How Long Can The Irs Collect Back Taxes

There is a 10-year statute of limitations on the IRS for collecting taxes. This means that the IRS has 10 years after assessment to collect any taxes you owe. This is a general rule, however, and the collection period can be suspended for various reasons, thus extending how long the IRS has to collect your debt.

Years For Filing Back Taxes 3 Years To Claim A Refund

There might not be a hard limit to how many years you have to file back taxes, but thats not to say that the IRS doesnt want your returns sooner rather than later. You must have filed tax returns for the last six years to be considered in good standing with the IRS. And if you want to claim a tax refund for a past year, youll need to file within three years.

The IRS will eventually intercede and file a substitute tax return for you if you wait too long and if you had any income during the year in question, and this probably would not be in your best interest. They wont worry about claiming any tax credits or deductions that you might be entitled to. Theyll prepare a rudimentary tax return for you without them, so youll most likely end up owing more than if you had prepared the return yourself or paid a professional to do it for you.

Youll have some notice before this happens. Youll receive a Notice of Deficiency CP3219N giving you 90 days to either file the past-due tax return yourselfpreparing it with those deductions and creditsor to file a petition with the Tax Court to argue your case.

Why You Should File Your Past Due Return Soon

Avoiding penalties and interest is perhaps the most compelling reason to file late tax returns sooner rather than later. When youre struggling and short on cash, your tax bill may feel so overwhelming that $50 in interest and $500 in interest both feel like equally insurmountable obstacles. Eventually, however, the taxman will come calling and when he does, youll want to have yourself in the best position possible. Your tax bill isnt going away, so act today to keep it as low as you possibly can. We promise you that there is light at the end of the tunnel, so keep that tunnel as short as you can.

Youll also need to file previous year taxes if youre due a tax return. This works in two ways. The IRS wont process your tax refund if you dont file your taxes. If you were due a tax refund in 2018 but never filed your taxes, you wont get your 2018 refund until you do. You have three years in which to file your taxes and claim any money youre due. As the kids are fond of saying, if you snooze, you lose. Wait too long and youll forfeit your refund and any tax credits you could have taken.

A missed return in the past can also foul up your refund this year. The IRS pays attention. If you missed filing a return in the past, youre not getting this years tax refund until you either correct the problem or give them a valid reason for skipping out on the missed filing.

Also Check: Michigan Gov Collectionseservice

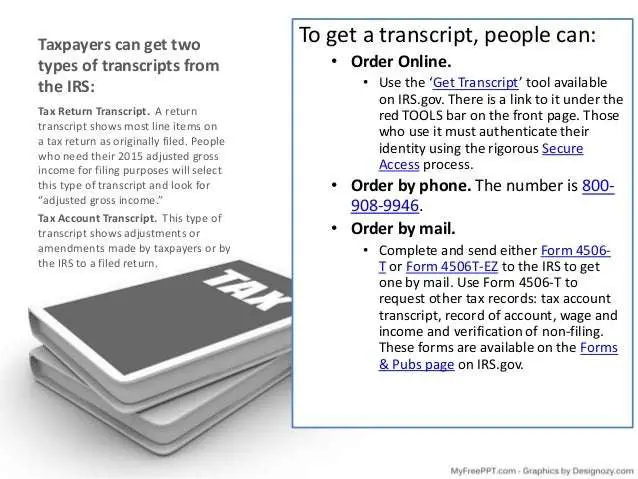

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

What Are The Penalties For Failing To File

If you aren’t going to get your tax return finished by April 18, it’s best to file for an extension because the failure-to-file penalty is stiff. It is based on the lateness of a tax return as well as the size of unpaid taxes from the due date.

The penalty rate is 5% of unpaid taxes for each month that a filing is late, capped at 25%. Take a taxpayer who owes $10,000 but doesn’t file for an extension if they file two months late, they would $500 each month for a total of $1,000 in penalties.

The 5% penalty is the most stringent fee the IRS levies against late filers, Rebecca Walser of Walser Wealth Management told CBS News.

Also Check: Efstatus Taxact Online

Complete And Submit The Return Forms

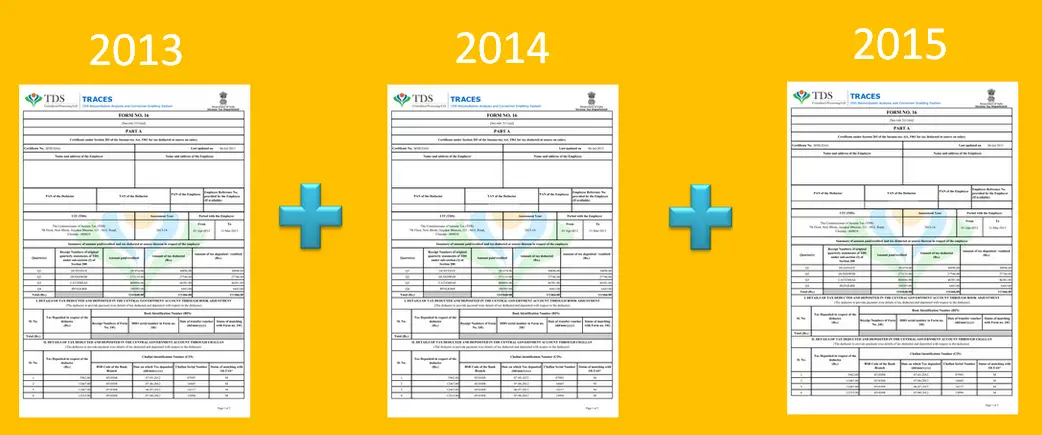

Though the specific list of forms needed to file back taxes depends on your personal financial situation, below are some of the documents you’ll likely have to round up for the year you need to file.

Forms for filing back taxes

They include:

- Form W-2, a wage and tax statement

- Form 1099-G if you received unemployment benefits

- forms 1099-MISC or 1099-NEC if you completed contract work or received certain kinds of payments

- forms 1099-INT and 1099-DIV if you had interest income or dividends

- Form 1099-R if you took distributions from a retirement account

- Form SSA-1099 if you got Social Security benefits

- Form 1098 if you received over $600 of mortgage interest

- Form 1098-T if you paid tuition expenses

- records that prove you’re eligible for certain deductions and credits

Where to submit back taxes

The IRS says you can “file your past due return the same way and to the same location where you would file an on-time return,” though if you received an IRS notice you should follow its instructions.

We’ve rounded up the best tax software programs here, but note that the fine print may be different for the current year than it is for back taxes.

For example, tax prep service TurboTax has links on its website where you can buy products to prepare your 2018, 2019 and 2020 taxes, though it says “you will have to print out and mail in your tax return for previous years.” In other words, you can’t file these tax returns online through TurboTax.

How Far Back Can You Go To File Taxes In Canada

According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately. You may think that since you dont have the money to pay your taxes, its best to not file, but this isnt the right move.

The CRA does not forget about you over time. Every day that goes can cost you more money in late-filing penalties, interest, and other potential fees when you delay filing your taxes.

Read Also: Employer Tax Identification Number Lookup

How Do I File Returns For Back Taxes

OVERVIEW

When would someone file back taxes, and what does this process typically look like?

Should you file back taxes? It may not be too late to file a previous year’s tax return to pay what you owe or claim your refund. Learn more about why one may choose to file back taxes and how to start this process.

How Do I File Old Tax Returns With Sprintax Can I Still File Taxes For 2019 2018 2017 And Other Years

If you want to file a previous years tax return, you should know that you can use Sprintax to file for the last 3 years. However, if you need to file prior years tax returns, we have another option for you.

When you choose Prior tax years, you will be transferred to Sprintaxs sister company Taxback.com who has more than 20 years of experience in tax return services. The process with them is very simple and straightforward. You just need to follow the steps.

Whats the difference?

With Sprintax, you can use a software service to prepare your old tax returns online, while with Taxback.com, an experienced tax agent will help you complete and file your prior-year tax returns at affordable pricing.

Also Check: Turbo Tax 8962

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

Why Should I File Back Taxes

Perhaps the biggest reason to file past-due taxes is to claim a refund. There are a couple exceptions, but the IRS typically requires you to file within three years of a tax return’s due date in order to get that refund. Tax credits are handled the same way.

If you’re a taxpayer living in the U.S., don’t have certain international disclosures to make, and the government owes you or your tax liability is zero, “it’s not as big of a deal” as when you owe the government, says Ryan Losi, a certified public accountant with PIASCIK.

But if you’re on the hook for a tax bill and you skip out on filing, the IRS may charge you penalties. The IRS says failing to file your taxes could also impact your Social Security benefits and chances of getting approved for a loan.

It’s prudent in general to have your income on file with the IRS. Not only did it help some people get their stimulus checks and advance child tax credit payments faster during the pandemic, but Losi says it also could also establish a record you’ll need later.

“There may be tax attributes in those years that carry forward,” he adds. “For example, if there’s a business loss, or maybe you had a capital loss, sale of securities or investments those might offset future taxable income. But if you haven’t substantiated and documented it, generally itll get denied.”

Don’t Miss: How Do Taxes For Doordash Work

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

How Is Child Tax Credit Money Related To 2021 Tax Returns

Six child tax credit payments went out in 2021, and the rest of the money will come with your tax refund this year after you file your taxes. If you chose to opt out of those checks last year, you’ll get the full amount owed to you.

However, if you had a new baby or gained a dependent any time in 2021 that the IRS didn’t know about, you could get even more money back. Or if your income changed and you didn’t update those details in the IRS Update Portal, you may be eligible to receive more money.

Don’t Miss: Does Doordash Take Taxes Out

Request Tax Documents From The Irs

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

What To Do If You Can’t Afford To Pay Back Taxes

Because of the potential for interest, the IRS advises you to pay your tax bill in full as soon as possible.

If you owe less than $100,000 and can’t pay right away but will be able to soon, you may want to pursue a short-term payment plan. Short-term payment plans can buy you an extra 180 days and don’t cost anything to set up online. You can apply using the Online Payment Agreement tool at IRS.gov or call 800-829-1040.

If you’re unable to pay that quickly, there are other options.

Request an installment agreement

If you can’t afford to cover your unpaid taxes, you can request an installment agreement by filling out Form 9465 . Fees start at $31 but vary based on your income level, how much you owe, how you pay and how you set up the long-term payment plan.

Request an offer in compromise

If paying your bill would be a serious financial hardship, you might consider an offer in compromise, which is essentially a settlement with the IRS for less than your total bill. The IRS warns that this program is “not for everyone” given its restrictions and rigor. Fees depend on your income but start at $205 .

You can apply for an offer in compromise, or OIC, by completing Form 656. Lacy says it’s a good idea to hire a tax professional if you’re planning to pursue an OIC because it’s “a lengthy process, and it does take diligence.”

Read Also: Irs Gov Cp63

Ways To File Your 2021 Tax Return

The IRS says that taxpayers can file and schedule their federal tax payments online, by phone or with the mobile IRS2Go app.

If you need to find a tax software service to use, and you make $72,000 or less, you can find an IRS-approved free filing service easily. You’ll need to gather the following information: income statements any adjustments to your income your current filing status and dependent information. If you make more than $72,000, you can use the Free File Fillable Form.

If you haven’t already made a tax payment, the IRS prefers that payments be made electronically, and offers a variety of ways to do so, including IRS Direct Pay, which is directly linked to a checking or savings account. Another option is by credit card using the mobile IRS2Go app, or through the Electronic Federal Tax Payment System.

When To File An Amended Tax Return

- you filed by mistake with the incorrect tax filing status

- you learned you forgot to claim a credit or a tax deduction you are entitled to

- you must either remove or add a dependent

- you neglected to include taxable income on your tax return.

- you found out that you claimed a cost, deduction, or credit for which you were not entitled.

Just bear in mind that the IRS restricts the period of time you have to file an amended return in order to get a refund to:

- Within three years following the initial filing deadline, or

- within two years after paying the tax owed for that year, whichever comes first.

If youre outside of that time frame, you wont be able to get a refund by changing your return.

Also Check: Reverse Ein Lookup

If You Can’t Pay Your Bill

If you’re unable to cover your tax bill, you may have options, such as a long-term payment plan through the IRS known as an installment agreement. But you must be up to date on all returns, and can’t owe more than $50,000 including tax, penalties and interest.

Other options may include an offer in compromise for taxpayers with financial difficulties, allowing you to settle with the IRS for less than you owe, or “currently not collectible” status, where the agency temporarily stops trying to collect. But you must meet specific criteria for each one to qualify.

Help Filing Your Past Due Return

For filing help, call 1-800-829-1040 or 1-800-829-4059 for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 1-800-Tax-Form or 1-800-829-4059 for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Recommended Reading: Doordash Tax Deduction

Choose A Netfile Certified Tax Software

You may have an accounting degree, but the CRA will still not allow you to go on its site and file your tax return through its NETFILE system. For that, youll need to choose from one of many online tax preparation software available. Naturally, to keep the riff raff from stealing any of your financial information, the CRA is pretty rigorous about kicking the tires of the companies that it allows to access NETFILE, the system used for filing to the government electronically. In fact, you can easily access a list of all certified software on the CRAs website. If youre at all concerned about bogus providers, use one of the links off the CRA page to link directly to one of the dozens of certified services.

Are all services the same? In one important way, they are. The certification process that the CRA subjects all electronic suitors to assure a uniformity in the results of the returns. In other words, no company offers a method to scoring a bigger refund than any other. They do, however, differ in other respects. Heres a few things worth checking on.