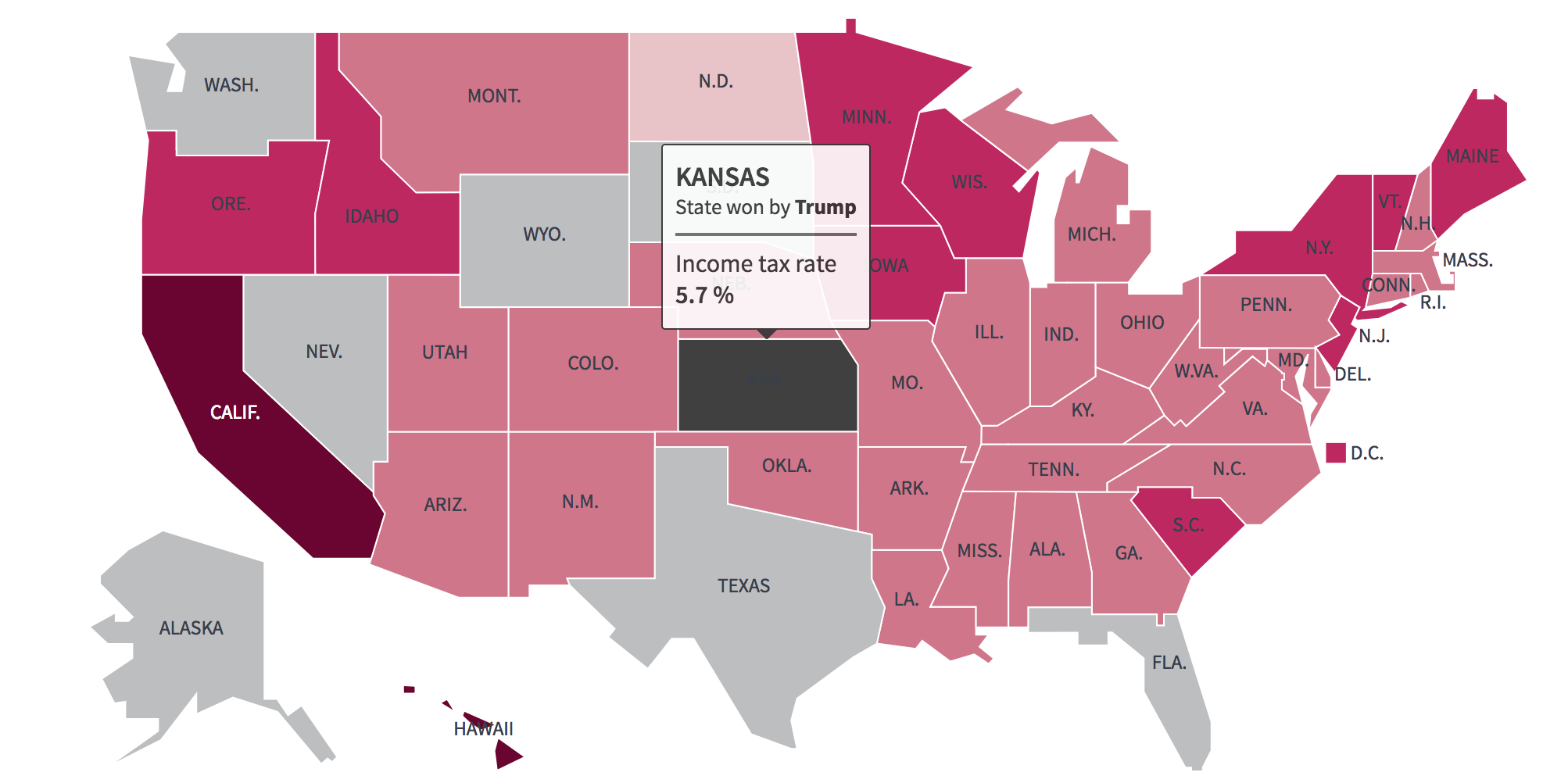

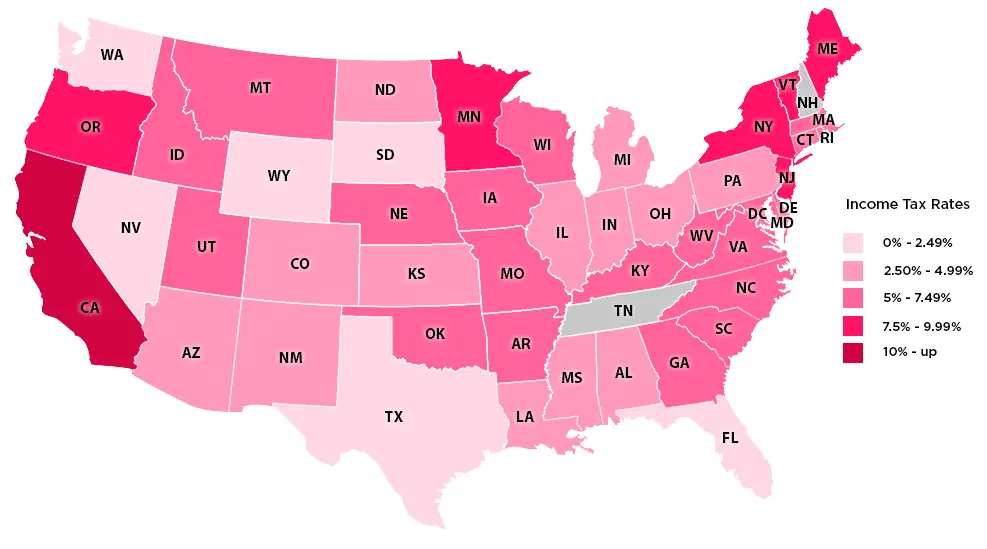

Top Income Tax Rates By State

Below, you’ll find the top 10 states with the highest income tax rates.

| State | |

|---|---|

| Wisconsin | 7.65% |

California tops the list with the highest income tax rates in the countryits highest tax rate is 12.3%, but it also implements an additional tax on those with income of $1 million or more, which makes its highest actual tax rate 13.3%. New Jersey and New York also implement this type of “millionaire’s tax.” Other states have a top tax rate, but not all states have the same number of income brackets leading up to the top rate. For example, Hawaii has a top tax rate of 11% and 12 income brackets, while Iowa has a top tax rate of 8,53% and nine income brackets. And of course, Washington, D.C. is not a state, but it has its own income tax rate.

Ready To Move To A Tax

If youre tired of paying high taxes, consider moving to one of these tax-friendly states listed above. For more information about cities within these tax-friendly states, check Moving.coms City Profile Report feature. Our reports include city demographics, real estate information, quality of life factors and more. Simply enter the zip code or the state and city of your potential move to get a free report at the click of a button. For help finding and booking the best moving company, check Moving.coms extensive network of reputable and reliable interstate movers. Best of luck and happy moving!

The Effect On Your Federal Tax Return

It used to be that you could claim a tax deduction for state income taxes you paid if you itemized on your federal return, and you can still do that … sort of. The Tax Cuts and Jobs Act capped this deduction at $10,000 when it went into effect in 2018, and this $10,000 limit includes property taxes as well.

Those who don’t have to pay income tax might be able to deduct most or all of their property taxes on their federal returns.

Read Also: Pastyeartax.com Review

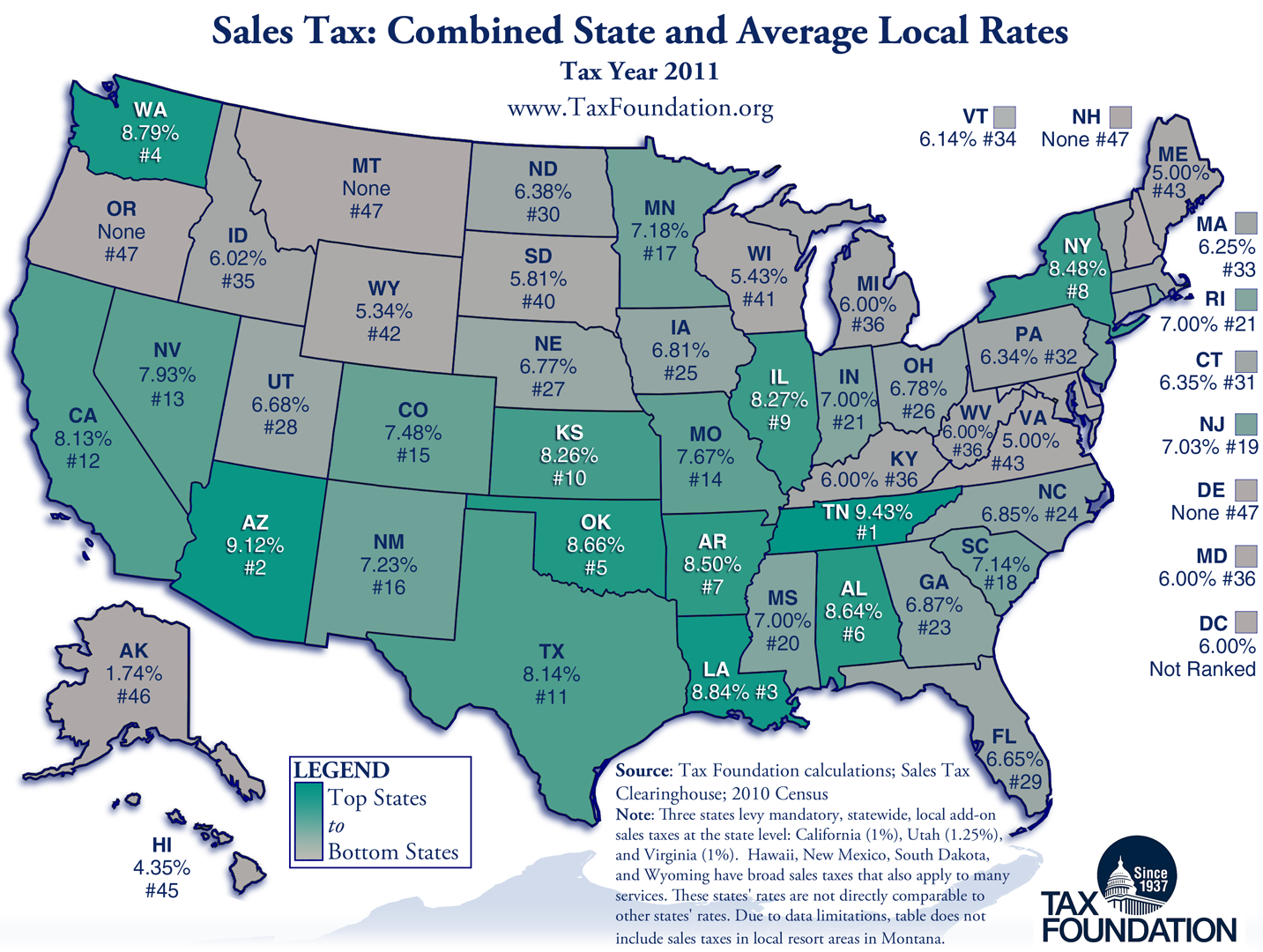

Which State Has The Lowest Sales Tax

Sales tax is one of the top sources of revenue for most of US states. It is a direct tax imposed by the state government on purchased goods and services. The rate of sales tax paid is calculated as a percentage of the sales price. As of 2015, 45 US states charge sales tax. States may exempt certain goods such as prescriptions drugs and some food items from sales tax. In fact, out of all the states, only Illinois charges sales tax on prescription drugs. The rate of sales tax differ from state to state. Also, the rate of sales tax may differ from county to county within a state since the local government allows for local taxes.

Combined Sales And Income Tax Leaders

The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Its 2019 State and Local Tax Burden Rankings study reported that Americans paid an average rate of 9.9% in state and local taxes.

According to the foundation, the top five states with the highest state and local tax combinations are:

- New York 12.7%

- Illinois 11.0%

- California and Wisconsin 11.0%

The same states have ranked as the top three consistently since 2005, according to the foundation.

Although taxes may not be the first thing you consider when deciding where to live, knowing the tax situations of the locations you’re considering for a move could help you save in the long-run, especially when retiring.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Recommended Reading: Property Tax Protest Harris County

Analysis Shows Population Growth In Lower Tax States

For many, the pandemic has altered their perceptions about where they want to live and where they can live. Millions of city-weary residents aching for more space have moved since the start of the pandemic.

Analysis of state tax burden rates and the change in population from 2019 to 2020 as estimated by the U.S. Census Bureau shows a negative correlation. The lower the state and local tax burden, the higher the population growth in 2020.

Four of the five states with an A grade in tax friendliness had population growth at or above the national average. The fifth state in the group with negative population growth was Alaska.

Of the states with an E grade, all three had population declines in 2020. Of the 9 states with a D grade, only one, New Hampshire, had population growth higher than the national average.

The included expert insights section on this page has advice on how to manage moving and taxes.

States With The Lowest Average Effective Property Tax Rates In 2022

Property taxes are determined at a local level, not the state level, so different communities in a state can have different property tax costs. To get the bigger, statewide picture of each states property tax costs, we looked at its average effective property tax rate which is based on the average cost of owner-occupied residential property taxes paid across all communities.

Credit Karma found this data in the U.S. Census Bureaus 2020 American Community Survey.

Note that theres a tie for third and fifth place for states with the lowest average effective property tax rates.

| Rank | Avg. effective property tax rate |

|---|---|

| 1 | |

| South Carolina | 0.566% |

Hawaii is the real surprise on this list because it typically ranks as a pretty expensive state, especially in terms of the cost of property. In our study on the cheapest states to live in, Hawaii came in as the most expensive state for average Zillow home value, average rent and cost of living.

The state with the highest average effective property rate is New Jersey at 2.47%, followed by Illinois at 2.24% and Connecticut at 2.13%.

The map that follows shows the average effective property tax rate for each state, along with its rank. Theres a little cluster of higher average effective property tax rates in New England. Texas and Nebraska also make the list of top 10 most expensive states in terms of average property tax rates.

Read Also: Do You Pay Taxes On Doordash

Which States Don’t Tax Retirement Distributions

Twelve states do not tax retirement distributions. Illinois, Mississippi, and Pennsylvania don’t tax distributions from 401 plans, IRAs, or pensions. The remaining nine states are those that don’t levy a state tax at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Alabama and Hawaii also don’t tax pensions, but they do tax distributions from 401 plans and IRAs.

How Does Monaco Survive With No Taxes

All foreigners officially residing in Monaco and people with the Monegasque nationality can benefit from this zero personal income tax regime. The Principality of Monaco doesnt levy capital gains tax nor wealth tax. Inheritance tax and gift tax are payable, but only with regard to assets situated in Monaco.

Read Also: How Much Should I Set Aside For Taxes Doordash

What States Have The Highest Income Tax

Below are the 10 states with the highest state income tax rates in 2018:

- California: 1 to 13.3 percent

- Hawaii: 1.4 to 11 percent

- Oregon: 5 to 9.9 percent

- Minnesota: 5.35 to 9.85 percent

- Iowa: 0.36 to 8.98 percent

- New Jersey: 1.4 to 8.97 percent

- Vermont: 3.55 to 8.95 percent

- Washington, D.C.: 4 to 8.95 percent

- New York: 4 to 8.82 percent

- Wisconsin: 4 to 7.65 percent

States With No State Sales Tax

What is a sales tax? The U.S. Department of the Treasury defines a sales tax as a tax levied on the sale of goods and services. The three different types of sales tax include the vendor tax, the consumer tax and the combination vendor-consumer tax. Only five U.S. states do not have a sales tax. These five states are:

Although Alaska doesnt have a statewide sales tax, the state does allow localities to impose a local sales tax on residents. While most states do charge a statewide sales tax, not all of these tax rates are particularly high. According to data from The Tax Foundation, states with low state sales tax rates include Colorado , Georgia , Hawaii , Louisiana , Missouri , Alabama , Wyoming , New York , North Carolina , Oklahoma and South Dakota .

Of course, when considering sales tax, its important to keep in mind local sales tax rates as well. Combined with the state sales tax, these rates can quickly add up. According to data from The Tax Foundation, the five states with the highest average combined state and local sales tax rates are Tennessee and Arkansas , Louisiana , Washington , and Alabama . States with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .

Recommended Reading: What Home Improvement Expenses Are Tax Deductible

State & Local Tax Breakdown

All effective tax rates shown below were calculated as a percentage of the mean third quintile U.S. income of $63,218 and based on the characteristics of the Median U.S. Household*.

|

State |

|---|

| 15.01% |

*Assumes Median U.S. Household has an income equal to $63,218 owns a home valued at $217,500 owns a car valued at $25,295 and spends annually an amount equal to the spending of a household earning the median U.S. income.

How The 9 States With No Income Tax Stack Up

Americas largest state is also considered one of the most tax-friendly. When Alaska repealed its personal income tax in 1980, it began to tax companies involved in oil and gas production at high rates to generate revenue. The states mean effective property rate is 0.98%, and Alaskas overall state and local tax burden is 5.8%, the lowest in the nation. On the downside, Alaska is remote and expensive in other ways. U.S. News & World Report ranks Alaska an overall 47 out of 50 on its affordability list, making it the fourth-lowest ranking state in the country. Contributing factors include higher-than-average housing costs and a steep cost of living relative to median family incomes. Most residents can receive an annual stipend, the Alaska Permanent Fund Dividend, of up to $2,000, which might help offset some costs.

This southern state is a popular retreat for vacationers and retirees alike. Florida generates most of its revenue from state and local sales tax and tuition through state universities. This makes for an overall state and local tax burden of 8.8%. While cost of living might not be a deal-breaker for most people, Floridians may still have to contend with a competitive housing market and prices. U.S. News & World Report ranks the state at 41 out of 50 for housing affordability.

Note: State, local and property tax data come from tax policy nonprofit the Tax Foundation and is for the 2019 calendar year, the most recent year for available data.

Recommended Reading: How Do I Get A Pin To File My Taxes

Do People In States With The Highest Income Tax Rates Have The Highest Tax Burden

Not always. This is because your total tax liability depends on more than federal and state income tax. It also includes property tax, sales tax, and other local taxes.

For example, Texas levies no state income tax, but the statewide average property tax rate is 1.86 percent. This is the sixth-highest property tax rate of any state. Compare this with Louisiana, which has a state income tax rate of anywhere from 2 to 6 percent. But certain parishes pay no more than 0.25 percent in property tax. So you could end up paying more in total taxes in a low-tax state depending on other taxes imposed. You also have to consider any deductions that could reduce the tax you owe.

As a result, you shouldn’t decide where to work based on the states with the lowest and highest taxes. But it is one way to gauge the cost of working in a certain state versus another.

Is It Better To Live In A State With No Income Tax

At the end of the day, whether or not its better to live in a state with no income tax depends in part on your personal financial situation but there are other considerations as well. For example, quality of life and the lifestyle you choose to live are also important.

From a strictly financial standpoint, its important to remember that the amount you earn plays a large role in your tax situation. If youre a single taxpayer living in California and earning $1 million per year, for example, tax rates reach a whopping 13.3%. However, if you earn a low-to-moderate wage, tax rates are not that onerous, even in California. As with any financial question, theres no black-and-white answer to whether its preferential to live in a state with no income tax, as a number of personal factors come into play.

Don’t Miss: How To Do Taxes For Door Dash

The Percentage Of Students Receiving Personal Finance Education

When you graduated from high school, did you know how to create a budget? Did you have an understanding of what stocks and bonds were? Did you know how to do your own taxes?

For many Americans, the answer to these questions is probably a no. Only 22.7% of U.S. high school students are guaranteed to receive a personal finance education. While this is up from 16.4% in 2018, this still represents a small fraction of students.

This graphic uses data from Next Gen Personal Finance to show the percentage of high school students required to take a personal finance course by state.

States With The Lowest Property Taxes In 2022

When buying or selling property in a new state, its wise to consider how property taxes might fluctuate from one state to another. Especially for those looking to invest in multiple properties, understanding the states with the lowest property taxes can help optimize taxpayer obligations and allow investors to further expand their assets. In this article, well explore which of these states feature the most attractive property tax rates, which states have the highest property tax, as well as how those looking to purchase real estate can calculate these taxes.

Read Also: How Does Doordash Taxes Work

Who Sets Home Value

After looking at the example above, youre probably wondering who exactly determines why person A and person B in the example above paid what they did in property taxes last year. The entities that set home values in each state are tax assessors, and they are typically government agents who value your property every one to five years. They will look at other similar properties in your market and compare recent sales prices to determine your propertys value. Unique formulas are also involved, and as you might imagine, this involves a lot of complicated math.

These tax specialists look at numerous other factors unique to each state and properly calculate tax rates. It might be that Person Bs condo was located a short distance from a popular tourist attraction, or perhaps Person As home is valued at a higher value but local property taxes are considerably low for that area. You can expect your tax bill to go up if you add any value to your home, such as by adding a pool or building a second story. Most states offer an appeal process so that there is some recourse if you feel like your property value assessment is unfair or unreasonable.

States With The Highest Personal Income Tax Rates

A comparison of 2020 tax rates compiled by the Tax Foundation ranks California as the top taxer with a 12.3% rate, unless you make more than $1 million. Then, you have to pay 13.3% as the top rate. The additional tax on income earned above $1 million is the state’s 1% mental health services tax.

The top 10 highest income tax states for 2021 are:

Each of these states has a personal income tax floor, deductions, exemptions, credits, and varying definitions of taxable income that determine what a citizen actually pays.

Also Check: Plasma Donation Taxes

States With Flat Income Tax Rates

Rate information is gathered from various State Department of Revenue materials and various rate providers including Thomson Reuters and Vertex, Inc. The corporate tax component measures impacts of states major taxes on business activities, both corporate income and gross receipts taxes. State and local property tax laws also provide tax breaks for senior citizens that can dramatically change the apparent incidence of property taxes. The report includes the statewide general sales and use taxes levied by 45 states and the District of Columbia. The report also includes the local sales and use taxes currently levied by about two-thirds of the states. Where the base of these local taxes differs from the base of the state tax, the differences are reflected in our analysis.

What Are Property Taxes Used For

Now you may be thinking, if Im going to pay a lot of taxes as a property owner, I want to know where my tax dollars are going. Local governments predominantly use property tax dollars to fund public services. Although taxes can be expensive, you may find some reassurance knowing that your tax dollars are typically used to improve your local neighborhood, schools, parks, infrastructure, and amenities. These can help improve the attractiveness of your zip code, and thus help you bring in higher-paying tenants over time and improve your property value.

Here are some examples of where your property tax payments might go:

-

Building or improving public schools

-

Maintaining city parks and other green spaces

-

Help pay for museums, libraries, and other public amenities

-

Road construction and repair

-

Salaries and operational costs of emergency services

-

Local government services, administration, and infrastructure

Recommended Reading: Do You Get A 1099 From Doordash