About Where’s My Refund

Use Where’s My Refund to check the status of individual income tax returns and amended individual income tax returns you’ve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

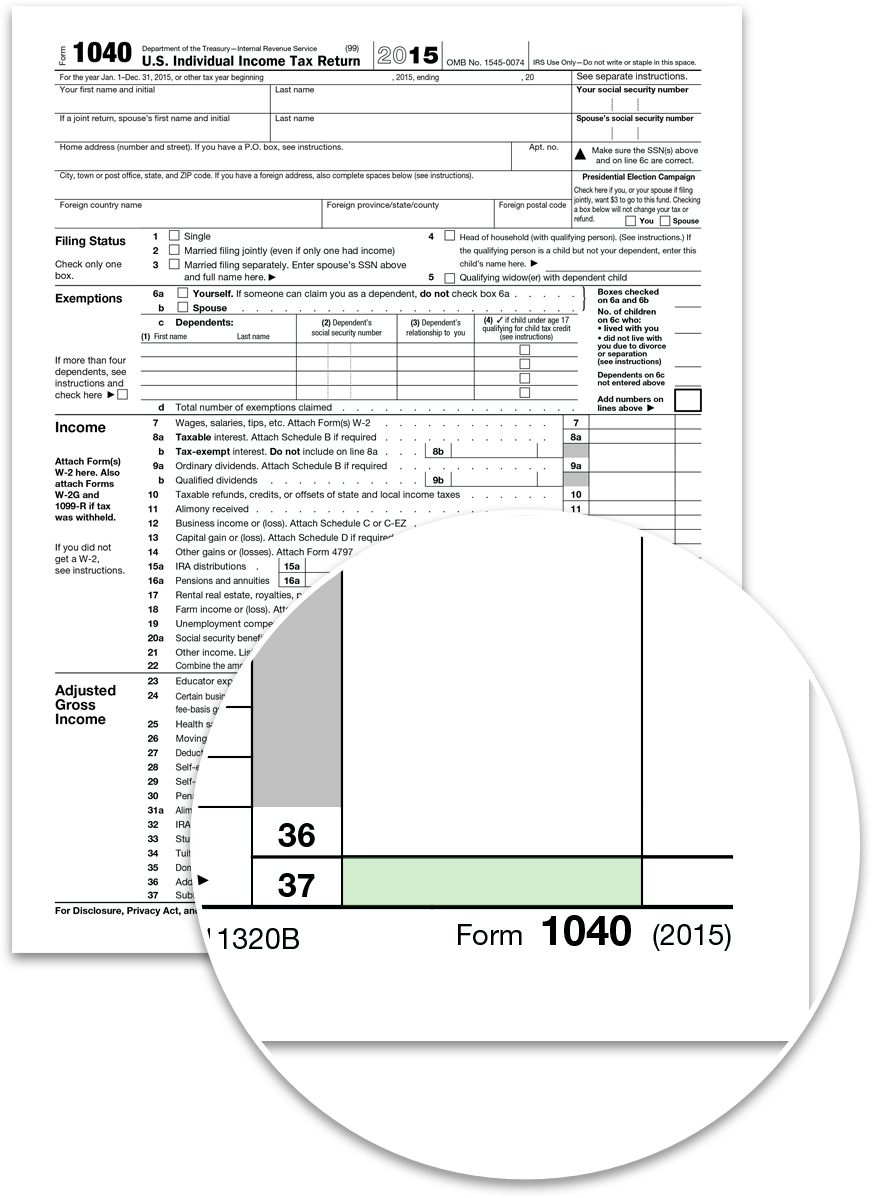

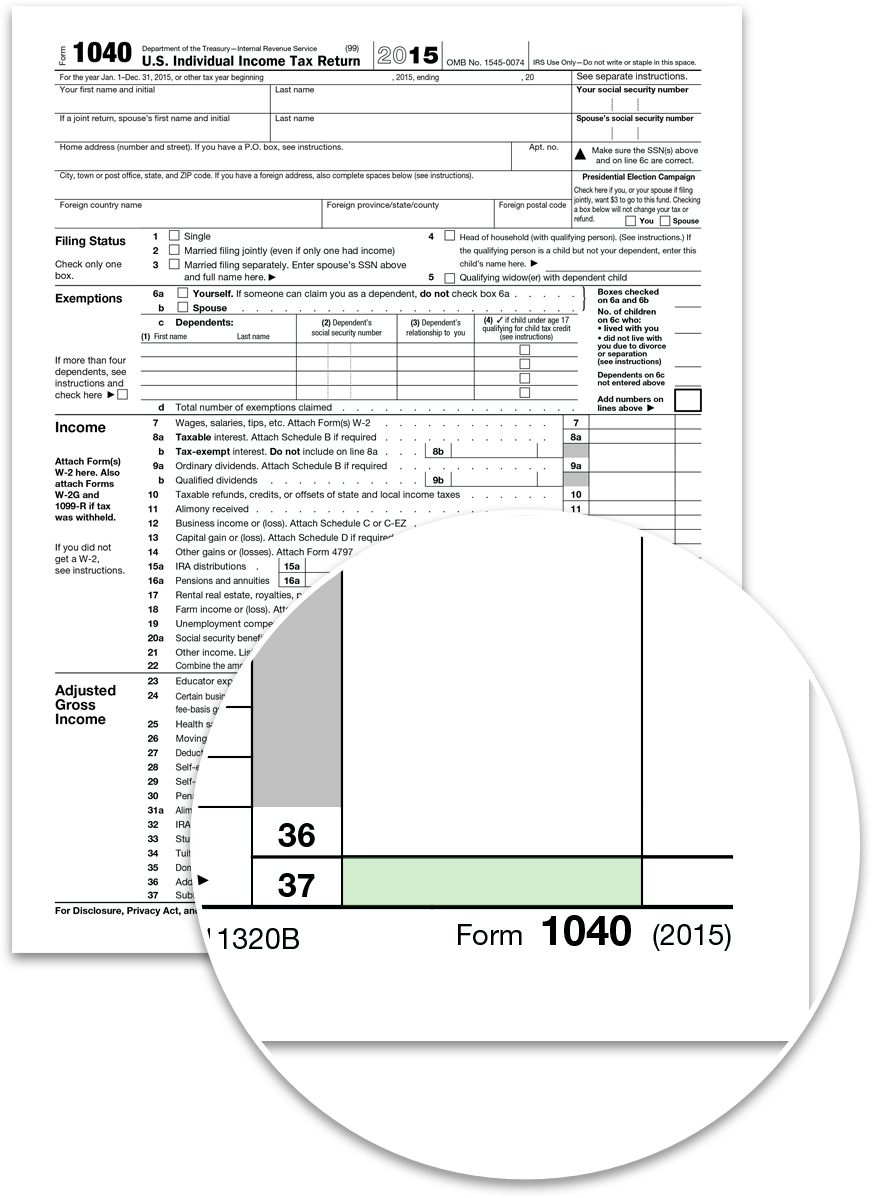

Request Federal Return From Irs

To get a photocopy of your federal tax return, download and print Form 4506 from the IRS website. Fill in the information requested about yourself and the tax return year requested and then sign the form.

You’ll need to include a money order or check for $50. However, there’s an exception if you’re eligible for a fee waiver for disaster assistance and emergency relief. The IRS notes that you’ll need to use the memo or note field to write “Form 4506 request” along with your Social Security number or tax ID.

The second page of Form 4506 will list IRS offices sorted by location. Find your local office’s address and mail the form and payment to that location. The IRS will mail the photocopied tax return within 75 days.

Consider Irs Transcript Vs Return

If you can’t access your H&R Block tax records for some reason, you can fill out IRS Form 4506, Request for Copy of Tax Return, and pay a fee to have the IRS send you a photocopy of your federal tax return. This method will let you get a past return as far back as six years ago. The downside is that you may have wait as long as 75 days to have the IRS mail you the documents, and this can be a problem if you need them quickly for an application you’re filling out.

If you only need to know specific information from your last tax return and don’t need the actual document, then requesting an IRS tax transcript can be a free and quick alternative. The IRS makes transcripts available for the last three tax years, and you can get yours as soon as five to 10 days from when you order.

You have a few transcript options that may work for you. If you need your adjusted gross income, taxable income and other basic items from your tax return, you can request a tax account transcript. You can also request a tax return transcript that has much of the information from your tax return and related forms but doesn’t account for any changes made after the original filing date. Credit Karma notes that banks and other organizations will often accept tax transcripts as part of their verification process, so check to find out which they prefer.

You May Like: How Can I Make Payments For My Taxes

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.;

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

How About Checking The Status Of An Amended Tax Return

You can use the Wheres My Amended Return IRS tool. This tool shows updates for amended returns for current years and up to three prior years. However, it is recommended that you wait three weeks after mailing your return to retrieve the most accurate status update. Before opening the tool, youll want to make sure you have a few bits of information on hand:

- tax year

- zip code

Read Also: Where Can I Get Taxes Done For Free

How To Get A Copy Of Your Tax Transcript

There are three ways to get a copy of your tax transcript.

The easiest way is to use the IRSs online transcript portal, Get Transcript. To use this service to access your transcripts online, youll need to provide your Social Security number, filing status from your most recent return, date of birth and the mailing address from your most recent tax return. Youll also need a few other things: an email account, a mobile phone with your name on the account, and an account number from an eligible account to verify your identity.

You can also fill out and mail in a copy of Form 4506-T or use the Get Transcript by Mail option through the Get Transcript portal. But if you make your request that way, you should be prepared to wait 30 days to receive your copy. Finally, if youre a phone person, you can also get a copy of your transcript by calling the IRS at 1-800-908-9946. Phone orders typically take five to 10 business days.

One thing to note: The IRS is now issuing transcripts that block out portions of your Social Security number, telephone number, last name and address. Thats why youll have to provide an account number to verify your identity so they can use it to match up with your file. By limiting the amount of personal information on the transcript, the IRS hopes to help reduce the risk of identity theft.

Where Can I Find Help With My Taxes

You can find helpful and affordable assistance by choosing a provider from CNET’s roundup of;the best tax software for 2021. But the IRS does offer some free tax help, too. The Volunteer Income Tax Assistance;program is designed to offer guidance to people who make less than $54,000 per year, have disabilities or have limited facility with English. And the Tax Counseling for the Elderly;program specializes in tax issues that affect people who are 60 or older. Due to COVID-19, however, many VITA sites, and all TCE sites, have been closed. For now the IRS’;International Taxpayer Service Call Center;remains available at 267-941-1000, Monday through Friday, 6 a.m. to 11 p.m. ET.

Also Check: How Much Income To File Taxes

Tax Situations Requiring A Specific Return Or Form

There are exceptions, such as if you had residential ties in another place, where you would need a specific tax return.

You will also need to file a provincial income tax return for Quebec.

For details: What to do when someone has died

For details: Leaving Canada

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

do not

You may be considered a deemed resident of Canada if you:

- do not have significant residential ties with Canada

- are not considered a resident of another country under a tax treaty between Canada and that country

Use the tax package for non-residents and deemed residents of Canada.

If you are not a factual resident of Canada, or a deemed resident of Canada, you may be considered a non-resident of Canada for tax purposes. Use the tax package for non-residents and deemed residents of Canada.

If you earned employment income or business income with a permanent establishment in a certain province or territory, complete the following instead:

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. For example, if you e-filed with Credit Karma Tax® in prior years, you can get your prior-year returns for free after accessing this years free tax product. Other online filing services may also allow you to access past returns you filed with them. But be aware they may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Don’t Miss: How To File Federal Taxes For Free

Irs Transcripts Are Free

Your other option is to order a tax transcript from the IRS rather than an actual copy of your return. The IRS makes two types of transcripts available: a tax return transcript and a tax account transcript, and both are free. A transcript is more or less a summary of the information included in your return and your payment and refund histories.

Mail in Form 4506T-EZ if you want a tax return transcript, or Form 4506T if you want a tax account transcript. You can also request a transcript online from the “Get Transcript Online” page of the IRS website, or even call the agency, although the IRS isn’t taking phone calls in spring 2020 due to the coronavirus pandemic.

It will take from five to 30 days to get the transcript, depending on whether you make the request online or via USPS mail, and they’re only available for four years the current year and the previous three.

Rrsp Contributions Not Reported On Previous Year Tax Return What Now

It is necessary to include all RRSP contributions made in the first 60 days of the current year on Schedule 7 of the tax return for the past tax year, even if you are not claiming a deduction for the contribution for the past tax year.

Make sure your contributions up to March 2, 2020 were recorded on your 2019 tax return!;; Make sure your contributions from March 3, 2020 to March 1, 2021 are recorded on your 2020 tax return!

You may have made an RRSP contribution in the previous year, but didn’t record this on your return.

You then have 2 options regarding your 2020 tax return:

;;; 1.; Wait for the reassessment notice for your 2019 tax year before filing your 2020 tax return , including the 2019 contribution as a carry-forward from 2019, or

;;; 2.; File your 2020 tax return without the carry-forward from 2019, and subsequently file a form T1Adj requesting a change to your 2020 tax return to include the carried-forward contribution from 2019, and to claim the RRSP deduction.

Read Also: Can I Check My Property Taxes Online

Use A Tax Return To Validate Identity

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days;

Recommended Reading: What Is Deduction In Income Tax

How Can You Use The Where’s My Refund Tool

To check the status of your 2020 income tax refund using the;IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.;

Using the IRS tool Where’s My Refund, go to the;Get Refund Status;page, enter your SSN or ITIN, filing status and exact refund amount, then press;Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called;IRS2Go;that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.;

Cmo Verificar El Estado De Su Cheque De Estmulo Del Coronavirus

Si está tratando de averiguar el estado de su pago de estímulo del coronavirus, vaya a la página Obtener mi pago del IRS. Puede;averiguar si su pago se ha emitido y si; se trata de un cheque enviado por correo;o de un depósito directo.

Obtenga información adicional;sobre los pagos de estímulo, incluido si califica para uno, exactamente para qué califica;y;si tiene que;hacer;algo para obtener el suyo.

You May Like: How To Pay My Federal Taxes Online

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.;

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS; you should also submit a Change of Address to the USPS.

How Can I Obtain Copies Of Previously Filed Returns

You may;obtain copies of previously filed returns using;self-service. ;

Include your full name, complete current mailing address and the tax year with your request.

- Primary filers Social Security number

- Primary filers last name

- Tax year

- Adjusted Gross Income /Total Household Resources

- If your AGI is a negative number, enter -; after the number.;Example: 1045-

Note: If you are unable to authenticate using your current tax year information, select the previous tax year for;;;;;;;;;; authentication.;When you submit your question, explain that you selected a previous tax year for;;;;;;;;;; authentication. Include the AGI/THR;and tax year for which you are inquiring.;;;;;;

You May Like: How Much Is Sales Tax In Illinois

Security Changes For 2018

The IRS is trying to reassure taxpayers that theyre taking steps to secure their information and that its safe to e-file. They notify you if they receive duplicate filings under your Social Security number. Theyve also published Form 14039 for you to use if your e-filing is rejected because someone already filed a return with your Social Security number on it. A fillable version of this form is available on their website. After youve filled it out, you have to print it and attach it to your paper return. When the IRS receives the paper return, theyll do an investigation to identify which return is fraudulent and they will process the legitimate one. Yes, this takes a long time.

Tax Refund Delay: The Latest On The Irs’ Backlog And How To Track Your Money

How long will it take the tax agency to get through its massive backlog? Here’s what we know.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.;

At the beginning of the month, the IRS announced it had 8.5 million unprocessed individual returns, including 2020 returns with errors and amended returns that require corrections or special handling. And refunds that usually take around 21 days to process are taking at least 120 days. Refund checks were expected to come this summer, but it’s nearly fall and the IRS hasn’t given an update to let taxpayers know when the money is coming.;

To add to that, the IRS has also been busy with stimulus checks, child tax credit payments and;refunds for tax overpayment;on unemployment benefits. The “plus-up” stimulus adjustments and the third advance monthly check of the child tax credit payment that went out today — could give families some financial relief, but an overdue tax refund would be an even bigger help.;

In most cases, taxpayers can only continue to practice patience — the tax agency isn’t easy to reach. The best solution is to track your refund online using the Where’s My Refund tool or check your IRS account. We’ll show you how. We can also tell you what to do if you received a “math-error notice” from the IRS. This story is updated frequently.;

You May Like: What Is California State Tax Rate