How Do You Find The Sales Tax Rate In Math

To find the amount of sales tax, take the difference in the total before and after tax and divide by the price before tax.

If your business has nexus in several locations, you might need to collect and remit sales tax for other states, too. Nexus occurs when your business has a presence in a state. You must collect sales tax if your business has a presence in a state that imposes sales tax. The sales tax is calculated as a percent of the purchase price. The sales tax is determined by computing a percent of the purchase price.

- In order to receive updates on the correct sales tax percentages, file to do business with the various governments in whose jurisdictions the company has nexus.

- You can find your sales tax rate with a sales tax calculator or by contacting your state taxing authority.

- Remember that whatever the application, once we write the sentence with the given information , we can translate it to a percent equation and then solve it.

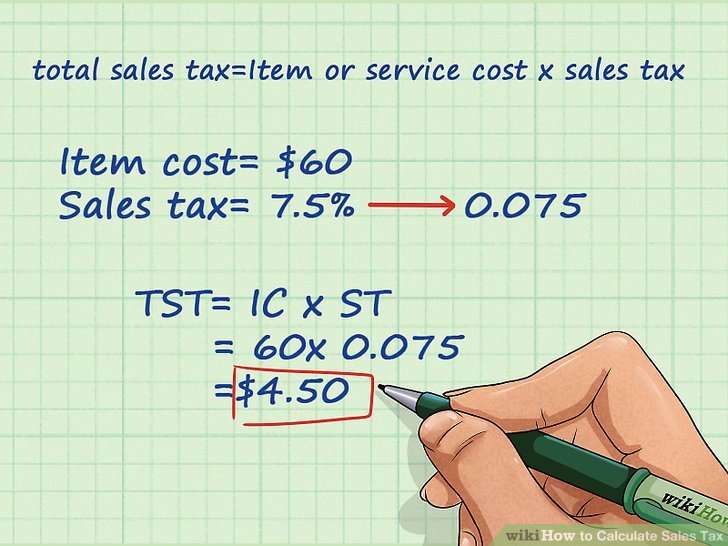

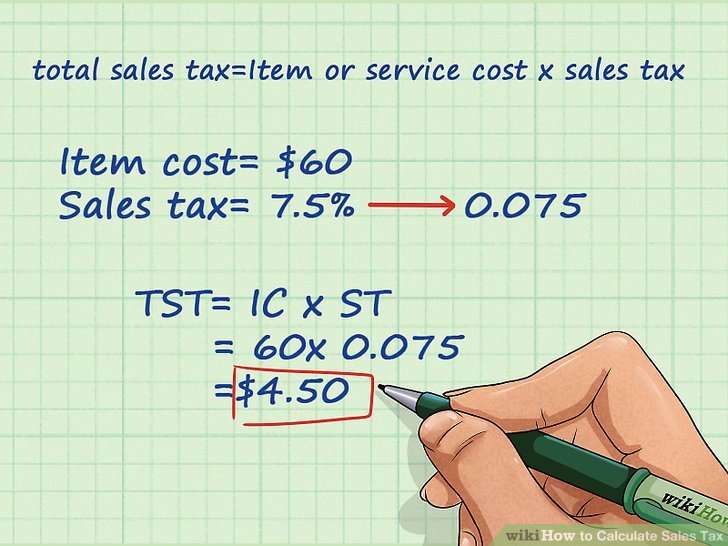

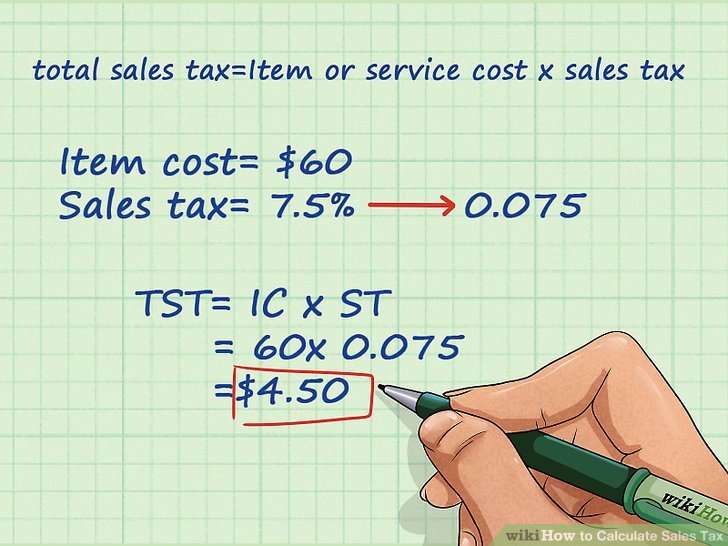

- In order to calculate the sales tax of an item, we need to first multiply the pre-tax cost of the item by the sales tax percentage after it has been converted into a decimal.

- Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax.

- Keeping an insight and know-how regarding the sales track may facilitate retailers and buyers to check on the standard sales tax or value-added tax.

What Are Sales Tax Holidays

Sales tax holidays are short-term periods in which consumers are exempt from paying sales taxes. These holidays usually exist to provide additional savings that encourage consumers to make purchases for back-to-school shopping or hurricane preparedness during a specific time. The length of a sales tax holiday also varies, but it is often a day, weekend or one week.

Not every state has a sales tax holiday. States that have a sales tax holiday usually identify specific items and a maximum sales price for each item that qualifies for the sales tax exemption.

Sales Tax Percentage Calculator

This converter requires the use of Javascript enabled and capable browsers. This script calculates the sales tax percentage of a given purchase amount and a given sales tax amount. It then displays the sales tax percentage and the total sales price, including tax. You may change the default values if you desire. Enter the total amount that you wish to have calculated as the sales amount, in dollars and cents. In our example, that is $50.00 as the sales price. Then, enter in dollars and cents, the sales tax amount. In our example, that is $2.00 for the tax amount. For instance, if a shopping cart does a sales tax calculation for you based on your city, state and zip code, enter the tax amount that it displays. That entry might be something like $2.50 or something similar with dollars and cents. Then click on Calculate and the result should be YOUR local sales tax percentage and the total of the sales price and the sales tax amount. An example of the sales tax percentage might be something like this… If your sales tax has been designated as as 7.75% , it can be written as .0775 we would show it as 7.75 in the Sales Tax Percentage field. If you need to calculate the sales tax amount and you know the sales amount and the sales tax rate or percentage, use our Sales Tax Calculator And De-Calculator. You can use the same page to calculate the appropriate sales tax in a transaction that includes tax. CALCULATE SALES TAX PERCENTAGE

You May Like: How Do I Protest My Property Taxes In Harris County

How Do You Calculate Total Income

The formula for calculating net income is:

How To Calculate Sales Tax: Formula To Use With An Example

Sales tax has an important role in many business transactions. Consumers pay a sales tax when they purchase a product, but it’s up to the business to give this money to the government. Therefore, it’s important for both businesses and consumers to know the sales tax formula and how sales tax works. In this guide, we discuss what sales tax is and how you can calculate it for yourself.

Read Also: Efstatus Taxact Online

How Do You Find The Original Number From A Percentage

Step 1) Get the percentage of the original number. If the percentage is an increase then add it to 100, if it is a decrease then subtract it from 100. Step 2) Divide the percentage by 100 to convert it to a decimal. Step 3) Divide the final number by the decimal to get back to the original number.

And then the city of Atlanta sets an additional sales tax rate of 1.9%. Add those three different taxes up, and you get the Atlanta total sales tax rate of 8.9%. In the U.S., sales tax is a small percentage of a sales transaction.

Keep in mind that sales tax jurisdiction rules can sometimes be too complicated to describe rate areas by zip code, so this calculator is provided for reference purposes only. When you purchase goods, you may wonder how much these items actually cost before the sales tax gets added to them. Either that or you may want to check the accuracy of the sales tax indicated on your items receipt. Fortunately, you can get this amount easily using this reverse sales tax calculator. This is a very useful tool, especially if you itemize deductions and then claim any overpaid sales taxes. Just remember to keep all of your receipts if you plan to claim these overpaid taxes from the items youve purchased. Keep in mind that some purchases may be exempt from sales tax, and others others may be subject to special sales tax rates.

Love Our Calculators Donate To Calculatorpro

The following tables show how the sales tax would be calculated if based on total taxable sales or on each taxable line item. States requiring the use of this tax calculation method include North Carolina, North Dakota, South Carolina, Tennessee, and Vermont. The standard tax rate is applied to the sales amount, the amount being subject to a specific maximum dollar limit.

Recommended Reading: Where’s My Tax Refund Ga

Splost Voting Is Tuesday In Columbus Find Out Where Your Tax Dollars Would Go Wtvm

SPLOST voting is Tuesday in Columbus Find out where your tax dollars would go.

And, most states do not charge sales tax on prescription medicines. Check with your state to learn about sales tax exemptions. Many states provide a day or weekend where consumers can shop without paying sales tax. Generally, your state will designate certain items that are tax free. Do not collect tax on tax-free items during a sales tax holiday. Sales tax is a percentage of a customers total bill.

Calculating Sales Tax At Time Of Purchase:

In order to calculate the sales tax of an item, we need to first multiply the pre-tax cost of the item by the sales tax percentage after it has been converted into a decimal. Once the sales tax has been calculated it needs to be added to the pre-tax value in order to find the total cost of the item. Let’s start by working with an example. If a magazine costs $2.35 and has a 6% sales tax, then what is the total cost of the item. First, we need to convert the sales tax percentage into a decimal by moving the point two spaces to the left.

Now, we need to multiply the pre-tax cost of this item by this value in order to calculate the sales tax cost.

Round to two decimal places since our total is in dollars and cents.

Last, add this value to the pre-tax value of the item to find the total cost.

Read Also: Plasma Donation Taxes

Do You Need To Collect Sales Tax

You must collect sales tax if your business has a presence in a state that imposes sales tax. The majority of states enforce sales tax.

If your business has nexus in several locations, you might need to collect and remit sales tax for other states, too. What is nexus? Nexus occurs when your business has a presence in a state.

You have nexus if you store inventory, have employees, use a third-party provider to ship orders to customers, or attend a trade show in a state with sales tax. Understand origin vs. destination sales tax laws to determine whether you collect sales tax using your primary or secondary states tax rate.

You might not need to collect sales tax on every transaction, or even at all. Here are some instances where you might not need to collect sales tax:

1. You do business in a state that does not impose sales tax. Alaska, Delaware, Montana, New Hampshire, and Oregon do not enforce sales tax. Although there is no state-mandated sales tax in these five states, keep in mind that there might be local sales tax laws that require you to collect.

2. There is a sales tax holiday. Many states provide a day or weekend where consumers can shop without paying sales tax. Generally, your state will designate certain items that are tax free. Do not collect tax on tax-free items during a sales tax holiday.

Find Out How Much Sales Tax Your State Charges

Because sales tax can vary by state and by item, it can be difficult to predict exactly how much you’ll pay, but not nearly as hard to get a general idea.

The Sales Tax Institute keeps an updated list of the range of sales taxes in every US state. While you can go down an online rabbit hole trying to figure out whether you’ll owe 3% or 3.5% sales tax, you might want to just use the high end of the tax range. No one is ever disappointed to pay less than they expected.

It can be much more complicated to calculate sales tax for national retailers that operate across multiple states. Amazon, for instance, clearly lists the factors that go into determining sales tax: It will be the “combined state and local rates of the address where your order is delivered to or fulfilled from.”

However, that statement is followed by a laundry list of exceptions and caveats, like whether the order is delivered to a residential or business address. Amazon does present an estimated tax amount right before you check out, and in that case, you might just want to wait for your estimated tax to be presented to you instead of trying to do the math yourself.

Also Check: Cook County Assessor Deadlines

Use The Sales Tax Deduction Calculator

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A .

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 .

Enter your information for the tax year:

- Filing status

- Sales tax paid on specified large purchases

- Income

W-2, 1099 or other income statements

Receipts for specified large purchases

ZIP code of your address and dates lived

State Business Tax Climate Index

The high diversity of sales tax structures on a state level means that states have difference attractiveness for businesses. There are two key reasons behind it:

- higher rates and more complex taxation system raise the cost of production,

- as a response to higher sales tax rates consumers may reduce consumption or move their shopping to states where the tax burden is low.

An optimal sales tax is one that is applied to a broad base of goods and services with a low tax rate. Such a tax system can minimize the adverse impacts, especially the economic distortion, that occurs when consumers adjust their consumption behavior according to the tax differentials.

The below graph shows the ranking among states according to their State Business Tax Climate Index in 2019 that gives you an overview of how attractive tax systems are over the United States.

Don’t Miss: How To Get Tax Preparer License

How To Calculate Sales Tax: A Simple Guide

Sales tax is a tax consumers pay when buying anything . In the U.S., sales tax is a small percentage of a sales transaction. Sales tax rates are set by states and local areas like counties and cities. Governments use sales tax to pay for budget items like fire stations or street sweeping.

If the products and services you sell are subject to sales tax, then youâre required to:

- Calculate how much sales tax to charge on each transaction

- Collect the sales tax from buyers

- Pass it on to your stateâs taxing authority by filing a sales tax return

Your stateâs taxing authority is generally called the â Department of Revenue,â but it may go by another name.

See For Yourself How Easy Our Accounting Software Is To Use

The use tax applies to the purchase price, which is calculated by using the same basis as sales tax . For example, some states do not enforce sales tax on food products.

In other countries, the listed prices are the final after-tax values, which include the sales tax. The seller is liable for the tax whether it is collected from the customer or not. However, the seller may collect the tax from its customers.

Recommended Reading: Where’s My Tax Refund Ga

Sales Tax By States In 2019

To demonstrate the diversity of sales taxes in the United States, you can find more details about the applied sales taxes in U.S. states in the following table. Besides, you can check when the different states introduced the sales tax and if there is an exemption or reduced rate on sales of food.

| State |

|---|

How Businesses Calculate Sales Tax

The cost a customer pays when purchasing goods or services from a business includes both the company’s sales price and the cost of applicable sales taxes. Businesses and their employees need to know what sales tax is, why they must collect it and how to calculate the correct sales tax amount on each purchase.

Thoroughly understanding this information helps ensure they comply with their state and local sales tax rules and regulations. In this article, we discuss how sales tax is calculated, what it is and answer other frequently asked questions employees have about sales tax.

You May Like: Do You Have To Pay Taxes On Plasma Donations

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

State and Local Sales Tax Rates, Midyear 2021.

If you dont know the rate, download the free lookup tool on this page to find the right combined NYC rate. If you run a retail business with computerized cash registers, theyll be able to break out the total sales tax for you. Otherwise, youll have to go over your books or handwritten receipts and identify which transactions involved sales tax.

Use The Sales Tax Formula To Find The Sales Tax Amount And The Final Sales Amount The Customer Owes

Once you know the combined sales tax rate for the area your business is in and the total taxable sales price for the customer’s purchase, you can calculate the amount of sales tax the customer owes. The sales tax formula is:

x = Sales tax amount

After you find the sales tax amount, add it to the total taxable and non-taxable sales price to calculate the final sales amount. Be sure to add the total non-taxable sales price back in at this point. The final sales amount formula is:

+ + = Final sales amount

The resulting sum is the total amount the customer owes your business for their purchase.

Recommended Reading: How Can I Make Payments For My Taxes

Inari Medical Shareholders Will Want The Roce Trajectory To Continue Nasdaq

Inari Medical Shareholders Will Want The ROCE Trajectory To Continue.

Sometimes, the tip is left in cash on the table. When this happens, you dont have to add it to the price of the meal. However, when using a credit card, you have to add the tip to the total to be sure that the server receives his/her tip. You need to charge sales tax in New York City if you have a sales tax nexus in the state of New York.

Since the end-user of a taxable good or service pays the sales tax, people who purchase goods and intend to resell the product to the end-user are exempt from paying the sales tax. The reseller usually needs a resale certificate that proves their exemption to the businesses they are purchasing the goods from. The reseller then becomes responsible for collecting the sales tax from the end-user with the final sale of the product and passing it on to their state and local government. Sales tax has an important role in many business transactions.

How To Calculate Sales Tax

If your state, county, and city impose a sales tax, you must add all the rates together to get the total rate. For example, you want to find the sales tax rate for Scottsdale, Arizona. Arizona has a state sales tax of 5.6%, Maricopa County has a county sales tax rate of 0.7%, and Scottsdale has a city sales tax rate of 1.75% .

Once you know the sales tax rate you need to collect at, use the sales tax formula to calculate how much to charge the customer.

The amount you collect for sales tax depends on the percentage you collect at and how much your customer spent on products or services. For example, a customer who bought $1,000 worth of products will pay more sales tax than a customer who bought $100 worth of products.

Use the following formula to calculate sales tax:

To determine how much sales tax to charge, multiply your customers total bill by the sales tax rate.

Also Check: How Much Will A Roth Ira Reduce My Taxes