What Is Your Adjusted Gross Income

Adjusted gross income is the number you get after you subtract your adjustments to income from your gross income. The IRS limits some of your personal deductions based on a percentage of your AGI.

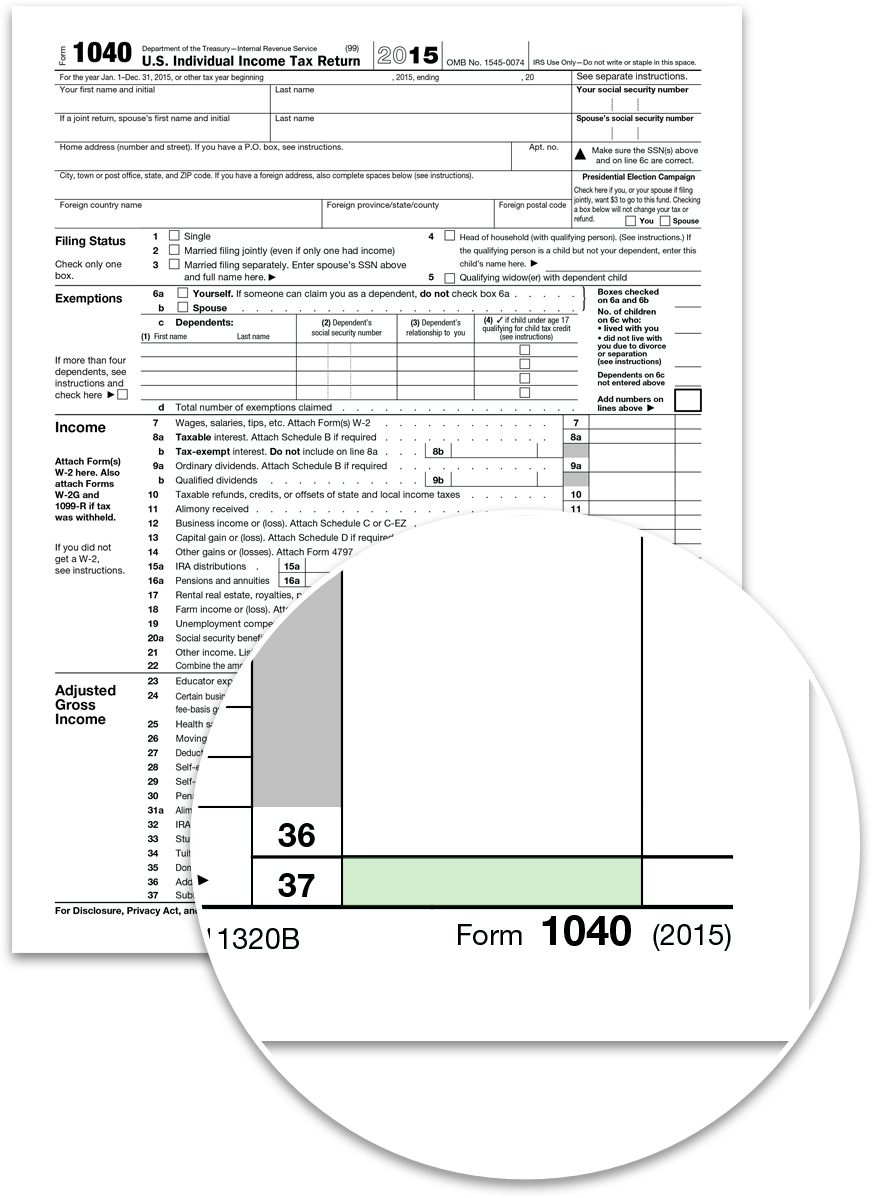

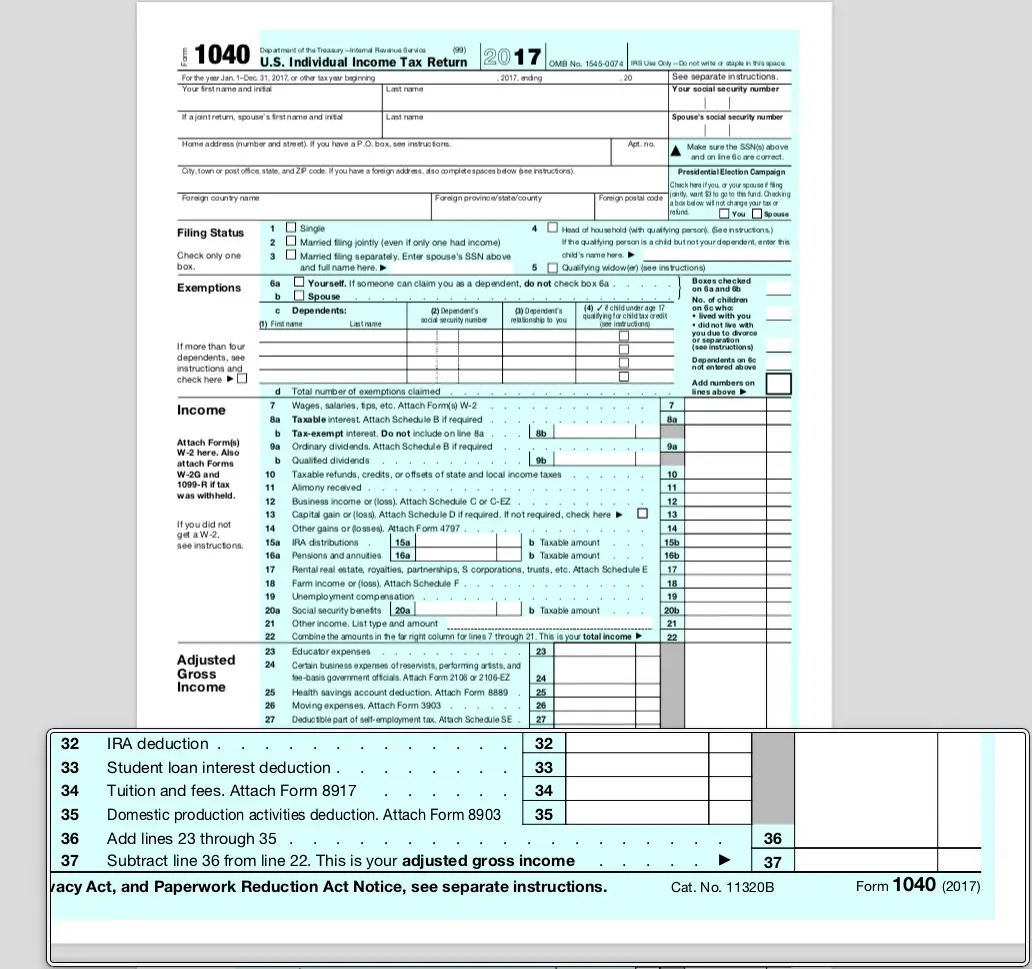

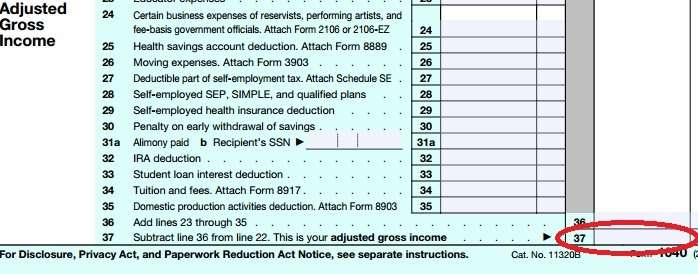

That’s why it’s so important. Your AGI levels can also reduce your personal deductions and exemptions. Many states also base their state income taxes on your federal AGI. The AGI calculation is at the bottom of Form 1040 in line 37.

Where Is The Agi Located On Tax Forms

FormAGIFormAGIFormAGI

Finding Your AGILine 7 on Form 1040 Line 21 on Form 1040A Line 4 on Form 1040EZ Line 35 on Form 1040NR.

Secondly, how do I get my AGI from 2017?

Likewise, people ask, how do I get my AGI from last year?

To retrieve your original AGI from your previous year’s tax return you may do one of the following: Contact the IRS toll free at 1-800-829-1040. Complete Form 4506-T Transcript of Electronic Filing at no cost. Complete Form 4506 Copy of Income tax Return.

How do I find my AGI for 2018?

Here are three ways to locate your 2018 AGI: 1) If you e-filed your 2018 Tax Return on eFile.com, sign into your eFile.com account and download/view your PDF tax return file from the My Account page. Find your prior-year AGI on line 7 of your Form 1040.

How Do I Get My Original Agi If I Cannot Locate My Last Year’s Return

To retrieve your original AGI from your previous year’s tax return you may do one of the following:

- Use;the IRS Get Transcript Online tool to immediately view your Prior Year;AGI.; You must pass the IRS Secure Access identity verification process.; Select the Tax Return Transcript option and use only the “Adjusted Gross Income” line entry.

- Contact the IRS toll free at 1-800-829-1040

- Complete Form 4506-T Transcript of Electronic Filing at no cost

- Complete Form 4506 Copy of Income tax Return

Don’t Miss: How To Calculate Net Income After Taxes

How Your Agi Impacts Your Dependents

With the third stimulus check, your AGI is the main qualification for getting the money or not, due to a change in the rules and formula the IRS uses to calculate your payment total. If your AGI exceeds the limit, you won’t get a check. If it falls under $80,000 for single taxpayers , you’ll receive a full or partial check that includes up to $1,400 per dependent of any age you claim.;

Your AGI is also critical in your eligibility for the child tax credit. As with stimulus checks, your total will become lower on a sliding scale if you make a certain amount of money in 2021.

How Adjusted Gross Income Is Calculated

Adjusted gross income equals gross income minus certain adjustments to income. Gross income includes money from jobs, investments and other sources.

In general, the formula for calculating adjusted gross income is:

|

Start with … your gross income from jobs, investments, Social Security, pensions, businesses, alimony, real estate, farms, and unemployment. |

|

… and then subtract

|

Tax software or your tax preparer will calculate your adjusted gross income as part of the process of preparing your tax return.

Don’t Miss: How To Calculate Quarterly Taxes

If The Internal Revenue Service Changed My Adjusted Gross Income And/or Exemptions On My Federal Return Am I Required To File An Amended Michigan Return

Yes. If a change on your federal return affects the;AGI and/or exemptions;reported on your Michigan return, you must file an amended Michigan return within 16 weeks of the change. Include a copy of your amended federal return with all applicable schedules and supporting documents.Submit payment of any tax and interest due.

Examples of supporting documents include but are not limited to:

-

The Michigan Amended Return Explanation of Changes for tax years 2017 and forward

-

Michigan Schedules and Forms

-

Federal amended return and schedules

-

Copies of the Internal Revenue Service audit report, notice, federal transcripts or other supporting documents

-

Property tax statements/lease agreements

-

Copy of original or corrected W-2, 1099, and/or U.S. Schedule K-1

- Copy of other state return

I Can’t Find My Tax Return

If you can’t find your tax return, you can use the IRS’s Get Transcript website.

You can request it online, for which you’ll need a whole series of personal information from your latest tax return including social security number, date of birth, filing status and mailing address, plus an email account to which you have access; your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan; and a mobile phone account in your name.

Alternatively you can request it by mail, for which you’ll only need your Social Security Number or Individual Tax Identification Number, your date of birth and the mailing address from your latest tax return.

The transcript should arrive within five to 10 calendar days.

- More aboutâ¦:

Also Check: Did The Tax Deadline Get Extended

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Locate Your Previous Years Adjusted Gross Income

You can find adjusted gross income of the previous year to sign your current years return on line 38 on Form 1040, line 4 on Form 1040 EZ, and line 21 on Form 1040A of your last years return .

How to Retrieve Your Original AGI If You Cannot Locate Your Last Years Return?

You can do one of the following to get your original adjusted gross income from your prior years tax return: Copy of Income Tax Return Form 4506 needs to be completed. You can also fill out Form 4506-T Transcript of Electronic Filing without any charges. The toll-free number 1-800-829-1040 can be used to contact the IRS. You can take a look at your Previous Years AGI by using the IRS Get Transcript Tool. While using the tool, you will have to clear the IRS Secure Access identity verification procedure and then use just the Adjusted Gross Income line entry while choosing the Tax Return Transcript.

What You Can do to Get Your Original AGI If Your Filing Status has Changed from the Previous Year?

Every individual taxpayer will have to turn in their individual original AGI from their previous years tax returns in case their filing status has changed from the prior year to .However, both taxpayers will use the same original adjusted gross income from the last years joint tax return if the change is from Married Filing Joint.

Read Also: How Do I Pay My State Taxes In Missouri

How Can I Find Out My Agi If I Filed An Amended Return To Include Income I Forgot

You should use the;AGI;from your;originally;filed;Form 1040,;not;your amended 1040-X.

Your;Adjusted Gross Income;;can be found on your;2017 Tax Return:

If you filed a:

- 2017 Form 1040: your AGI can be found;on line;37

- 2017 Form 1040A: your AGI can be found;on line;21

- 2017 Form 1040 EZ: your AGI can be found;on line;4

If you do not have a copy of your;2017 Tax Return, you can order a;free;transcript;online from the IRS by clicking here:;Get My Transcript.; Your IRS;transcript;will include your;AGI;from last year.

Once you find your correct 2017;AGI;amount, please follow these instructions to correct it in TurboTax:

- Login to your TurboTax Account;

- Click “Take Me To My Return“

- Click “File” from the left side of your screen

- Go to;Step 3;.

- Proceed, and make sure you’ve selected the option;”I want to E-file“

- Continue through the screens and you will be given the opportunity to input your;2017;AGI

- Keep walking through the steps until you have re-transmitted your return

Please comment below if you need further assistance;finding your AGI.

Need To Know More About Adjusted Gross Income

Still have questions about Adjusted Gross Income? Our Tax Pros can help. Theyre dedicated to knowing the nuances of taxes and can help you understand your return.

Make an Appointment to speak with a tax pro today.

Related Topics

Learn more about Form 3921 and incentive stock option rules with the tax experts at H&R Block.

Also Check: How To Review My Tax Return Online

How Do I Find Last Years Agi

The IRS requires your 2018 AGI to verify your identity for e-filing. If you’re;paper-filing your return, you won’t need your AGI because those are manually processed.

There are a few places you can get your 2018 AGI:

- If you filed your 2018 taxes with TurboTax, sign in and go down to;Your tax returns & documents. Select;View adjusted gross income .

- If you didnt file your taxes with TurboTax in 2018, the best place to get last year’s AGI is from the 1040 form you filed with the IRS. Look on page 2, line 7. If you filed a 1040NR, it’ll be on line 35.

- If you’re having trouble locating your 2018 return, the second-best place to get your AGI is from the IRS. You can order a free transcript of your return at the IRS;Get Transcript;site or you can purchase a;full copy of your 2018 return. Both versions will include your AGI.

You won’t find your AGI on your W-2 or 1099 form because those forms don’t take into account over a dozen above-the-line deductions that go into calculating your AGI.

If you didn’t file a 2018 federal tax return , enter;0;as your AGI.

If; you are looking for your 2018 AGI to e-file:

How To Calculate Adjusted Gross Income On W2

With some background knowledge about AGI and W-2, you can coast across the jumble of alphabet soup and get the tax terms clearer in your head. W-2 is a form used by employers to report your taxable income to you and to the IRS. You then use this information on Form 1040, 1040A or 1040-EZ to file your tax return. You will need information in addition to the details on your W-2 to calculate your AGI.

Step one in calculating your AGI is, to begin with the amount displayed in Box 1 of your form W-2 labelled Wages, Tips, Other Compensation. Step two includes adding any additional taxable income you have for the year in order to calculate your total taxable income. Most frequently, there is another form on which this taxable income is reported, it is known as 1099-INT for interest or 1099-DIV for dividends. The last step is to subtract any adjustments to income you qualify to claim.

Lets take a look at an example to help you understand better. If your W-2 shows that your taxable wages earned are $61,000 and there is an additional $1,000 in investment income and $500 in taxable interest, then your total taxable income is $61,000 plus $1,000 plus $500 which adds up to $61,500. However, say that you contributed $2000 to a traditional IRA and paid off a student loan interest of $1,200. You then find that your adjusted gross income is $59,300 after subtracting the $3,200 in total adjustments to income.

Don’t Miss: How To Reduce Income Tax

No Existing File From Last Year

If you didnt file last year, you need to follow a different method. To e-file, you will be asked: Did you file a tax return with the Internal Revenue Service last year? You should answer no to this question, and then your AGI will be adjusted to 0. If youre experiencing issues with this method, it would be best to contact the IRS or the company youre attempting to use to file.;

Where Do I Find My Agi Pin Number

If you do not have a copy of your tax return, you can get your AGI from one of the IRS self-service tools:Use your online account to immediately view your AGI on the Tax Records tab. Use Get Transcript by Mail or call 800-908-9946 if you cannot pass Secure Access and need to request a Tax Return Transcript.

Also Check: How Much Is New York State Sales Tax

Where Do I Find My Last Years Agi

For tax years 2020 and 2021, your AGI;is calculated;on page 1, line 11 of your Form 1040 or 1040-SR.;Your;AGI;for tax year 2019 ;is on Line 8b.;;

Simply look at the printed copy of last years return to find your adjusted gross income.;If you filed with TaxSlayer, you;can;also;log in to My Account;to view;this info on;your prior year return.;;

When you return to;TaxSlayer to;file your tax;return;each;year,;your AGI is;pulled;forward and;entered;into;your current tax form.;

Stimulus Payments: A 2020 Tax Rebate

Note that the stimulus payments are in reality non-taxable rebates on 2020 taxes, meaning that if your income in 2020 ends up being below the threshold you should be able to claim a stimulus check when you file your 2020 tax return , even where your AGI was over the thresholds in 2018 and/or 2019.

Even better, even if your AGI in 2020 is over the limits, but you received a stimulus check based on 2018 or 2019 figures, the IRS will not claim any amount of the stimulus check back .

Don’t Miss: How To Get Tax Exempt Status

How Does The Irs Use Your Magi

Your MAGI is what determines whether you can make tax-deductible contributions to an IRA. If the total is over a certain amount, you can’t deduct anything you added to an IRA for that tax year.

For example, as of tax year 2021, if you are;a single or head-of-household filer on your tax return and are covered by a retirement plan at work, you can’t take an IRA deduction if you had a MAGI of $76,000 or higher.

These limits change based on your tax filing status. For example, married couples who file taxes jointly can have a MAGI up to $125,000.

The IRS also uses your MAGI to determine whether you’re allowed to take a tax deduction for tuition and fees.

These limits don’t just change based on your filing status. They are also changed each tax year. You’ll need to consult a tax adviser or tally the numbers yourself to see where you stand with your MAGI.;That will let you know what deductions you can make come tax time.

Importance Of The Agi

Your AGI impacts many of the tax deductions and credits you can take at tax time. Thats especially important because deductions and credits can increase your tax refund or reduce the amount of taxes you owe. Depending on your filing status, you may be subject to an AGI limita dollar amount that limits the deductions you can takewhich usually applies to higher income earners.

Generally, the more deductions and credits you take, the lower your taxable income.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

You May Like: How Are Property Taxes Calculated In Texas

Gross Income Vs Adjusted Gross Income

When tax time comes around, Americans are often required to become better acquainted with certain tax terms even if they are not accountants. Thankfully, most of us leave the majority of the tax prep work to the tax experts. However, when it comes to the different ways in which your taxable income can be described, things can get confusing. For this reason, it’s a good idea to get to a better understanding of the difference between your gross income and adjusted gross income and how it impacts your personal financial planning.

What Is Adjusted Gross Income

Adjusted Gross Income is simply your total gross income minus specific deductions. Additionally, your Adjusted Gross Income is the starting point for calculating your taxes and determining your eligibility for certain tax credits and deductions that you can use to help you lower your overall tax bill.

Don’t Miss: What Is Tax Liabilities On W2

How Do I Calculate My Agi

When you file with TaxSlayer, the calculation is done for you.;This is one;of the;major benefits;of filing your taxes online.;If you are filing your return on paper,;you;will calculate your AGI;right on Form 1040.;;

To figure out what your AGI;is, youll;want;to;find your gross income first. Thats anything you earned for the year, including wages, dividends, capital gains, retirement distributions, and so on. These amounts are added together on Form 1040.;;

Once youve added up all these and found your total, you will subtract any adjustment to income amounts that you have. These include:;;

Read also:;Calculating adjusted gross income when married;

Why Does My Agi Keep Getting Rejected

When you enter your prior year AGI or PIN, it must match the IRS master file exactly. If your return was rejected for an AGI or PIN mismatch, it means that what you entered doesnt match their records. The IRS only requires one of these to match their records to get accepted. Most people use their prior year AGI.

You May Like: How To Find Out Who Claimed You On Their Taxes