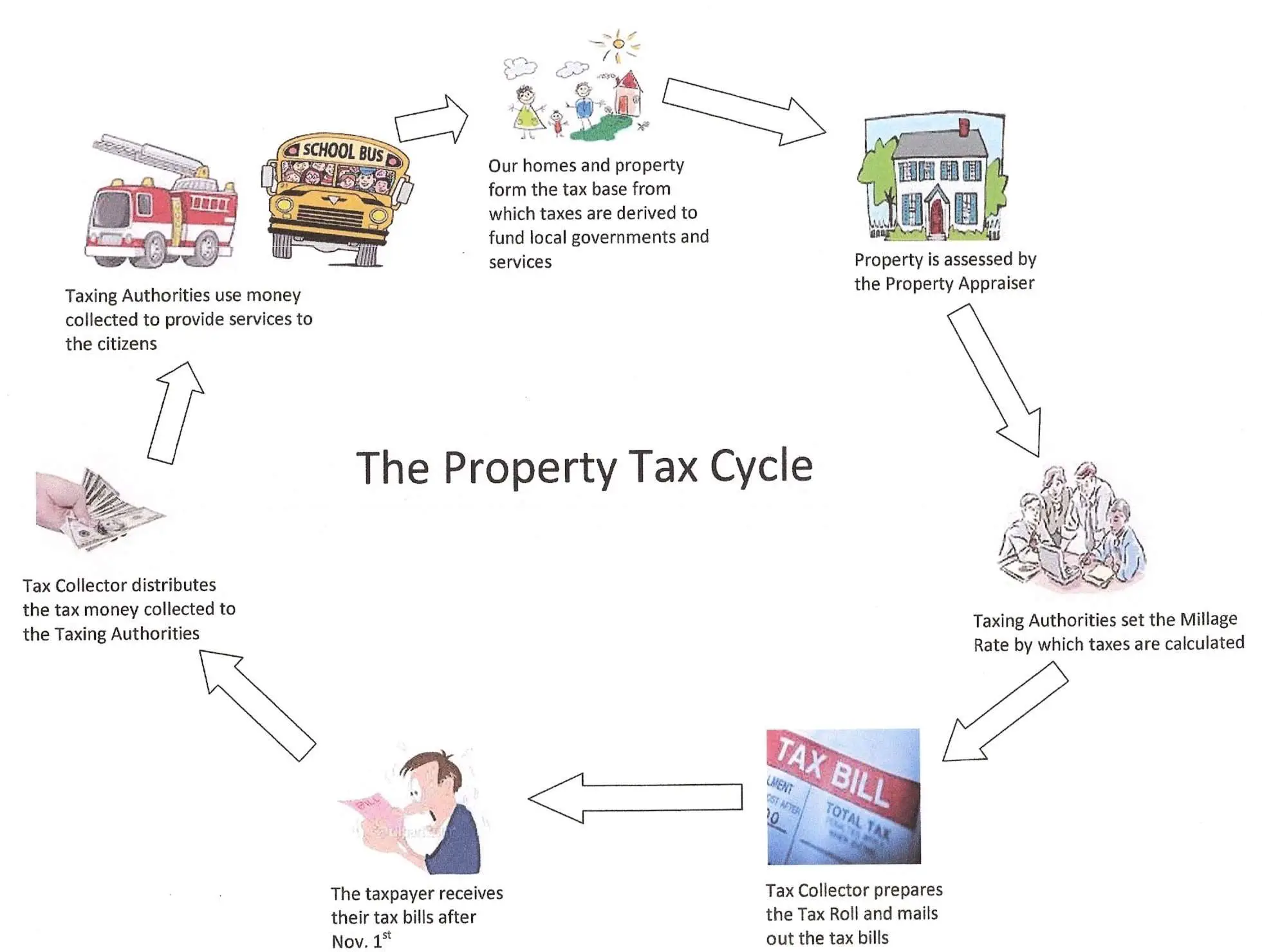

How Does The System Work

There are three main parts to the property tax system in Texas:

The system has four stages: valuing the taxable property, protesting the values, adopting the tax rates, and collecting the taxes.

Between January 1 and April 30, the appraisal district processes applications for tax exemptions, agricultural and timber appraisals, and other tax relief. Around May 15, the appraisal review board begins hearing protests from property owners who believe their property values are incorrect, or who feel they were improperly denied an exemption or agricultural/timber appraisal. The ARB is an independent panel of citizens responsible for handling protests about the appraisal district’s work. When the ARB finishes its work, the chief appraiser gives each taxing unit a list of taxable property known as the appraisal roll.

Don’t Miss: Where To File Taxes For Free