Reporting And Depositing Payroll Taxes

Employers can either directly report and deposit payroll taxes with federal, state, and local governments, or they can contract with a payroll company to handle this task.

Generally, filings are handled electronically. The employer designates how much of each tax is to be withheld each pay period by each employee, and those funds are withheld from paychecks and electronically deposited on a periodic basis with the relevant federal, state, and local agencies.

How State Taxes Work

States that levy an income tax may set a flat rate or rates based on the amount of income you earn, as do local governments that levy an income tax. For both local and state income taxes, you generally pay tax on your compensation income based on the state and locality where you work, rather than where you live.

To avoid double taxation, you are generally given a credit for the state and/or local government where you paid the tax so you do not have to pay extra taxes where you live in addition to those you paid in the locality and state where you work.

Preventing And Correcting Payroll Tax Mistakes

According to SMB CEO, payroll taxes can be a potential minefield for small businesses. As the largest source of uncollected payroll taxes, small businesses are also under greater scrutiny from the Internal Revenue Service .

While most agencies, including the IRS, will likely work with a business thats made an honest mistake, if theres a willful pattern of errors or overdue amounts, the response tends to be less generous.

Sometimes a mistake is caused by something in your payroll setup. Learn more here.

Read Also: How To Get Stimulus Check 2021 Without Filing Taxes

What Do Payroll Taxes Include

Payroll taxes are divided into three main streams: Social Security and Medicare, which are mandated under FICA, and federal income.

Social Security contributions are paid into a fund toward senior benefits and disability insurance, while Medicare provides healthcare for the elderly. In addition to withholding taxes from an employee’s paycheck, employers must match Social Security and Medicare contributions and issue other payments like state and federal unemployment taxes or workers’ compensation.

Sonya Muenchen, founder of The Payroll Gal, has been a payroll tax consultant for small businesses for more than 20 years. She said it’s important for business owners to understand exactly what they’re responsible for.

“As an employer, you are responsible for keeping track of time, calculating payroll based on employees’ tax certificates, and depositing a payroll check on a weekly, biweekly, semimonthly or monthly basis,” she said.

According to the Society for Human Resource Management, the taxable wage cap for Social Security is typically raised each year based on increases in the national average wage. In 2021, the maximum earnings subject to the Social Security payroll tax is increasing by $5,100, to a total of $142,800.

Major Payroll Tax Mistakes

Payroll taxes are also called trust fund taxes because the funds are held in trust by the employer until they are passed to the relevant tax authorities. While innocent mistakes can happen, if there are signs of negligence or intent, you could be facing some serious fines and potential legal troubles.

Read Also: How Do I Get My Pin For My Taxes

Federal Tax Deposits Must Be Made Electronically

Federal tax deposits must be made electronically, unless the small business exception applies.

There are four methods that an employer can use to electronically transmit tax payments:

- Use the Treasury Department’s free Electronic Federal Tax Payment System , either online or the voice response system.

- Ask your financial institution to initiate an ACH Credit payment on your behalf.

- Ask a trusted third party, such as a tax professional or payroll service, to make the payment for you.

- In extraordinary circumstances, ask your financial institution to make a same-day tax wire payment for you.

Limited exception to electronic filing requirement. Small businesses with a federal tax liability of less than $2,500 per quarter still have the option of mailing a check with their quarterly returns.

“Business daysâ and âlegal holidays.â What if the date that you’re required to make a federal tax deposit falls on a non-business day? In that case you have until the close of the next business day to make a timely deposit. A business day is any day other than a Saturday, Sunday, or legal holiday. For federal tax purposes, a legal holiday is federal holiday or a legal holiday in the District of Columbia. Other holidays, such as statewide legal holidays, do not delay the due date.

Example

If your deposit’s due date happens to fall on a Friday that is a legal holiday in the District of Columbia, you’ll have until the end of the following Monday to make your deposit.

Warning

Minor Payroll Tax Mistakes

These kinds of mistakes are minor, administrative in nature and dont indicate a willful intent to deceive. In these instances, there may still be red tape to untangle, but the corrections are much easier to make. These mistakes also underscore the care that you should take when setting up your payroll. A few seconds of checking details could prevent hours of backtracking. Minor mistakes include:

- Incorrect or temporary employer identification numbers: This could be a simple typo or transposed number. It could also be that you used a temporary ID number, issued during the application process, in a state that requires a permanent ID number, issued once the application process is complete.

- Incorrect payroll tax payment schedule This can happen if you enter the wrong information during setup or if a tax authority has notified you that youve been assigned a new payment schedule and you havent updated your information in the payroll software.

- Incorrect payment posting Every once and awhile, even the tax agencies make mistakes. If a payment is missing, but you know that youve deposited it, check to see if it might have been posted to the wrong business ID or payment period.

Recommended Reading: Michigan Gov Collectionseservice

How Is Social Security Financed

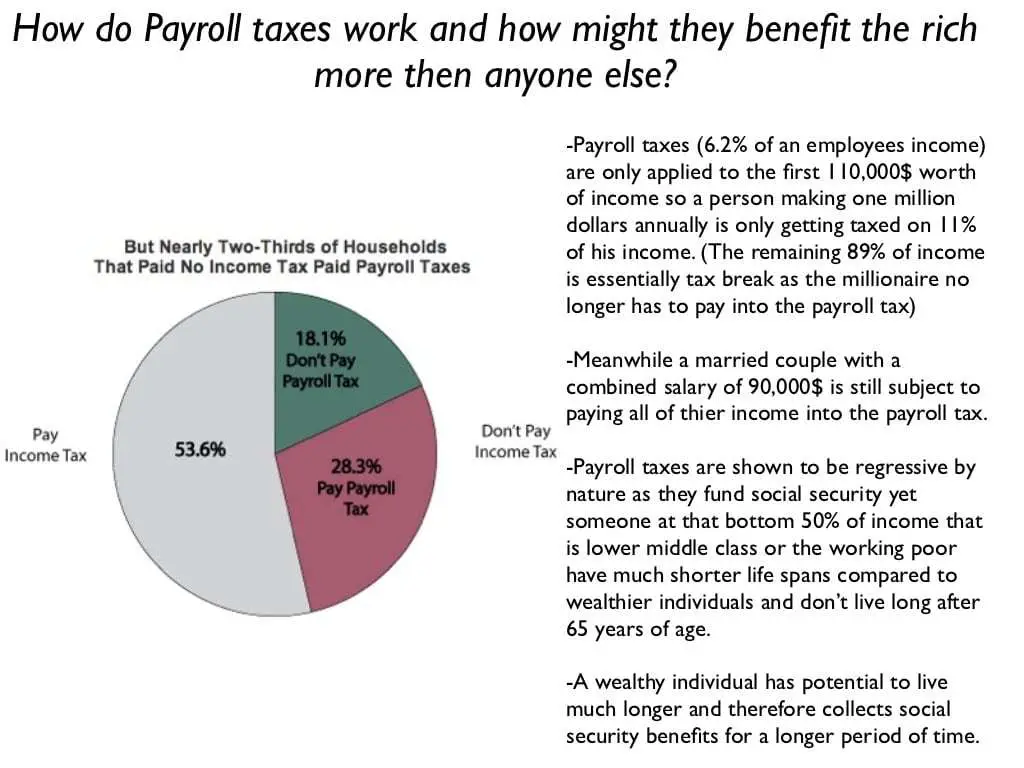

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $142,800 , while the self-employed pay 12.4 percent.

In 2020, $1.001 trillion of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes. The remainder was provided by interest earnings $76 billion and revenue from taxation of OASDI benefits $41 billion .

The payroll tax rates are set by law, and for OASI and DI, apply to earnings up to a certain amount. This amount, called the earnings base, rises as average wages increase.

Tax rates for employees and employers each under current law

| Year |

|---|

What Is Social Security

Social Security is a federally sponsored retirement income and disability income program. Based on how much a person has earned during their lifetime, they receive benefits once they retire.

The earliest permissible age to receive Social Security benefits is currently 62. If beneficiaries wait until age 65, 66 or 67 to receive benefits, their monthly benefit is larger than if they started taking benefits at age 62.

The benefits received do not equal what a beneficiary contributed into the system, as retired workers generally end up getting more in benefits than they contributed.

Medicare taxes pay for the Medicare health care program, which provides health care coverage for all US citizens over the age of 65. Coverage includes hospitalization, care by physicians, and some drug and medical equipment benefits.

Don’t Miss: How To Buy Tax Lien Properties In California

Who Should Use This Guide

This guide is intended for the employer and the payer. It contains tables for federal and provincial tax deductions, CPP contributions and EI premiums. It will help you determine the payroll deductions for your employees or pensioners.

For more information on deducting, remitting, and reporting payroll deductions, see the following employers’ guides:

- T4001, Employers’ Guide Payroll Deductions and Remittances

- T4130, Employers’ Guide Taxable Benefits and Allowances

- RC4110, Employee or Self-employed?

- RC4120, Employers’ Guide Filing the T4 Slip and Summary

- RC4157, Deducting Income Tax on Pension and Other Income, and Filing the T4A Slip and Summary

These guides are available on our website at canada.ca/taxes.

Penalties For Late Employment Tax Payments

| Penalty | |

|---|---|

| 16 or more days but before 10 days from the date of the first IRS notice | |

| 10% | Amounts that should have been deposited, but instead were paid directly to the IRS or paid with your tax return |

| 15% | Amounts still unpaid more than 10 days after the date of the first IRS notice or the day you receive notice and demand for immediate payment |

Recommended Reading: Www.1040paytax.com Official Site

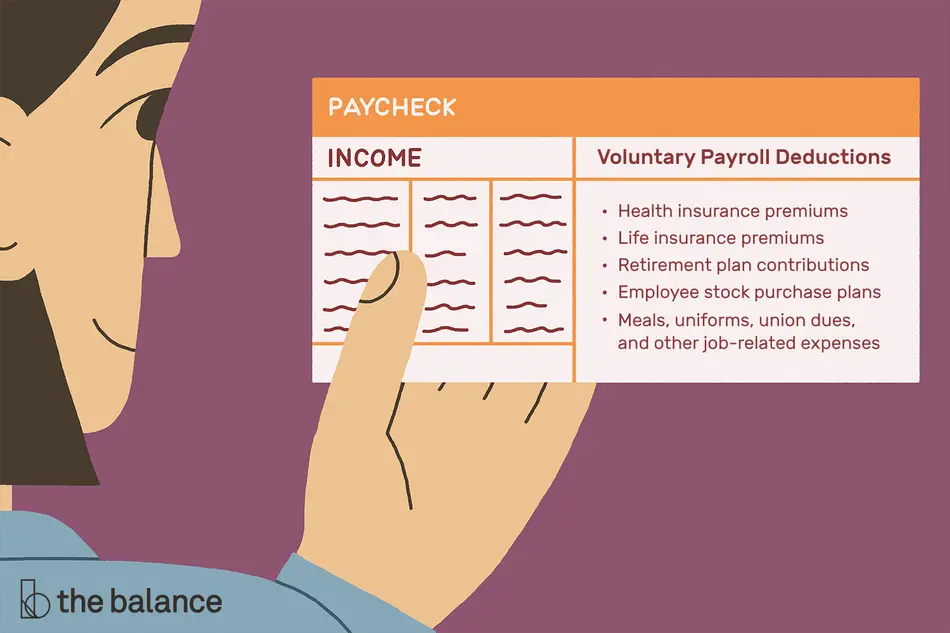

Should All Deductions Reduce Taxable Income

Not all deductions impact taxable income. Only those items specified by the IRS have an impact on taxes. Items such as 401k loan repayments, garnishments, company loan repayments, and union dues wont reduce your taxable wages.

The IRS Publication 15-B Fringe Benefits document includes a detailed chart of how specific fringe benefits are treated for tax purposes:

Now that we understand what makes up federal income taxable wages, we are ready to calculate our federal income tax withholding. We will tackle those withholding calculations in my next blog.Want more payroll content? Check out our other Money Matters blog posts.

Transmit Net Pay To Employees

Now that the gross pay has been calculated and deductions have been processed, youre left with the net pay figure that is, the amount the employee will actually receive.

How you transmit the money depends on your organization’s policy, although most companies these days do it through direct deposit. You may choose to do it via check, although you should be aware of the potential cash-flow complications this can cause for a business when employees wait days, or even weeks to cash it.

Also Check: How Much Does H& r Block Charge To Do Taxes

What Does A Payroll System Do

Setting up a payroll system helps to ensure that payroll gets done accurately and on time. With a system in place, companies can better manage payroll. The last thing you want as an employer is for your team to have problems with their paychecks. Every employee expects to be paid the amount theyre owed on payday. If they receive a late payment or a light paycheck, theyll likely be dissatisfied with management.

So what is a payroll system? As far as what a payroll system looks like, companies have a few different options. Many companies use the following types of payroll systems to manage employee compensation.

If youre not sure which payroll system is suitable for your company, see our article on how to choose a payroll management system.

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

Don’t Miss: How To Buy Tax Forfeited Land

A Payroll Tax Withholding Example

Lets say a business has an employee named Bob who is married, has two children and a spouse who also works. How would his federal tax withholding each pay period be determined if he earns $1,000 per week?

First, see if Bobs wages need to be adjusted. Since he isnt claiming any additional income from investments, dividends or retirement and hes chosen the standard deduction, his wages remain $1000.

Second, look at the weekly pay period bracket table on 15-T. For married filing jointly with the Form W-4 Step 2 checkbox withholding option, the tentative withholding amount is $88.

Third, account for tax credits. Bob has two children, so he may get $4000 in tax credits. Divide this number by 52 since hes paid weekly and subtract the result from $88 . The result is $11.08.

Finally, if Bob requested an additional $1000 withheld from his taxes each year on his Form W-4, divide that number by 52. The result is $19.23, which when added to $11.08, equates to a final withholding amount of $30.31 per pay period.

The Best Payroll Software For Small Businesses

If you dont already have good payroll software in place, its time to go shopping. You need software that can organize your employees and automatically calculate their gross pay, net pay, and deductions all while keeping the paperwork easily accessible.

Weve reviewed a number of payroll software options at The Blueprint, and the following three have earned the highest ratings so far.

Read Also: How Can I Make Payments For My Taxes

Payroll Taxes For Small Businesses Including Cares Act Payroll Tax Breaks And The Payroll Tax Credit

If you are self-employed or an employer, your tax considerations are different from an individual taxpayers. As such, you should read up on small business taxes.

According to the IRS, a qualified small business may elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax credit against the employers share of social security tax.

This payroll tax credit must be elected on an original income tax return that is timely filed . When can you apply for this? The portion of the credit used against the employers share of Social Security tax is permitted in the first quarter beginning after the date the business filed its income tax return.

The election and determination of the credit is calculated and assessed on IRS Form 6765, Credit for Increasing Research Activities. The amount from Form 6765, line 44, must then be reported on Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities. Form 8974 is used to determine the amount of the credit that can be used in the current quarter. For more information on the Payroll Tax Credit, visit IRS.gov/ResearchPayrollTC.

Getting Started With The W

When you begin employment and at certain times thereafter, you fill out a federal Form W-4 withholding form, which is provided by your employer. Prior to the new tax law in 2018, you would also state the number of withholding allowances you wished to claim these were the personal exemptions you took, and they reduced your taxable income.

The new tax law eliminates exemptions, though it also raises the standard deduction. Your employer uses your W-4 form to determine what percentage of federal and state income taxes to withhold from your paycheck.

Also Check: Where’s My Tax Refund Ga

What Year Are The Earnings Taxed

The first step in reviewing our taxes is understanding the period in which they belong. According to the IRS, income is constructively received when an amount is credited to your account or made available to you without restriction. It is not the pay period when the work was done that determines the year, what matters is when the payment is made.

For payroll purposes, this means check date. Lets say youre paid on January 5, 2017, for work performed on December 16 through December 31, 2016. For IRS purposes, youll be taxed using 2017 withholding tables, and that paycheck should be included in your 2017 W-2.

Other State Payroll Tax Rates

Some states like Nevada and New Hampshire have no other employment taxes. However, theyre the exception. Most states have state income taxes, supplemental taxes, or taxes like workers compensation, disability, or local taxes.

Here are the most common state taxes.

State Income Taxes

Most states have an income tax. They tax a portion of an employees income based on withholding tables. Each state sets its own withholding tax rates, such as Arizona, which withholds between 0.08% and 5.1%, depending on the number of deductions an employee is eligible for.

Local Taxes

In states with large urban areas, youll often find local taxes added to your employment tax requirements. For example, San Francisco, Denver, and Newark require employees to pay local income taxes. Other states like Kentucky, Ohio, and Pennsylvania collect local income taxes in many cities.

Supplemental

Some states tax supplemental wages like bonuses, commissions, overtime, and severance pay as examples. Less than half of US states have no supplemental tax while the rest range from 1.84% to 11%except Vermont that charges 30%. For instance, in California, employees are taxed 6.6% for most supplemental pay but are taxed at 10.23% if the supplemental pay is received from a bonus or stock option.

Workers Compensation

For more information on workers compensation and where to purchase it, check out our guide on workers comp.

Disability

Paid Leave

Read Also: How To Buy Tax Lien Properties In California

Federal And State Unemployment

Typically, only employers pay unemployment taxes, but in a few states, employees also contribute. The federal rate ranges from 0.6 to 6% , depending on how much the employer pays in state unemployment tax.

Unlike the flat rate FICA taxes, calculating federal income taxes is a little more complex. To determine what to withhold for an employee who earns up to $100,00 per year and has completed the revised 2020 Form W-4, employers may use the IRS wage bracket method as follows: