Pricing Methods Used By Tax Preparers

You can ask up front how the firm determines its prices if you’re comparing tax professionals or accountants. Ask for an estimate of what their services might cost you, although you probably won’t get an answerat least not a firm, definitive oneuntil you’ve met with the professional and they have a firm grasp of your tax issues.

Some accountants offer free consultations, so you might get an answer at the end of this initial meeting.

Otherwise, the firm would have to base its number on your personal summary of your situation, and this might or might not provide an accurate picture of your tax situation. After all, you probably wouldn’t be seeking a professional’s services if you were exceptionally savvy about tax matters.

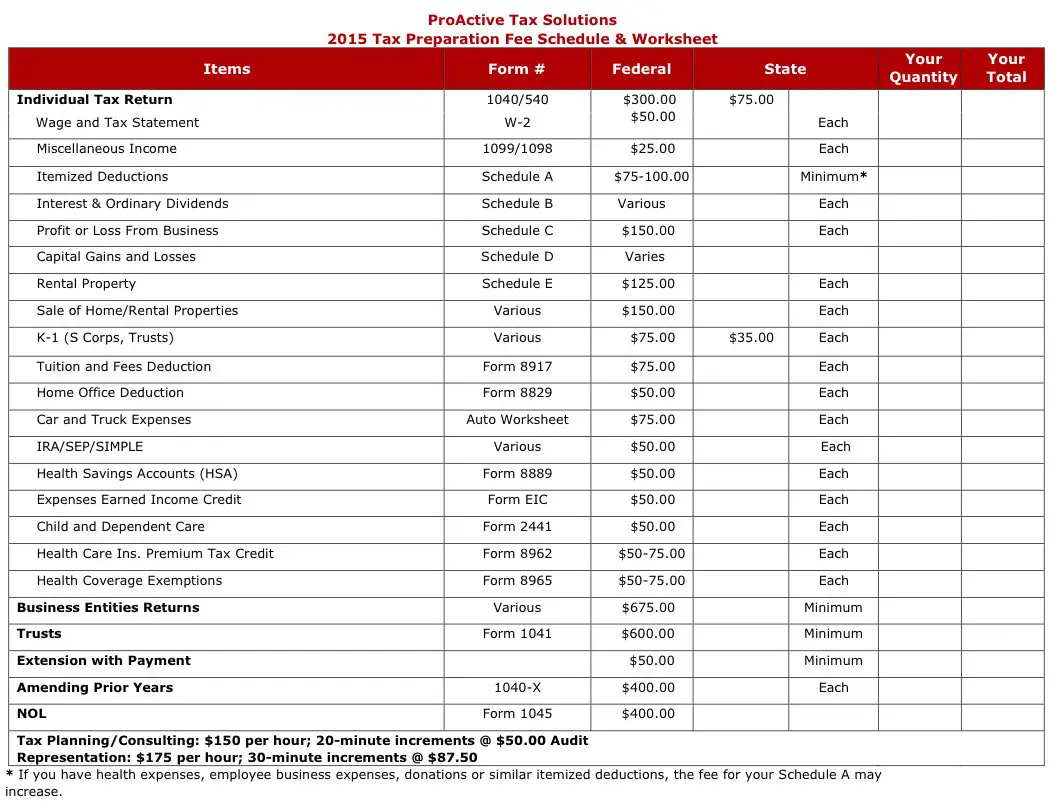

Some of the methods used by tax professionals to set prices include:

- A set fee for each tax form or schedule

- A fee based on last year’s fee plus an additional fee for any changes in a client’s tax situation

- A minimum tax return fee, plus an additional fee based on the complexity of the client’s situation

- A value-based fee based on the subjective value of the tax preparation service

- An hourly rate for time spent preparing the tax return and accompanying forms and schedules

- A set fee for each item of data entry

How To Amend A Tax Return: Step By Step

If a taxpayer does need to amend a tax return, the taxpayer must file Form 1040X and include documents to back up the changes on the amendment. These could include forms, schedules, statements, receipts or worksheets.

Then, the taxpayer must mail the 1040X to the IRS, with payment if required. If the IRS owes the taxpayer a refund, it will send the refund in about 8 to 12 weeks.

File A Superseding Return If The Filing Deadline Hasn’t Passed

What if you just filed a tax return and then discovered a mistake the very next day. If the filing deadline, including extensions, hasn’t passed, then you don’t want to file an amended return. Instead, you can file what’s called a “superseding return.” Basically, if you file a second return before the filing deadline, the second return “supersedes” the first return and is treated as the original return.

A superseding return must be filed on a paper Form 1040 e-filing is not allowed. We also recommend writing “Superseding Return” at the top of the form.

Since 2019 tax returns aren’t due until July 15, 2020 , there’s still time to file a superseding return this year. Say, for example, you filed a 2019 return back in February and, instead of getting a refund, elected to apply your overpayment against your 2020 tax liability. But then you lost your job in April because of the coronavirus pandemic and now wish you were getting a refund. If you file a superseding return before July 15, you can get the refund this year. It might take a while before the IRS is able to process your superseding return, since they’re behind on tackling paper returns, but at least you won’t have to wait until next year to benefit from the overpayment.

Read Also: Turbo Tax 1099q

Benefits Of Hiring A Professional To Do Your Taxes

There are many benefits to working with a professional tax preparer, such as:

- Peace of mind: Knowing that a trained professional is working on your taxes can be a source of stress relief.

- Support: If you are audited, your preparer should work with you on reviewing the return that was filed and assisting in any corrections or explanations.

- Maximized refunds, deductions and credits: The professionals understand the tax code and are familiar with what credits you can claim.

- Answers to your questions: When you file on your own, you are left to find the answers on your own. Working with a CPA, enrolled agent or another experienced tax preparation expert allows you to tap into their knowledge.

What Are Tax Preparers

A tax preparer is someone who will prepare, calculate and file your taxes. In some cases, the preparer can represent you if youre facing an audit or if other problems arise. Some have a strong accounting background, while others may be very familiar with the law.

In short, a person who prepares taxes can have different roles and be known by different titles, such as:

Also Check: Buying Tax Liens California

How Qualified Do You Want Your Professional To Be

The average tax preparer will charge less than a high-quality advisor with loads of experience. But when it comes to the IRS and your money, the stakes can be high, depending on your specific situation.

Now, dont get us wrong. We want you to save money just as much as you do. But when hiring expertslike tax pros, doctors and mechanicswere all for spending more cash to get the job done right. Paying an extra $100300 on the front end may be worth it in the long run if the expert is thorough, accurate and ends up saving you a ton. Remember, were talking about estimates here, so adjust your professional expectations accordingly.

Pay Any Tax Owed Right Away

It’s nice if amending your return results in a refund, but, unfortunately, that’s not always the case. If you owe the government money as a result of filing an amended return, pay the tax right away to avoid additional interest and penalties.

You can pretty much count on paying some interest, since the IRS charges interest on any taxes not paid by the due date. But you can minimize the amount of interest you’ll be charged by paying the tax owed quickly. The interest rate changes on a quarterly basis .

You’ll also pay a penalty if you don’t pay any tax due within 21 calendar days of the date of the IRS’s request for payment . The penalty is usually equal to 0.5% of the unpaid amount for each month or part of a month that the tax isn’t paid. However, the IRS might waive the penalty if you have a good reason for not paying your tax on time.

There are several ways to pay any tax due. You can pay online or by phone, mobile device, cash, check, or money order . If you can’t pay the full amount right away, the IRS recommends asking for an installment agreement that will allow you to make monthly payments. You’ll still pay interest and penalties, and probably a fee to set up the agreement. Other, potentially less costly alternatives include bank loans or credit card payments.

Also Check: Taxes For Doordash

To Itemize Or Not To Itemize

You might not have to torture yourself over the decision between itemizing and claiming the standard deduction. The Tax Cuts and Jobs Act effectively doubled the standard deduction for all filing statuses when it went into effect in 2018.

As of the 2020 tax yearthe return you would file in 2021you’d need more than $24,800 in itemized deductions to make itemizing worthwhile if you’re married and you file a joint tax return. You’d be taxed on $4,800 more in income if you itemized and have only $20,000 in itemized deductions. That’s not even to mention the additional tax prep fee.

The standard deductions for other filing statuses are $12,400 if you’re single or if you’re married and filing separately, and $18,650 if you qualify as head of household.

Where Do You Live

The fees for hiring a tax professional differ across the country. For instance, you can expect to pay more than average on the Pacific Coast and less in the good ol South.2

Here are the average tax preparation fees for an itemized 1040 with a Schedule A and state return in each region:

- New England : $285

- Middle Atlantic : $303

- South Atlantic : $339

- East South Central : $217

- West South Central : $313

- East North Central : $273

- West North Central : $267

- Mountain : $310

- Pacific : $4323

Youll notice all these averages are higher than the $220 mentioned above, but thats because many people who use a tax pro have more complicated situations than the standard 1040 can cover. Either way, expect a slight fluctuation in cost based on the quality of the pro, the region and your specific needs.

Recommended Reading: Www Aztaxes Net

How To File An Amended Tax Return

To file an amended return, you must submit a copy of your original tax return and any additional information related to the changes you made to the existing return. Its important to fix all errors on your tax return, even if it means that youll end up owing money to the IRS.

Here are situations for filing an amended return:

Incorrect Personal Information

Social Security numbers or the previous tax return sometimes call for an amendment.

Wrong Tax Filing Status

You may have filed as head of the household but dont qualify as such.

Wrong Number of Dependents

One of the reasons to amend tax return is a wrongfully listed number of dependents, especially if it affects the number of tax breaks, such as the Child Tax Credit, Earned Income Tax Credit , or the Health Coverage Tax Credit .

Forgotten or Wrongly Reported Income

Additional income also has to be reported. In case youve forgotten, for example, dividend income, you need to refile federal tax to avoid fines and penalties. You should also know that cryptocurrencies are taxable property and must be reported. If you have cryptocurrencies, it might be advantageous to use great crypto tax software to help you report them on your return.

Incorrect Tax Form

Individuals sometimes file their taxes on the wrong formthis needs to be rectified by filing the correct form.

Forgotten Deductions or Credits

Why Should I Buy Turbotax Online

TurboTax is one of the easiest to use tax softwares on the market to date. The login process is quick and easy, and if you lose your login information, you can quickly retrieve it.

Assistance is available whenever you need it, and TurboTax never confuses you with complex tax jargon.

As soon as TurboTax becomes available, it will begin accepting tax returns early and then will submit the returns when the IRS system opens. Which means you get your tax refund as soon as possible.

When you use Turbo Tax online, you do not have to meet numerous system requirements. You have the ability to prepare and file your taxes from any location as long as you have an Internet-enabled device. You also do not have to worry about updating.

You can be confident knowing that this software will catch your errors, and even if they dont alert you of all of them, they will be fixed automatically. Furthermore, before you file your return, and as an extra layer of security, TurboTax runs and error and audit risk scan.

TurboTax Online finds all the deductions and credits you are entitled to for the largest possible refund. Its the most complete free tax filing solution for everyone. Start free now or sign into your TurboTax Account.

Recommended Reading: How To Appeal Property Taxes Cook County

How To Amend A Tax Return: Step

Amended tax returns are filed to rectify mistakes on previously filed taxes. Amending a tax return is not a complicated process, but you need to be careful not to miss anything when filing for an amendment. But if you go through all the required steps the first time you file for an amendment, youll have no additional responsibilities regarding the amendment process, and you wont have to refile tax returns.

Can I Amend My Tax Return

You forgot to declare the money you earned from your side gig on your annual tax return. This could be an honest mistake, of course. But what will happen next? Will the IRS come after you?

Fortunately, the government knows that to err is only human, especially when filing your taxes. That’s why the IRS allows taxpayers to make any changes to their tax returns by submitting an amendment.

This article will discuss amending your tax returns as well as when and how you should do it.

Also Check: Www.myillinoistax

When To File An Amended Return

You should file an amended return to report an error, omission or change on a return that has already been filed, whether increasing or decreasing the amount of tax.

For Personal Income Tax, if you were assessed a Health Care Penalty and had health insurance, file an amended return and be sure to include a complete and accurate Schedule HC. If you’re claiming an exemption or requesting an appeal due to a hardship or other circumstances, make sure to indicate that on the schedule.

Consent To Extend The Time To Act On An Amended Return Treated As An Application For Abatement

In certain instances, an amended return showing a reduction of tax may be treated by DOR as an application for abatement. Under such circumstances, when you file your amended return, you give your consent for the Commissioner of Revenue to act upon the abatement application after six months from the date of filing. See TIR 16-11.

If you dont wish to grant us additional time beyond the statutory six-month period, or if the statutory period has passed and you want to withdraw your consent, you must tell us in writing that you wish to withdraw your consent to allow DOR additional time for review of your application for abatement. Be sure to include information such as:

- Your name

- The taxpayers name

- The Letter ID from the notice you received from us and

- A phone number or email address

Fax your statement to 626-3349, Attention: Office of Appeals, or mail it toDepartment of Revenue

Don’t Miss: 1040paytax.com Official Site

How Long Do You Have To File An Amended Return

- If you or the IRS changes your federal return, you must file an amended Virginia return within one year of the final IRS determination.

- If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.

Interest on any amount due will still accrue from the original due date, so file the corrected return as soon as you can.

If Changes to Your Return Result in a Refund

We can only issue a refund if the amended return is filed within:

Reasons You Need To File An Amended Virginia Income Tax Return

Changes to Your Federal Return

If you or the IRS changes your federal return, youre required to fix or correct your Virginia return to reflect the changes on your federal return within one year of the final determination date of the federal change.

IRS CP2000 Notices & Federal Tax Adjustments

The IRS reports changes to federal returns to Virginia Tax. However, this can happen years after you receive your IRS notice, and interest will continue to accrue on any additional balance due starting from the original due date. To avoid additional interest on any tax due, file your amended Virginia return as soon as you are notified of a change to your federal income tax return by the IRS – dont wait for us to notify you.

You have one year from the resolution of your federal audit to file an amended Virginia return. If you dont file an amended return, or notify us in writing of IRS audit results, we can adjust your return based on the IRS audit findings at any time in the future, which may result in additional tax and interest.

If youre not sure if you need to file an amended Virginia tax return, give us a call.

Changes to Another States Return Affecting Your Virginia Return

If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.

Correcting an Error

Don’t Miss: Harris County Property Tax Protest Services

List The Reasons For Filing The Amendment On The Form

- Additional schedules and forms: In some cases, when filing for an amendment, you must use Form 8949 to report incomefromsales and exchanges of capital assets that you previously forgot to include on your return. Schedule D often accompanies this form, which is used to report capital gains or losses.

- Filling out Form 1040X: The form has three columns: column A, column B, and column C. In column A, the number from the original tax return is entered, while the amended number is entered in column C. The difference between the two columns is recorded in column B, resulting in a balance due, tax refund, or no tax change.

If youre unsure as to how to amend taxes already filed, the 1040X form comes with instructions that guide you through the process of filling out the form and exactly where to send it. The taxpayer also needs to list all the changes made to the return. The year for which you are amending the return also needs to be prominently featured on the form. How far back can you amend tax returns? Three years.

They Charge An Hourly Rate

If your tax advisor charges by the hour, make sure you find out how much they charge and how much time they expect to spend on your taxes. Usually, a tax pro will charge an hourly fee between $100200 per hour, depending on what kind of tax forms you need to file.6 If they can get your taxes done in less time, you wont get stuck with a high bill at the end.

Also Check: How To Report Ppp Loan Forgiveness On Tax Return

Filing An Application For Abatement

Most taxpayers are able to file an application for abatement online with MassTaxConnect. Be sure to include all supporting documents so your request can be acted on as quickly as possible.

See Filing an appeal in MassTaxConnect for instructions on filing an application for abatement electronically.

Keep in mind that some taxpayers are required to file applications for abatement electronically.

Refer to TIR 16-9 to see if the electronic filing and payment requirements apply to you.

Filing electronically is always the quickest option but if you are not required to file electronically, you can mail a completed Form ABT.