History Of Social Security Taxation

The good news is that households of the non-elderly pay almost double the taxes of the elderly, so you may not have to pay as much as expected. The government gives preferential treatment to those who saved for retirement, and Social Security income is taxed differently. If Social Security is your only income, you may even be able to stop filing taxes! For the first 50 years of the programs existence, it was not taxed at all; however, due to decreased incomes and increased reliance on the program in the 1980s, Social Security benefits started getting taxed.

Information Slips Capital Gains

Most capital gains and capital losses reported on Schedule 3 come from amounts shown on information slips.

Although you report most of these amounts on line 17400 or line 17600 of Schedule 3, there are exceptions. For example, capital gains from qualified small business corporation shares and qualified farm or fishing property are eligible for the lifetime capital gains deduction. Therefore, you have to report those gains on lines 10700or 11000, whichever applies.

Chart 1 explains how to report the capital gains and other amounts shown on certain information slips.

Reduce Your Income Tax Liability

If youre concerned about paying income tax after age 70, there are some things you can do to prepare. Even if it doesnt resolve your need to file altogether, you can at least reduce the amount you owe each year. If you havent already, look at areas of your budget where you can cut back in order to rely more heavily on your Social Security earnings than other income sources. But if that isnt possible, there are a few other options.

If you havent turned 70 yet, look at some things you can do ahead of that date to reduce your income tax liability. Take a look at the Social Security benefits youll be receiving and determine exactly how much youll need from other sources. Taking withdrawals from your IRA before you sign up for Social Security can help minimize that extra income after you start receiving that check, since youll already have it in the bank. If youve chosen a Roth IRA for your retirement savings, you may also be able to withdraw your funds gradually in a way that reduces your retirement liability.

You May Like: Where Can I Find My Property Tax Bill

When Do You Have A Capital Gain Or Loss

Usually, you have a capital gain or loss when you sell or are considered to have sold capital property. The following are examples of cases where you are considered to have sold capital property:

- You exchange one property for another.

- You give property as a gift.

- You settle or cancel a debt owed to you.

- You transfer certain property to a trust.

- Your property is expropriated.

- The owner dies .

Disposing of Canadian securities

If you dispose of Canadian securities, it’s possible that you could have a gain or loss on income account . However, in the year you dispose of Canadian securities, you can elect to report such a gain or loss as a capital gain or loss. If you make this election for a tax year,;the CRA;will consider every Canadian security you owned in that year and later years to be capital properties. A trader or dealer in securities or anyone who was a non-resident of Canada when the security was sold cannot make this election.

If a partnership owns Canadian securities, each partner is treated as owning the security. When the partnership disposes of the security, each partner can elect to treat the security as capital property. An election by one partner will not result in each partner being treated as having made the election.

To make this election, complete Form T123, Election on Disposition of Canadian Securities, and attach it to your 2020 income tax and benefit return. Once you make this election, you cannot reverse your decision.

Personal-use property

Do I Need To File Even If Im Not Required To By Filing Status Age And Income Level

In some cases, yesyou will still need to le a tax return if any of the following apply:

- You owe any taxes, such as alternative minimum tax, taxes on a retirement plan distribution, household employment taxes, and Social Security and Medicare taxes that were not withheld from income.

- You received a distribution from a health savings account, Archer MSA, or Medicare Advantage MSA.

- You had at least $400 in self-employment income.

- You earned $108.28 or more from a church or qualified church-controlled organization that is exempt from employer Social Security and Medicare taxes.

- You received an advance payment of the Premium Tax Credit for health insurance bought from a health insurance marketplace. You should receive Form 1095-A with the amount of the advance payments.

- Advance payments of the health coverage tax credit were made for you, your spouse or a dependent. You should receive Form 1099-H with the amount of the advance payments. Note: For tax year 2020, any excess amount of advance premium tax credit payments received doesnt have to be repaid, according to the American Rescue Plan .

- You were required to file Form 965 for a triggering event or Form 965-A for an elected installment payment.

You May Like: Can You File Missouri State Taxes Online

Paying On Social Security

The biggest problem with owing income tax on your Social Security benefits is that it wont automatically be withheld from each check, as your taxes are from an employer. That means you could owe big in April, along with penalties for underpayment of taxes. If you expect to owe $1,000 or more at tax time, the IRS expects you to make estimated payments. That means four times each year, youll need to pay one-fourth of your anticipated taxes for the year. Since this isnt an exact science, it may help to use the IRSs calculator to determine how much you should pay.

If youll pay income tax after age 70 or at any age and its not being automatically withheld, youll need to use Form 1040-ES to determine the amount to send in. Form 1040-ES includes an estimated tax worksheet that asks the gross income youll expect for the tax year. Youll need to scroll down to the section titled 2018 Self-Employment Tax and Deduction worksheet for Lines 1 and 9 of the estimated tax worksheet. Here you can input your Social Security payments. You can then transfer this information to the worksheet and use it to calculate your tax debt for the year.

References

Writer Bio

Allowable Business Investment Loss

If you had a business investment loss in 2020, you can deduct 1/2 of the loss from income. The amount of the loss you can deduct from your income is called your allowable business investment loss . Complete Chart 6 to determine your ABIL and, if applicable, your business investment loss reduction. Claim the deduction for the ABIL on line 21700 of your income tax and benefit return. Enter the gross business investment loss on line 21699 of your return.

What is a business investment loss?

A business investment loss results from the actual or deemed disposition of certain capital properties. It can happen when you dispose of one of the following to a person you deal with at arm’s length:

- a share of a small business corporation

- a debt owed to you by a small business corporation

For business investment loss purposes, a small business corporation includes a corporation that was a small business corporation at any time during the 12 months before the disposition.

You may also have such a loss if you are deemed to have disposed of, for nil proceeds of disposition, a debt or a share of a small business corporation under any of the following circumstances:

What happens when you incur an ABIL?

You could have;carried a non-capital loss arising in tax years ending after March 22, 2004 through December 31, 2005, back 3 years and forward 10 years.

Note

Any ABIL that you claim for 2020 will reduce the capital gains deduction you can claim in 2020 and in future years.

Don’t Miss: How To Correct State Tax Return

Tax Credits For Seniors

Even if you have to file a tax return, there are ways you can decrease the amount of tax you will pay on your taxable income. So long as you are a minimum of 65 years old and your income from sources other than your Social Security is not high, then a tax credit for seniors, the elderly or disabled, can lessen your tax bill on a dollar-for-dollar arrangement. Nevertheless, this tax credit is only useful when you truly owe tax to the IRS.

What Is A Principal Residence

Your principal residence can be any of the following types of housing units:

- a house

- an apartment in an apartment building

- an apartment in a duplex

- a trailer, mobile home, or houseboat

A property qualifies as your principal residence for any year if it meets all of the following;4 conditions:

- It is a housing unit, a leasehold interest in a housing unit, or a share of the capital stock of a co-operative housing corporation you acquire only to get the right to inhabit a housing unit owned by that corporation.

- You own the property alone or jointly with another person.

- You, your current or former spouse or common-law partner, or any of your children lived in it at some time during the year.

- You designate the property as your principal residence.

The land on which your home is located can be part of your principal residence. Usually, the amount of land that you can consider as part of your principal residence is limited to 1/2 hectare. However, if you can show that you need more land to use and enjoy your home, you can consider more than this amount as part of your principal residence. For example, this may happen if the minimum lot size imposed by a municipality at the time you bought the property is larger than 1/2 hectare.

Designating a principal residence

For more information, see the section called Form T2091, Designation of a Property as a Principal Residence by an Individual .

Can you have more than one principal residence?

For 1982 to 2000, your family included:

Note

Read Also: Will I Get Any Money Back From My Taxes

You Must File An Income Tax Return If:

- You owe tax to the CRA.

- Youve participated in the Home Buyers Plan ;or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have received a Canada Workers Benefit advance payments in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

What Is A Flow

You are a member of, or investor in, a flow-through entity if you own shares or units of, or an interest in, one of the following:

Read Also: What Is The Tax In Georgia

Selling A Building In 2020

If you sold a building of a prescribed class in 2020, special rules may make the selling price an amount other than the actual selling price. This happens when you meet both of the following conditions:

- You, or a person with whom you do not deal at arm’s length, own the land on which the building is located, or the land adjoining the building if you need the land to use the building.

- You sold the building for less than its cost amount and its capital cost.

Calculate the cost amount as follows:

- If the building was the only property in the class, the cost amount is the undepreciated capital cost of the class before the sale.

- If more than one property is in the same class, you have to calculate the cost amount of each building as follows:

×

Note

You may have to recalculate the capital cost of a property to determine its cost amount in any of the following situations:

- You acquired a property directly or indirectly from a person or partnership with whom you did not deal at arm’s length.

- You acquired the property for some other purpose and later began to use it, or increased its use, to earn rental or business income.

For more information, call 1-800-959-8281.

If you sold a building under these conditions, this may restrict the terminal loss on the building and reduce the capital gain on the land.

For more information, see Guide T4036, Rental Income, or Income Tax Folio S3-F4-C1, General Discussion of Capital Cost Allowance.

Selling part of a property

Example

Total ACB

Tips For Seniors In Preparing Their Taxes

Current research indicates that individuals are likely to make errors when preparing their tax returns. The following tax tips were developed to help you avoid some of the common errors dealing with the standard deduction for seniors, the taxable amount of Social Security benefits, and the Credit for the Elderly and Disabled. In addition, you’ll find links below to helpful publications as well as information on how to obtain free tax assistance.

Standard Deduction for Seniors – If you do not itemize your deductions, you can get a higher standard deduction amount if you and/or your spouse are 65 years old or older. You can get an even higher standard deduction amount if either you or your spouse is blind.

Taxable Amount of Social Security Benefits -When preparing your return, be especially careful when you calculate the taxable amount of your Social Security. Use the Social Security benefits worksheet found in the instructions for IRS Form 1040 and Form 1040A, and then double-check it before you fill out your tax return. See Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

– You must file using Form 1040 or Form 1040A to receive the Credit for the Elderly or Disabled. You cannot get the Credit for the Elderly or Disabled if you file using Form 1040EZ. Be sure to apply for the Credit if you qualify; please read below for details.

Also see Publications 524;; and 554;.;

Also Check: How To Track Your Taxes

Income Requirements For Filing A Tax Return

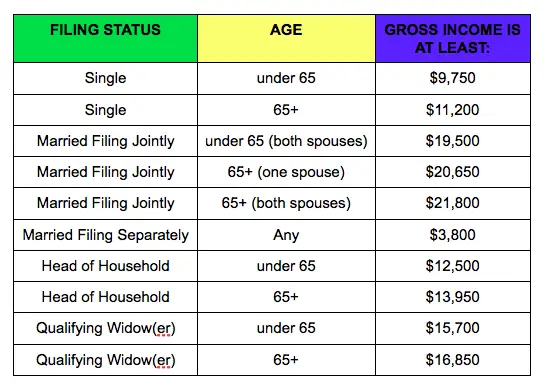

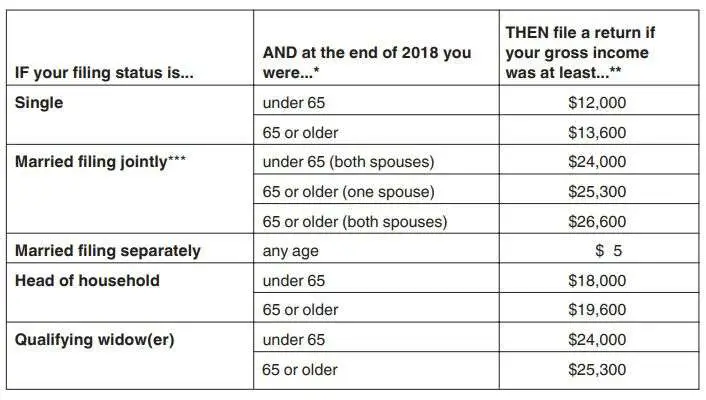

Your first consideration is how much do I have to make to file taxes?. If your gross income for 2020 is above the thresholds for your age and filing status, you must file a federal tax return next year. See the table below.

Tax-filing earnings thresholds for 2020 taxes| Filing status | |

|---|---|

| $5 | $5 |

In addition to federal taxes, you may also have to pay state taxes. Currently, seven states dont tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your states revenue, finance or taxation offices website. The IRS also has a link to every states tax office.

Filing Taxes For Kids: Does My Child Have To File A Tax Return

-

Date

Did your kids discover the joys of entrepreneurship this year, raking in the dough from lemonade stands, shoveling driveways, or walking the neighbors dogs? Or maybe generous family members gifted them with stocks and bonds instead of toys. While your child may enjoy having some money of their own, they might also get to experience a little something called paying taxes.

As dependents, your children face different rules for determining whether they need to file a federal income tax return. However, unlike adult taxpayers, children have some flexibility in choosing how to report their income.

Here are the key points you need to know when helping your children file taxes.

Don’t Miss: How Much Is New York State Sales Tax

Four Factors That Impact Income Thresholds

Four factors determine whether you must file, and each circumstance has its own gross income threshold. The four factors are:

- Whether someone else claims you as a dependent

- Whether you’re married or single

- Your age

Some of these factors can overlap, which can change the income thresholds for required filing.

Maximum Earned Income For Seniors

To calculate whether you need to file a tax return, set aside the money you earned from Social Security benefits during the tax year and look at your other income. If youre single, youll need to file a return if you earned $11,900 or more. If youre married filing jointly, that minimum goes up to $14,900. If youre a widower with one or more dependent children, you can make up to $17,900 without being required to file.

How much youll have to pay is a little more complicated. You can use a Social Security tax calculator to help you determine how much youll owe. Basically, though, youll add your adjusted gross income and nontaxable interest to 50 percent of your Social Security benefit for the year to determine whether youll owe or not. If the total of that calculation is between $25,000 and $34,000, or $32,000 and $44,000 if married filing jointly, youll owe taxes on half of your Social Security earnings. If your income exceeds $34,000, or $44,000 for couples, you could pay taxes on as much as 85 percent of your Social Security income.

Read Also: How To Pay Llc Taxes