Loss Of Entitlement To The Credit

You are not entitled to receive the solidarity tax credit for a given month if, immediately before the first day of the month, you are no longer resident in Québec or are confined to a prison or similar institution. If such a situation arises after you claim the credit, .

In the case of a deceased person, we will stop paying the credit in;the month;following;the death. However, if your spouse received the credit for your couple and dies, you do not have to claim the credit for the current payment period. If you meet the eligibility requirements, we will pay you the remaining amounts once we have been notified of the death.

If your spouse received the credit for your couple and he;or;she is confined to a prison or similar institution, you can receive the credit instead, provided you meet the conditions and;claim;it.

For more information, contact us.

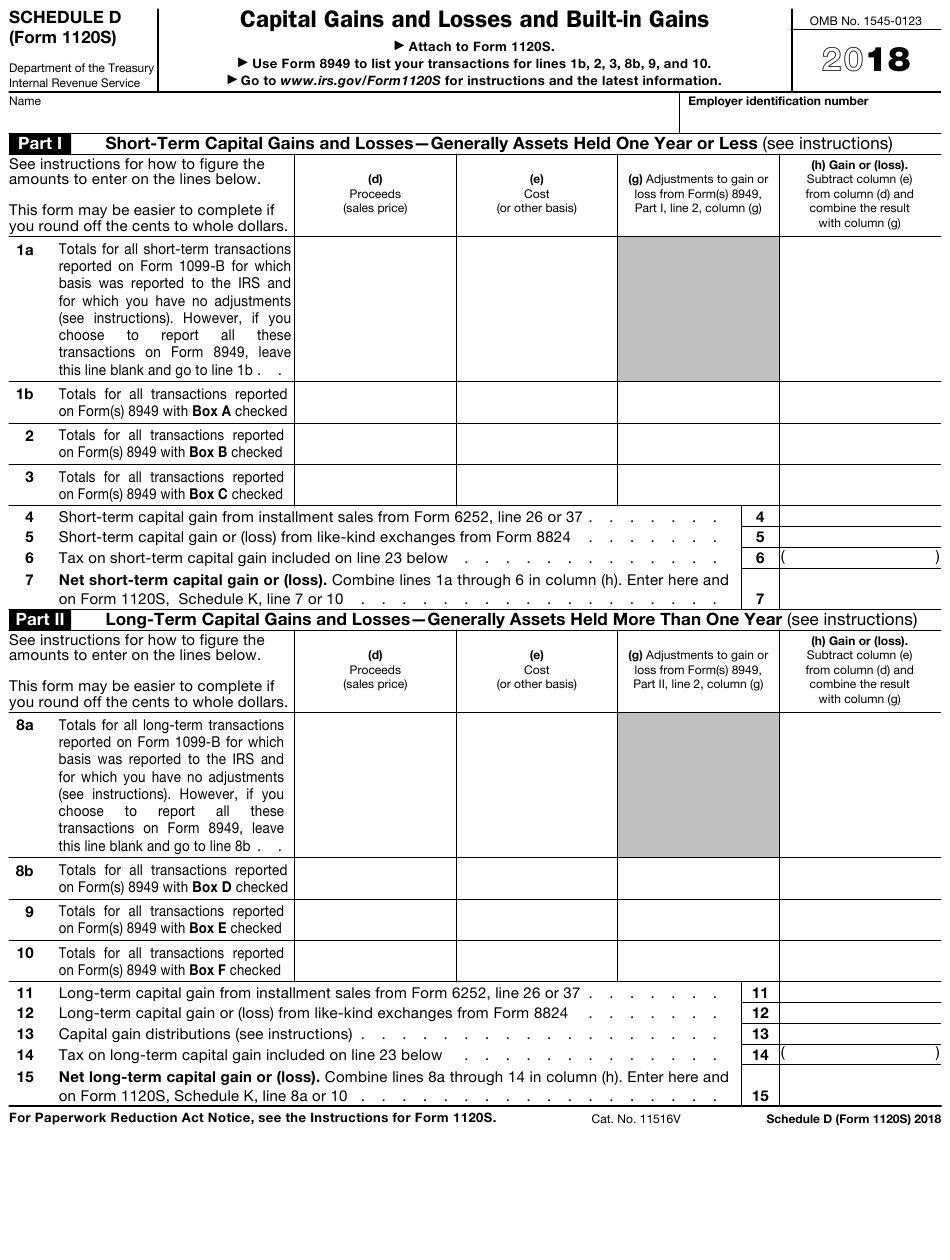

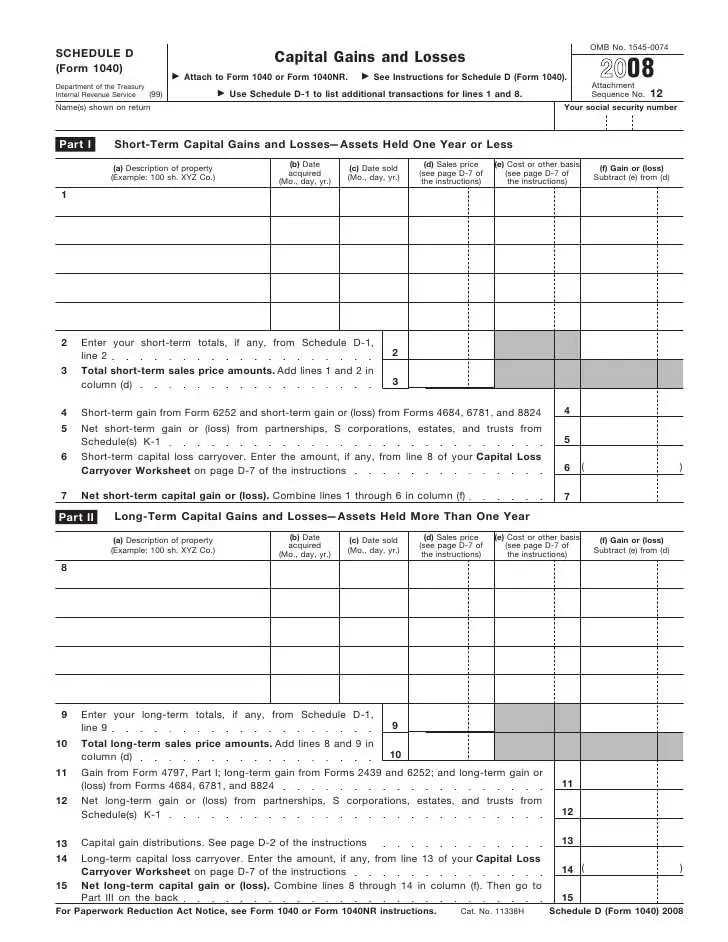

Basic Layout Of Irs Form 8949

The 1040 Form 8949 is laid out in two parts:

- Part I – Short-Term Capital Gains and Losses – Assets Held One Year or Less

- Part II – Long-Term Capital Gains and Losses – Assets Held More Than One Year

The holding period of the trade is what determines whether it is long or short term. Anything held one year or less is considered short term, and anything held for more than one year is considered long term. Special wash sale rules can also change a short term holding to a long term holding period.

Each part of the form is almost identical when it comes to listing your trade activity for the tax year being filed. There are eight columns in each part as shown below:

Each part of IRS Form 8949 has three categories, indicated by the check box at the beginning of each section: , , and for the long-term transactions in Part II.)

Because you may have transactions that fall into more than one of the above categories, for either part of the form, it is possible that you will have multiple Forms 8949 to file with your Schedule D. The topic below, Understanding Form 8949 Categories, discusses the factors in determining which trades are reported in each category.

Who Uses Irs Form 8949

Anyone who has received one or more Forms 1099-B, Proceeds From Broker and Barter Exchange Transactions; Forms 1099-S, Proceeds From Real Estate Transactions; and/or IRS-allowed substitutes for those forms should file a Form 8949. Those Forms 1099 or substitutes would also have been sent to the IRS.

You should look carefully at the Forms 1099 you’ve received from your broker. If the cost or other basis for all of your transactions was reported to the IRS and you don’t need to make any adjustments, you may not need to file Form 8949.

Complete information on the two exceptions that enable you to forgo filling out Form 8949 is available on pages three and four of the IRS’s Instructions for Form 8949.

Your Forms 1099 should give you information on whether you should check Box A, B, or C for short-term transactions or Box D, E, or F for long-term transactions , all for a given transaction or set of transactions. Youll have to determine from your own records whether the transaction was short term or long term if Box 2 of Form 1099 is blank, however, and if code X is in the “Applicable checkbox on Form 8949” box.

Exclude the date you entered into the transaction, but include the date you exited the transaction, when youre determining your holding period.

Also Check: Who Can I Call About My Tax Refund

How To Complete A Schedule D Form

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 45,729 times.

Internal Revenue Service Form 8949 and Schedule D are the Capital Gains and Losses section of the Form 1040. Schedule D is used to calculate and report the sale or exchange of a capital asset. To start, you will need to fill out Form 8949. This form allows you to total your gains and losses for various investments and assets obtained during the year. On your Schedule D form, you will use these values to figure out if you had a net loss/gain for the year in terms of short and long term investments.

Deadline For Claiming The Tax Credit

To receive the full amount of the solidarity tax credit you are entitled to for a given period, you;must claim it no later than four years after the end of the taxation year used to calculate the credit for the period in question. Since the tax credit for the period from July 2021 to June 2022 is based on the 2020 taxation year, you must claim it by December 31, 2024. If you are not registered for direct deposit, you must include the registration form when you claim the credit.

Read Also: What Is Tax Liabilities On W2

Statutory Merger Vs Consolidation

A statutory merger, or merger for which a business owner would need to complete a Schedule D form, differs from a standard consolidation. In a traditional consolidation, one company buys up and overtakes a second. In a statutory merger, however, the companies join together with neither taking control of the other. When companies complete a statutory merger, the power over the new resulting company is divided between all of the stakeholders who oversaw the previous companies. For example, if two companies, each headed by two individuals, go through a statutory merger, the control of the resulting company will be divided between the four heads of the previous companies.

Understanding Schedule D: Capital Gains And Losses

Investments or assets that are sold must be recorded for tax purposes. This includes realized capital losses, which can be deducted from your income tax bill if the shares sold were owned for investment purposes. Capital gains or losses are broken down into either short-term capital gains/losses or long-term capital gains/losses . Long-term capital gains tax is often more favorable than short-term gains that are taxed as ordinary income.

All prior versions of Schedule D are available on the IRS website.

Schedule D has instructions that help you collect information about the current year capital asset sales and prior year capital loss carry-forwards.;Depending on your tax situation, Schedule D may instruct you to prepare and bring over information from other tax forms.

- Form 8949 if you sell investments or your home

- Form 4797 if you sell a business property

- Form 6252 if you have installment sale income

- Form 4684 if you have a casualty or theft loss

- Form 8824 if you made a like-kind exchange

Ultimately, the capital gain or loss you compute on Schedule D is combined with your other income and loss to figure your tax on Form 1040. Schedule D and Form 8949 are included with Form 1040 when you file your federal tax return.

Also Check: How To Correct State Tax Return

Tax Season : Irs Form 1040 Changes Include Where You Report Capital Gains

Before you start your federal tax return, know the changes in key IRS forms that affect you

getty

Tax Season 2021 has begun. When you dig into your tax return for reporting 2020 income, youll notice that Form 1040 has changed yet again. In 2018, the IRS condensed Form 1040 significantly, completely revamping the prior traditional version, and introduced additional schedules that funnel information to Form 1040. While the IRS did not modify the 2020 Form 1040 as drastically, there are differences from last years form that you need to know about.

Below I explain key tax-return topics that can apply to executives and employees who have income from stock compensationsuch as stock options, restricted stock units, or an employee stock purchase plan or who have gains from sales of company stock.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How To Get Tax Exempt Status

Filing A Schedule D With Your Form 1040

Gains and certain losses resulting from the sale of capital assets, as well as certain other items, are reported on Form 1040 Schedule D. It is generally used to report:

- The sale or exchange of a capital asset not reported on another form or schedule

- Gains from involuntary conversions of capital assets not held for business or profit

- Capital gain distributions not reported on Form 1040 itself

- Effectively connected distributions not reported on Form 1040NR

- Nonbusiness bad debts

Most assets that a taxpayer owns and uses for personal purposes or investment are capital assets. Houses, furniture, cars, stocks, and bonds are generally capital assets. When selling these at a profit, except when exempt , a taxpayer is responsible for the capital gains tax.

A capital loss may be used to offset a gain in another other sale. When losses exceed gains in a calendar year they are deductible up to $3,000 . Excess capital losses may be carried over to future years.

The following are not capital assets:

Irs Schedule D Tax Worksheet

Schedule D is divided into three parts:

You May Like: Do You Have To Claim Social Security On Taxes

Who Must File Form 1040 Schedule D

- Short-term gain or loss on stocks, bonds, ETF, etc.

- Long-term gain or loss on stocks, bonds, ETF, etc.

- Gain or loss from a partnership, S corporation, estate or trust.

- Like-kind exchanges of real or personal property.

- Gain or loss from casualty or theft or property.

- Capital gain distributions not reported directly on Form 1040.

- Capital loss carryover from a prior year.

What Is Tax Form 1040 Schedule D

Modified date: Jan. 26, 2020

Editor’s note –

If youre a homeowner who might soon sell a home or an investor with money in stocks, bonds, or real estate, youll need to be familiar with tax form Schedule D.

Tax form 1040 Schedule D is used to report capital gains for the purpose of income tax. A capital gain is any profit made from the sale of an investment for more than the purchase price.

Deal of the Day

So, if you purchase a home or investment property for $250,000 and sell it for $300,000, you have a capital gain of $50,000.

For tax purposes, the purchase price of your main home includes a number of things, including upkeep costs, purchase costs, and sale costs, minus accumulated depreciation.

You can also exclude up to $250,000 of profit if youve lived in the home for 2 or more years. If youre selling a home at a gain,;you almost certainly need to meet with a tax adviser to get advice on how to reduce your liability.

Schedule D isnt just used to report capital gains when you sell a home. Its also used to report:

- The sale or exchange of a capital asset not reported on another form or schedule

- Gains from involuntary conversions of capital assets not held for business or profit

- Capital gain distributions not reported directly on Form 1040, line 13

- Non-business bad debts

Read Also: How To Pay Back Taxes Online

Who Needs To File Schedule D: Capital Gains And Losses

In general, taxpayers who have short-term capital gains, short-term capital losses, long-term capital gains, or long-term capital losses must report this information on;Schedule D, an IRS form that accompanies form 1040. Schedule D is not just for reporting capital gains and losses from investments.

Schedule D is also used to report capital gains or losses from ownership in a partnership, S corporation, estate, or trust. Also, taxpayers who have capital loss carryovers from previous years use Schedule D to report this information. Using tax software can make it easy to figure out whether Schedule D is required and to complete it if so.

Notably, the IRS distinguishes between short-term capital gains or losses as those held less than one year, and long-term capital gains or losses as those held longer than one year. Only short-term losses can be used to offset short-term gains, and long-term losses for long-term gains. Losses that are recorded that exceed any gains may be eligible to be carried forward and applied to the next year’s taxes.

The Schedule D And Form 8949 Are Often Considered To Be The Most Complex Of All Irs Tax Forms

Most active traders and investors who are reporting capital gains and losses must file these forms every year.

With so many different things to comprehend, such as how to calculate cost basis and adjust for wash sales, how to correctly report short sales, and understanding the various form categories and layout, it’s no wonder that these forms maintain their ominous reputation. Therefore, we have compiled this resource guide to be your companion in completing these necessary, but difficult, set of documents.

TradeLog Software has produces accurate Schedule D / Form 8949 reporting for traders.

- Single-stock futures

- Exchange traded funds / notes

Some securities are classified as Section 1256 contracts, and are therefore not to be reported on Schedule D. These securities are reported on IRS Form 6781 with totals flowing onto IRS Schedule D.

These securities are reported on Form 6781:

Those who have elected IRS Section 475f trader status and use the method will record their trade activity on IRS Form 4797 – Sales of Business Property. However, many of the complexities of filing a Schedule D also apply to Form 4797.

The Schedule D is used with most tax returns – 1040, 1041, 1065, 1120 etc. Since most active traders and investors are filing 1040 Schedule D for individual income tax, our guide is primarily based on that forms layout and instructions. The other versions of Schedule D are typically identical or very similar.

Don’t Miss: What Is California State Tax Rate

Planning For Capital Gains

Now that weve discussed the Schedule D, its a good time to briefly discuss planning your investment sales around capital gains and losses. Lets say, for example, that you need $20,000, and need to sell that much in investment assets.

Well say that your stock in Widgets R Us has appreciated to $25,000 from an initial investment of $20,000, and your investment in Kingpin Bowling Supplies has dropped to $15,000 from an initial investment of $20,000. A sale of $12,500 in Widgets stock and $7,500 in Kingpin stock would end up with a total gain of zero.

Now, understand that you should closely consider these decisions and discuss them with your broker. You need to take taxes into account, but letting them completely dictate your investing decisions can be a recipe for disaster. And you should never sell stock in a company you still believe is well-poised for growth and return.

But, if you find yourself convinced that a stock youre holding is a lemon and youre looking for a good time to sell, you may be able to use that sale to offset a capital gain.

Should you need help filing your taxes this year, you may want to consider both;Turbo Tax and;H&R Block.; Their free online;tax software;can make your tax nightmares disappear.

Proof Of Eligibility For The Housing Component

To receive the housing component, you must be able to prove that you or your spouse was the owner, tenant or subtenant of an eligible dwelling on December 31, 2020. If either of you was the owner, you must enter, in Schedule D, the roll number or cadastral designation shown on your municipal tax bill. If you or your spouse was a tenant or subtenant, you must enter, in Schedule D, the dwelling number shown in box;A of the RL-31 slip issued by the landlord of the building in which your dwelling was located. If you have not received an RL-31 slipby mid-March 2021, contact your landlord. If you are still unable to get the slip,;contact us.

Don’t Miss: When Is Sales Tax Due