Victims In Fema Disaster Areas: Mail Your Request For An Extension Of Time To File

Find out where to mail your form.

Need more time to prepare your federal tax return? This page provides information on how to apply for an extension of time to file. Please be aware that:

- An extension of time to file your return does not grant you any extension of time to pay your taxes.

- You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

- You must file your extension request no later than the regular due date of your return.

Paper Returns Have Vulnerabilities Too

Its also important to consider how safe it is to submit your tax return by mail. Paper returns can be lost or stolen. Theyre also more susceptible to error. Unfortunately, your private information is vulnerable no matter how you submit your return.

Certain forms cant be e-filed no matter how you complete them. However, most people wont need to file these forms. The most common circumstance when you might have to submit a paper return is if you need to file an amended return.

Besides the possible security riskswhich may be outweighed by features such as convenience and receiving your refund fasterare there any other cons of filing your tax forms electronically?

Paying Other Business Taxes

Making your tax payments online is the best and easiest way to pay. LLC owners, sole proprietors, or partners in partnerships can use one of several IRS e-pay options, including direct debit from a bank account, credit card, or debit card.

Corporation and partnership returns should use the IRS Electronic Federal Tax Payment System .

You May Like: How Much Tax For Doordash

Do I Have To File Maine State Taxes

Anyone who is a resident of Maine for any part of the tax year, and has taxable Maine-source income, must file a Maine return. Anyone who is not a resident of Maine, but performs personal services in Maine for more than 12 days and earns more than $3,000 of income from all Maine sources, must file a Maine return.

What Happens If You Dont File Taxes While Living Abroad

Just like every US resident, if youre living abroad and fail to file your US or state taxes, you can receive a penalty for not filing taxes, even if you do not owe taxes. The failure to file penalty could be thousands of dollars, being disqualified from benefits that will reduce your tax obligation, or worse.

Read Also: Reverse Ein Lookup Irs

What To Do About Missing Tax Forms

If you dont receive one or more of the forms you need, youre not absolved of reporting that information on your tax return. Heres how to handle this situation.

If you file a paper return by mail, youll need to include copies of the forms issuers have sent you if they show taxes withheld. If you file electronically, you wont have to.

How Does The Irs Find Out About Foreign Income

The IRS has various ways to find out about international or overseas bank accounts. Another tool used by IRS is to get a Federal Court to issue John Doe summonses and have them served on financial institutions to investigate a foreign financial institutions compliance in reporting U.S. account holders.

Read Also: How To Pay Tax Uber Driver

How Do I Send My Tax Return By Mail

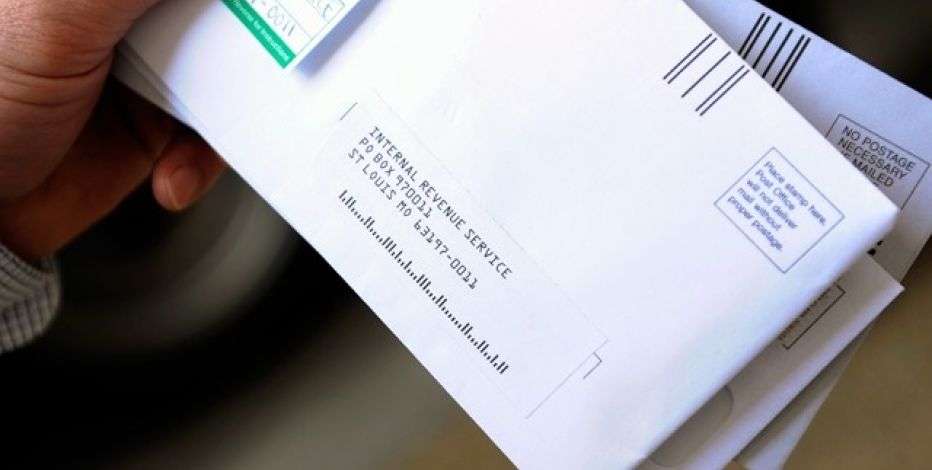

Use the U.S. Postal Service® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS. Mailing Tips

Use A Secure Method To Mail Your Return

Always use a secure method, such as certified mail, return receipt requested, when you’re sending returns and other documents to the IRS. It will provide confirmation that the IRS has actually received your documents or payment.

In addition to addressing it correctly and using sufficient postage, be sure the envelope is postmarked no later than the date your return is due. If you use registered mail, the date of the registration is the postmark date if you use certified mail, the date stamped on the receipt is the postmark date. If you use an IRS-approved private carrier , make sure the return is sent out no later than the date due.

Don’t Miss: Protest Property Taxes In Harris County

Filing An Extension Application

You can e-file an extension application or mail it to the IRS. There are two application forms for most circumstances: Form 7004 for corporations and partnerships, and Form 4868 for other business types and personal returns.

You can get an automatic extension by filing either of these forms.

If you were affected by winter storms in Texas, Oklahoma, or Louisiana, you do not need to file for an extension if you plan on filing taxes by June 15. If you want to delay filing until October 15, you will need to request an extension.

Regardless of your income, you can also use Free File to electronically request an extension, which will give you until October 15, 2021, to file a return. To get an extension, you must estimate your tax liability and pay any amount due.

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Don’t Miss: Wheres My Refund Ga.state

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Don’t Miss: Www.1040paytax.com Review

Where To Send Returns Payments And Extensions

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The Balance / Lara Antal

It’s usually best to go the extra mile when you’re dealing with the Internal Revenue Service , even if it feels like a nuisance or a waste of time. That’s even more applicable if you’re one of the few people who still files a paper or snail-mail tax return rather than filing electronically.

Following a few guidelines will ensure that your tax return goes to the proper address, that it gets there on time, and that you have proof of delivery.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Read Also: How Do You Pay Taxes For Doordash

Completing Online Tax Forms

In the tax year 2018, the government changed Form 1040 and the supplemental forms many taxpayers file along with it. Instead of forms 1040, 1040-A, and 1040-EZ, theres Form 1040 for most filers, plus a different form you can choose to file if you’re a senior: Form 1040-SR.

Taxpayers who take the standard deduction and have simple returns dont need to file any other forms.

The IRS provides a fillable PDF of Form 1040 and Form 1040-SR online. You can type in your information and then print the form, but a safer option is to download it first, then save it to your hard drive as you fill it out so you dont lose your entries if your browser crashes or you accidentally close it. After filling out and printing the form, you’ll sign it, attach copies of any required forms , and mail it in.

This process is simple and inexpensive youll need to pay for postage, preferably a method you can track to prove you submitted your return on time. If youre due a refund, the IRS says it will process your payment within six to eight weeks for a paper return submitted by mail.

People who need to report information not included on Form 1040 will need to submit additional schedules. These might include one or more of the following:

For a complete list, see “Schedules for Form 1040 and Form 1040-SR.” You can fill out these schedules just as we described above for Form 1040.

Where To Mail Maine State Tax Return

Income/Estate Tax Division

| What is being mailed: | Mailing Address: |

|---|---|

| Individual Income Tax Mail to this address if you are enclosing a check for payment | P.O. Box 1067, Augusta, ME 04332-1067 |

| Individual Income Tax Mail to this address if you are expecting a refund | P.O. Box 1066, Augusta, ME 04332-1066 |

You May Like: Cook County Appeal Property Tax

Where Do I Mail My Federal Tax Return

Where to mail Form 1040? The taxpayers who are filing a paper tax return must mail their returns by April 15 to the Internal Revenue Service. If you arent required to file a paper tax return for any reason, we suggest e-filing though as it will be a lot faster for both you and the IRS.

The most common reason why taxpayers mail their returns to the IRS is to fill out certain tax forms that cannot be filed electronically. In these cases, the IRS needs to get the return mailed to them. One of the better examples of this is Form 4852 which is used for replacing Form W-2 in absence of it.

Regardless of the tax forms, you used to file your tax return with, you must mail Form 1040 along with the attachments to the Internal Revenue Service. As for the mailing addresses, they are below. The mailing address is different depending on your state of residence and whether or not youre mailing your return with payment or not.

Take note that it takes between two and six weeks to process paper tax returns for the IRS. If you can e-file, we highly suggest doing so as it will take less time to receive your refund.

| State |

|---|

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

Also Check: Buying Tax Liens In California

Where Do I Mail My California Amended Tax Return

4.6/5amended returnmailTaxCATaxCAanswer here

Mail your federal return to the Internal Revenue Service Center listed for the state that you live in. *Please Note: There is no street address. The zip code indicated in the chart below is exclusive to the corresponding IRS processing center. The zip code will identify it as going to the IRS.

One may also ask, how do I file an amended California tax return? Need to change or amend an accepted California State Income Tax Return for the current or previous Tax Year? Simply complete Form 540 or Form 540NR and Schedule X .

Considering this, where do you mail your California state tax return?

You can complete and mail these forms to the Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0001, if no balance is due or you’re owed a refund. If you’re filing with a payment, mail it to PO Box 942867, Sacramento, CA 94267-0001.

What do I mail with 1040x?

When mailing my 1040X amended return, do I need to mail my original 1040 with it?

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

You May Like: Is Donating Plasma Taxable

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Heres Where You Want To Send Your Forms If You Are Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000

- Florida, Louisiana, Mississippi, Texas: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7910

If youre filing a different 1040 income tax form, the IRSs website has a nifty breakdown of where each form has to go, most depending on whether or not a payment is enclosed.

Don’t Miss: Does Doordash Withhold Taxes

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.