What Are Georgias Filing Requirements

Non-Residents. Non-residents who work in Georgia or receive income from Georgia sources and are required to file a Federal income tax return are required to file a Georgia Form 500 Individual Income Tax Return. Some examples of Georgia source income are: Wages. Georgia Lottery Winnings. Income from flow through entities

Many Taxpayers Can File Their State And Federal Tax Returns For Free

IRS Tax Tip 2021-10, February 1, 2021

As taxpayers get ready to file their federal tax returns, most will also be thinking about preparing their state taxes. There’s some good news for filers wanting to save money. Eligible taxpayers can file their federal and, in many cases, their state taxes at no cost.

Taxpayers whose adjusted gross income was $72,000 or less in 2019 can file their 2020 federal taxes for free using IRS Free File. Many of them can also do their state taxes at no charge. They do so through Free File offered by the IRS.

What Do I Need To Bring To My Appointment

- Bank routing and transit number and your account numbers for Direct Deposit

- A copy of last year’s federal and state returns . If not available, you can obtain a Tax Return Transcript at irs.gov/transcriptand download a copy of your federal return

- Proof of identification

- Social Security Cards or Individual Taxpayer Identification notices/cards for you, your spouse and/or dependents and/or a Social Security number verification letter issued by the Social Security Administration

- Your birth date and birth dates of your spouse and/or dependents

- Wage and earning statement, Form W-2, W-2G, 1099-R, from all employers

- Interest and dividend statements from banks, credit unions, other financial institutions or government agency

- Records of earnings from self-employment and expenses related to self-employment income

- Documents supporting itemized deductions, child/dependent care, etc., where applicable

- Forms 1095-A, B or C Affordable Healthcare Statements

Don’t Miss: What Type Of Business Is Doordash For Taxes

Misplacing A Sales Tax Exemption/resale Certificate

Georgia sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the Georgia Department of Revenue may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Miltax: Tax Services For The Military

This tax season, start with MilTax from Military OneSource and the Department of Defense. MilTax free tax services include tax prep and e-filing software and personalized support that address the realities of military life deployments, combat and training pay, housing and rentals, multistate filings, living OCONUS and more.

Read Also: Do Doordash Drivers Pay Taxes

Failure To Collect Georgia Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

When Do I Need To File My Georgia Tax Return

File your Georgia and Federal tax returns online with TurboTax in minutes. FREE for simple returns, with discounts available for Tax-Brackets.org users! We last updated Georgia Form 600 in March 2020 from the Georgia Department of Revenue. This form is for income earned in tax year 2019, with tax returns due in April 2020.

Recommended Reading: How To File Taxes For Doordash

Individual Income Tax Filing

Filing electronically, and requesting direct deposit if youre expecting a refund, is the fastest, safest, and easiest way to file your return.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

Ways To File Your State Income Tax Online For Free

It isnt too difficult to find a place to file your federal tax return for free, but finding a service to file your state return for free is another story.

So if you are asking where can I file my state taxes for free? you are in for good news!

I did a little digging and found a few options to consider . . . .

You May Like: Appeal Cook County Property Taxes

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

- PreSDDSpare, E-file, and Print

- Prepare, E-file, and Print

- Prepare, E-file, and Print

How To Pay Your Taxes Online In Georgia

The Georgia Tax Center is your one-stop shop for electronic filing and paying taxes. Create an account with the Georgia Tax Center to sign up for electronic notifications. How do I create an Account in GTC? No login required. You may need FEIN, SSN, Georgia tax number, etc. Credit card payments are not allowed with Quick Payment

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Filing When There Are No Sales

Once you have a Georgia seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Robust Customer Service And A Guided User

TurboTax is one of the top services for tax filing. Its free service brings the same expertise that has built a reputation in the industry. Those with W-2s and other simple tax returns will enjoy all it has to offer.

Free federal income tax and state tax returns are available and TurboTax Free Edition supports many of the important, commonly filed forms and schedules:

- US individual income tax return

- Unemployment income

- Schedule EIC

- Form 1099-INT

- Form 1040-V payment vouchers

Certain forms and schedules associated with more complicated returns, such as Schedule SE , Schedule D , and educational forms, such as 1098-E and T require a paid tier.

TurboTax Free Edition advantages

- Maximize refund: If you get a larger refund using a different service, TurboTax Free Edition users are entitled to a payment of $30. If IRS penalties should arise from calculation errors, TurboTax will pay the penalty and interest. You will be shown if you qualify for additional credits, to help get you a larger return.

- Teaching tools: You will see your updated tax refund in real-time as you work through the process, and personalized insights will explain why you are receiving certain credits, helping you better understand your taxes.

- Support and security: TurboTax Free Edition offers some of the most robust customer services of all the free tax software programs available, and it’s one of the most secure cloud services.

Also Check: How To Buy Tax Liens In California

Miltax Software Will Be Available Mid

Check back early 2022 to learn when you can begin filing your taxes.

This easy-to-use, self-paced tax software walks you through a series of questions to help you complete and electronically file your federal return and up to three state tax forms. Calculations are 100% accurate guaranteed by the software provider. Visit the software details page for more information.

Worst Option: Get The Paper Forms And Mail Them In

Yes, it sounds pretty archaic, but if you really want to file your state return for free and dont qualify for the options listed above, this might not be a bad option. If you have already completed the federal form online, it should be pretty easy to fill out the state return. You can get the forms from your local library or you can print them off at your states Department of Revenue website.

Don’t Miss: How Do I Pay Taxes For Doordash

Can You File Georgia State Taxes For Free

The Georgia Department of Revenue is working with software vendors to offer free electronic filing services to qualified Georgia taxpayers. Qualifying taxpayers can prepare and file both federal and Georgia individual income tax returns electronically using approved software for less or free of charge.

Why Is Ga State Refund Taking So Long

The Department of Revenue is protecting Georgia taxpayers from tax fraud. It may take more than 90 days from the date of receipt by DOR to process a return and issue a refund. All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia for at least five years, will receive a paper check.

Also Check: Door Dash Taxes

Taxes Prepared In Person

Volunteer Tax Assistance

Free tax help is provided to taxpayers that meet certain income and/or other requirements. For more information, please go to our Volunteer Assistance page.

If you would like to get your taxes prepared in person, you also can use an authorized e-file Provider. Note: The authorized e-file providers charge a fee to prepare and electronically file your Alabama and/or federal returns.

Below are some additional resources to help you to choose a tax return preparer.

IRS links

Best Free Tax Software 202: Free Online Tax Filing

Professional tax preparation services are great programs for those with complex tax filings. But many online programs offer free tax software for those with simple returns.

Tax filings and payments are due by Monday, April 18, 2022. That day is quickly approaching, and tax preparation takes time and careful attention. Understanding the tools available to you is important, too.

Using a tax preparation service or a professional tax preparer is great if you can afford it. But many people are unaware that there are free tax software options available online.

No matter how you file taxes, there is free tax software on the market that can help you get it done quickly and efficiently. Here is a look at some of the free tax software options that could help you during tax season.

You May Like: Doordash Write Offs

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Georgia sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Here’s A Few Things For Taxpayers To Know About Filing State Tax Returns Through Free File

- Most people make less than the $72,000 income limit. So, most people can use Free File.

- Generally, taxpayers must complete their federal tax return before they can begin their state taxes.

- More than 20 states have a state Free File program patterned after the federal partnership. This means many taxpayers are eligible for free federal and free state online tax preparation.

- The states with a Free File program are Arkansas, Arizona, Georgia, Idaho, Indiana, Iowa, Kentucky, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, Montana, New York, North Carolina, North Dakota, Oregon, Rhode Island, South Carolina, Vermont, Virginia and West Virginia, plus the District of Columbia.

- IRS Free File partners feature online products, some in Spanish. They offer most or some state tax returns for free as well. Some of them may charge so it’s important for taxpayers to explore their free options.

- Free File partners will charge a fee for state tax return preparation unless their offer says upfront the taxpayer can file both federal and state returns for free. Taxpayers who want to use one of the state Free File program products should go to their state tax agency’s Free File page.

- Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming don’t have an income tax. So, IRS Free File for a federal return may be the only tax product people in those states need.

Don’t Miss: Does Doordash Deduct Taxes

Other Free State Income Tax Filing Websites

3. MyFreeTaxes.com This is a not-for-profit with funding from the Walmart Foundation, The United Way and H& R block and they offer free state and federal tax returns if you meet the criteria.

4. On-Line Taxes This one is pretty simple. You have to have an adjusted gross income within a certain range. If you dont qualify both returns cost $7.95. They are a little bit different than many of the other places in that they offer free customer service with a toll-free number, e-mail, and live tax help. They also allow you to view the forms before paying.

How To Prepare For Tax Season

You can file your tax return as early as January 24 this year. The sooner you file, the sooner you can receive your refund . Numerous tax preparation services and professional tax preparers stand ready to help during this tax season. Of course, these services often come with a fee depending on the tax situation. Complicated tax filers dealing with less common forms and schedules will benefit the most from professional services.

The new tax filing extension deadline is quickly approaching. For those with common, less complicated tax filings, such as W-2 employees, the process can be more simple and even free. Many of the top-tier tax preparation services offer free editions for simple tax filers who qualify, bringing their expertise at no cost to you.

Regardless of whether you file yourself using online tax software or a tax professional, you still have to do most of the legwork to get organized. You can make tax filing easier by getting organized in advance in a few ways:

-

Find and review the previous year’s tax return: Last year’s tax return can be a good starting point to determine what type of deductions you took and what figures and documents you may need to collect for the current year.

-

Save and categorize your receipts: If you plan on taking deductions for specific categories such as medical or work-related expenses, keep your receipts organized by categories such as uniforms, dry cleaning, prescription drugs, and more.

You May Like: Protesting Property Taxes In Harris County

Who Must File Ga Tax Return

The following individuals who live in Georgia must file a tax return: Those who filed a federal tax return. Single head of household individuals or married couples filing separate returns with gross income of more than $9,750. Married couples filing a joint return with gross income of more than $19,500.

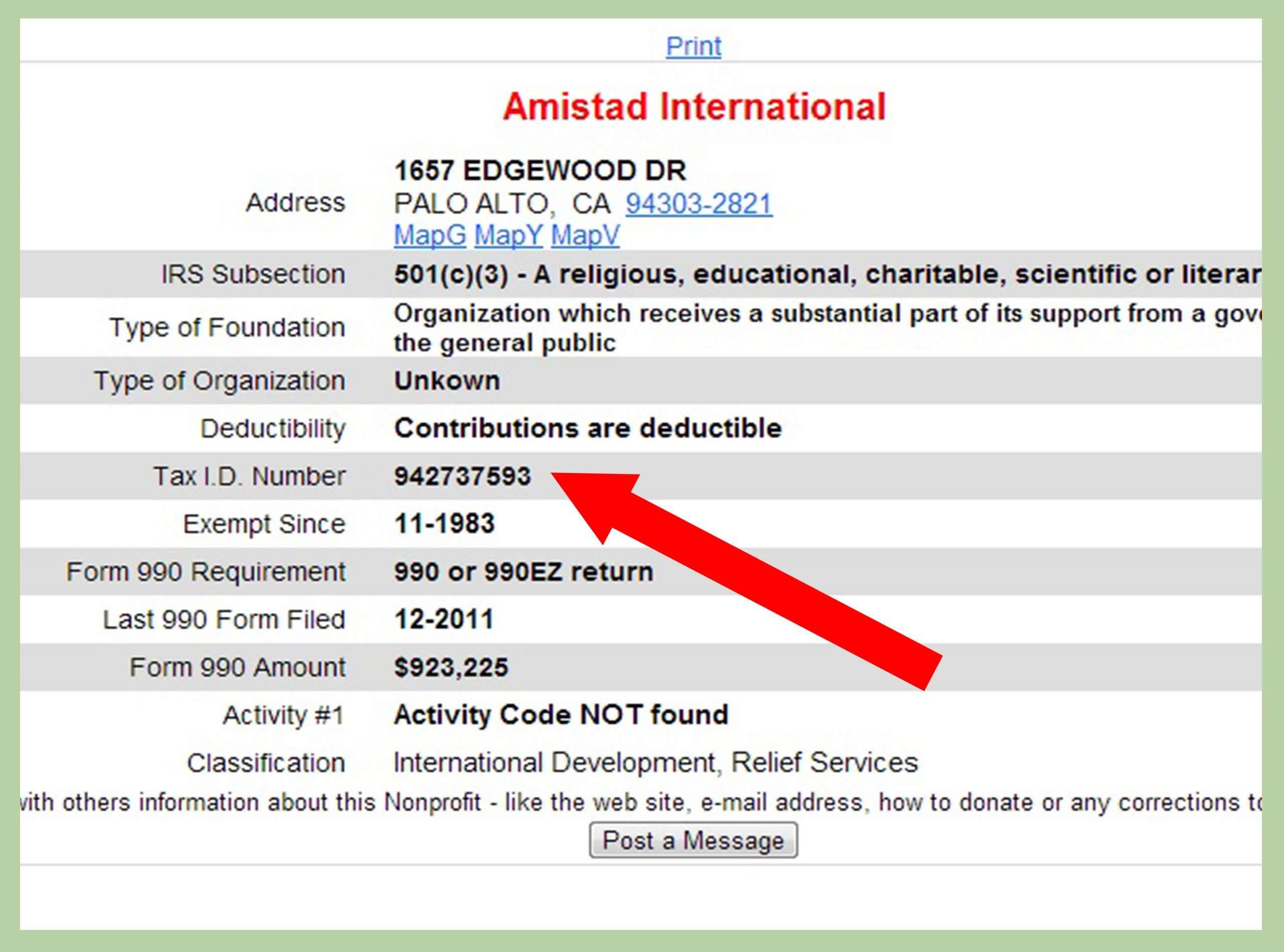

How To Register For A Georgia Seller’s Permit

You can register for a Georgia sales and use tax number online through the Georgia Tax Center . To apply, youll need to provide the GTC with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

- Products to be sold

Also Check: Doordash Taces

Its Goal Is Accuracy And Max Refund For Tax Filers

It may seem odd at first to list Credit Karma as one of the best free tax software since most folks associate them with free credit scores. But it is true: Credit Karma offers a free, online tax preparation program now called Cash App Taxes. To start, you must .

Unlike other free tax filing software that may charge for state returns or certain deductions, Cash App claims there are no restrictions. You can file state or federal taxes for free regardless of the deductions or credits you choose.

-

High customer ratings: Nearly four million returns have been filed with an overall rating of 4.8 out of 5 stars.

-

Totally free: There are no hidden fees or restrictions, regardless of state or federal filing or the deductions and credits you choose.

-

Tax calculator: You can estimate your tax refund before downloading the app to file.

-

Faster refunds: Choose to receive your refund into Cash App to get it up to two days earlier.

-

Accurate: Cash App guarantees your tax filing is accurate and double-checks your return before submitting it.

- Maximum Refund Guarantee: You’ll receive the maximum refund you’re entitled to. Cash App will reimburse you up to $100 if you amended your tax refund with another service and received an additional refund.