How Much Is Vat

The rate of VAT paid depends on what you sell and where you sell it.

As of June 2021, the EU member states no longer have their own tax nexus thresholds. They share the same threshold of 10,000 – excluding the UK, of course.

The rates may differ, however. And whose rate you pay also depends on various factors.

Below Economic Nexus Thresholds

If youre collecting sales tax in your home state, but youre sure you havent hit economic nexus anywhere else, youre in a great position to set up systems before you need to start collecting.

Track

To do this, make sure you have a system in place to track sales. During times of growth, periodically review your sales by state, as outlined above . Most platforms have some way of downloading sales data, and knowing a few basic spreadsheet formulas can save you tons of time adding them up.

Research

Starting to watch and listen for companies and software solutions will give you a head start when you do reach that point of needing them. If you know other ecommerce sellers, ask for reviews and recommendations on solutions to use.

Prepare for a Nexus Study

As your business grows, be prepared to commission a professional nexus study which will tell you where youve hit nexus and need to register.

Navigating Sales Tax When It Comes To Selling Products On Ebay

For online sellers, eBay is a great platform to offer your goods up for sale. They have an excellent reputation, generate a lot of traffic, and are user friendly, making the whole online selling process easy to understand. Because of this, many online sellers find it the perfect place to get started. Once you get your listings up and running the process is pretty straightforward. However, there is one area that causes a lot of confusion for online sellers and that is eBay sales tax.

Read Also: Aztaxes Gov Refund

Ebay Taxes: An Overview Guide

eBay sellers generally need to pay most attention to the following taxes depending on their location:

For more detailed information on these, select the guides linked above. Here, well cover some of the frequently asked questions about eBay taxes across the board.

It might be worth bookmarking this page for quick and easy reference later on!

We have divided these questions into General Queries, eBay Sales Tax Queries, eBay VAT Queries, eBay Income Tax Queries and Accountants and Other Tax Resources:

Claiming Sales Tax Exemption For Your Ebay Purchases

The documentation required for tax exemption can vary from jurisdiction to jurisdiction. Use the dropdown menus below to see documentation required for your jurisdiction.

Please allow 10-15 business days for processing. We will send you a confirmation email when your tax exemption status has been verified.

TipWhen you upload your documentation, make sure the image is clear and all information is clearly visible – otherwise we may not be able to verify your details. Your image can be in jpeg, jpg, pdf, or png format, and the maximum file size is 5MB.

Read Also: File Amended Tax Return Online Free

How Do I Pay Ebay Sales Tax

You will need to register for sales tax in all the states or locations in which you have economic nexus – this is also true for VAT or GST if you sell overseas and meet those applicable thresholds.

Once you have registered, you should have access to the paperwork and deadlines that you will need to file your tax. You can do this all yourself, but you can also use tax automation apps, or better yet, consult an accountant.

How Sales Tax Collection Works On Ebay Today

When a seller sells an item to a buyer in the US on eBay, eBay collects sales tax on the transaction. Where, before South Dakota v. Wayfair, it was the sellers job to collect and remit sales tax, eBay now takes care of that administrative hassle.

Except in two states.

As of this writing, Florida and Missouri have both not yet passed a marketplace facilitator law. What does this mean for eBay sellers?

It means that if you have sales tax nexus in Florida or Missouri, and you sell taxable items on eBay to buyers in Florida or Missouri, then you are required to set up sales tax collection on eBay and collect sales tax from those buyers.

Lets look at an example.

Katherine sells vintage comic books through her eBay store. She lives in Florida, has an employee in Missouri, and has economic nexus in Texas, New York and California due to her high volume of sales in those states. This means that when she makes a sale, either through eBay or through other online sales channels such as her website powered by BigCommerce, she is required to collect sales tax from buyers in these states.

When Katherine makes a sale through her eBay store to a buyer in California, eBay collects sales tax on her behalf due to Californias law that requires marketplace facilitators like eBay to collect and remit sales tax on their 3rd party sellers behalf.

To sum it up, the good news is that eBay collects sales tax on behalf of 3rd party sellers in most states.

Also Check: Appeal Cook County Property Taxes

Using Ebay To Make Profits Is A Business

If you sell and buy articles on eBay in order to earn money, the IRS will likely classify your sales activities as a business. This means you will have to report net income from eBay sales. Report your total gross income on Schedule C, then reduce it to net income by subtracting the amounts you spent for allowable business-related expenses.

For example, if your income is $45,000 and you have business-related expenses that total $10,000:

- $45,000 – $10,000 = $35,000

- $35,000 is your net income on your Schedule C

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Is Money From Donating Plasma Taxable

Where Can I Find My Ebay Sales Tax Totals

eBay sales tax totals are important to be aware of. This information is available on your sellers hub. You can also find information on related sellers and processing fees on your sellers hub as well. This information is important when it comes to seeing which deductions you can qualify for. As an online seller, eBay processing fees are an ordinary and necessary business expense and therefore may qualify as a tax deduction.

What Happens If I Dont Pay My Ebay Tax

If you dont get audited, then nothing will happen.

If you do, however, you may be liable to pay back as many years worth of taxes as you were obligated to pay in the first place. If your company has evaded tax for a decade, youll have a pretty nasty bill.

This also depends on the tax jurisdiction that catches you. Enforcement has increased greatly in recent years with the new laws and regulations coming into play, so now is probably the worst time to ignore your tax obligations.

Don’t Miss: Efstatus.taxact 2013

Does Ebay Collect Sales Tax For Sellers

Only in states where it is required to by law, and you meet a certain revenue threshold set by that state.

In the cases where eBay collects sales tax for you, you do not need to do anything. In the cases where eBay does not collect sales tax, and you have nexus in the state your buyer comes from, you will need to collect and remit the tax yourself.

Piecing Together Compliance For Marketplace Sellers

Rest assured, all of the new requirements are enough to make your head spin. Florida, Kansas, and Missouri are the only states yet to enact legislation for marketplace facilitators. Louisiana and Mississippi passed legislation just days before the July 1, 2020 effective date. Tennessees marketplace facilitation will be effective October 1, 2020. Marketplace nexus rules are widespread and here to stay.

If youre just starting to get a handle on marketplace nexus requirements for yourself or even a client, take it slow. Break down each state requirement a piece at time, then start putting them together to see your bigger picture of sales tax compliance.

Here are some guiding questions to start piecing everything together: How does your combination of marketplace and direct sales compare to the state threshold? Are you required to include your marketplace sales towards the threshold? Do you need to register or file returns, or will the facilitator handle that? How will you track your sales going forward to know if you exceed a threshold?

For a handy chart to help you understand each states economic nexus rules, check out our Economic Nexus State Guide. For a broader look at which states have other types of remote seller nexus, including marketplace facilitator rules, visit our Remote Seller Nexus Chart.

Read Also: How To Find Your Employer’s Ein

One: Evaluate Physical Nexus

With the spotlight on economic nexus following the Wayfair decision, a lot of businesses have put blinders on to other nexus-creating activities they perform. You cant let physical nexus-creating activities fall to the wayside and purely focus on economic thresholds.

Because heres the thing

The economic nexus thresholds are not relevant in states where you have physical presence. The Wayfair decision did not alter states longstanding physical presence rules.

The core elements of physical nexus are people and property. Evaluating physical nexus involves asking questions like:

- Where do you have employees working on your behalf either temporarily or permanently?

- Where do you have a permanent place of business?

- Do you have a temporary place of business like a trade show booth?

Property is a sticking point for online sellers, particularly Amazon FBA sellers. Company-owned inventory in a third-party warehouse is considered physical presence. Amazon FBA sellers must monitor their sales to track where Amazon is sending their inventory.

There may be some states that will not require marketplace sellers that sell exclusively on a marketplace that is collecting tax to register for sales tax due to the inventory but this could still create requirements for income tax, gross receipts tax, or business licenses.

Ebay’s Buyer Exemption Program For Sales Tax

If you are a tax-exempt buyer, we have a buyer exemption system that allows you to submit sales tax exemption certificates to eBay and make purchases without paying sales tax.

Alternatively, you may be able to get a credit for sales tax paid to eBay directly from your state. However, you should consult a tax advisor or contact the Department of Revenue for your state for further details as policies are different for each state.

You May Like: Taxes On Plasma Donation

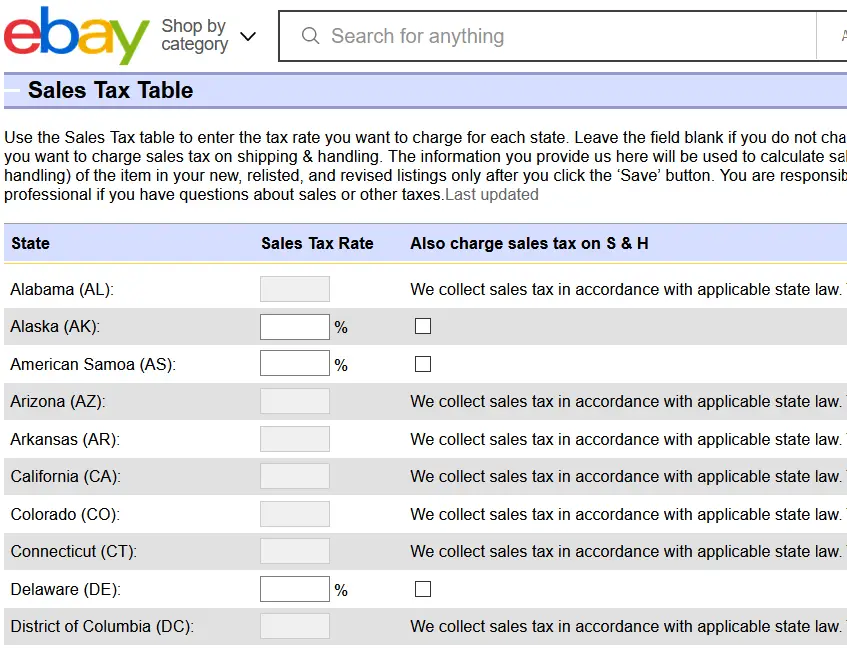

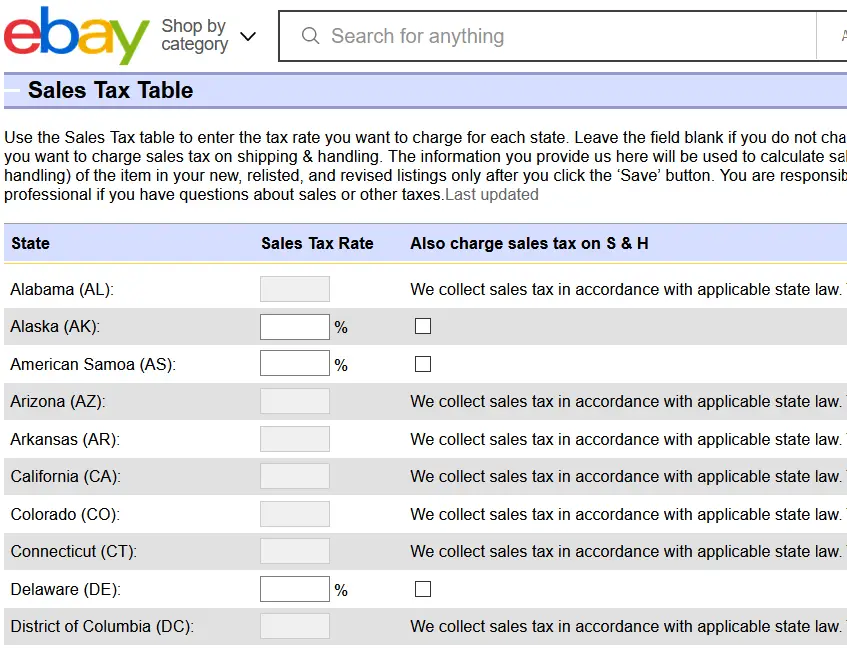

Setting Up A Tax Table

You can specify a sales tax rate for each US state in which you’re required to charge sales tax. You can also charge tax on shipping and handling, if it’s required by law.

Buyers see your tax rates on the listing page. Once they confirm their shipping address at checkout, we automatically calculate the sales tax amount and add it to their order total.

Here’s how to set up your tax table:

Important things to keep in mind when setting up a tax table:

- When you list your item you need to indicate that you charge sales tax in the listing form and associate your tax table with the listing.

- Changes that you make to your tax table won’t be reflected in your live listings. You will need to revise any current active listings in order for your tax table changes to apply to those listings. Listing created after you have saved your tax table changes will reflect your tax table updates.

Once you’ve created your tax table, you need to specify in your listing that you are charging sales tax. Here’s how:

Internet Sales Tax And What This Means For Ebay Sellers

- Date: April 15, 2020

- 5

As a multi billion dollar online marketplace, eBay has to be seen to react quickly to constantly changing laws and regulations. One of the most significant recent developments in the retail industry is the Internet Sales Tax, now enshrined in law in 35+ states across the USA.

This article will first look at the introduction of the Internet Sales Tax before scrutinizing how it has affected both buyers and sellers using eBay.

You May Like: Www.michigan.gov/collectionseservice

How To Collect Sales Tax On Amazon

Important to note: Amazon now collects sales tax on sellers behalf in most states with an Amazon fulfillment center. The below information applies to .

Now that you are registered to collect, your next step is to ensure you are collecting sales tax from your Amazon FBA customers.

Fortunately, Amazon has a very robust sales tax collection engine.

Once you tell it what you want to collect, it will collect the right rate, even keeping up with complicated concepts like whether a state is origin-based or destination-based, or if a sales tax rate has changed.

It will also allow you to add product tax codes so you charge the right amount of sales tax on items like groceries and clothing, and allow you to choose whether or not you charge sale tax on shipping and gift wrapping.

Keep in mind that Amazon charges 2.9% of each transaction in order to collect sales tax.

The alternative, however, is not to collect sales tax from your Amazon customers and to instead pay out of your profits.

Does Ebay Track From Whom I Should Be Collecting Sales

eBay does not track from whom you should be collecting sales tax. As the seller, you are responsible for collecting sales tax on all non-exempt items from customers in each state in which your business operates and or maintains nexus.

As an online seller, its sometimes difficult to determine in which states you maintain nexus. Although the determination of nexus varies from state to state, an ecommerce business usually has nexus if it operates a physical office or warehouse, maintains sales representatives, or markets its products in a given state.

Don’t Miss: Federal Tax Id Reverse Lookup

How Sales Tax Works For Remote Sellers

Earlier, we touched on how economic nexus is determined: youre considered to have nexus in a state because you had a certain dollar amount of sales in that state, or have a certain number of sales transactions in that state.

However, there are a number of other reasons remote sellers may find they have nexus in a state. Well go through the rules of each state later, but first lets review the most common types of nexus.

If you have any of the following arrangements as a remote seller, you may have nexus in multiple states, even if you have not hit the economic nexus threshold in that state. Keep in mind that the exact definitions and fine print differ with each state. Check individual state regulations if these rules apply to you.

Ebay Sales Tax Table Shortfalls

eBays sales tax collection features arent as comprehensive as other eCommerce platforms. You can set sales tax rates manually, but the platform doesnt offer destination-based sales tax calculations.

Some localities charge an additional sales tax on top of the state-imposed tax, but eBay only lets you set sales tax rates for the entire state. This limitation can cause some headaches for sellers.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Does Ebay Charge Sales Tax

eCommerce sales used to escape sales tax scrutiny, but states are wising up. In the past few years, many states have passed new legislation that allows them to impose taxes on online purchases. Now, in most cases, eCommerce sales tax operates almost identically to traditional sales taxes. If your businesss home state imposes sales tax requirements, youll most likely have to pay taxes on your eBay sales.

eBay doesnt charge tax, but most states do. Under Marketplace Facilitator laws, eBay collects sales tax on behalf of the state in many instances. As a result, you could see eBay charging sales tax on your transactions.

How Does Ebay Tax Collection Work

Sales tax should be added onto a sale just before the buyer completes the transaction. It cannot be added after this time.

eBay may do this for you automatically when the buyer lives in a state that requires it to by law, but if it is not required by law, you may need to add this cost on yourself. You will need to keep track of how much sales tax you collect in order to remit the correct amount at the end of the tax year.

Integrating eBay Managed Payments with your accounting software and A2X can help you do this successfully.

Read Also: Pastyeartax