When Are Taxes Due Important Tax Deadlines And Dates

OVERVIEW

Make sure your calendar is up-to-date with these important deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2021.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Pay What You Can To The Irs To Slash Penalties And Interest

While no one likes paying the IRS at tax time, doing so can help save money. Any unpaid income taxes not paid in full by the tax deadline may incur additional penalties and interest. Even if you cannot afford to pay your entire tax bill, you should pay something toward your balance.

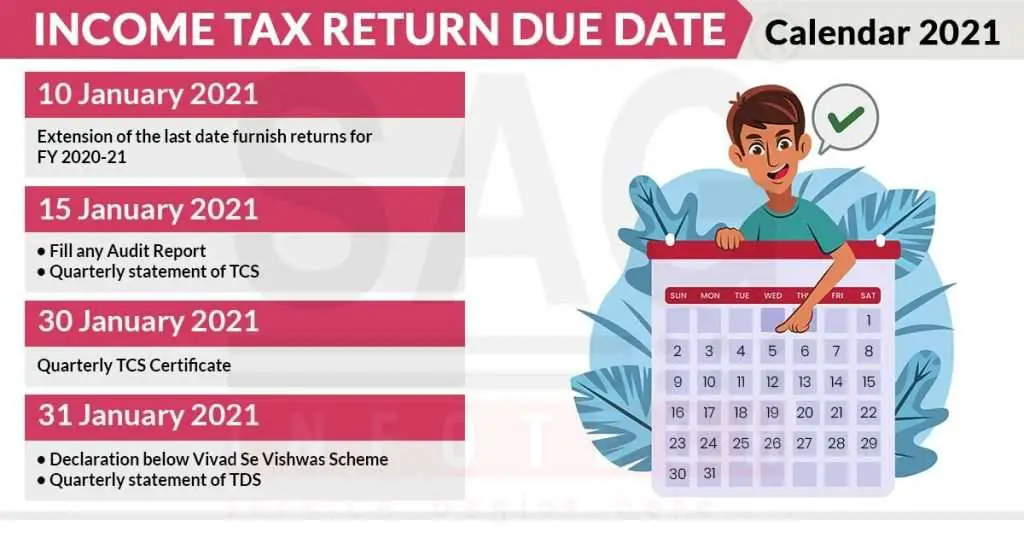

Typically, the due date of your federal income tax payments for Form 1040 and related forms, such as self-employment taxes is due by April 15. However, the IRS also automatically extended the due date to May 17, 2021, for most taxpayers. The IRS will not charge any penalties or interest during this time despite the amount due. Penalties and interest will continue to accrue on any unpaid balance after May 17, 2021.

Remember, the May 17 deadline does not apply to estimated tax payments for 2020 tax returns. Estimated tax payments are due quarterly on income earned or received during the year where taxes were not withheld. Those payments were due on April 15, unless you live in Oklahoma, Texas or Louisiana. Taxpayers who reside in these states have until June 15 to pay estimated tax payments to the IRS.

When Is Tax Day

The big âtax dayâ is usually April 15, 2021, this is when you have to file your taxes! However, for individual tax filers in 2021, this has been changed to May 17, 2021.

The IRS has also announced it is giving victims of the winter storms until June 15th, 2021 to file and pay business returns normally due on March 15th and April 15th. More information can be found on the IRS website. This extension applies to Texas, Oklahoma, and Louisiana.

You May Like: Did The Tax Deadline Get Extended

Turbotax Has You Covered

Many taxpayers scramble to figure out when are taxes due every year, but you can be confident that TurboTax is ready to help you file whenever you’re ready. TurboTax asks simple questions about your tax situation and helps you fill out the right forms and find every deduction you qualify for so you can get every dollar you deserve.

If you have additional questions, you can connect live to a TurboTax Live tax expert for unlimited tax advice or even have a tax expert or CPA file for you from start to finish.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Tax Day 2021 Is May 17 Heres What You Need To Know Before The Deadline To File Your Taxes

The IRS extended the tax season deadline from Thursday, April 15 to Monday, May 17 this year. The postponement occurred due to the backlog of millions of unprocessed tax returns.

The announcement was made in March. Back then, the IRS stated there was an estimated 24 million unprocessed returns, some dated back to 2019.

This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities, said IRS Commissioner Chuck Rettig in a statement.

Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds, he added. Filing electronically with direct deposit is the quickest way to get refunds, and it can help some taxpayers more quickly receive any remaining stimulus payments they may be entitled to.

According to the IRS:

Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15, 2021, to May 17, 2021, without penalties and interest, regardless of the amount owed. This postponement applies to individual taxpayers, including individuals who pay self-employment tax. Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. Individual taxpayers will automatically avoid interest and penalties on the taxes paid by May 17.

READ MORE:

Read Also: Can You Refile Your Taxes

When Is My 2020 Tax Return Due In 2021

Though last year the IRS extended the deadline from April 15 to July 15, this year the agency has granted us only one extra month:;Your 2020 tax return is due on May 17, 2021. If you request an extension , your last day to file will be Oct. 15, 2021.;

There’s one considerable caveat, however: The IRS has said the May 17 deadline does not apply to those who make estimated payments, which are still due on April 15 — which is coming up this Thursday. Though legislators introduced;a new bill that would delay the Q1 estimated tax due date until May 17, it’s not clear whether there’s enough time or political will to get it passed.

How Do I Send The Irs My Tax Payment

If you’re mailing your tax payment, you can elect to have the funds withdrawn directly from your bank account or include a personal check or money order. If you choose the latter, make it payable to “US Treasury” and include your name, address, phone number, Social Security number or Individual Tax ID Number. Under no circumstances should you ever mail cash to the IRS.

Read more:;How to handle cryptocurrency on your taxes

Don’t Miss: Can You File Missouri State Taxes Online

Are Taxes Due At Midnight

The tax deadline for the 2020 tax year is May 17, 2021, and many filers wait until the absolute last possible minute to complete their taxes. This extension is automatic for all tax filers with no additional paperwork. ;

As long as you get your taxes filed by midnight on May 17, you won’t incur any penalties for late filing or failure to file taxes. However, you shouldnt wait until 11:59 p.m. to head to the post office or click submit on your electronic tax forms. ;

Since technology could fail and/or the IRS website might experience delays, you should complete your e-file process as early as you can on the due date. If youre among the estimated 10 percent who like to file paper taxes, get to the post office as early as you can to minimize delays from long lines and meet the deadline.;

Its a good idea to file taxes even without any income for 2020. This makes it easier for you to receive any economic stimulus payments or various tax credits that are available.;

Mileage Driven For Charitable And Medical Purposes

Did you volunteer for your favorite charity? Did you travel to your doctors office for checkups and procedures? The IRS will allow you to claim mileage for both medical and charitable purposes during the year. To qualify, you must itemize your deductions on Schedule A of your Form 1040. For the 2020 tax year, you can claim 14 cents per mile for charity and 17 cents for medical.

You should itemizeincluding medical, dental, charitable, mortgage interest, taxes and other deductionsif your deductions are greater than your applicable standard deduction. Generally, the 2020 tax standard deduction for a married filing joint taxpayer is $24,800. For a single and head of household filer, the amount is $12,400 and $18,650, respectively.

Read Also: How To Pay My Federal Taxes Online

If You Miss The Tax Filing Deadline And Are Owed A Refund

If you overpaid for the 2020 tax year, there’s typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2020 tax returns, the window closes in 2024. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

Will My Tax Refund Be Delayed

No. The IRS says that most tax refunds are still being paid within 21 days of filing. The IRS encourages taxpayers to file electronically with direct deposit as its the quickest way to receive your refund. While the IRS continues to accept paper forms, it has a severe paperwork backlog and strongly urges e-filing. Heres how to track your tax refund.

Also Check: How Are Property Taxes Calculated In Texas

Ira Contributions For 2020

If you want to put more money in an IRA and have it count towards 2020 contributions, you’ll have to do it today. For 2020, you can sock away up to $6,000 in an IRA $7,000 if you’re age 50 or older.

If you haven’t already maxed out your 2020 IRA contributions, doing so before the May 17 tax deadline can be a smart move. First, contributions to a traditional IRA are often tax deductible, while withdrawals from a Roth IRA are tax-free. So, whether you contribute to a traditional or a Roth IRA, you can cut your tax bill now or in the future.

Low- and moderate-income people who contribute to an IRA might also qualify for the Saver’s Credit, which can be worth as much as $1,000 .

If you contribute to an IRA for 2020 by the May 17 tax deadline, you can claim the IRA deduction and/or the Saver’s Credit on your 2020 tax return. That means you can get the tax benefits immediately, instead of waiting until next year if you were to contribute the same amount on May 18 or later.

Also note that today is the last day to withdraw any excess 2020 contributions to your IRAs . So, if you put in more than the $6,000 limit , take it out now to avoid stiff penalties.

4 of 9

What If I Need More Time

Don’t let a looming tax deadline force you to rush through the tax filing process and make a mistake on your return. Simply request an extension.

The IRS grants an automatic six-month extension of the tax filing deadline to anyone who requests it. You can request an extension electronically with TurboTax or mail Form 4868.

Just keep in mind, the tax extension gives you more time to file your return, not more time to pay the tax you owe. You’ll need to estimate the amount you owe and make your payment by the tax filing deadline.

Don’t Miss: Do You Have To Do Taxes For Doordash

Are Stimulus Checks Taxable

No. Anyone who qualified but didnt receive a payment can claim the amount as a credit on their 2020 federal return. Tax experts say some people might be able to receive a larger tax refund if they were shortchanged on their stimulus payments.

In the first round of stimulus payments last spring, the IRS used 2019 tax returns to determine eligibility in most cases, so those who ended up earning less in 2020 could be eligible for more, said Jason Katz, a wealth management advisor for Bartlett Wealth Management.

New parents who had a child last year and report it on their 2020 return might receive a higher tax refund or see their tax liability shrink. Taxpayers who received a higher stimulus payment than they should have based on their 2020 income arent liable to pay it back to the IRS, Katz said.

If you got PPP loan, heres what you need to know to file taxes »

In the first round of stimulus payments, individuals earning less than $75,000 in adjusted gross income qualified for the full $1,200 payment, and married couples filing a joint return with income of less than $150,000 qualified for $2,400. The federal government offered $500 per dependent child to certain taxpayers. People who made more qualified for smaller amounts, and it was phased out for individuals whose income exceeded $99,000 or $198,000 for joint filers with no children.

Reason : Calculate Your Plus

If you’ve received your third stimulus check;you may be due a plus-up payment, too, but only if the IRS has your 2020 tax return. If the IRS based your payment on your 2019 tax return but your 2020 federal tax return shows you qualify for more money for that third payment, the IRS will send you the difference as a separate plus-up.

Also Check: How To Buy Tax Lien Properties In California

How The Worlds Biggest Companies Have Fared During Covid; Taxes Due Monday

Get Forbes’ top articles on pressing issues that matter to your financial well-beingpersonal finance, investing, taxes and retirementdelivered to your inbox;every week.

Taxes are due at midnight! But it’s not too late to request an extension…read on to find out how. …

Stocks are tumblingor so say;recent headlines. Watching the tech-heavy Dow Jones Industrial Average flounder this week, its easy to forget just how much U.S. markets have risen since the pandemics early days, when major indices plummeted more than 30% and the longest-running bull market came to a screeching halt. But Forbes 19th annual Global 2000 list, our ranking of the largest public companies in the world, is a good reminder of the rebound in stock prices over the past 12 months, with the collective market value of the 2000 up roughly 47% in the year ended April 16.

Dont throw your short-term lens out the window completely, thoughtaxes are still due tonight at midnight! Read on for Global 2000 takeaways, student loan updates, inflation profiteers and more.

Contribute To Or Open An Ira By Tax Day

Contributions to a traditional IRA can be tax-deductible. You have until the May 17, 2021, tax deadline to;contribute to an IRA, either Roth or traditional, for the 2020 tax year. The maximum contribution amount for either type of IRA is $6,000 or $7,000 if you’re age 50 or older.;See all the rules here.

» MORE:;Learn how IRAs work and where to get one

Don’t Miss: How Much Is New York State Sales Tax

How Do I File My Taxes Online

CNET has rounded up the best tax software, featuring vendors such as TurboTax, H&R Block and TaxSlayer. These companies can make the tax filing process much easier, from reporting your taxable or self-employed income to setting up direct deposit to going through your itemized deductions.

That noted, the IRS provides a list of free online tax prep software;offered by many of those same providers. You can use this service if you meet certain criteria and have a relatively simple tax situation. Requirements include: You make less than $72,000 annually, you don’t itemize deductions and you don’t own a business. This will likely be helpful for people who do not typically have to file taxes but need to do so this year to claim missing stimulus money.

If you want to itemize deductions or have a more complex financial situation — you run a business, have investments or generate rental income — you’ll have to pay for a higher tier of service, which can run a couple hundred dollars. Still, for most people, even the most deluxe online package is far less expensive than hiring an authorized tax pro. And if you prefer to keep it old-school, the IRS’ online tax forms handle some but not all of the calculations for you and still allow you to e-file or print and mail.

A number of online tax software providers will help you file for free.

What Someone Should Do If They Missed The May 17 Deadline To File And Pay Taxes

COVID Tax Tip 2021-69, May 18, 2021

The federal income tax deadline has passed for most individual taxpayers. However, some haven’t filed their 2020 tax returns or paid their tax due.

If an individual taxpayer is owed a refund, there’s no penalty for filing late. On the other hand, tax owed and not paid by May 17, 2021 is subject to ;penalties and interest;.

Anyone who didn’t file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest. Electronic filing options, including IRS Free File, are still available on IRS.gov through October 15, 2021, to prepare and file returns electronically.

Taxpayers should then review their payment options. The IRS has information for taxpayers who can’t pay taxes they owe.

Some taxpayers may have extra time to file their tax returns and pay any taxes due. This includes some disaster victims, taxpayers living overseas, certain military service members and eligible support personnel in combat zones.

Filing soon is very important because the late-filing and late-payment penalties on unpaid taxes add up quickly. However, in some cases, a taxpayer filing after the deadline may qualify for penalty relief. For those charged a penalty, they may contact the IRS by calling the number on their notice and explain why they couldn’t file and pay on time.

Read Also: How Can I Make Payments For My Taxes

What If Im Self

The self-employed and small-business owners might be able to deduct home office expenses if they meet two requirements.

One, taxpayers must regularly use their home office exclusively for work and not for any other purpose, and two, it must be the main place where the individual conducts his or her business.

The rise of remote work has opened the possibility of self-employed people who typically run their business from an office but have shifted operations to their home to claim the home office deduction.

Most peoples principal place of business didnt exist during COVID. A self-employed business owner would be able to possiblymake the claim that their home office served as their principal place of business during 2020, said Steven Savoy, an accounting professor at the University of Illinois at Chicago.

Those taxpayers can use two calculations to deduct a portion of their expenses, including utility bills, mortgage interest, depreciation, rent or office supplies. The first calculation uses the percentage of the home office space relative to the entire area of the home. The second involves multiplying $5 by the area of the home used as an office, which is limited to 300 square feet.