How Can I Get My Old Tax Returns

To get a transcript, taxpayers can:

Transcript of Return from the IRSYou can request an IRS transcript of your tax return from the IRS website. Visit the IRS website for instant online access toyour transcript. Call 1-800-908-9946. Use Form 4506-T.

Also Know, how do I get my old tax returns from TurboTax? How to Open Previous Tax Returns in TurboTax

Similarly, it is asked, do you need previous tax returns?

You must always file your back tax returns on the original forms for each tax year you are filing. You can always search through the IRS website for the forms, but for quicker access, you should use sophisticated tax preparation software, such as TurboTax.

How do I get my w2 from previous years?

If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return, you can order a copy of the entire return from the IRS for a fee. Complete and mail Form 4506, Request for Copy of Tax Return along with the required fee. Allow 75 calendar days for us to process your request.

How To Get Copies Of Past Years Tax Returns

Heres how to obtain copies of a prior year return you filed in TurboTax Online:

If you dont see your tax year listed, you may have multiple accounts.

Hope this was helpful!

Read Also: What Do Tax Accountants Do

Pay Social Security Taxes To Qualify For Benefits

Self-employed individuals have to pay Social Security taxes through their estimated tax payments and individual income tax returns. By filing a return and paying the associated taxes, you report your income so that you may qualify for Social Security retirement and disability benefits when you need them.

Don’t Miss: Do I Need To Attach 1099 B To Tax Return

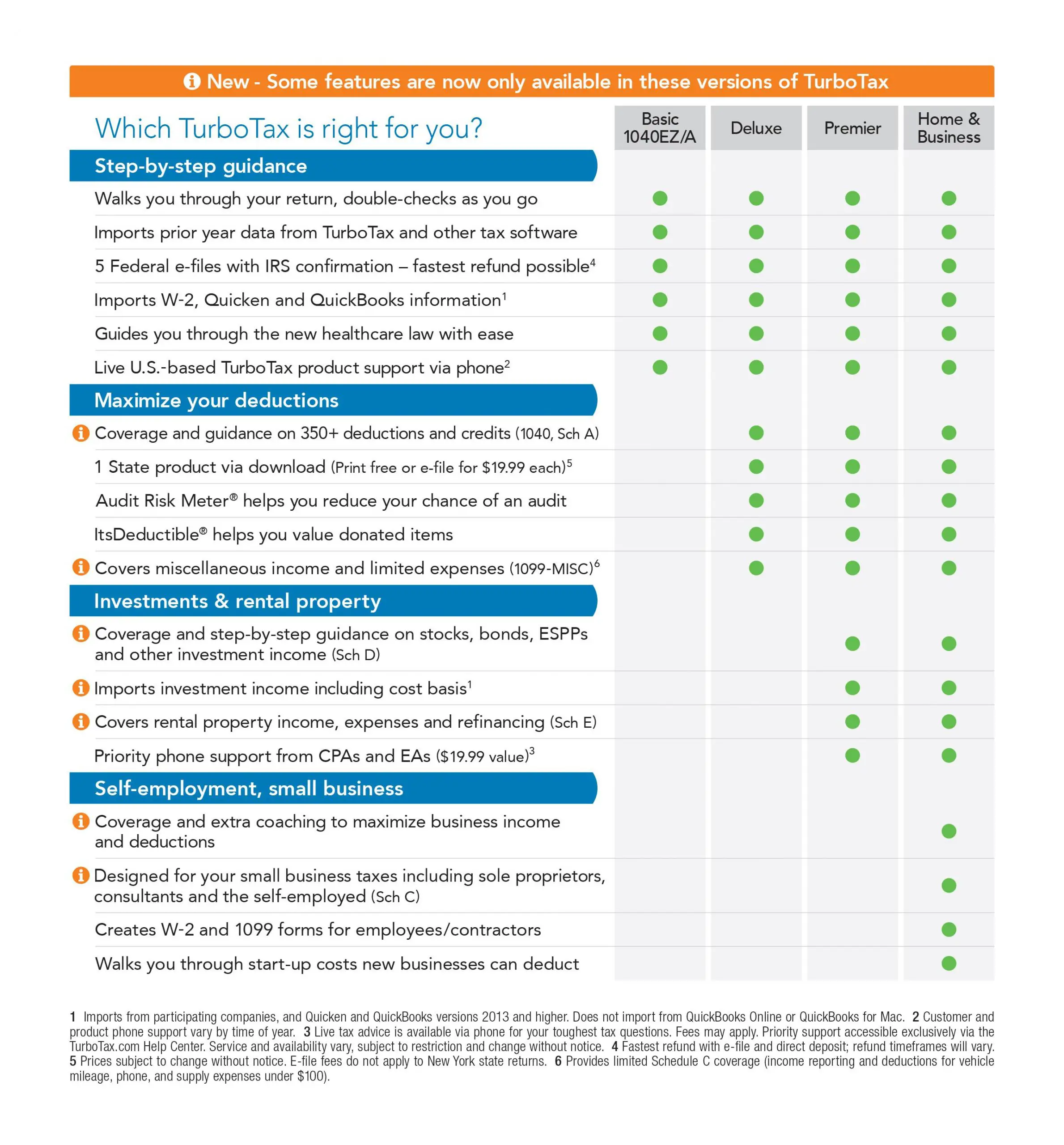

What You Get From Turbotax’s Free Version

TurboTax offers a free version for simple tax returns only it lets you file a Form 1040, claim the earned income tax credit, reconcile your advanced child tax credits and deduct student loan interest. Unlike last year, the free version no longer handles unemployment income reported on a 1099-G.

The free package also cant handle itemized deductions or schedules 1, 2 or 3 of Form 1040, which means it probably wont work for you if you plan to do things such as deduct mortgage interest, report business or freelance income, or report stock sales or income from a rental property.

File Your Return With The Right Tax Agency

After you review your sales tax, you can e-file your return on your tax agencys website, or file by mail.

Most states encourage businesses to e-file. But if you cant file online, you can check your tax agencys website for more info on how to mail your return. While you cant e-file right in QuickBooks, you can manually enter your tax payment in QuickBooks right after you file to keep your sales tax info up to date.

You may choose to prepay your sales tax. A sales tax prepayment is like a deposit paid ahead of time to cover future sales tax liability before the due date. Prepayment requirements, calculations, due dates, and thresholds vary for each state.

To find out how your state handles sales tax prepayments, visit the IRS State Government Websites page.

Dont Miss: When Is The Deadline Of Filing Income Tax

Recommended Reading: How Early Can You File Your Taxes 2021

What Business Deductions Can I Claim As A Freelancer

If you’re self-employed or a gig worker, you’re allowed to deduct “both ordinary and necessary” expenses related to your work, per the IRS. An ordinary expense is one that’s familiar to anyone in your industry and claimed by other self-employed tax filers. A necessary expense is one that’s absolutely required in order for you to work.

Depending on the specifics of your work, you can deduct all sorts of expenses. Office supplies, travel costs, software, internet service fees, vehicle expenses, insurance costs, advertising and legal services are some of the most common business expenses for the self-employed.

Accurately organizing and reporting your business expenses is a good way to reduce your overall tax burden and increase the size of your tax refund. Be warned, however, that self-employed business deductions are a red flag for IRS audits — make sure to keep all of your receipts and documentation.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you arent required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Also Check: What Happens If You File Your Taxes One Day Late

Read Also: Where Is My Federal Income Tax Refund

For Brokerage And Managed Accounts

NOTE: All available tax forms for all Brokerage and Managed accounts accessible by chase.com username can be imported.

Turbotax For Previous Years

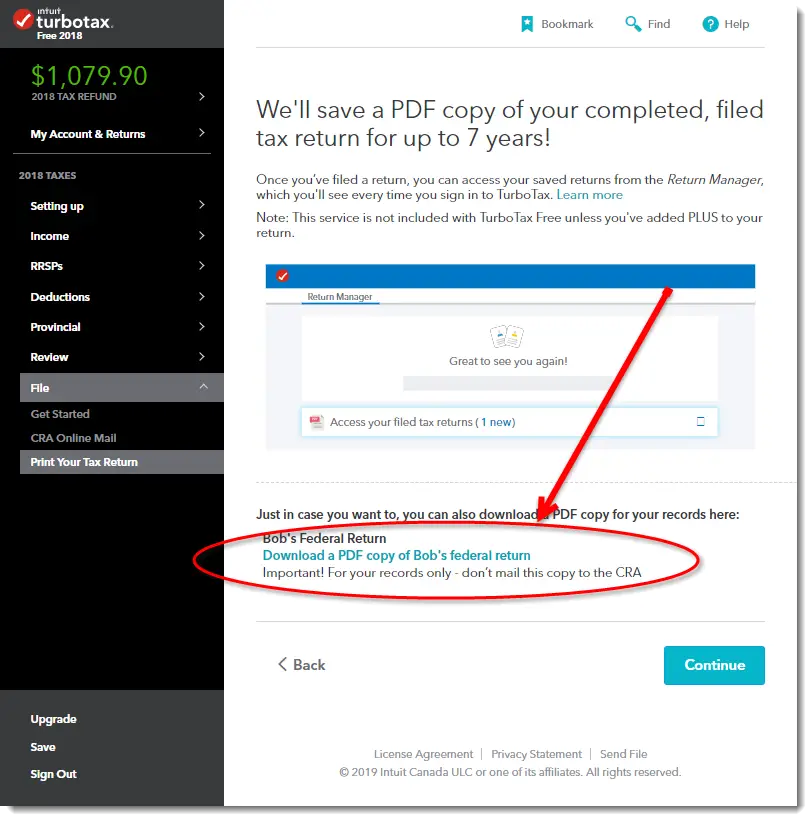

If you filed tax returns with Turbotax, those returns are stored in your account. You must use the same account that you used during the filing process, according to the Turbotax community. Its not uncommon to create a new account in the new tax year, and this practice separates your returns across multiple accounts. Search through your email to find your Turbotax account setup and reset your password if necessary to log in.

Once you access the account used to file previous returns, Turbotax recommends selecting the Documents option on the left menu. The selection is located immediately below the Tax Home label. Next, access the drop-down menu to select the desired tax year for the return you want to retrieve. This menu only shows the years you filed returns through Turbotax.

At this point, you can open the file to view it in PDF form, or you can download or print it directly from the screen.

Don’t Miss: Do You Have To File Taxes If Your On Ssdi

What Is The Standard Deduction For Married Filing Jointly

The standard deduction is $25,900. Thats up $1,900 from last year. If you and your spouse are both 65 or older, or if youre blind, you get an additional $1,300 deduction. So, your total deduction would be $27,200

If you are a single filer, the standard deduction is $12,550. Thats up $550 from last year. If youre blind or 65 or older, you also get an additional $1,300 deduction. So your total deduction would be $13,850.

How To File Your Taxes With Turbotax

The IRS offers several options for married taxpayers. The most common is married filing jointly, allowing couples to pool their incomes and claim certain tax benefits.

To file taxes jointly with TurboTax, simply select the Married Filing Jointly option when prompted during the tax-preparation process. You and your spouse will then need to enter your individual information, such as your Social Security numbers, incomes, and deductions.

One advantage of filing your tax return jointly is that you may be able to lower your overall tax rate by combining your incomes and claiming certain deductions.

For example, if one spouse has a higher income than the other, they may be able to claim a larger portion of the mortgage interest deduction.

Don’t Miss: How Do Millionaires Avoid Taxes

Can I File My Taxes For Free

Almost all American taxpayers can file their tax returns for free, and some have a choice of several options. If your adjusted gross income is $73,000 or less, you can use the IRS Free File program.

Both Cash App Taxes and FreeTaxUSA will let anyone file a federal tax return for free. Cash App Taxes also offers one free state return, while FreeTaxUSA charges $15.

Other commercial software like TurboTax and H& R Block do offer free versions of their software, but they are limited in scope and service. Most free versions of paid software do not include the forms that self-employed taxpayers need to complete their tax returns. The Federal Trade Commission has recently filed a lawsuit against TurboTax for misrepresenting its free services in its advertising.

How To Check Your Tax Refund Status

Are you the sort of person constantly wonders, How long does it take to get a tax refund? If you want to check the status of your federal tax refund, you can use the Wheres My Refund? on the IRS website. You can also access that tool on the IRS2Go mobile app. Your returns status will usually be available within 24 hours if you file electronically. If you mailed a paper return, it will take at least four weeks before you can check the status of your return.

Youll need three pieces of information to check your returns status:

- Your filing status

- The exact dollar amount of your expected refund

If you filed a return with the EITC or ACTC, the IRS says you can expect your refund status to update by late February.

Also Check: How To Do Your Taxes As An Independent Contractor

Read Also: How Much Taxes Deducted From Paycheck Sc

Import A Pdf For A Prior Year:

If last year you used other tax software, an accountant, or tax service, youll get the option to import a PDF when youre starting in TurboTax. A PDF imports your personal info and your AGI so you can e-file.

Select the method you used to file last year and follow the screens. The PDF needs to be your 1040, 1040A, or 1040EZ, and the program accepts PDFs from a range of providers.

But, if the PDF is password protected or a scan of a hard copy, you wont be able to import. If this happens, dont worry, well guide you through typing in your info.

*Tip: While you can import a 1040EZ return to a paid version of TurboTax, you cant import prior years to their Free Edition , so you may have to pony up for another edition

Import To Tax Preparation Software

With Online Access, you can import information from certain Edward Jones tax forms into TurboTax®, H& R Block At Homeand other tax preparation software programs.

- Use your Online Access login information to import information from your Form 1099-R and Consolidated 1099 Tax Statement .

- Importing your tax information into the software means you won’t have to determine which information needs to be entered.

Important:

You must be a current Edward Jones client who is enrolled in Online Access to import into tax preparation software. If you are not enrolled, you may enroll at www.edwardjones.com/access.

It is important to set closed accounts to be viewable so they are also available for import into the tax preparation software. For instructions, visit .

You May Like: When Are Irs Taxes Due

Where Can I Find My Old Tax Returns

Request a transcript of your old tax returns online. Once you register online with the IRS, you can send in a request for the transcript type that suits your needs. The transcripts are free of charge, so you do not need to include a payment with your request. View the transcript online or receive it by mail.

How can I get a prior year tax return?

Other ways to get a prior year return: Order a free tax return transcript online or by mail from the IRS that has a lot of the information from the return. Pay the IRS $50 for an exact copy of your return.

Dont Miss: Do You Charge Sales Tax On Services

Last Years Tax Info Transferred

Now that youve transferred last years info, you can continue through TurboTax to review and complete your return.

*If you havent yet completed this years tax return with TurboTax, check out our TurboTax coupon page with an exclusive 10-20% discount for all editions of TurboTax including: Basic, Deluxe, Premier, and Self-Employed.

Don’t Miss: How Does Payroll Tax Work

What Does Tax Software Do

Tax software helps you accurately complete your tax return and file it with the IRS in order to receive your potential tax refund or to pay any taxes you owe. The tax code for 2022 includes several changes to deductions and credits. The best tax software will take into account all the tax rules and laws to automatically calculate your tax refund.

Tax software will either file your tax return with the IRS electronically or allow you to print your tax return for mailing. Tax programs also let you enter your direct-deposit information so that the IRS can send money straight to your bank account.

Other Ways To Check Your Tax Refund Status

If you dont have access to the Internet or a computer, you can call the IRS at 800-829-1954 to obtain the status of your refund. You will need the same three pieces of information as those who use the online tool, so be sure you have a copy of your tax return available.

TurboTax also has a Where’s My Refund Tracking step-by-step guide that will show you how to find the status of your IRS or state tax refund. Use TurboTax, IRS, and state resources to track your tax refund, check return status, and learn about common delays.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Don’t Miss: How Much Is Tax In Georgia

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2020 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income. The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS starting mid-February. Tax software companies also are accepting tax filings in advance of the IRS launch date.

Please refer to the E-File Service page for details on the e-filing process.

Also Check: Do Nonprofits Pay Payroll Taxes

How To Filean Amended Tax Return With The Irs

turbotax.intuit.comtaxreturn

Beginning with the 2019 tax year, you can e-file amended tax returns. If you used TurboTax to prepare Form 1040-X, follow the softwares instructions to e-file the

www.PastYearTax.com/_Tax2019Ad

Do Your 2019, 2018, 2017, 2016 Taxes in Mins, Past Tax Free to Try! Easy Fast & Secure

You May Like: How Can I Get Old Tax Returns From Turbotax

Not Free No Help When The Irs Sends A Letter And Still Waiting For Refund Four Months Later

I used the TurboTax app to file my refund in early February. The app was relatively easy to use, but it did get old going in circles sometimes. Unfortunately, the free option really is not usable. If you have to file state taxes like just about everyone, then you will have to pay $40 per state. If youre a college student in another state like me, that means two states so $80. Of course, no student discount. Honestly, that was not too bad since I was supposed to get a lot back.Unfortunately, that was not what happened. I did get some from one the state returns, but that was it. The IRS sent a letter for a health insurance form that didnt even apply to me. If you want help with that, guess what? It will cost you even more money! At that point, I wasnt paying TurboTax any more so I went off on my own. Eventually I got it figured out, but not without massive disruption to my school work. None of that help was thanks to TurboTax which sends you to FAQs that dont really apply.They have online discussions which appear to have many people with the same problem. This program is made to look easy- and it is at first- but the headache it causes later is not worth it. Never had trouble like this with H& R Block so I think Ill go back to them next year. Whatever you do, dont use TurboTax. It is seriously not worth it. Still waiting for that federal tax refund BTW.