How Do I Avoid Capital Gains Tax On Real Estate In California

Avoid Taxes on Capital Gains on Real Estate in 2020 NerdWallet.How to avoid capital gains tax on a home sale

Where Can You Find Information On Your California State Refund

You can check your refund status on the California Franchise Tax Board website. You’ll need your Social Security number, ZIP code, exact refund amount, and the numbers in your mailing address. It typically takes three weeks to receive a refund if you e-filed and three months if you mailed in your return.

Income From S Corporations Partnerships And Trusts

In most circumstances, income derived from California sources will be deemed taxable in the state. Conforming to this general principle, distributions from S corporations, partnerships and simple trusts that are based on California income sources are taxable for nonresidents.

Occasionally, California residents receiving distributions from an; out-of-state entity will leave California at some point during a certain tax year.

In such scenarios, the taxpayer will have to determine their tax liability through calculations that take into account their share of the organization and the companys income in California and in other jurisdictions during the periods that the individual was and was not a resident.;

For an example of how the tax liability would be calculated, refer to the FTBs Residency and Sourcing Technical Manual, 23-25.;

Don’t Miss: Can I Check My Property Taxes Online

Supplementary Local Sales Taxes

Supplementary local sales taxes may be added by cities, counties, service authorities, and various special districts. Local county sales taxes for transportation purposes are especially popular in California. Additional local sales taxes levied by counties and municipalities are formally called “District Taxes.”

The effect from local sales taxes is that sales tax rates vary in California from 7.25% to 10.75% . For example, the city of Sacramento, the state capital, has a combined 8.75% sales tax rate, and Los Angeles, the largest city in California, has a combined 9.50% sales tax rate.

Local sales tax rate cap

The combined tax rate of all local sales taxes in any county is generally not allowed to exceed 2.00 percent. However, this is a statutory restriction and the California Legislature routinely allows some local governments, through the adoption of separate legislation, to exceed the 2.00 percent local tax rate cap. The 2.00 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 9.25% .

As of July 1, 2021, the following 140 California local jurisdictions have a combined sales tax rate in excess of the 2.00 percent local tax rate cap:

| CITY |

|---|

| SAN MATEO |

SB 566 and the rise in local sales tax increases

Local jurisdictions with at least 10.00% combined sales tax rates

As of July 1, 2021, the following 68 California local jurisdictions have a combined sales tax rate of at least 10.00%:

| CITY |

|---|

| SUTTER |

California Property Taxes By County

You can choose any county from our list of California counties for detailed information on that county’s property tax, and the contact information for the county tax assessor’s office. Alternatively, you can find your county on the California property tax map found at the top of this page. Hint: Press Ctrl+F to search for your county’s name

Median Property Taxes In California By County

You May Like: How Much Is New York State Sales Tax

How To Calculate California Sales Tax On A Car

To calculate the sales tax on your vehicle, find the total sales tax fee for the city. The minimum is 7.25%. Multiply the vehicle price by the sales tax fee.

For example, imagine you are purchasing a vehicle for $20,000 with the state sales tax of 7.25%. $20,000 X .0725 = $1,450. $1,450 is how much you would need to pay in sales tax for the vehicle, regardless of if it was used, purchased with trade-in credit, or included an incentive.

Remember that the total amount you pay for a car not only includes sales tax, but also registration, and dealership fees.

Do You Pay Capital Gains On Stocks If You Reinvest

The Internal Revenue Code is full of provisions that allow people to take proceeds from sales of property and reinvest it without having to recognize capital gain. If theyve owned the stock for a year or less, then theyll pay short-term capital gains tax at their ordinary income tax rate on the profit.

Recommended Reading: How Do You Find Property Taxes By Address

Car Sales Tax For Trade

Those who trade in a vehicle will still have to pay sales tax. California state sales tax applies to the full price of the new vehicle. In essence, their sales tax does not consider whether or not you traded in your vehicle. For example, if you traded in a vehicle for $7,000 and applied that credit to a new vehicle purchase of $15,000, you will pay sales tax for the $15,000 full purchase price.

How Much Is The Sales Tax In California

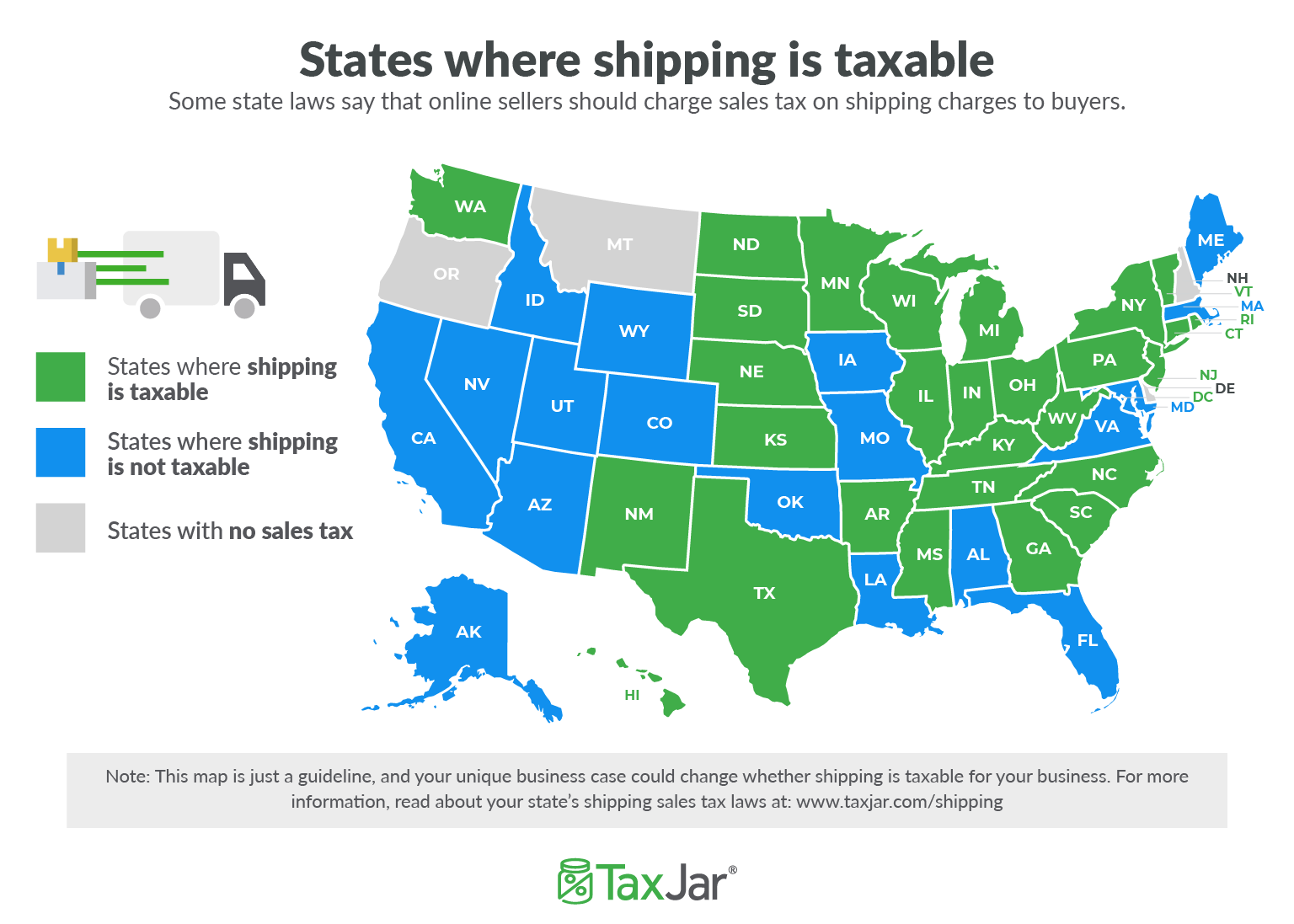

You pay sales tax in 45 states when you purchase a product or service. Some of the 45 states may have cities and counties charging their own rates for sales taxes. If you buy a product or service in California, you might notice that there are 25 different sales tax rates explains Smartasset. These taxes will go to the California Department of Tax and Fee Administration.

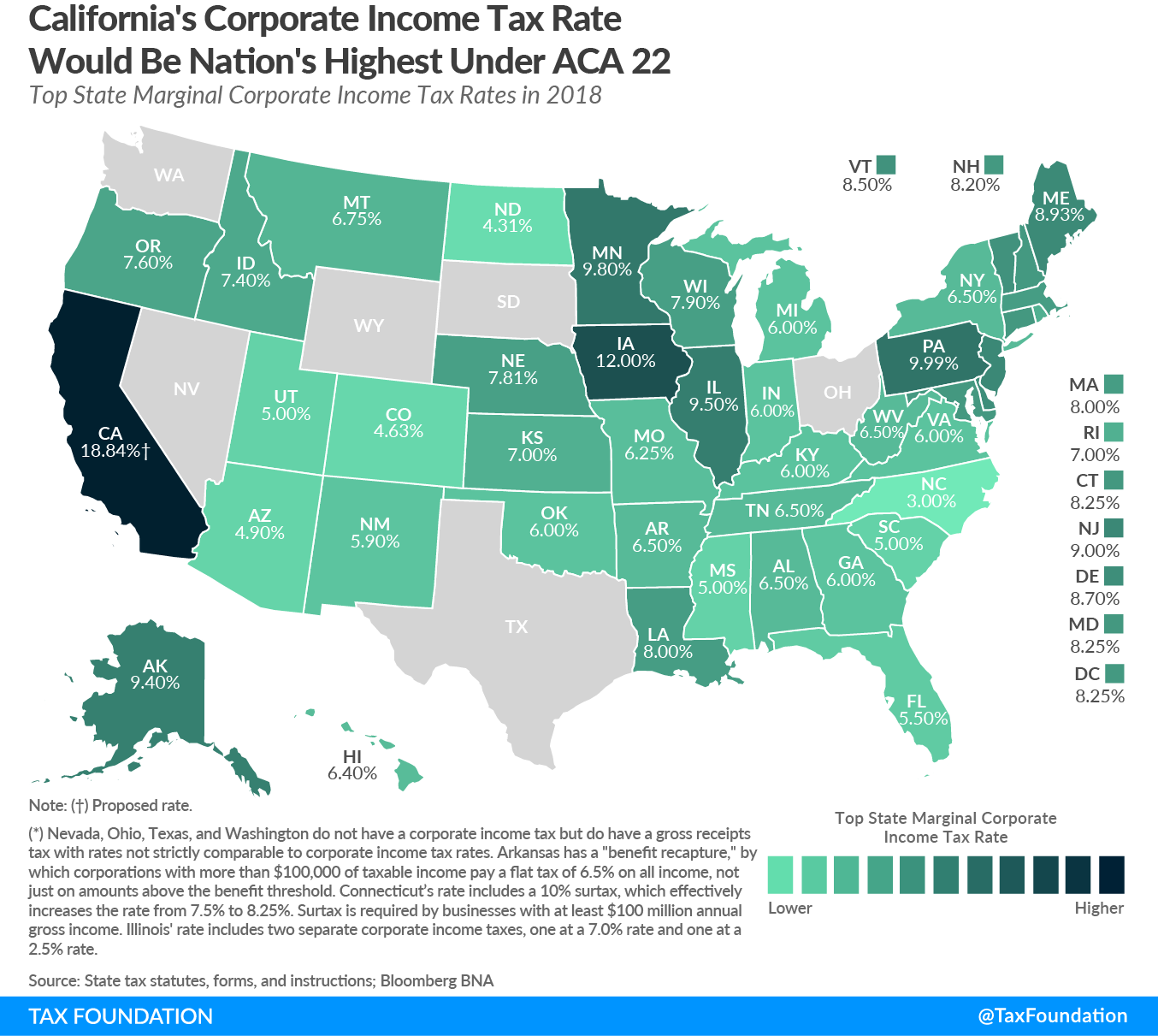

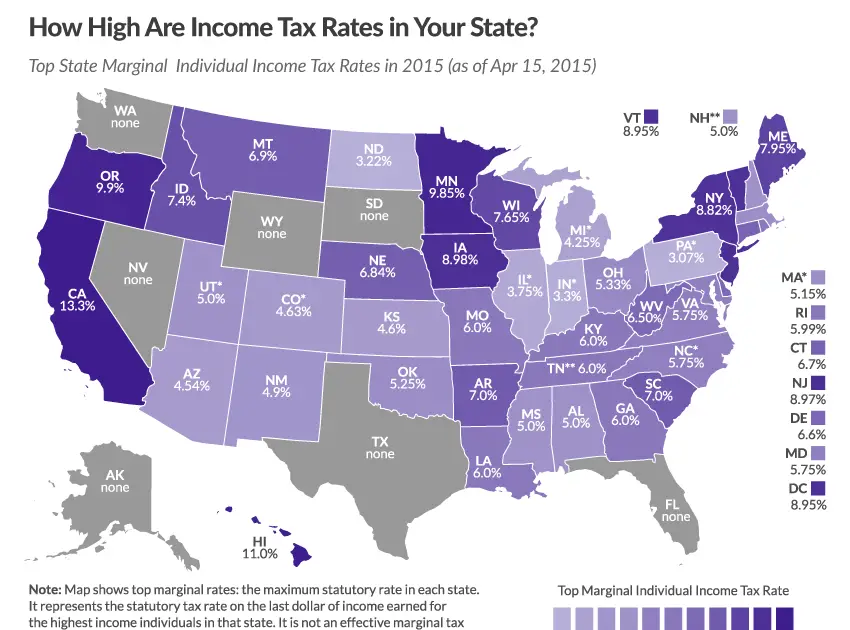

The initial sales tax in the state is 6 percent, but you have to pay a sales tax of 1.25 percent to counties and cities in the area you buy your product in. Therefore, you must pay a minimum of 7.25 percent in sales tax for the purchase of a product, but only one-fourth of cities in the state charge this rate. This is one of the largest sales tax rates in the United States. California residents have one of the highest state income tax rate of any other state in the country at 13.3 percent.

Let’s look at Oakland, located in Alameda County. You’ll pay 9.25 percent sales tax if you buy an item in this city because you add the state rate of 7.25 percent to the county rate of 2 percent. If you travel to San Francisco County, you’ll pay a sales tax rate of 8.5 percent since the county rate is 1.25 percent, which is .75 percent lower than Alameda County.

Recommended Reading: How Much Tax On Unemployment Benefits

Recent Statewide Sales Tax Increases

Recent temporary statewide sales tax increases include:

- From April 1, 2009 until June 30, 2011, the state sales and use tax increased by 1% from 7.25% to 8.25% as a result of the 2008-2009 California budget crisis.

- Effective January 1, 2013, the state sales and use tax increased by 0.25% from 7.25% to 7.50% as a result of Proposition 30 passed by California voters in the November 6, 2012 election. The change was a four-year temporary tax increase that expired on December 31, 2016.

The California Standard Deduction

The California standard deduction is markedly less than what’s offered by the IRS. As of the 2020 tax yearthe return you’d file in 2021the state-level standard deductions are:

- $4,601 for single taxpayers, as well as married and registered domestic partner taxpayers who file separate returns

- $9,202 for married and RDP taxpayers who file jointly, as well as heads of household and qualifying widows

The 2020 standard deductions at the federal level are $12,400 for single taxpayers and married taxpayers filing separately, $18,650 for heads of household, and $24,800 for married taxpayers filing joint returns and qualifying widows.

Recommended Reading: How Do I Pay My State Taxes In Missouri

California State Budget And Finances

| Total spending : $265,894,000,000 |

| State budget and finance pages Total state expenditures State debt Tax policy in California |

| Note: In comparing dollar amounts across the states, it is important to note that the cost of living can differ from state to state and within a state. The amounts given on this page have not been adjusted to reflect these differences. For more information on “regional price disparities” and the Consumer Price Index, see the U.S. Department of Commerce, Bureau of Economic Analysis. This article, which is updated on an annual basis, was last updated in June 2017. It contains information from several sources; consequently, the currency of the information can vary from source to source. |

HIGHLIGHTS

Does California Have A Capital Gains Tax Rate

Finding 2020 California Income Tax Rates

Because California does not give any tax breaks for capital gains, you could find yourself taxed at the highest marginal rate of 12.3 percent, plus the 1 percent Mental Health Services tax. This is maximum total of 13.3 percent in California state tax on your capital gains.

Read Also: How Do I Paper File My Taxes

California State Tax Calculator

The California tax calculator is updated for the 2021/22 tax year. This tax calculator performs as a standalone State Tax calculator for California, it does not take into account federal taxes, medicare decustions et al.

The California tax calculator is designed to provide a simple illlustration of the state income tax due in California, to view a comprehensive tax illustration which includes federal tax, medicare, state tax, standard/itemised deductions , please use the main 2021/22 tax reform calculator.

Your Tax Status & FamilyPaying State Business Taxes In California: A Summary

Hereâs a summary of which California state taxes apply to which business entity type.

Keep in mind this table doesnât include the income taxes that sole proprietors, general partners and pass-through entity owners must pay on their share of business income, which weâll cover in the next section.

| What kind of business do you have? | Did it report a net income ? | What state taxes do you have to pay? |

|---|---|---|

| C Corporation | ||

| AMT , $800 Franchise Tax | ||

| LLC taxed like a corporation | Y | |

| LLC taxed like a corporation | N | AMT , $800 Franchise Tax |

| S Corporation | ||

| Franchise Tax | ||

| LLC | ||

| No business taxes |

Recommended Reading: How Is Capital Gains Tax Calculated On Sale Of Property

Other California State Excise Taxes

California is known for tacking additional excise taxes onto certain products. You’ll pay an extra 33% if you buy fruit from a vending machine there.

And, like most states, California also adds an additional tax to cigarettes and gasoline. A pack of cigarettes will cost you an extra $2.87 there. The tax used to be just 87 cents, but legislation ramped it up by an additional $2 on April 1, 2017.

Gasoline will run you an additional 12 cents a gallon under legislation that began increasing the tax incrementally effective November 1, 2017. That’s the highest rate in the country. As of 2020, the average California driver pays $2.93 per gallon compared to the national average of $1.90.

The issue went to the ballot in November 2018 when opponents of the tax sought to implement a law that would prohibit any new transportation fuel taxes without a majority public vote. The measure was defeated.

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

Recommended Reading: Where To Find Real Estate Taxes Paid

Things To Know About California State Tax

Californias tax-filing deadline generally follows the federal tax deadline.

Tax software will do your state taxes .

Wondering “Where is my California state tax refund?” Good news: You can check the status of your state tax refund online.

If you cant pay your California state tax bill on time, you can request a one-time, 30-day delay.

If you cant afford your tax bill and owe less than $25,000, California offers payment plans. Typically, you get three to five years to pay your bill. Theres a fee to set up an agreement.

You can also apply for the states Offer in Compromise program, which might allow you to pay less than you owe.

Accurately Calculating Your Taxable Income Is Important

As you prepare to file your California and federal income tax returns, it is important to be certain that you are accurately reporting your taxable income and fully paying what you owe. Failing to report income from all sources, taking deductions for which you are ineligible, and otherwise evading your state and federal tax obligations whether intentionally or unintentionally can have severe consequences.

Using tax software or hiring a certified public accountant to prepare your taxes can help you avoid mistakes. However, as the taxpayer, you are the one who is ultimately responsible for ensuring that you meet your state and federal income tax obligations.

You May Like: How To Pay Federal And State Taxes Quarterly

What Income Sources Are Subject To California State Tax

If you live in California, you probably feel that you are taxed to death. True, California has one of the highest tax rates in the country and the state will derive income from any and all sources that it can.

This can get complicated if you conduct business across state lines.

In this chapter, I am going to address what sources of income are taxable in California, which extends beyond employment income. There is tax on tangible and intangible assets, income from S corps, partnerships and trusts, alimony, sale of stocks and the list goes on.

However, before considering the specific rules of taxation for each of the various sources of income, there is one overarching principle that can guide you in determining your tax liability regardless of your residency status: if any money you receive derives from a California source, chances are, you owe taxes on those earnings.;

See FTB Pub 1100 Taxation of Nonresidents and Individuals Who Change Residency. If you are a resident of the state, income derived from any jurisdiction can be taxed.;

All of this is difficult to sort out. If you are confused and need some guidance, give me a call. I specialize in helping small business owners in California with their tax questions. That is one of the reasons why I created this series.

Where To Send Your California Tax Return

| Income Tax Returns Franchise Tax Board |

You can save time and money by electronically filing your California income tax directly with the . Benefits of e-Filing your California tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

California’s free eFile program allows all California taxpayers to instantly file their income tax return over the internet. California provides several free resources for eFile users, including ReadyReturn , and CalFile, a free software program offered by the Franchise Tax Board. In addition, California supports e-filing your return through a variety of third-party software packages.

The benefits of e-filing your California tax return include speedy refund delivery , scheduling tax payments, and instant filing confirmation. If you have questions about the eFile program, contact the California Franchise Tax Board toll-free at 1-800-852-5711.

To e-file your California and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

Recommended Reading: When Does Income Tax Have To Be Filed

Overall California Tax Picture

If you inherit a retirement account or pension, withdrawals will be fully taxable. This will likely mean you will have to pay Federal Taxes and California Taxes on your withdrawal from an Inherited Retirement Account. . California does not tax Social Security benefits, which is good; many states do.

California sales tax;rates range from 7.35% to 10.25%. This base rate is the highest of any state. California is quite fair when it comes to property taxes when you look beyond the sky-high housing prices in Los Angeles and most of the state. Property taxes in California;are not as burdensome, as the average rate is just 0.75% the 15th-lowest in the nation. When you add in other local taxes based as part of your property tax bill, much of California is hit with a 1.25% property tax bill. Thanks to Prop 13, this amount can only increase 2%, per year, which means many Californian homeowners are paying taxes on values much lower than their current estimated values.

No California estate tax is great news. Another piece of good news for California taxpayers is voters passed prop 19, making it easier to transfer your property tax base to a new home in retirement.