Can You Look Up An Ein Number Of Another Business

It is not a common situation, but sometimes small business owners may want to find out the EIN of another company, sometimes called a reverse EIN lookup. For example, some vendors require an EIN from companies theyre doing business with. In certain industries, like insurance and law, you may need another companys EIN as a part of your day-to-day business. Another possibility is that you want to look up another businesss EIN to make sure their information is valid.

The bad news is that theres no convenient, searchable database in which you can just type in the name of the company and get its EIN if its a private company. If the company is publicly traded and registered with the Securities and Exchange Commission , then the business is required to have its EIN on all documents. You can use the SECs EDGAR system to conduct an EIN lookup of a publicly-traded company for free.

When finding the EIN of a private company, things get a bit more difficult. Here are some basic steps you can take to track down another businesss EIN:

- Contact the companys payroll or accounting department and ask for the EIN.

- Get the companys business credit report through a credit bureau like Experian, Equifax or Dun & Bradstreet. You can purchase or view another companys credit report, which contains their EIN.

- Hire a service to look up the EIN for you.

- Check to see if the company filed any local or federal registration forms, which can sometimes be found online.

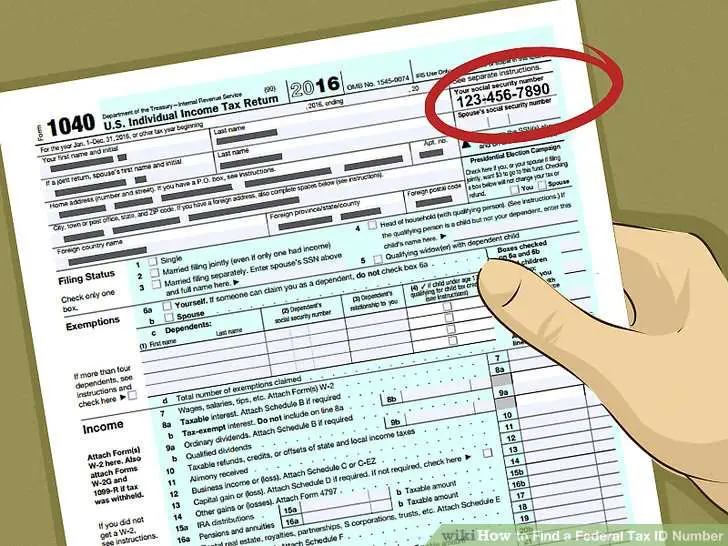

Check The Places Where The Tax Id Is Usually Recorded

The very first place where your EIN is usually recorded is the Confirmation Letter.

Your EIN confirmation letter is the original document that you get from the IRS when you first apply for the tax ID. Depending on the method you used to apply for the EIN, your confirmation letter could be available online, on mail, return fax, or return mail.

The chances are that you stored the EIN confirmation letter along with the rest of your key business paperwork, including the incorporation documents and bank account information. This should be the first place to look for the letter .

Suppose you are unable to locate the letter anywhere, proceed to check:

- Your old federal tax returns, it should be stamped all over these piles of paperwork. More specifically, your EIN will be at the top of the first page of your return paperwork.

- Your business permits and licenses.

- Official tax notices from the Internal Revenue Service theyll always include it to identify your business.

- The bank account statements of your business, or the bank itself via a telephone call.

- Your business payroll paperwork. These include the 1099 forms that you send out to independent contractors and more.

- Your business loan applications or credit report.

One or more of these resources will have the number, and you can pick it up and write it down somewhere for future reference, in case you forget or lose it again.

How To Apply For A Federal Tax Id Number

Once youve determined that your business needs a tax ID, youll work with the IRS to receive one. You can apply online other options include phone, mail or fax.

A federal tax ID number is free, so steer clear of any scams that try to get you to pay for an EIN. The IRS administers and grants tax ID numbers to businesses throughout the United States, so you can apply directly at IRS.gov.

Here are the three key steps:

Read Also: How Can I Make Payments For My Taxes

Finding Your Individual Tax Id

The Three Types Of Tax Id Number

You may already have a tax ID number, and not even know it.

There are three types of ID number that can serve as your identification for tax purposes:

- a Social Security Number

- an Individual Taxpayer Identification Number

- an Employer Identification Number

Either your SSN or ITIN can serve as your tax ID number. SSNs and ITINs both have additional uses besides tracking your business.

However, the EIN is essential if you want to hire employees. Hereâs how to choose which tax ID number is right for you.

Also Check: How To Protest Property Taxes In Harris County

Why Does A Business Need An Ein Number

The EIN is the businesss identifier and tax ID number. You use it to file taxes, apply for loans or permits, and build business credit. If you ever get a request for your TIN, or tax identification number , its the same as the EIN.

If youre a sole proprietor working for yourself, you wont need the number until you start to hire employees and contractors. Then, you will use it to register a tax withholding account.

Does My Business Need An Ein

Businesses of all types are allowed to apply for an EIN. However, the IRS requires certain businesses to have one. If you answer yes to any of the following, you’ll need an EIN:

- Does your business have employees?

- Does your business file employment or excise taxes?

- Is your business taxed as a partnership or corporation?

- Does your business withhold taxes on non-wage income paid to a nonresident alien?

- Do you have a Keogh plan?

Even if your business is a sole proprietorship or LLC with no employees, its still beneficial to get an EIN. It makes it easier to keep your personal and business taxes separate, and it may be required to open a business bank account or apply for business licenses. If you don’t have an EIN, you’ll need to use your personal SSN for various tax documents.

Keep in mind that those with an SSN, an individual tax identification number , or an existing EIN may apply for an EIN.

You May Like: Where Can I File An Amended Tax Return For Free

Ein Lookup Is Important

If you run a business or do business with other businesses, you’ll need their EINs. Rather than asking a company for their EIN, you can do an EIN lookup yourself. Or, if you have a company’s EIN but not their name, you can do a reverse EIN lookup just as easily as you can look up a company’s EIN.

Remember to keep your business EIN private unless the IRS or a financial institution is asking for it. Just like you wouldn’t share your Social Security Number with just anyone, avoid sharing your EIN with someone you don’t trust.

Contact The Irs To Find Your Ein

If you can’t find your EIN on any of your documents, you can contact the IRS, but you’ll need to call them Monday through Friday between 7 a.m. and 7 p.m. local time.

If your EIN has changed recently, and your EIN is probably different on older documents, this should be your first option. Be sure that the person contacting the IRS is authorized to do so, such as a sole proprietor, partner in a partnership or corporate officer.

Recommended Reading: Pastyeartax.com Reviews

What Is A Cra Business Number

Your business will be given a business number by the CRA if you:

- Incorporate it federally

- Register for any CRA program accounts, such as paying the GST or HST

- Register or incorporate it with any of these provinces: Alberta, British Columbia, Manitoba, Nova Scotia, New Brunswick, Ontario, Prince Edward Island, and Saskatchewan

- Register it using Business Registration Online

The business number is supposed to allow for the easy identification of a business at all levels of government. It also prevents confusion of entities that have the same or similar names.

Acronym: BN

The province of Quebec has a different system for identifying businesses. Registraire des entreprises Québec assigns 10-digit Québec enterprise numbers. And Revenu Québec handles payment of the GST and HST.

Why You Should Get A Tax Id Number Now

Even if youâre donât need a tax ID number to file your taxes now , itâs in your best interest to get one as soon as you go into business. Your best bet is to apply for an EIN.

Why the rush? Getting an EIN is free, and doesnât take much time or effort. It gives you the freedom to grow your business in the future. When you eventually decide itâs time to open a business bank account, hire employees, or restructure your business, youâre all set. Getting a tax ID number now will save you a step later on, when your hands are full helping your business grow.

Need help setting up an ITIN? Let BenchTax take care of the crucial stuff. A tax expert will handle the heavy lifting, so you can focus on your business. Learn More.

Don’t Miss: Harris County Property Tax Protest Services

How To Change Or Cancel An Ein

Once you obtain an EIN for your business, that tax ID remains with your business for its entire lifespan. However, there are some situations where you might need a new business tax ID number.

Here’s when you’ll need to apply for a new EIN:

-

You incorporate for the first time or change your business entity

-

You buy an existing business or inherit a business

-

Your business becomes a subsidiary of another company

-

You are a sole proprietor and are subject to a bankruptcy proceeding

-

You are a sole proprietor and establish a retirement, profit sharing, or pension plan

-

You receive a new charter from your state’s Secretary of State

-

There are changes to your ownership structure

The IRS has a detailed list of situations where you need a new EIN. A new EIN replaces your old EIN, so once you get the new tax ID, you would use that on tax returns and other business paperwork moving forward.

Note that more common changes, such as changes to your business name or address, generally don’t require a new EIN. But you should still report a business name change or location change to the IRS.

Discover The Steps Involved In Getting A Federal Tax Id Number For Your New Business And How This Asset Helps Simplify A Range Of Financial Processes From Paying Employees To Filing Taxes Presented By Chase For Business

Getting a federal tax identification number is an important first step when you start your business.

According to the IRS, a federal tax ID number is used to identify a business. There are many reasons why a business may need one, including paying employees, claiming benefits and filing and paying taxes.

Heres how to figure out if you need a federal tax ID number, how to apply for one and when your business should use it.

You May Like: Can Home Improvement Be Tax Deductible

Other Cra Program Accounts

A business that files information returns, such as tax free savings account , T5, T5013 and more, may also need the following business account:

Very few businesses need other CRA program accounts such as:

- Fuel Charge , for businesses that need to include a fuel charge on products

- Excise duty , for businesses that need to charge excise duty on products

Itin As Tax Id Number

If you arenât eligible for an SSN, the IRS may provide you with an ITIN instead.

Typically, you can get an ITIN if youâre:

- a non-resident alien

- the dependent or spouse of a U.S. citizen or resident alien

- the dependent or spouse of a non-alien visa holder

You can only use an ITIN for tax reporting purposes. ITINs canât be used to:

- gain authorization to work in the United States

- receive social security benefits

- qualify a dependent for an Earned Income Tax Credit

How to get an ITIN

To get an ITIN, you need to submit IRS Form W-7, Application for IRS Individual Taxpayer Identification Number.

On Form W-7, you must provide:

- current name and birth name

- birthdate

- place of birth

- ID documents such as your passport, driverâs license or state-issued ID

- foreign status or immigration documents

You can submit Form W-7 in person or by mail. The IRS provides in-person locations and mailing addresses.

Using your ITIN as a tax ID number

While you can use your ITIN to file taxes for your sole proprietorship or LLC, we recommend getting an EIN. You donât need to be a U.S. citizen to get an EIN, and it can benefit you down the line as your business expands.

Also Check: How To Get Tax Preparer License

Frequently Asked Questions: Ein Number Lookup

Do I need an EIN if Im self-employed?

You dont need an EIN if youre self-employed you can simply use your Social Security number. Some people who are self-employed choose to apply for an EIN instead of using their Social Security number to reduce the risk of identity theft its less likely for someone to break into your accounts when you keep business finances and personal finances separate.

I have a sole proprietorship with a DBA . Do I Need an EIN?

Having a DBA doesnt impact whether or not you are required to have an EIN for your sole proprietorship. The same rules apply to a sole proprietorship with a DBA as apply to a sole proprietorship without a DBA.

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

Is there a difference between an EIN and a TIN?

No, there isn’t a difference between an Employer Identification Number and a Taxpayer Identification Number . Both refer to the nine-digit number issued by the IRS to identify your business.

Is there a difference between an EIN and a FEIN?

No, there is not a difference between an EIN and a Federal Employer Identification Number . A FEIN can also be referred to as a Federal Tax Identification Number.

When Does A Sole Proprietorship Need An Ein

A sole proprietor normally uses their own personal social security number for their business but even they must obtain an EIN to hire employees or files excise taxes. Learn more in our Does a Sole Proprietor Need an EIN guide.

Single-member LLCs should also generally obtain an EIN number and operate using their EIN number in order to maintain their corporate veil.

Recommended Reading: 1040paytax.com Safe

Minnesota Unemployment Insurance Employer Account Number

All business entities, other than sole proprietorships, single member limited liability companies, partnerships without employees or corporations and limited liability companies with no employees other than owner/officers with 25 percent or more ownership share, must register with the Department of Employment and Economic Development, Unemployment Insurance Program.

The Unemployment Insurance Program issues identification numbers that are different from those issued by the Minnesota Department of Revenue and the Internal Revenue Service. Register at Employers and Agents. Employers may contact the Unemployment Insurance Program at 651-296-6141, option 4. The UI Program requests that businesses not register for a UI Employer account number until wages have actually been paid.

Retreiving A Lost Tin Or Ein

If you have lost your documents establishing your TIN or EIN, you can retrieve your number from the IRS. You’ll need to call its toll-free customer service number, 800-829-1040, and get the help of an IRS representative, who will take steps to identify you before discussing confidential information.

You May Like: Is Past Year Tax Legit

How Do I Recover A Lost Ein

Companies will keep the same EIN so long as their firm is open unless they reorganize and apply for a new number. You can recover a misplaced or lost EIN by looking up the number on your computer-generated IRS notice associated with the ID number assignment.

If you are unable to use that original paperwork, contact your bank or credit union. These institutions keep your company’s EIN on file with the rest of your account information.

If these options are unavailable, you can contact the IRS Business and Specialty Tax Line. You’ll need to provide personal information in order to confirm your identity before the department will provide the EIN.

If you need help understanding how to find a state tax ID number for a company, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees