What Is The Capital Gains Rate For Retirement Accounts

One of the many benefits of IRAs and other retirement accounts is that you can defer paying taxes on capital gains. Whether you generate a short-term or long-term gain in your IRA, you dont have to pay any tax until you take money out of the account.

The negative side is that all contributions and earnings you withdraw from a taxable IRA or other taxable retirement accounts, even profits from long-term capital gains, are typically taxed as ordinary income. So, while retirement accounts offer tax deferral, they do not benefit from lower long-term capital gains rates.

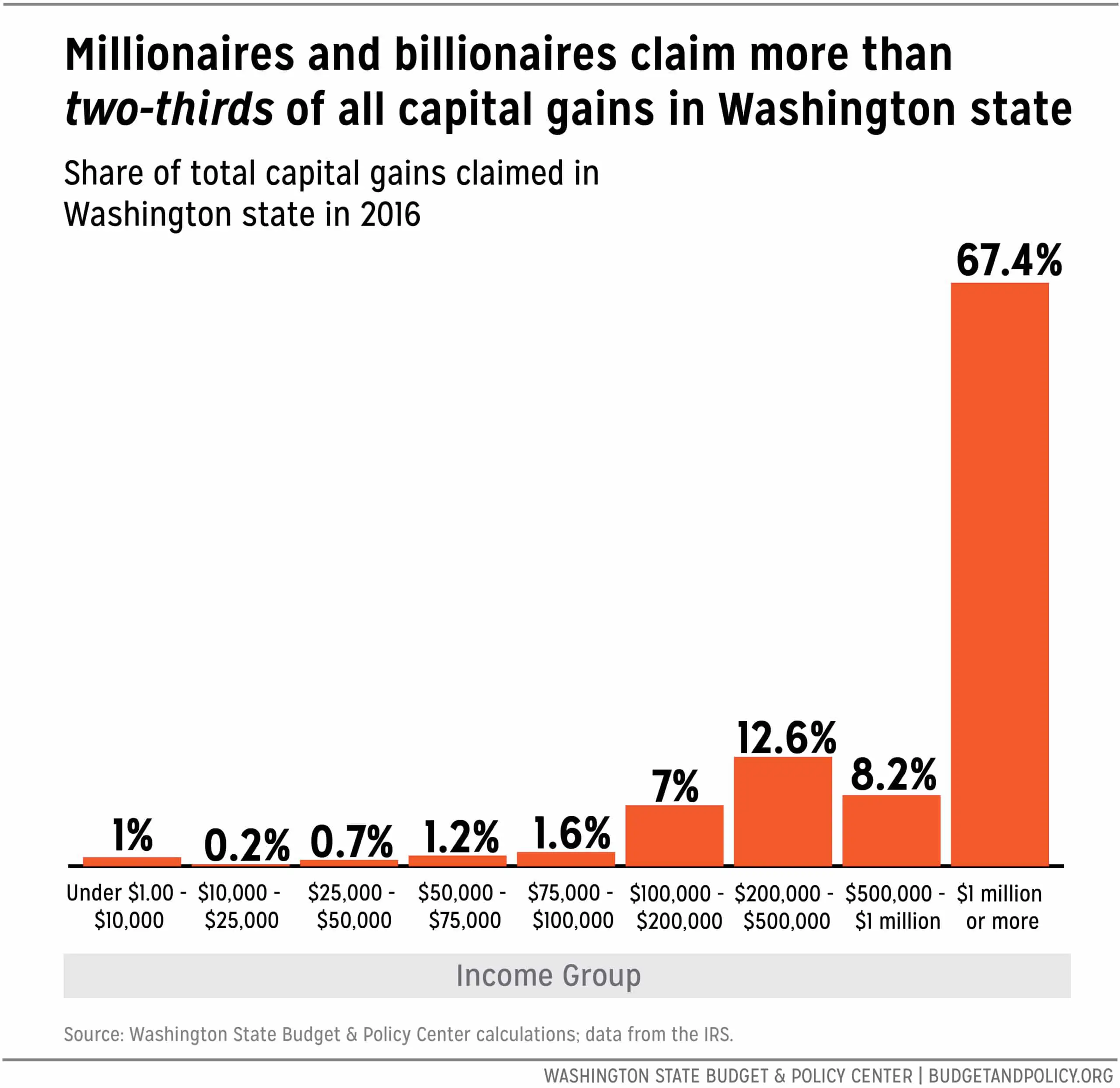

What Is Bad About Reducing The Capital Gains Tax Rate

Opponents of a low rate on capital gains question the fairness of a lower tax on passive income than on earned income. Low taxes on stock gains shifts the tax burden onto working people.

They also argue that a lower capital gains tax primarily benefits the tax-sheltering industry. That is, instead of using their money to innovate, businesses park it in low-tax assets.

Allowable Business Investment Loss

If you had a business investment loss in 2021, you may be able to deduct half of the loss from income. The amount of the loss you can deduct from your income is called your allowable business investment loss . Complete Chart 6 to determine your ABIL and, if applicable, your business investment loss reduction. Claim the deduction for the ABIL on line 21700 of your income tax and benefit return. Enter the gross business investment loss on line 21699 of your return.

What is a business investment loss?

A business investment loss results from the actual or deemed disposition of certain capital properties. It can happen when you dispose of one of the following to a person you deal with at arm’s length:

- a share of a small business corporation

- a debt owed to you by a small business corporation

For business investment loss purposes, a small business corporation includes a corporation that was a small business corporation at any time during the 12 months before the disposition.

You may also have such a loss if you are deemed to have disposed of, for nil proceeds of disposition, a debt or a share of a small business corporation under any of the following circumstances:

What happens when you incur an ABIL?

You can deduct your ABIL from your other sources of income for the year. If your ABIL is more than your other sources of income for the year, include the difference as part of your non-capital loss.

Note

You May Like: How To Get The Most Out Of Taxes

What Is The Capital Gains Tax Rate For 2022 And 2023

For taxation purposes, a profit made on an asset sold less than a year after purchase is typically treated as if it were salary or wages. Your ordinary income or earned income is increased by these gains when you file your tax return.

In general, the same holds true for an assets dividend payments, which, while not capital gains, still show a profit. Dividends are subject to ordinary income taxation in the United States for individuals paying taxes at a rate of 15% or higher.

For long-term capital gains, however, a different system is in place. A rate schedule that is based on the taxable income of the taxpayer for that year determines how much tax you must pay on assets that you own for longer than a year before selling them for a profit. Each year, the rates are lowered to account for inflation.

Individual taxpayers who have taxable income totaling $41,675 or less in 2022, for instance, wont be subject to any capital gains tax. If their income is between $41,676 and $459,750, they will, however, pay 15% on capital gains. The percentage rises to 20% above that level of income.

If their total taxable income in 2023 is $44,625 or less, individual filers will not be subject to capital gains tax. If their annual income ranges from $44,626 to $492,300, the rate on capital gains increases to 15%. The rate rises to 20% over that threshold of income.

For short-term capital gains taxes, there is no 0% rate or 20% cap, in contrast to long-term capital gains taxes.

If You Pay Basic Rate Income Tax

If youre a basic rate taxpayer, the rate you pay depends on the size of your gain, your taxable income and whether your gain is from residential property or other assets.

Work out how much taxable income you have – this is your income minus your Personal Allowance and any other Income Tax reliefs youre entitled to.

Work out your total taxable gains.

Deduct your tax-free allowance from your total taxable gains.

Add this amount to your taxable income.

If this amount is within the basic Income Tax band youll pay 10% on your gains . Youll pay 20% on any amount above the basic tax rate.

Example

Your taxable income is £20,000 and your taxable gains are £12,600. Your gains are not from residential property.

First, deduct the Capital Gains tax-free allowance from your taxable gain. For the 2021 to 2022 tax year the allowance is £12,300, which leaves £300 to pay tax on.

Add this to your taxable income. Because the combined amount of £20,300 is less than £37,700 , you pay Capital Gains Tax at 10%.

This means youll pay £30 in Capital Gains Tax.

Also Check: How To Check Tax Return Status

Exempt Capital Gains Balance

When you filed Form T664 for your shares of, or interest in, a flow-through entity, the elected capital gain you reported created an exempt capital gains balance for that entity.

Note

Generally, your ECGB expired after 2004. If you did not use all of your ECGB by the end of 2004, you can add the unused balance to the adjusted cost base of your shares of, or interest in, the flow-through entity.

Example

Andrew filed Form T664 for his 800 units in a mutual fund trust with his 1994 income tax and benefit return. He designated the fair market value of the units at the end of February 22, 1994, as his proceeds of disposition. Andrew claimed capital gains reductions of $500 in 1997 and $600 in 1998. At the end of 2003, his exempt capital gains balance was $2,250. In 2004, he had a $935 capital gain from the sale of 300 units. This left him with an unused balance of $1,315 at the end of 2004. In future years, he can only add the unused ECGB to the cost of any remaining units.

1. ECGB carryforward to 2004

6. Unused ECGB at the end of 2004

6

The unused ECGB expired after 2004 so Andrew can add this amount to the adjusted cost base of his shares of, or interest in, the flow-through entity.

Be Mindful Of Holding Periods

A sale of an asset must occur more than one year and one day after the date of purchase in order for the gain to be considered long-term.

Before you sell a security that you purchased about a year ago, be sure to verify the actual trade date of the purchase. Waiting just a few days might be enough to prevent it from being treated as a short-term capital gain.

Naturally, these timing strategies have a greater impact on big trades than on little ones. The same holds true whether you are in a higher tax bracket than a lower one.

Read Also: How Much Is Federal Income Tax In Florida

Minimizing Capital Gains Tax

Here are a few ways to reduce your capital gains tax burden in Canada

Use tax-free or tax-sheltered accounts: A tax-free savings account can help you avoid capital gains tax. The income you earn in a TFSA, regardless of the type of income, is not taxable, even when the gain is realized. Funds withdrawn from a TFSA are also not taxable. The only exception is dividend income from U.S. corporations, which will generally be subject to U.S. withholding tax. Please note, TFSAs have a yearly contribution limit and exceeding your limit results in monthly taxation on the excess amount. Read: How to make the most of your TFSA contribution limit

A registered retirement savings plan can also help reduce your tax burden. Capital gains earned on income in an RRSP are not taxable when the gain is realized but rather when the funds are withdrawn. These withdrawals are taxed at your marginal tax rate as ordinary income.

Track expenses: It’s a good idea to keep track of any qualifying expenses incurred in securing or maintaining investments as these expenses may increase the adjusted cost basis of your investments. Capital gains tax is calculated when an asset is sold for more than its ACB.

Capital gain income is a sign that your investments are growing. Careful planning, however, is essential when it comes to getting the best tax benefit.

What Are Capital Gains Taxes

When you own an investment or other asset – such as real estate, land, a business or stocks, for example – and later sell that asset for a profit, you have realized capital gains. The tax that is then levied on the profit portion of your sale is called capital gains tax.

Depending on how your gains are classified, and your total taxable income for the year, your capital gains tax rate can vary. This percentage could be as low as 0% or as high as your ordinary tax rate.

Don’t Miss: Are Legal Fees Tax Deductible In 2020

Adjusted Cost Base For Real Estate

For real estate properties, the adjusted cost base includes the purchase price of the property, closing costs, and capital expenditures on the property.

Closing costsare the fees that a buyer pays to acquire the real estate property and include one-time fees such as theland transfer taxes, lawyer and legal fees, home inspection fee, and property survey fee. It is important to differentiate between capital expenditures and current expenses on your property.

Current expenses cannot be included in the adjusted cost base while capital expenditures should be included in the ACB, irrespective of when the capital expenditures were made during the entire duration of your ownership of the home.

Some examples of capital additions and improvements to your home include installing a new HVAC system, waterproofing your basement, installing a hot tub, etc. Meanwhile, current expenses are monthly costs incurred by the homeowner or a tenant, such as electricity bills, hydro bills, restorations, and short term repairs such as painting the wall or replacing broken light bulbs.

TheCanada Revenue Agency guidelines on current expenses and capital expensesindicate that capital expenditures are improvements that provide a long term benefit, significantly increase the value of the home, and contribute to extending the useful life of your property.

Capital Gain Calculation In Four Steps

Looking for a capital gains tax calculator? When you file with H& R Block Premium, theres a capital gains tax calculator built right in. Once youve added the information about your asset, youll see a results page that outlines your total gain or loss. Of course, you could also get help from our tax pros when you file.

Also Check: How Much Is Sales Tax In Ohio

But What If I Have A Loss From Selling Real Estate

If you sell your personal residence for less money than you paid for it, you cant take a deduction for the capital loss. Its considered to be a personal loss, and a capital loss from the sale of your residence does not reduce your income subject to tax.

If you sell other real estate at a loss, however, you can take a tax loss on your income tax return. The amount of loss you can use to offset other taxable income in one year may be limited.

What Is The 2022 Capital Gains Tax Rate

The capital gains tax rate for tax year 2022 ranges from 0% to 37%, depending on your income and whether you held the assets for more than a year. For most people, the long-term capital gains tax does not exceed 15%. This 15% rate applies to the following:

- Single individuals who earn $41,675 to $459,750

- Heads of household who earn $55,800 to $488,500

In some cases, capital gains are taxed at a greater rate. Individuals and couples with an income that exceeds the limits of the 15% tax rate are subject to a 20% tax rate. Individuals and couples with an income below the minimum for the 15% capital gains tax pay 0%.

A 28% tax rate applies to these capital assets, regardless of how long you held them:

- Taxable part of a gain resulting from the sale of a Section 1202 qualified small business stock

- Net capital gains from the sale of collectibles like coins or art

Any unrecaptured gain from the sale of Section 1250 real property is taxed at a maximum 25% rate.

Short-term capital gains are taxed as ordinary income according to the taxpayers tax bracket, which ranges from 10% to 37% depending on your income.

One exception to capital gains tax rules is the sale of your primary home. Up to $250,000 $500,000 for married joint filers is excluded. To qualify, you must have both owned the home and lived in it as your primary home for at least two of the previous five years. You can take the exclusion one time during a five-year period.

Don’t Miss: Where To Pay Irs Taxes

How Capital Gains Tax Works In Ontario

In todays financial environment, many individuals make the choice to invest, whether it is an investment in stocks, shares in a mutual fund, real estate holding investment or an investment in exchange-traded funds.

Essentially, the term capital gains is if the value of the asset increases, the amount of capital that you have invested increases. In other words, you have gained capital. Since this is a form of income, you are required to pay capital gains tax in Ontario when the capital gain is realized. Realized capital gain means that you have sold or traded the investment, solidifying the increase in your gained capital and putting the capital in your pocket. Its at this point that you are required to pay capital gains tax in Ontario.

Conversely, you arent required to pay capital gains tax in Ontario if the gains arent realized, meaning you havent sold off the investment and gained that capital from the sale as a result of the increase in value.

Did you sell your property in the last year and make a profit? Did you see an increase in your stocks and trade it off in your favor? Then its more than likely that capital gains tax is going to be an influential element of your personal tax return. If you do sell the property and make a profit an increase in capital you have to pay tax on it at that point unless the property you are selling is your primary residence and qualifies for the primary residence exemption.

Lifetime Capital Gains Exemption

The lifetime capital gains exemption is also known as the capital gains deduction and is on line 25400 of your tax return. Canadian residents have a cumulative lifetime capital gains exemption when they dispose of eligible properties. The capital properties eligible for the LCGE include qualified small business corporation shares and qualified farm or fishing property . The lifetime limit refers to the total amount of LCGE you can claim throughout your lifetime. Last updated in 2019, the lifetime capital gains exemption for qualified small business corporation shares is $866,912 and the lifetime capital gains exemption for qualified farm or fishing property is $1,000,000. This means that in the years prior to 2019, if you have already claimed $866,912 in lifetime capital gains exemption for QSBCS, you cannot claim any further amounts.

Letâs say you have earned $10,000 in capital gains on a QSBCS in 2019 and you have not reached the lifetime capital gains exemption limit. Upon claiming the LCGE exemption, you will have used up $5,000 of your LCGE for QSBCS as the capital gains inclusion rate is 50%. You will still have $861,912 left in your lifetime capital gains exemption for qualified small business corporations as of 2019 limit amounts.

Read Also: How Do I Get Last Year’s Tax Return From Turbotax

Exemptions On Capital Gains

According to the KRA, not all capital gains are taxable there are some exemptions

- Income that is taxed elsewhere, such as property dealers.

- The issuance of a companys own shares and debentures.

- Transfer of property for the sole purpose of securing a debt or a loan

- Transfer of property by a creditor for the sole purpose of returning property used as security for a debt or a loan

- Transfer of any property to a person as a beneficiary in the course of administering the estate of a deceased person

- Transfer of assets between spouses:

- Transfer of assets between former spouses as part of a divorce settlement or a valid separation agreement

- To a company in which spouses or spouses and immediate family own 100% of the stock.