Do You Pay Taxes On Lyft Income

Yes, you must pay taxes on the money you make driving for Lyft.

Lyft doesnt take taxes out of your pay like youre probably used to at current or past jobs.

Jobs where they classify you as an employee usually handle taxes for you.

Employees receive a W-2 tax form to use when filing a tax return.

Independent contractors receive whats called a 1099 tax form.

Most likely, youll get a 1099-K form and a 1099-NEC form from Lyft.

Companies draw taxes from an employees pay based on how many exemptions those employees listed on their W-2 paperwork.

Employers dont take any taxes out from independent contractors who receive 1099 forms.

This means youre responsible for setting aside enough money to pay taxes on your Lyft driving income.

There Is a Threshold for Filing Lyft Taxes

Lyft doesnt create and send a 1099 to every Lyft driver.

In most states, youll receive a form 1099-K if you made at least $20,000 from ride payments and gave at least 200 rides during the year.

These four states work differently:

- Illinois: Youll get a 1099-K if you earned $1,000 or more in ride payments.

- Virginia, Massachusetts, and Vermont: Youll receive your 1099-K after earning $600 or more from giving rides to passengers.

In all states, the 1099-NEC tax form goes out to you if you earned $600 or more from income other than giving rides.

These earnings might include bonuses paid to you by Lyft, for instance.

What Forms Will I Need To File My Taxes

- Annual Summary: All drivers will receive an Annual Summary if they received any earnings during the year. Your Annual Summary isnt an official tax document.

- 1099-NEC form: Some drivers will receive a 1099-NEC form depending on how much they earned from things like bonuses.

- 1099-K form: Some drivers will receive a 1099-K form depending on how much they earned while giving rides.

B Notice: If Your Information Was Wrong

If there was an issue with the name or TIN you gave Lyft in a previous year, youâll receive a B Notice from the IRS. Sometimes, itâs as simple as a typo on the info you provided.

Donât panic if you get a B Notice. Itâs just important to notify Lyft immediately. Fortunately, the B-Notice provides clear instructions for you to correct it.

Correcting your info after getting a B Notice

Simply contact Lyft to provide the corrected information, so they can submit it to the IRS.

Donât wait on this. If Lyft doesnât receive the requested information within 15 days, theyâre required by the IRS to withhold 24% of your earnings. These get sent directly to the IRS in whatâs called âbackup withholding.â

To make matters worse, Lyft doesnât allow you to use Express Pay or Lyft Direct if there is backup withholding on your account.

Don’t Miss: How Do I File My Taxes Through Mail

What Mileage Can I Write Off For My Lyft Driving

Lyfts mileage breakdown will give you all mileage you drove while you had driver mode on . This will be the total mileage youre able to write off for the year, since you arent generally allowed to write off commuting costs. This isnt the only deduction you can claim. For a list of deductions common to the self-employed, click here.

How To Report Cash Income Without A 1099

When not hanging out with his high profile friends like Gandhi or Batman, Robby enjoys spending time with his wife and children. He can sneeze with his eyes open, has won two lifetime achievement awards, and has visited every country three of which haven’t been discovered yet. He is also a Certified Public Accountant and assists clients with a wide variety of accounting and tax issues.

It’s not uncommon for freelancers and independent contractors to get paid in cash.

If you’ve got clients who prefer to do things that way, they won’t send you the usual 1099-NEC reporting what they paid you.

Unfortunately, not having a 1099 form for your earnings doesn’t mean you can skip reporting them. The IRS counts cash payments as part of your self-employment income. That means you’re still expected to report it â and pay taxes on it.

Contents

Read Also: What Form To Use To File Taxes

How To Use Your Lyft Tax Documents

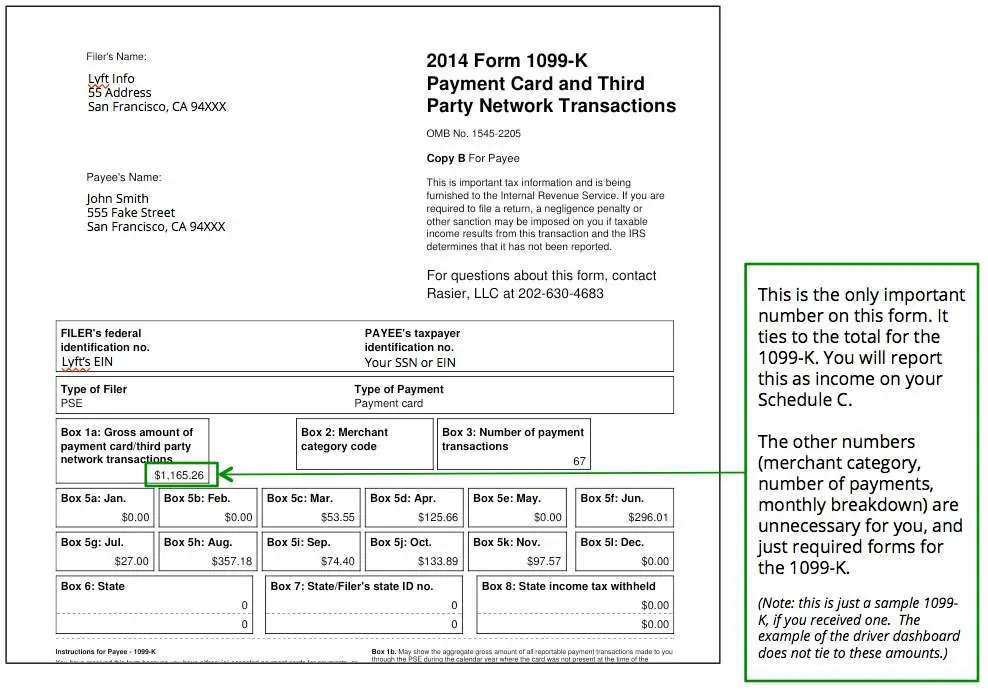

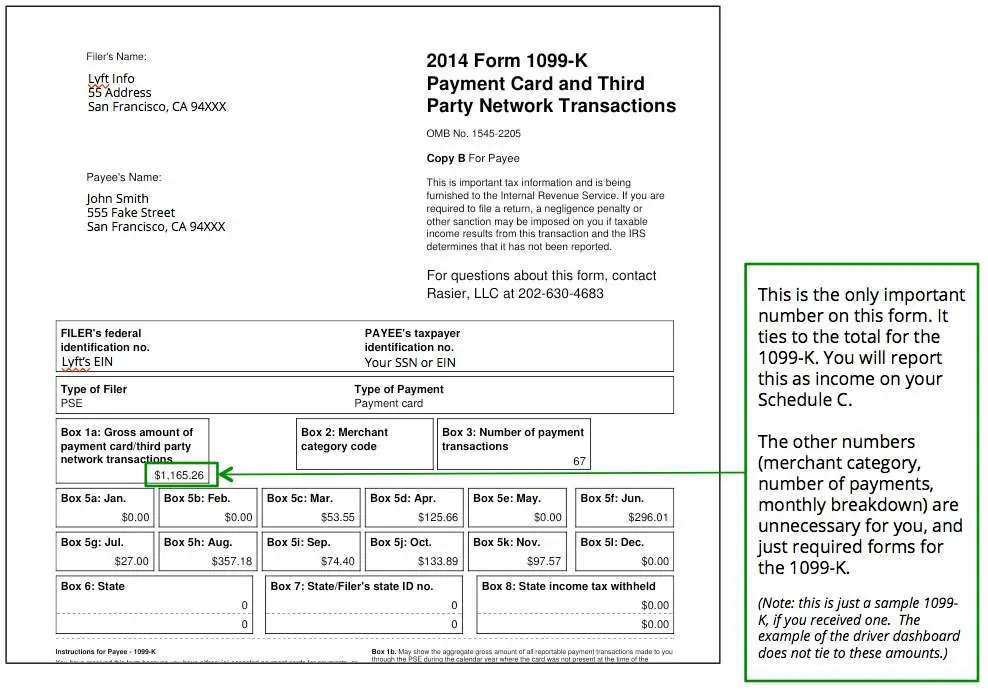

If reading your 1099s feels like trying to solve a crossword puzzle before guzzling your first cup of coffee, youâre not alone. Thankfully, theyâre simpler than they look. The Lyft 1099 forms have many boxes, but you only need to concern yourself with two:

- Box 1a on 1099-K

- Box 1 on 1099-NEC

These report your gross earnings in each category â earnings from rides on the 1099-K and bonus earnings on the 1099-NEC.

Important note: The amount in Box 1a of 1099-K will be larger than what you actually got paid. Thatâs because it shows the total amount your customers paid before Lyft took their cut.

Gather All Of Your Documents

Its a good idea to use an app like Stride or TripLog to monitor and record your on-app driving. If you need help choosing which app is best for you, check out our Mileage Tracker Review article. One driver from Oregon who wrote to us about being audited stated:

I have supplied them with all my Uber/Lyft documentation and daily driving logs which include begin and ending odometer readings for each day. They are now asking for a narrative of all my miles between drop-off and the next pick up to include where I went, why I picked where I did if sitting in a parking lot, and the amount of time between the requests.

That is a lot more detailed than anyone would have imagined the IRS would ask for. Who writes down why they decided to park in a mall parking lot to wait for their next ping or records how much time there was between dropping of someone and getting your next ping?

According to the IRS, when you receive a notification of being audited, Were asking for information to verify items you claimed on your tax return. You must send in the documents needed to close your audit or we will send you an audit report showing our proposed changes.

The IRS website also features a section called, Your Rights During an Audit:

Your audit packet includes:

If youre being audited, be sure to read these to make sure you understand your rights and what steps you can take to appeal if you feel the need to. It even includes a way for you to get help with your audit if you need it.

You May Like: When Does Irs Open For 2021 Tax Season

How Bench Can Help

Want to have the easiest tax season and the smallest tax bill? With Benchâs premium subscription package, you get access to a tax professional year round in addition to automated bookkeeping. Our tax professionals are there to ensure you take advantage of every deduction available to you. While spending your money right can decrease your tax bill, the confidence of going into tax season knowing it will be the smallest bill possible is priceless. Learn more.

Lyft Driver Tax Checklist Of Deductions

The following items are generally allowed deductions.

- Fees to apply for a platform or for a background check.

- Water and candy you provide to your riders.

- Transaction fees .

- Signs or lighting to identify you as a rideshare driver.

- Business software you use to help you find the best times to drive.

- Parking fees if you have to pay to pick up a passenger.

The following items are generally not deductible because they are also for your own personal use.

- Cellphone bills.

- Phone chargers, cellphone mounts, and similar accessories.

- Dash cams .

- Floor mats and other improvements to your car.

Some of the above items could be partially deductible if you can prove to the IRS what portion of the expense was for business use. This is hard to do because so many people try to deduct personal expenses, and the IRS auditor will be very skeptical.

Don’t Miss: How To Get An Advance On Your Taxes

Estimated Or Quarterly Tax Payments

As a Lyft driver, it is up to you to calculate and pay taxes at the end of each quarter in which you made money from driving for Lyft.

You must pay estimated quarterly taxes four times a year if you expect to owe the IRS $1000 or more in taxes.

The quarterly tax payments are due on April 15, June 15, September 15, and January 15.

It is up to you to calculate your estimated tax and pay the appropriate amount to the IRS to avoid any penalties.

Do Lyft Drivers Receive A 1099

Lyft will file IRS form 1099-K for specific drivers. These drivers gave at least 200 rides and generated $20,000 in gross ride receipts. Lyft drivers who earned at least $600 from activities other than driving in the last year will get a Form 1099-MISC. These activities could include bonuses, mentoring and more.

Also Check: How To File Previous Years Taxes Turbotax

Tracking Down The Data

The easiest way to get this missing data is to call the employer, bank or investment company and ask for your income information over the phone. Most companies also allow you to check your accounts and tax documents online. And in some cases, the amounts that would be on a 1099 are readily available from documents you already have.

For example, your bank may put a summary of the interest paid during the year on your accounts December or January statement. Many financial companies make the interest figure available through customer service phone lines or websites. And most investment firms include the years Form 1099 cumulative amounts as part of quarterly dividend statements.

RATE SEARCH: Get some interest on your savings starting today by shopping money market accounts.

If your missing 1099 does finally show up, dont discard it because you got the information elsewhere and already filed your return. Check the form to ensure the amount it contains is the same as what you reported. If there is any discrepancy, call the issuer to reconcile the differences.

When the late-arriving data are correct and what you filed is not, youll need to file an amended return Form 1040X. If you dont, expect to hear from the IRS, usually by mailed notice, because the agency will use the final 1099 as its basis for reviewing your return for accuracy.

Does Uber And Lyft Take Taxes Out

Do Uber and Lyft drivers pay taxes? Uber drivers and Lyft drivers are not considered employees by the IRS. Instead, theyre classified as independent contractors, meaning the rideshare services dont withhold taxes from their payments. Independent contractors also receive a 1099 at year-end rather than a W-2.

Also Check: Who Has The Power To Levy Taxes

Two Kinds Of 1099 Tax Forms

Since you are in business for yourself and not an employee of Lyft, you will not receive a W-2 wage and tax statement from the ridesharing company. Instead, youll probably receive one or more 1099s, depending on how much you earned from certain services. Here are the forms you are likely to receive and the IRS requirements for issuing them:

- For tax years beginning in 2022, Form 1099-K if you generated more than $600 in transactions or for tax years before 2022 if you generated more than 200 transactions and more than $20,000 in gross ride receipts. This is the IRS requirement, however, you are likely to receive the 1099-K even if you have fewer transactions with less gross receipts.

- A 1099-NEC if you received more than $600 in non-driving income

Keep in mind, you are responsible for reporting all the income you earn, whether you receive a 1099 or not. For example, if you earned $400 in referral fees, you may need to report that income, even if you didnt receive a 1099-NEC. You can always see exactly how much you earned in driving and non-driving income on your Lyft Driver Dashboard.

How Does Policygenius Make Money

Were an independent insurance broker, so we get paid a commission by insurance companies for each sale. Insurance commissions are already built into the price of an insurance policy, so youre not paying any extra for working with us to buy a policy. Our compensation on any particular purchase may vary depending on a number of factors, including the type and size of product, the insurer, and the volume of business we have with an insurer, but we don’t push for or give preference to any one insurer over another because of the commission. We’re here to fight for you, not for ourselves.

Recommended Reading: How Can I File My Ga State Taxes For Free

Do Lyft Drivers Have To Pay Taxes

Yes. And, it’s not as straightforward as if you were a W-2 employee.

Because you’re running your own business, you will be expected to pay the Self-Employment Tax if you foresee to make over $400 in net earnings for the year. Plan on paying this tax each quarter. Of course, you’ll also have to file your annual tax return.

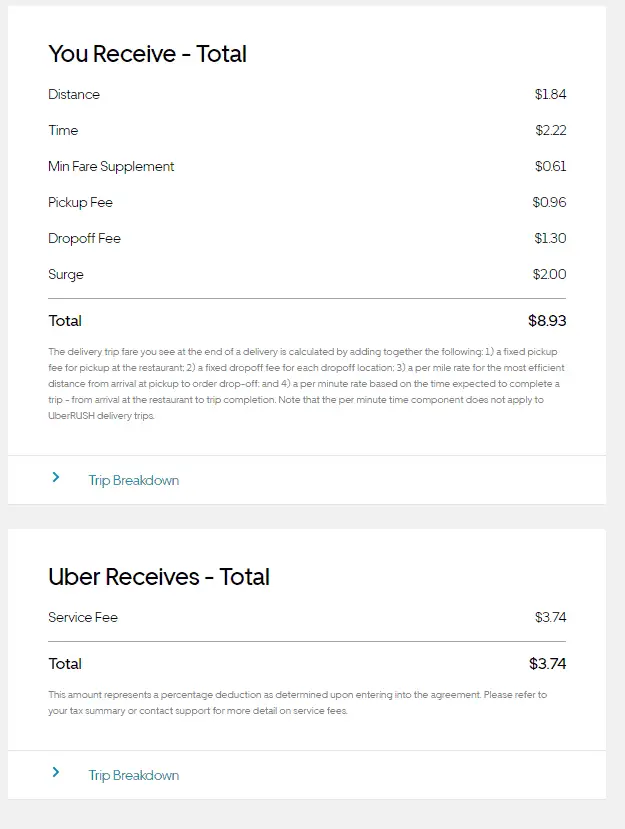

Thankfully, Lyft drivers can access a dashboard with their yearly stats. The collected info includes the number of rides, non-ride earnings, tolls, gross earnings from rides, and miles driven while in driver mode.

If you drive for Lyft as a way to supplement your W-2 income, your taxes can get slightly more complex. Here’s how to file taxes when you have a W2 and 1099.

Including Cash Income In Your Gross Receipts

Pro tip: Make sure the total you enter for “gross receipts” is at least as much as the total amount you have reported on 1099s. Here’s an example of how that works.

Say you received two 1099-NECs from freelancing clients. One of them reported $5,000 in nonemployee compensation, while the other reported $1,000. Together, that’s $6,000 in income that the IRS already knows about.

Now, let’s assume you also made some additional income that isn’t reported on any 1099s: say, $2,000 in cash from several smaller gigs.

When you report your total self-employment income, you’ll add that $2,000 to the $6,000. This gets you a gross income of $8,000.

Read Also: How Much Federal Tax Should I Pay

Keeping Track Of Your Cash Income

It’s hard to report your cash income if you don’t know exactly how much you made.

That’s why it can be helpful to keep a log of your cash earnings. It’s especially a good idea for any tips you got paid in cash, since those tend to vary in amount. That’s why the IRS created an easily accessible form for taxpayers to use to log their tips.

To be clear, the IRS doesn’t require you to track your tips this way â it’s just a recommendation. It’s preferred tip log format includes:

- The date you got the tip

- The amount you were paid

- The payment method

In practice, though, tips you receive through credit card and check are easy enough to track through your bank statements. All you really need to log is what you got in cash.

You can use the exact same format to track all your cash payments â not just your tips.

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.

Don’t Miss: Are New York State Tax Refunds Delayed

The Lyft Driver Tax Write

Write-offs can lower your taxable income and provide some necessary relief when itâs time to send the IRS your cut. For example, as a Lyft driver, you can snag tax deductions that help you recoup some of that wear and tear on your car.

The more eligible write-offs you can claim, the lower your taxable income will be.

Which Forms Do You Use To File Self

You will file Schedule C to report your profit to the IRS. On the form, you record all your business income and business tax deductions . You pay taxes on your net income, which is your total income minus any business tax deductions.

You have several options for preparing and filing your taxes. One option is to visit GetYourRefund.org for free virtual tax preparation. Depending on your income and needs, GetYourRefund will direct you to full-service virtual tax filing, free tax preparation services, or free in-person services. They serve people making up to $73,000.

Tax form with calculator, money and pen

Recommended Reading: Do My Taxes Myself Online

Whats The Difference Between A W

- IRS Form W2 reports employee wages. You will only get a W-2 if youre in a state that says drivers are employees.

- IRS Form 1099-NEC reports independent contractor income that the company you contracted with paid directly to you. This income used to be on Form 1099-MISC along with other types of income. The IRS now uses Form 1099-NEC instead for their tracking purposes. The IRS requires a 1099-NEC when you earn $600 or more from a payer.

- IRS Form 1099-K reports independent contractor income that you received from an electronic payment network such as PayPal, Stripe, or another system. Again, Lyft is saying theyre the payment network when it comes to rider payments. Up until 2021, you would only get a 1099-K if you earned at least $20,000 AND had 200 or more transactions in a year. Starting with 2022 , 1099-Ks will change to a $600 minimum with no number of transactions the same as form 1099-NEC.

How to Find Your Lyft Tax Documents

Lyft will post your 1099 in the Tax Information tab of your Driver Dashboard by January 31st. You can still access your tax documents even if your Lyft account is no longer active. If you didnt earn the minimum amount to receive a 1099 but need to know how much you earned to include on your tax return, you can use your Annual Summary. Lyft uses both 1099-NEC and 1099-K forms depending on your income.

Continue Reading Below