Why You Should Check Your Social Security Statement

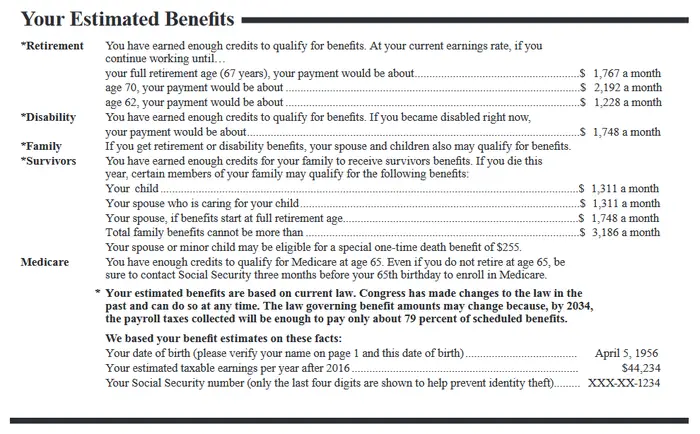

In order to accurately assess how much income youll need in retirement, and therefore how big of a retirement portfolio youll need to produce that income, you have to consider retirement income from non-investment sources. This includes pensions, income generated by non-retirement assets, and Social Security benefits.

For example, if you expect to need $5,000 per month in retirement, but you will receive $2,000 per month in Social Security benefits, then your retirement portfolio will only need to generate $3,000 per month.

Knowing your Social Security benefit is also important because most;workers today arent covered by a defined benefit pension plan. Those were the employer-only funded plans that many of todays retirees enjoy. But most workers today will be dependent on a combination of Social Security benefits and the income generated by a generously funded retirement portfolio.

Apart from retirement, its also important to know how much you can expect to receive if you needed to file for disability. This is an often under-appreciated benefit of Social Security, but an extremely important one for everyone who relies primarily on earned income to provide for themselves and their families.

When Social Security Is Not Taxable

You won’t owe federal tax on your Social Security benefits if your total income falls below the taxable thresholds set by the IRS.

You won’t owe state taxes on your benefits if you live in any of the 37 states that don’t tax this income. You can minimize the tax burden by adopting one of the strategies below.

What Is The Tax Rate On Disability Benefits

A lot of people want to know how much Social Security pays, so the next logical question would be how much tax is owed on these payments. The tax rate that you will pay on your benefits depends on your total income for the tax year, not just your disability payments. You must report your net income for the year from your disability payments. This amount is found on your Form SSA-1099 on your Social Security Benefit Statement that you receive from SSA at the end of the year. You must report this income on your Internal Revenue Service Form 1099 along with all other income for the year, including tax-exempt interest and other employment, even self-employment. If one half of your SSDI income plus all your other income is above the base amounts mentioned in the previous section, then a portion of your benefits payments are taxable.

The tax rate that you will pay on the taxable portion of your benefits depends on which tax bracket you land in. The IRS tax brackets for 2021 are as follows:

- 37% for incomes over $523,600

- 35% for incomes over $209,425

- 32% for incomes over $164,925

- 24% for incomes over $86,375

- 22% for incomes over $40,525

- 12% for incomes over $9,950

- 10% for incomes of $9,950 or less

Social Security operates two benefit programs for people with disabilities: Social Security Disability Insurance and Supplemental Security Income .

However, SSDI is potentially taxable using the same set of rules as Social Security retirement, family and survivor benefits.

Recommended Reading: How To Pay My Federal Taxes Online

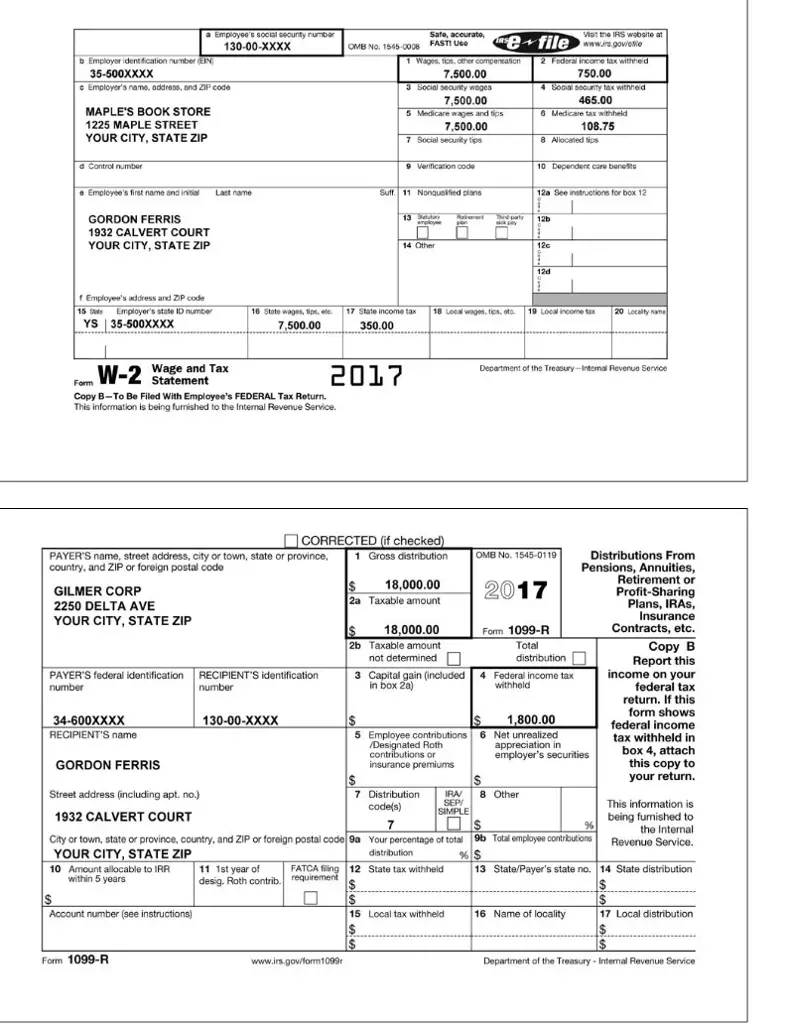

Box : Dependent Care Benefits

These are the contributions to Dependent Care Assistance Program made through payroll deductions.

Contributions to DeCAP are not subject to federal, social security, and Medicare taxes. The amounts in Box 1 for taxable wages and Boxes 3 and 5 for social security and Medicare wages are reduced by the amount of the contribution.

What Is The Ffcra And/or Efmla Reported In Box 14

Under the Families First Coronavirus Response Act , employers are required to provide paid leave for specified reasons related to the Coronavirus Disease 2019 through two separate provisions:; the Emergency Paid Sick Leave Act and the Emergency Family and Medical Leave Expansion Act .; The FFCRAs paid leave provisions are effective April 1, 2020, and apply to leave taken between April 1, 2020, and December 31, 2020.; The Internal Revenue Service issued guidance IRS Notice 2020-54;; to employers on the required reporting of qualified sick leave and family leave wages paid under the FFCRA.; The guidance requires employers to report separately the amount of emergency sick and family leave paid to employees under FFCRA on either 2020 Forms W-2, Box 14, or on a separate statement.; This required reporting provides employees who are also self-employed with amounts they may need to figure their qualified sick leave equivalent or equivalent family leave equivalent credits under FFCRA when they file their taxes.;;;

INFORMATION FOR FFCRA AND/OR EFMLA REPORTED IN BOX 14;;

Included in Box 14, if applicable, are amounts paid as qualified sick leave wages or qualified family leave wages under the Families First Coronavirus Response Act.; Specifically, up to two types of paid qualified sick leave wages or qualified family leave wages are reported in Box 14:;

- Sick leave wages subject to $511 per day limit because of care you required; and;

- Emergency family leave wages.;

You May Like: How Can I Make Payments For My Taxes

Taxes And Supplemental Security Income

You should not ever have to pay taxes on your SSI benefits. These need-based benefits only go to families who have an extremely low income and few assets. If you met the guidelines for someone who had to pay taxes on their disability income, you would not meet the qualifications for this program.

In addition, the Social Security Administration never issues SSI back pay as a lump sum. Instead, it pays it in installments spread several months apart. This can help you avoid having to pay taxes when the Social Security Administration first approves you for disability benefits.

Withdraw Taxable Income Before Retirement

Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits.

You could be in your peak earning years between ages 59½ and retirement. Take a chunk of money out of your retirement account and pay the taxes on it. You can use it later on without pushing up your taxable income.

For example, you could withdraw funds a little earlyor “take distributions,” in tax jargonfrom your tax-sheltered retirement accounts such as IRAs and 401s. You can make distributions penalty-free after age 59½. That means you avoid being dinged for making these withdrawals too early, but you must still pay income tax on the amount you withdraw.

Since the withdrawals are taxable , they must be planned carefully with an eye on the other taxes you will pay that year. The goal is to pay less in tax by making more withdrawals during this pre-Social Security period than you would after you begin to draw benefits. That requires considering the total tax bite from withdrawals, Social Security benefits, and any other sources.

Be mindful, too, that at age 72, you’re required to take minimum distributions from these accounts, so you need to plan for those mandatory withdrawals.

You May Like: How To Track Your Taxes

How To Receive Federal Benefits

To begin receiving your federal benefits, like Social Security or veterans benefits, you must sign up for electronic payments with direct deposit.

If You Have a Bank or Credit Union Account:;

- Call the Go Direct Helpline at .

If You Don’t have a Bank or Credit Union Account:;

- Direct Express debit card;- a pre-paid debit card. Get help by calling the Go Direct Helpline at .;

Make Changes to an Existing Direct Deposit Account:

Learn how to make changes to an existing direct deposit account. You also may contact the federal agency that pays your benefit for help with your enrollment.

Why Are The Wages Reported In Box 1 Federal Wages Different Than Box 16 State Wages

The amount in Box 16 state wages and Box 1 federal wages are usually the same. However, CA wages in Box 16 may differ from Box 1 federal wages for the following reasons:;

- Wages earned in another state.;

- Medical expenses. CA allows an exclusion from gross income for certain employer-provided benefits for a taxpayer’s registered domestic partner and that partner’s dependents.;;

- California does not conform to federal law regarding health savings accounts .;

- CA taxpayers cannot deduct contributions to federal HSA from their California Wages.; It is not excluded as income and is added to the taxpayers CA wages.;

- Ridesharing benefits.;

- Sick pay under FICA.;

- Clergy Housing Exclusion;

- Income exempt by U.S. treaties .;

- California and New York do not conform to the federal suspension of exclusion from income for qualified moving expense reimbursements under the 2017 federal tax law, HR.1, Pub. L. 115-97.; CA and New York allow exclusion from income for qualified moving expense reimbursements.;

Recommended Reading: How To Buy Tax Lien Properties In California

How To Get Your Social Security Statement

The Social Security Administration used to send statements out to all taxpayers on an annual basis. But several years ago they ended that practice, in an effort to save money. However, you can still obtain a copy of your statement online. You can create a;mySocial Security account;on the SSA website.

When you go to the mySocial Security page, set up a username and password. You can use this to access your account at any time. Once youve created your account, youll have regular access to your Social Security statement.

Are Spousal Survivor Disability And Ssi Benefits Taxable

These programs all follow the same general rules as the Social Security program for retirees, with one exception: Supplemental Security Income, or SSI for short, is not a Social Security program. It’s a separate program for people who are needy and disabled people, and payments from it are not taxable.

Recommended Reading: How To File 2 Different State Taxes

Box : Wages Tips Other Compensation

These are your taxable wages during the year. You need it for filing federal and New York State tax returns.

The taxable wages consist of the gross wages and other compensation paid to you during the year, including;the following taxable fringe benefits:

- Union Legal Service Benefit

- Commuter Benefits Administrative Fringe Fee

- Domestic Partner Health Insurance Premiums

- Health and Fitness Reimbursement

- Wellness Program

Your taxable wages are reduced by contributions to deferred compensation and/or tax deferred annuity accounts, pension plan, Commuter Benefits, and other programs that are not subject to federal taxes. These amounts are shown in Boxes 12 and 14.

The above listed taxable fringe benefits are shown in Box 14.

What Is Social Security Disability

The Social Security Disability Insurance program pays benefits to eligible people who have become disabled. To be considered eligible for Social Security disability benefits, you have to be insured, which means you worked long enough and recently enough to accumulate benefits based on your Social Security taxes paid.

You also have to meet the Social Security Administrations definition of disabled. To be considered disabled, it would have to be determined that you can no longer do the kind of work you did before you became disabled and that you wont be able to do any other type of work because of your disability. Your disability must have lasted at least 12 months or be expected to last 12 months.

Social Security disability benefits are different from Supplemental Security Income and Social Security retirement benefits. SSI benefits are paid to people who are aged, blind or disabled and have little to no income. These benefits are designed to help meet basic needs for living expenses. Social Security retirement benefits are paid out based on your past earnings, regardless of disability status.

Supplemental Security Income generally isnt taxed as its a needs-based benefit. The people who receive these benefits typically dont have enough income to require tax reporting. Social Security retirement benefits, on the other hand, can be taxable if youre working part-time or full-time while receiving benefits.

Recommended Reading: Who Can I Call About My Tax Refund

Brief History Of Social Security

The Social Security program was created by the Social Security Act that President Franklin D. Roosevelt signed into law in 1935. The first checks went out in 1940. Originally it paid benefits only to workers 65 and older, but in the 1970s the government altered it to allow workers to claim benefits as early as 62. It also instituted annual cost-of-living adjustments to help Social Security keep pace with inflation.

The program has worked fairly well so far, but many people fear for the future, when there will be fewer workers to support a greater number of Social Security recipients. The latest Social Security Trustees Report indicates the programs trust funds would be depleted by 2035, after which it would be able to pay out only about 76% of benefits to retirees and about 92% to disabled workers.

The government has proposed several possible solutions for ensuring the long-term sustainability of the program, but at present no plans have been set. Theres no risk of the program disappearing in the next decade or two, but its possible future benefits may not go as far as they do today. Thats why todays workers need to prioritize their personal retirement savings, so they can cover most of their expenses on their own.

You might also like

You May Like: Does Short Term Disability Cover Stress Leave

How To Get A Social Security Card

Recommended Reading: How To Pay Taxes For Free

How Can I Get A Social Security Statement That Shows A Record Of My Earnings And An Estimate Of My Future Benefits

You can get your personal Social Security Statement online by using your mySocial Security account. If you dont yet have an account, you can easily create one. Your online Statement gives you secure and convenient access to your earnings records. It also shows estimates for retirement, disability and survivors benefits you and your family may be eligible for. To set up or use your account to get your online Social Security Statement, go to . We also mail paper;Statements;to workers age 60 and older three months before their birthday if they dont receive Social Security benefits and dont yet have a;mySocial Security account. Workers who dont want to wait for their scheduled mailing;can request;their;Social Security Statement;by;following these instructions.;The;Statement;will arrive by mail in four to six weeks.

Important Information:

Disability Income Can Be A Financial Lifesaver If You Suffer From A Debilitating Illness Or Injury But In Some Cases The Irs Might View Your Disability Benefits As Taxable Income

You may hope you never have to receive disability income. But more than one in four people who are age 20 today can expect to lose at least a year of work because of a disabling condition before they reach normal retirement age, according to the Council for Disability Awareness.

If you do need to rely on disability benefits at some point in your life, youll likely wonder: Is disability taxable income? The answer depends on the type of benefits you receive, who paid for them and how they were paid.

Lets break down some of the types of disability income you might receive and how the IRS treats disability payments from different sources.

Dont Miss: How To Get Short Term Disability Approved While Pregnant

Also Check: How To Get Tax Exempt Status

Why Open A Social Security Account

A Social Security account is worth having. It is useful for tracking your Social Security statements and payments.

You can also see your earnings history and estimated future benefits, and order a new Social Security card, from your account.

Additionally, registering for your account can thwart identity thieves, as we detail in 3 Free Ways to Protect Your Social Security Number.

Disclosure: The information you read here is always objective. However, we sometimes receive compensation when you click links within our stories.

Check The Social Security Administration’s Math

Your statement includes a record of the earnings on which you’ve paid taxes and an estimate of the benefits you will receive at various retirement ages: 62, 67, and 70. It is always wise for you to check the SSA’s numbers. Don’t be surprised if you uncover an error. Some government-watchers estimate that the SSA makes mistakes on at least 3% of the total official earnings records it keeps.

When you check your record, make sure that the Social Security number noted on your earnings statement is your own, and make sure the earned income amounts listed on the agency’s records mesh with your own records of earnings as listed on your income tax forms or pay stubs.

Recommended Reading: How To Calculate Quarterly Taxes

Find Out Your Estimated Social Security Benefits

Periodically checking your estimated Social Security benefits serves several purposes: It helps you plan for retirement and allows you to check for and correct errors.

The Social Security Administration keeps a database of your earnings record and work credits, tracking both through your Social Security number. You can see this information on your Social Security Statement, which is available to everyone age 25 and over. The Social Security Statement also gives you an estimate of the benefits you’ll receive at retirement age, which can play an important role in your financial planning.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How Long Is Short Term Disability Insurance

Recommended Reading: How To Review My Tax Return Online