How To Pay Self

Self-employment comes with its own amazing freedoms and power in your work. But it also comes with its own unique challenges.

How to calculate payroll taxes – Self-employment will have you handling a lot of work by yourself. But hey! Youâve got control. Surround yourself with plants and have at it.

Self-employed payroll taxes are often referred to as SECA, or the Self-Employment Contributions Act tax. Similar to a business, you will be responsible for Medicare and Social Security tax. And the same percentages apply that an employee and employer contribute. FICA taxes amount to 15.3% of your total net wages: 12.4% for Social Security and 2.9% for Medicare.

While those percentages would be split between employee and employer for a business â 7.65% paid by each party â you will have to cover both sides. However, you can deduct the employer equivalent contribution from your gross income when calculating your income tax.

And, of course, youâve got to file.

For your yearly filing, you will submit your Form 1040 with your calculated income. As for the question of when are payroll taxes due for self-employment, you will need to file and submit your self-employed payroll taxes quarterly with Form 1040-ES.

Choose Your Calculation Method

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

- The Wage Bracket Method: The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

Recommended Reading: Does Doordash Tax Tips

Table 81 Rates Income Thresholds And Constants For 2023

Rates , income thresholds , and constants| Province or territory |

|---|

| 0.480 |

For information on 2022 federal personal amounts, see the form TD1, Personal Tax Credits Return and the form TD1X, Commission Income and Expenses for Payroll Tax Deductions. For information on 2022 provincial or territorial personal amounts, see the respective form TD1AB, TD1BC, TD1MB, TD1NB, TD1NL, TD1NS, TD1NT, TD1NU, TD1ON, TD1PE, TD1SK, or TD1YT. For information on QC amounts, refer to Revenu Quebec.

* Alberta resumed indexing as of 2022 the basic personal amount for 2022 has been updated retroactively** Basic personal amount for New Brunswick has been updated as per the announcement made by the province in 2022

Also Check: How Much Does It Cost To File Your Taxes

Calculating Withholding: Wage Bracket Method

Under the wage bracket method,you simply locate an IRS Publication 15-Tthe proper table for your payroll periodand the employee’s marital status as shownon the employee’s Form W-4.

Then look at the employee’s Form W-4 for the numberof withholding allowances claimed.

Using the number of allowances claimed on the Form W-4,and the amount of taxable wages paid,follow the column and row to find the amountof tax to withhold.

For withholding computations for employees claiming morethan 10 withholding allowances,you will need to refer to the special wagebracket instructions in IRS Publication 15-T.

When To Get A Payroll Account

Do you need a payroll account with the CRA?

First, determine if youre an employer. According to the CRA youre considered an employer if you pay salaries, wages , bonuses, vacation pay, or tips to your employees. You may also fall under the employer category if you provide specific taxable benefits to staff, such as automobiles or spending allowances. Even if you have no employees or employ seasonal staff, you must still report a nil remittance once per quarter.

Employers must register for a payroll program account with the CRA. To do so, youll need all employees Social Insurance Numbers and have them fill out form TD1 which should be done within seven days of hiring.

Once you register for an account youll be provided with 15-digit payroll account number. The first nine digits are your unique business number. The following two letters are the program code RP for the payroll program and the last four identify each payroll account your business has . Your payroll account number wont change, and can be used to remit all deductions from employees.

Also Check: Do You Have To Claim Stocks On Taxes

Calculation Of Tax For The Pay Period

For Option 2, you calculate the tax on the projected income for the year, and then find the tax amount that is proportional to the number of pay periods that have occurred . Compare the result to the tax deducted in the year-to-date. The difference is the tax payable on the current income.

Continuing the above example, if the total federal and provincial or territorial tax on $25,380.95 is $3,560.17, the proportional year-to-date tax is $2,875.52 . If the total tax deducted year-to-date is $2,736.40 the tax on the current income of $500 is $139.12 . The tax values used in this example are fictitious.

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees.

As with federal payroll tax, part of this tax is employer-paid, and part is employee-paid. Keep in mind that âemployee-paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees.

State and local payroll taxes are governed at the state and local levels, and payroll tax rates and rules vary by jurisdiction. To find out more about payroll tax in your state and local area, check out the Federation of Tax Administratorsâ list of each stateâs taxing authority.

You May Like: How To File Income Tax With No Income

Whats The Difference Between A Deduction And Withholding

In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. These are known as âpre-tax deductionsâ and include contributions to retirement accounts and some health care costs. For example, when you look at your paycheck you might see an amount deducted for your companyâs health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. Some deductions are âpost-taxâ, like Roth 401, and are deducted after being taxed.

In our calculators, you can add deductions under âVoluntary Deductionsâ and select if itâs a fixed amount , a percentage of the gross-pay , or a percentage of the net pay . For hourly calculators, you can also select a fixed amount per hour .

Formulas To Calculate The Estimated Federal And Provincial Or Territorial Tax Deductions For The Pay Period

T = + L You can round the resulting amount to the nearest multiple of $0.05 or $0.01.

Only for employees in Quebec, outside Canada, and in Canada beyond the limits of any province or territory: T = + L You can round the resulting amount to the nearest multiple of $0.05 or $0.01.

For employees paid by commission who have filled out Form TD1X: T = The tax to be deducted on the current commission payment = + L You can round the resulting amount to the nearest multiple of $0.05 or 0.01.

Recommended Reading: What Is Work Opportunity Tax Credit Program

Who Should Use This Guide

This guide is intended for the employer and the payer. It contains tables for federal and provincial tax deductions, CPP contributions and EI premiums. It will help you determine the payroll deductions for your employees or pensioners.

For more information on deducting, remitting, and reporting payroll deductions, see the following employers’ guides:

- T4001, Employers’ Guide Payroll Deductions and Remittances

- T4130, Employers’ Guide Taxable Benefits and Allowances

- RC4110, Employee or Self-employed?

- RC4120, Employers’ Guide Filing the T4 Slip and Summary

- RC4157, Deducting Income Tax on Pension and Other Income, and Filing the T4A Slip and Summary

These guides are available on our website at canada.ca/taxes.

Example Of Gross To Net Calculation

Lets say your employee is a single-filer living in Phoenix, Arizona with zero claims on their Form W-4.

The employee makes $15 per hour and works 40 hours per week. You pay the employee weekly, and their total gross is $600. The employee does not work overtime.

The employees health insurance premium is $50 per week. Health benefits are exempt from Social Security, Medicare, and income tax withholding.

You will withhold the following to determine the employees net pay:

You May Like: Do You Pay Taxes On Workers Comp

Table 823 Canada Pension Plan / Quebec Pension Plan 2022 Contribution Rates And Amounts

Canada Pension Plan / Quebec Pension Plan 2022 Contribution Rates and Amounts| CPP/QPP |

|---|

* Please see Table 1 for CPP contributions and year-to-date contributions for each pay period.

C = The lesser of: $3,754.45 × = $3,754.45 = $1,207.13 0.0595 × = 0.0595 × = $169.82

C = $169.82

K2R = = = = $474.30 + $150.37 = $624.67

K2RP = = =

What Is A Paycheck

A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

Read Also: Who Has Free Tax Filing

State And Local Taxes

Some states have no state income taxes, so you may be off the hook. But if youre required to pay state taxes , youll want to make sure your calculations are done right.

Different states apply payroll taxes in different ways, but once you know how to calculate the FIT and FICA taxes, calculating state taxes is a similar exercise.

Also, be sure to check whether your state imposes local taxes that are paid on top of federal and state taxes.

Formulas To Calculate The Annual Provincial Or Territorial Tax Deduction

T2 = T4 + V1 + V2 S If the result is negative, T2 = $0.

Only for employees in Quebec: T2 = $0

Only for employees outside Canada and in Canada beyond the limits of any province or territory: T2 = $0

Where: T4 = KP K1P K2P K3P K4P

V and KP are based on 2023 values for A see the Rates , income thresholds , and constants for 2023 Table 8.1 in Chapter 8.

K1P = Lowest provincial tax rate × TCP

K2P =

K2RP =

Replace the lowest provincial or territorial tax rate with the appropriate rate for the province or territory that applies to the employee or pensioner.

Unless specified, the value for K4P, LCP, S, V1 and V2 = 0.

British Columbia

S = Where A $23,179, S is equal to the lesser of: T4

= Where $23,179 < A $37,814, S is equal to the lesser of: T4 S2

= Where A > $37,814

LCP = The lesser of: $1,800 15% of the amount deducted or withheld for the pay period for the acquisition by the employee of approved shares of the capital stock of a prescribed labour-sponsored venture capital corporation

Note:

The maximum LCP credit for the whole year cannot exceed $1,800.

New Brunswick

LCP = The lesser of: $2,000 20% of the amount deducted or withheld for the pay period for the acquisition by the employee of approved shares of the capital stock of a prescribed labour-sponsored venture capital corporation

Note:

The maximum LCP credit for the whole year cannot exceed $2,000.

Note:

The maximum LCP credit for the whole year cannot exceed $2,000.

Ontario

V1 = 0.20 × + 0.36 ×

Recommended Reading: Are Donations To Churches Tax Deductible

Making Payments To The Irs

Just because youve calculated payroll and paid your employees doesnt mean your job is done. You also need to send the taxes you withheld to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your states withholding tax agency.

Be sure to send both the taxes you withheld from your employees paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period . The IRS Form 941, Employers Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so dont forget!

For state tax filings, you should contact your states withholding tax agency for filing requirements for state and local income tax rates. Each state is different.

What Is The Deduction

Employers are entitled to a deduction amount which is subtracted from their wages paid. The maximum deduction available is $600,000 per annum .

The deduction an employer is entitled to claim may vary according to whether the employer is a member of a group, how much of the financial year the employer employ and the employers interstate wages.

Video Transcript: Payroll tax South Australian deduction entitlement

The maximum annual deduction entitlement available in South Australia is $600,000.

Employers are entitled to a deduction amount which is subtracted from their wages paid.

Lets look at a simple example:

Business ABC employs only in South Australia and has taxable wages of $1.6m.

Their deduction entitlement is $600,000.

Payroll tax will be calculated on $1 million, that is $1.6 million – $600,000.

The annual deduction entitlement will be reduced if the employer:

- is part of a group

- employs in South Australia for part of the financial year or

- Employs in South Australia and another state and/or territory.

Read Also: Can You File Taxes With Last Pay Stub

Federal Income Tax : 2019 Or Prior

Federal Income Tax is calculated using the information from an employees completed W-4, their taxable wages, and their pay frequency. Based on Publication 15-T , Federal Income Tax Withholding Methods, you can use either the Wage Bracket Method or the Percentage Method to calculate FIT.

We will use the Percentage Method in our example, looking at tables found in the 2022 IRS Publication 15-T PDF file. You can open the file to follow our calculations below.

Using Worksheet 1 on page 5, we will determine how much federal income tax to withhold per pay period.

Step 1. Adjust the employees wage amount

1a) This is the same as gross wages: $2,083.33.

1b) Our employee is paid semi-monthly or 24 times per year.

1c) This should equal your employees annual salary: $2,083.33 x 24 = $50,000

Because we are using the 2019 W-4 form, we now skip to step 1j:

1j) Our employee has claimed 2 allowances

1k) $4,300 x 2 = $8,600

1l) $50,000 $8,600 = $41,400

To continue, you will need to refer to the tax tables on page 10:

Step 2: Figure the tentative withholding amount

2a) This amount is from line 1l, $41,400

2b) We are referring to the table labeled Single or Married Filing Separately on the left . Our employees adjusted annual wage amount is greater than $13,900 and less than $44,475. So, we would enter an amount of $13,900 .

2c) The amount in column C is $995.

2d) The percentage from column D is 12%.

2e) $41,400 $13,900 = $27,500

2f) $27,500 x 12% = $3,300

4a) $0

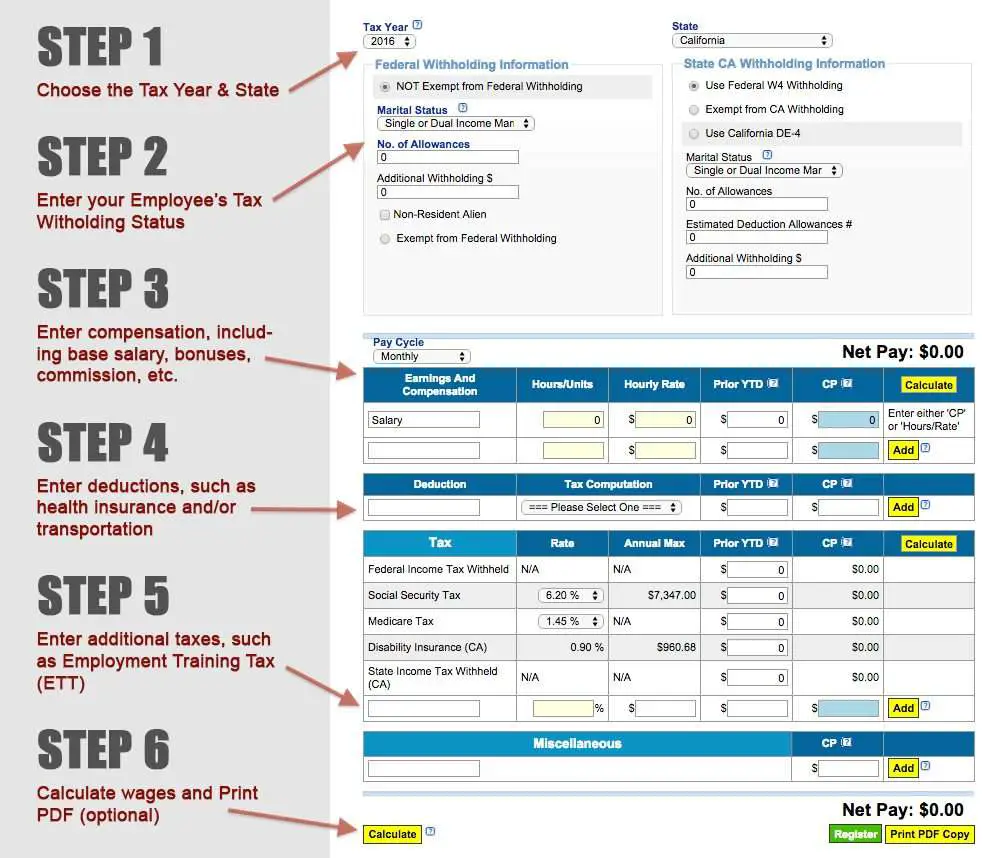

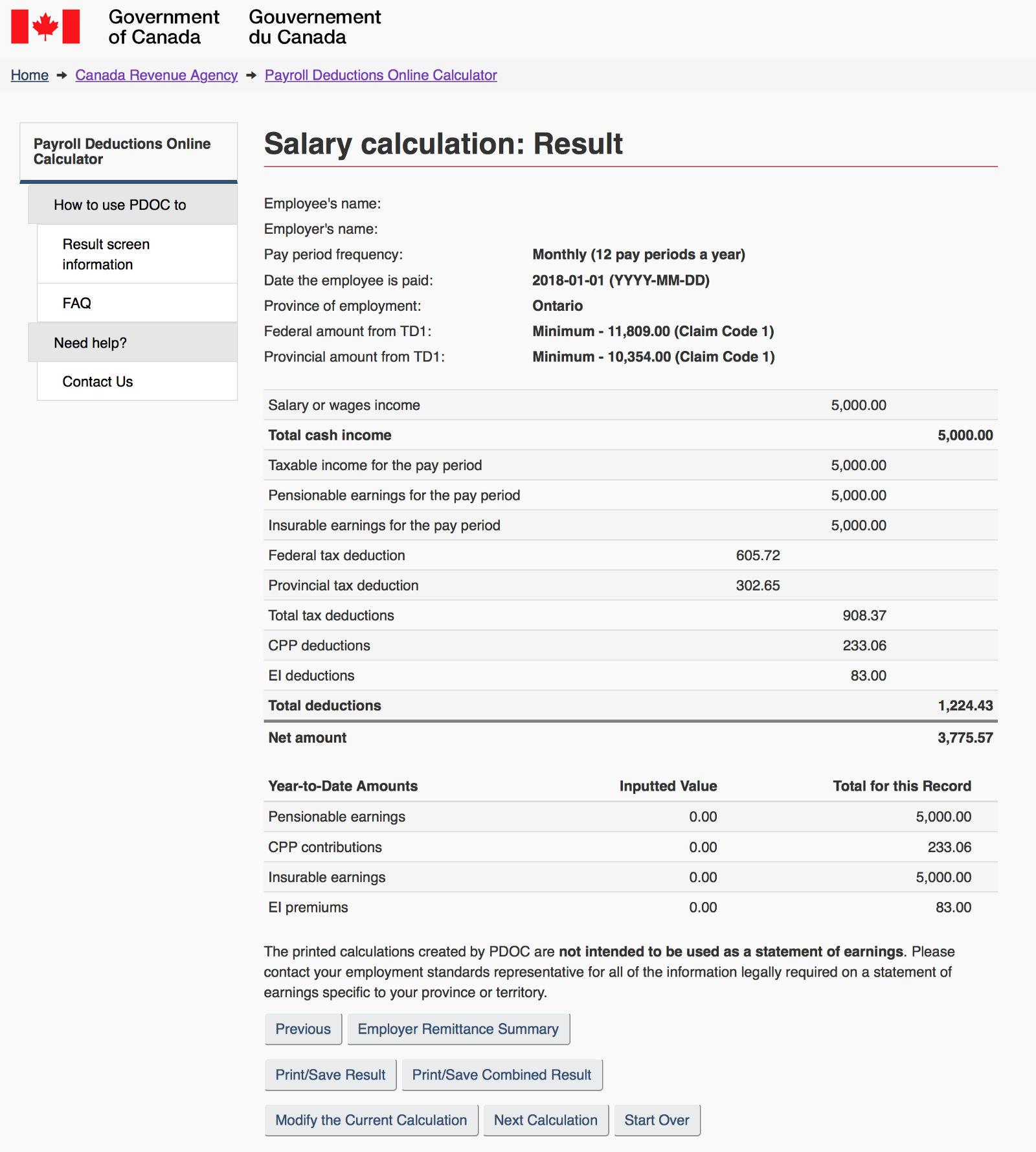

What Are The Added Benefits Of The Payroll Online Calculator

In addition to simplifying payroll, the payroll calculator helps you know how much you owe the CRA at the end of each month. After you complete calculations for your employees, you can also view, print and save a summary of your employer remittance amounts from a separate page.

When you operate a small business, using time-saving tools leaves you with more time left over to focus on growth and improving your products or services. Top-notch accounting software and apps can aid you in this mission with handy tools that make record-keeping, financial reporting, and even payroll simple and convenient. In addition, QuickBooks Online can help you maximize your tax deductions. Keep more of what you earn today.

Products

Recommended Reading: Does Doordash Give 1099

Recommended Reading: How To Subtract Tax From Total

Figuring Your Payroll Deductions

Beginning a new job with a new employer can be exciting, but sometimes receiving the first paycheck can be a shocker when one first sees the difference between salary and “take home pay.” Since payroll deductions can take a massive chunk out of one’s salary, it is important to understand them and do everything possible to maximize the benefits from them. Some deductions are mandated by law while others are optional for the employee.

How Do Payroll Deductions Work

Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your employees or a court order. The calculations can be done manually or you can automate the process using a payroll service provider. Many businesses choose automation because it reduces errors and ensures that payments are filed with the proper authorities on time.

The amount you withhold for each employee depends upon the individuals Form W-4 Employees Withholding Certificate, state and local withholding certificates, benefit selections and other details. For instance, has the employee enrolled in your health insurance plan or is there a court-ordered garnishment to comply with?

Your place of business and where your employees perform services also play a factor in payroll deductions because not every state collects income tax.

Recommended Reading: Can You File Llc Taxes Online

Run Your Own Payroll In Minutes

Get Started Now or Schedule a 15 Minute Demo

Get Started Now or Schedule a 15 Minute Demo

Ensure office safety and track time the new way with our latest, no-contact time clock that reads body temperature and detects face masks.

Ensure office safety and track time the new way with our latest, no-contact time clock that reads body temperature and detects face masks.

Get Started Now or Schedule a 15 Minute Demo

Ensure office safety and track time the new way with our latest, no-contact time clock that reads body temperature and detects face masks.