How To Estimate Your Quarterly Taxes

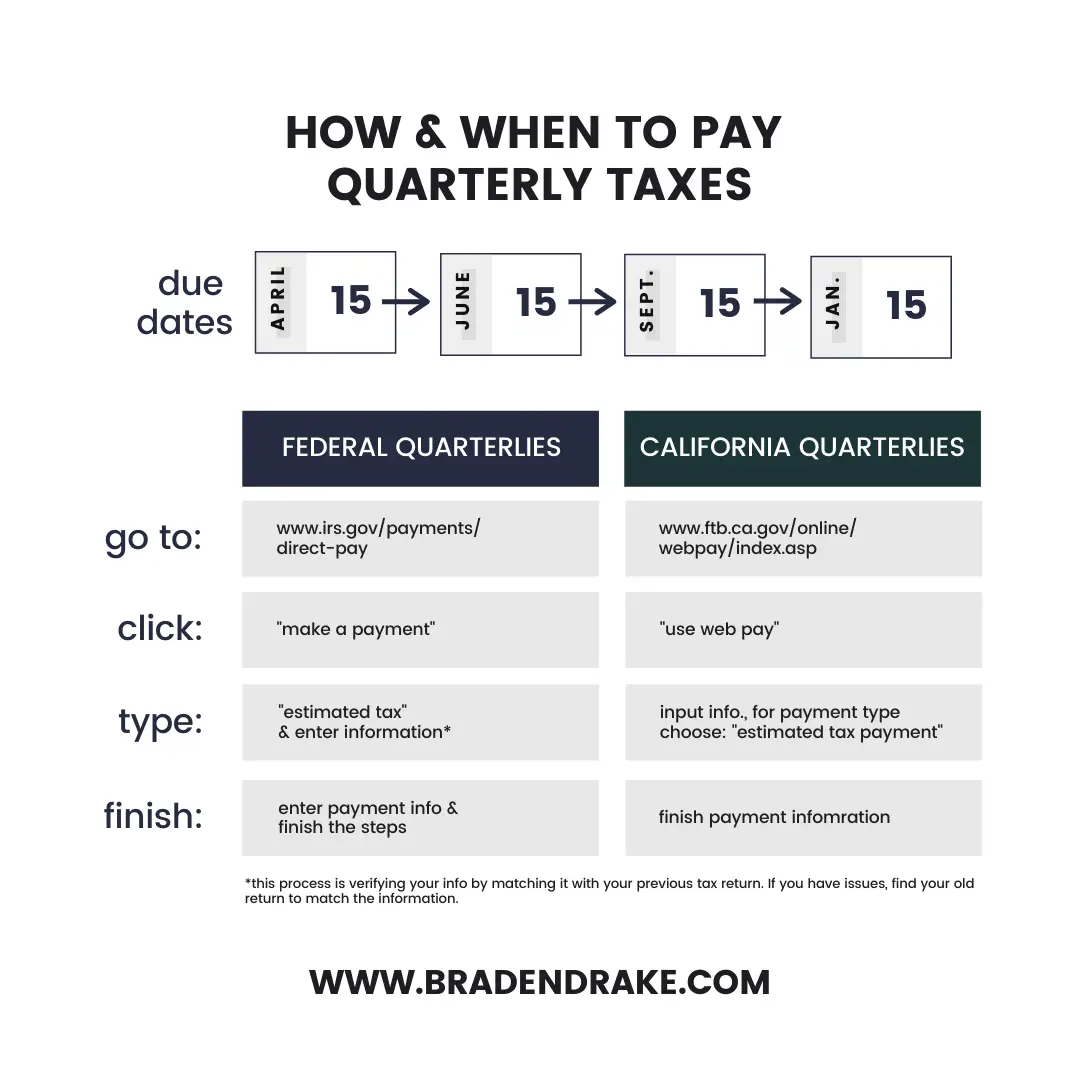

You pay federal income taxes on a pay-as-you-go basis. The burden is on you to payestimated taxes four times a year April 15, June 15, September 15, and January 15 of the following year to cover your anticipated tax bill.

Underpaying your taxes triggers a penalty, while overpayment is the equivalent of giving the government an interest-free loan that cant be recouped until you file your return. Fortunately, the IRS provides worksheets to help you calculate quarterly taxes accurately. You can also find resources on the TurboTax site. And QuickBooks Self-Employed can help manage your deductions and calculate quarterly tax payments for you.

Tip #: Prepay Your Work Expenses

If you know youâre in for a painful tax bill, this strategy could help.

Hereâs how it works: rather than waiting till January to pay your regularly scheduled bills, pay them in December instead.

For example, if your business rent is due January 5th, pay it December 30th. This will allow you to claim more deductions in the current tax year â essentially borrowing from next yearâs write-offs.

If youâre going to use this strategy, itâs important to look ahead first. Here are some scenarios where prepaying could be a beneficial move and help you save money overall:

- You owe a sizable tax bill and havenât made any estimated payments.In this situation, reducing your tax liability by prepaying expenses is a good idea. The lower your tax liability, the less youâll pay in underpayment penalties and interest.

- You donât expect to have much â or any â self-employment income next year. People change jobs and hop careers all the time. If you expect a major change to the type of income youâre earning, itâs probably worthwhile to maximize your write-offs now.

- You expect to have more tax-saving opportunities next year.If you recall, only two things can lower self-employment tax: business write-offs and tax credits. So for example, if you plan to enroll in college, youâll have a sizable tax credit to play with. In that case, borrowing from next yearâs write-offs probably wonât hurt you.

Sarah York, EA

How Will I Know If I Need To Make An Estimated Payment

If you are required to file a tax return and your Virginia income tax liability, after subtracting income tax withheld and any allowable credits, is expected to be more than $150, then you must make estimated tax payments or have additional income tax withheld throughout the year from your wages or other income.

Read Also: When Am I Getting My Tax Refund 2021

When Is The Due Date For Estimated Payments

Due dates for quarterly estimated tax payments are spread throughout the year, having you input four forms and payments. The dates for California are the same as with the rest of the United States. The only difference is the percentage needed for each payment.

This is how much you will have to pay for each due date:

- First Quarter April 15, 2021 30%

- Second Quarter June 15, 2021 40%

- Third Quarter September 15, 2021 0%

- Fourth Quarter- January 18, 2022 30%

It is important that you respect all of these due dates. Otherwise, you will be subjected to tax liability, for not reporting your taxable income.

Farmers Fishermen And Merchant Seamen

Farmers, fishermen and merchant seamen who receive 2/3 of their estimated Virginia gross income from self-employed farming or fishing have special filing requirements, which allow them to make fewer payments. If you meet the qualifications of a farmer, fisherman or merchant seaman, you only need to file an estimated payment by Jan. 15. If you file your income tax return on or before March 1 and pay the entire tax at that time, you are not required to file estimated tax payments for that tax year.

Don’t Miss: Where Do I Mail My Federal Tax Payment

How Bench Can Help

If you need bookkeeping support, Bench can help. Your Bench bookkeeper keeps your financial reports up-to-date, giving you access to essential and accurate information on your businessâs financial health. Then, when tax season rolls around, a CPA or tax professional can use your Bench-generated financial reports to get your taxes filed.

Looking for an even more hands-off tax solution? Choose a subscription package that includes tax support, and in addition to unlimited tax advisory services, weâll file those taxes for you. Learn more.

Pay As You Go So You Wont Owe: A Guide To Withholding Estimated Taxes And Ways To Avoid The Estimated Tax Penalty

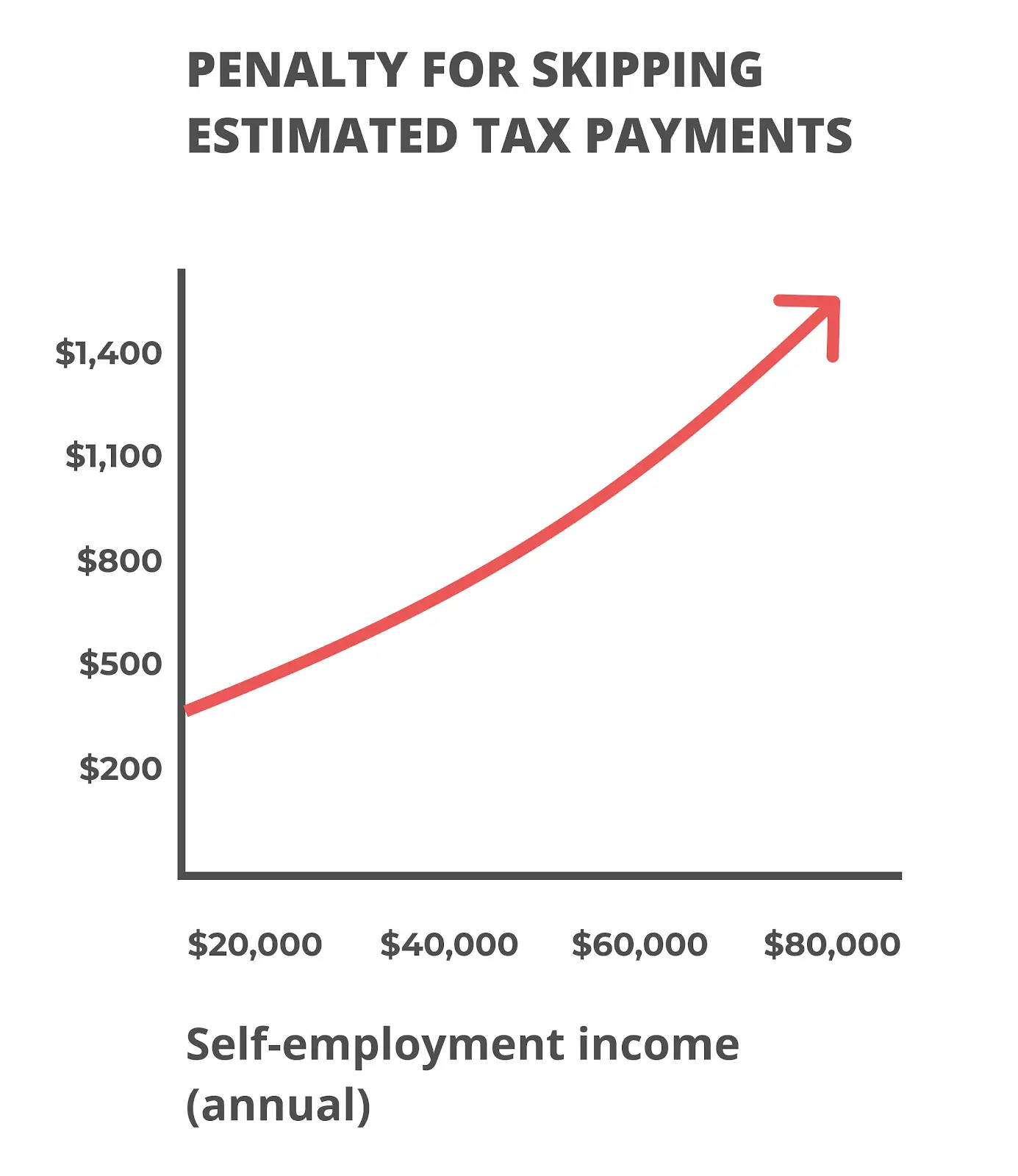

The IRS has seen an increasing number of taxpayers subject to estimated tax penalties, which apply when someone underpays their taxes. The number of people who paid this penalty jumped from 7.2 million in 2010 to 10 million in 2015, an increase of nearly 40 percent. The penalty amount varies, but can be several hundred dollars.

The IRS urges taxpayers to check into their options to avoid these penalties. Adjusting withholding on their paychecks or the amount of their estimated tax payments can help prevent penalties. This is especially important for people in the sharing economy, those with more than one job and those with major changes in their life, like a recent marriage or a new child.

There are some simple tips to help taxpayers.

Don’t Miss: Can I File My Taxes Over The Phone

Choose How To Make Your Payment

You can pay your estimated tax electronically with DOR, by mail, or in person.

What Is The Penalty For Not Paying Quarterly Taxes

If you miss a deadline, make the payment as soon as possible. Dont wait until the next deadline to pay them simultaneously. You could face fines and tax penalties when you file your tax return at the end of the year.

If you dont make sufficient payments throughout the year or on time, then an extra penalty may be added to what you owe on your tax return. That amount will depend on how much you underpaid and exactly how late you were with your payments.

The IRS isnt satisfied with receiving what you owe all at once at the end of the year instead of at the end of each quarter. Even missing a deadline by a few days can mean an extra fine. Understanding your tax obligations throughout the year can be difficult and stressful, but its necessary to avoid extra fines and unnecessary complications.

Recommended Reading: How To File Taxes If Self Employed And Employed

Don’t Miss: What Is The Penalty For Paying Taxes Late

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

How Do I Figure Out How Much I Owe In Quarterly Taxes

All righty, its time to dust off your calculator and crunch some numbers! Heres a step-by-step process to help you figure out how much youll need to pay in estimated quarterly taxes. Remember, this is just an estimate. Depending on your income, the tax year, your filing status and eligible deductions, your quarterly taxes will vary. And dont get us started on state income taxes!

Read Also: How To Calculate Sales Tax Percentage From Total

How Do You Pay Quarterly Income Tax Payments To The Irs

If you receive income from an employer, your federal income tax is withheld from your paycheck. But if you receive income from a small business or side hustle and you expect to owe more than $1,000 in federal taxes by the end of the year, youll need to pay quarterly estimated taxes. You dont have to pay estimated taxes for the current year if you had no tax liability for the prior year. Use Form 1040-ES to estimate and pay your quarterly taxes. Typically, youll need to mail your checks by these dates:

Estimate Your Tax Liability

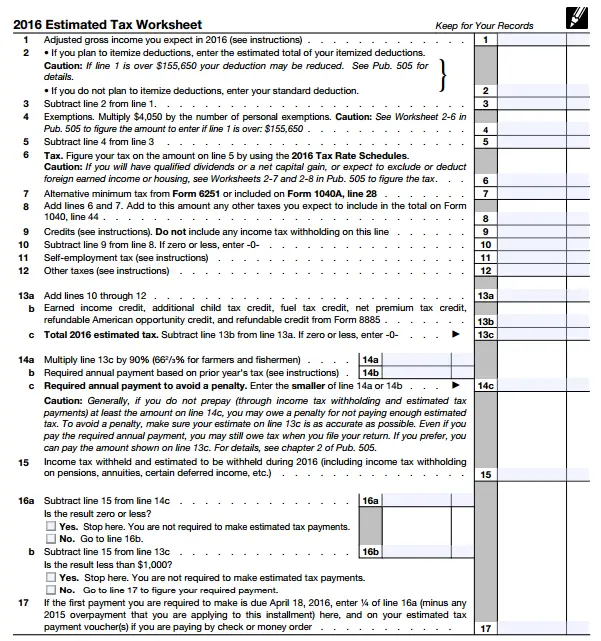

Once you’ve determined you’re required to pay quarterly taxes and when you need to pay them, it’s time to calculate how much you’ll owe.

The potentially huge number of inputs used in your final tax return can take hours to put together using tax prep software, depending on the complexity of your finances. Fortunately, the quarterly tax process is much simpler.

It’s better to estimate a little high than estimate low, as any excess taxes paid will come back in your refund. But if you underpay, you may end up facing underpayment penalties.

Read Also: How Do I Make An Amendment To My Tax Return

Who Is Responsible For Paying Quarterly Taxes

Small business owners, independent contractors, and freelance workers are responsible for paying quarterly taxes. According to the IRS, you must pay estimated quarterly tax if you pass the following 2-part test:

You are expected to owe at least $1,000 in taxes from your income.

The amount of taxes youve withheld and refundable credits will be less than the smaller of:

90% of your prior-year tax liability, or

100% of your tax liability two years prior.

Point two sounds confusing, which is why we cans stress enough that working with a tax professional, like a Certified Public Accountant or Enrolled Agent, is highly recommended. If you owe quarterly taxes and fail to pay four times per year, you may have penalties assessed to your balance, along with the taxes you owe. Because of this, its something you dont want to overlook.

Option #: An Eftps Account

Youâll need to set up an account to use this payment method, but I recommend all taxpayers do that at some point anyway. Itâs the only way to easily view your tax records and transcripts. It also lets you conveniently make tax payments.

To enroll, visit the IRSâs Electronic Federal Tax Payment System . Once registered, youâll be able to view all your tax return filings and can seamlessly make estimated payments.

Also Check: How Much Is California State Tax

How To Make An Estimated Payment

We offer multiple options to pay estimated taxes.

- Individual online services account. If you don’t have an account, enroll here. You’ll need a copy of your most recently filed Virginia tax return to enroll.

- 760ES eForm. No login or password is required. Make sure you choose the correct voucher number.

- ACH credit. Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

See all options to file and pay estimated taxes.

Electronic filing requirement

You must submit all of your income tax payments electronically if:

- Any installment payment of estimated tax exceeds $1,500 or

- Any payment made for an extension of time to file exceeds $1,500 or

- The total income tax liability for the year exceeds $6,000

If any of the thresholds above apply to you, all future income tax payments must be made electronically.This includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed.

Quarterly Estimated Tax Payments For Business Owners: How Much Should You Pay

by Jasmine DiLucci | Jan 19, 2022 | Business Taxes

Most business owners are familiar with the idea that the IRS has quarterly tax requirements, but were often asked about how much should be paid. Our answer is it depends. Business owners are usually in different situations, and we have explained the three options that we see individuals choose:

Dont Miss: How Do I Claim My Stimulus Check On My Taxes

Recommended Reading: When Do I Get My Federal Tax Refund

Changes In Income Or Exemptions

If your expected Virginia adjusted gross income changes during the year, re-compute your estimated tax to determine how much your remaining payments should increase or decrease.

A change in income, deductions or exemptions may require you to file an estimated payment later in the year. If you file your state income tax return and pay the balance of tax due in full by March 1, you are not required to make the estimated tax payment that would normally be due on Jan. 15.

If you file your return after March 1 without making the January payment, or if you have not paid the proper amount of estimated tax on any earlier due date, you may be liable for an additional charge for underpayment of estimated tax.

How Do I Figure Out How Much Ill Owe In Taxes

To figure out how much youâll owe in taxes, youâll need to estimate your taxable income for the upcoming year, find your owed tax, and , pay one fourth of your estimated balance each quarter.

Easier said than done, right? Figuring out exactly how much you should expect to owe can feel overwhelming, but there are a ton of online tools and softwares that can help you out.

If you use Found for your business bank account, you can view your current tax bill on your âTaxesâ tab in your Found app. If that tax bill is higher than $1,000, youâll know you need to pay quarterly.

If youâre not using Found, here are are a few other ways to estimate how much you owe:

-

Use the IRSâs âTax Withholding Estimator.â It asks you to answer about 10 questions about your tax situation, and then will run the numbers on how much you should expect to owe for the year.

-

H& R Blockâs W-4 Calculator. Similar to the IRS calculator, itâll help you estimate your income and owed tax in just a few minutes

-

Fill out the IRSâs Form 1040-ES if youâd prefer to do the math yourself. Form 1040-ES is a worksheet that basically works like a simplified tax return, where you input your income, adjustment, deduction, credit, and tax information, and the worksheet will help you figure how much you owe in taxes

Each of your four quarterly tax payments should roughly equal one-fourth of your total owed tax for the year. Owe $2,000 for the year? Each of your four payments should be roughly $500.

Also Check: How Much Taxes Do I Owe 1099

When Are Quarterly Taxes Due For 2022 And 2023

To avoid an Underpayment of Estimated Tax penalty, be sure to make your payments on time for tax year 2022:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

For tax year 2023, the following payment dates apply for avoiding penalties:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

What Taxes Do Self

As a self-employed individual, you file an annual tax return but typically pay estimated taxes every quarter. Quarterly taxes generally include two categories:

- Self-employment tax

- Income tax on the profits that your business made and any other income

For example, in the 20221 tax year:

- The self-employment tax rate on net income up to $147,000 is 15.3%. That breaks down to 12.4% Social Security tax and 2.9% Medicare tax. As your income increases past this amount, the 2.9% Medicare tax continues but the Social Security portion stops.

- High earners generally, individuals with earned income of $200,000 and above or married couples with incomes of $250,000 or more are subject to an additional Medicare tax of 0.9%.

To estimate your taxable income as a business owner:

- Take your expected annual gross income the total revenue you received and deduct expenses and any deductions you’re eligible for. For example, if your annual revenue came to $100,000 and you had business deductions that total $30,000, your taxable income amounts to $70,000.

- $100,000 – $30,000 = $70,000 taxable income

Recommended Reading: Do You Have To Charge Sales Tax For Online Sales

What You Should Know About Estimated Tax Payments

If you are an independent contractor or business owner, you are responsible for making sure that you get the correct tax payments to the government unlike people who work as employees of a company which withdraws payments from each paycheck. Estimated taxes are what you expect to pay on any salary you earn that isnt subject to withholding, along with other income like interest, dividends and capital gains. For help figuring out your estimated taxes and make sure you dont make any costly mistakes, consider working with a financial advisor.