How Much Does Assisted Tax Preparation Cost

This is the big question everyone has. Some believe that it isnt worth the cost. However, H& R Block gave an example of their costs. They said the average tax preparation fee was $225, including state filing fees. Yet the average IRS refund was $2,763.

But, as a rule, the more complex the tax situation, the more youre going to have to pay.

Someone who has no dependents, renting an apartment, and has a low income will have the easiest time filing taxes. Therefore they wont pay as much.

Someone who owns a home runs their own business, and has various investments will find it costs more to file through a professional. Therefore, in their case, its best to invest time into learning taxes, or even taking a tax preparer course, so that taxes can be done without assistance.

Do You Need To File A Tax Return

When you start a new job, you typically fill out a W-4 form. This form is used by employers and the IRS to estimate your withholding from each paycheck.

When you set up your withholding when first employed, the way you answer key questions can result in either an overpayment or an underpayment of taxes.

This is especially true if you do not change your withholding after major changes in your life, such as marrying, divorcing or having a child.

Many people work multiple jobs or bring in income on theside. This work can help fulfill a passion or make ends meet, but it can alsochange your tax responsibilities, and you may wind up owing more taxes.

To appropriately measure your tax burden each year, you need to file an income tax return, typically the IRS Form 1040. Completing your tax forms will help to determine if you will receive a refund or if you must make an additional payment and the specific amounts involved.

In many cases, you will also need to file a state income tax return, although the specific laws vary from state to state.

For the 2019 tax year, your tax return must be filed on or before April 15, 2020.

Tax Filing Assistance Options

If you fall within a certain income bracket or are a senior citizen, you may qualify for tax filing assistance. In 2021 and 2022, the Volunteer Income Tax Assistance provides free tax preparation services to people who earn $58,000 or less per year. In addition, if you are age 60 or older, you may qualify for free tax preparation services through Tax Counseling for the Elderly and the AARP Foundation’s Tax-Aide programs.

You May Like: Do Unemployment Benefits Get Taxed

Enroll In The Tax Course Today > > >

Naturally, returns for the low bracket individuals, because of their simplicity and of the relatively little skills required, bring lower fees.

On the other hand, because they can be handled quickly, preparing returns for lower income, lower fee taxpayers on a volume basis can be very profitable.

Serving higher income taxpayers and self-employed individuals, though the work is not really complicated, requires a greater amount of skill and obviously justifies higher fees. Moreover, these taxpayers often turn into a prolific source of additional fees by way of recommending new, similarly situated, clients as well as by their frequent need for additional tax services during the year. The typical tax practice grows at a yearly rate of 25 to 50 percent during the early years.

Many of our graduates find that the most satisfying challenging part of their business lies in serving these more lucrative types of clients but the National Tax Training School training program fully qualifies you to attract and serve all groups and classes of taxpayers.

Finance Management Made Simple

Finance Pal offers subscription-based pricing for small business finance services including tax preparation, planning, audit defense and consulting. Our dedicated accounting teams ensure your business finances are refined, strategized, and organized all year long. Not only does this help you prepare to file your business taxes, but it also helps you stay on top of your day-to-day finance services like payroll processing and budgeting.

Recommended Reading: How Do I Find Out Property Taxes

I’m No Stranger To Tax Errors

Not all tax preparers are created equal. I’ve had my own bad experience with a professional tax preparer. I brought her a shoebox full of my business receipts and got back a tax return that was wrong. She miscalculated my taxes, so I ended up sending a check to the IRS for tax I didn’t owe. That turned me off from so-called tax professionals until I met the excellent tax pro I work with now.

I’ve made my fair share of mistakes, too. The year I moved from Connecticut to California, I made a mistake on my taxes. I had worked at several different part-time jobs, so I had lots of W-2s to attach. When I totaled my income, I left out the amount from one of my W-2s . The error meant I underpaid my taxes. By the time the IRS informed me of the mistake three years later, I owed a heap of interest and penalties, plus the back taxes. That taught me the high cost of tax-filing errors.

I couldn’t afford help back then, so I went back to doing my own taxes, either manually or using software. I’m glad I had that experience. It helped me understand my business finances. I improved my record-keeping , so I’d be ready with income and expense data at tax time. If I had to prepare my own taxes today, I could. But I’m glad I don’t have to.

Should You Use Free Tax

The average cost of having a professional prepare a federal Form 1040 income tax return for the 2018-2019 tax season was nearly $200 for the simplest returns, according to the National Society of Accountants. And the more complex your tax situation, or the more forms you need to file, the higher the cost can run.

Lets look at how much it could cost to pay someone else to do your taxes, and what your options are if you choose to save money by going DIY.

Recommended Reading: Do Retired People File Taxes

How Much Does It Cost To Get Your Tax Return Prepared

Maybe youre looking for a new accountant, or maybe youre fresh out of college and have never had to file a tax return before. While price is an important consideration when choosing a tax advisor, its not the only factor that you need to keep in mind.

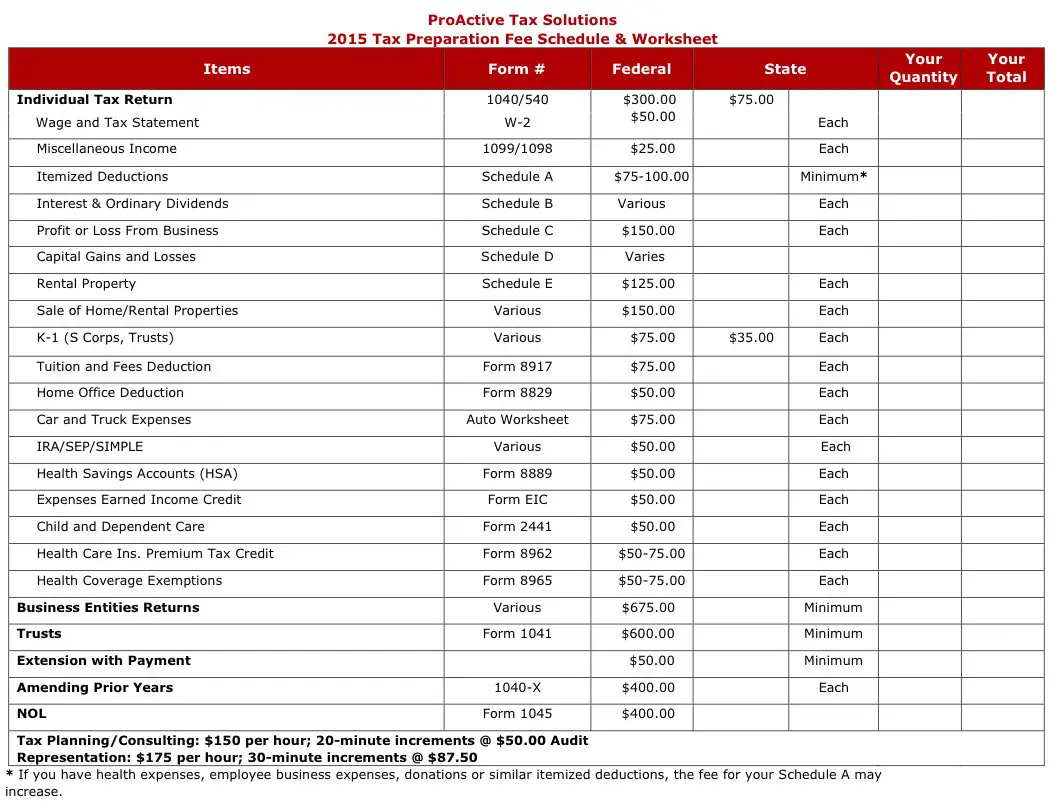

According to the 2016-2017 survey of members of the National Society of Accountants, the average cost for a 1040 with itemized deductions and a state return was $273. Adding a Schedule C for a home business increased the cost by $184, and a Schedule D to report the gains and losses of investments was an extra $124. For business returns. the average fee for a partnership return was $656, while an S-corp return was $809.

Keep in mind these are averages, and the National Association of Accountants includes a broad range of professionals, including Enrolled Agents, bookkeepers, and accountants without the CPA credential, so your fees may be quite different.

What factors impact tax preparation pricing?

The price you pay is impacted by many factors. Lets look at a few of them:

Credentials of the Preparer: Here in the U.S., no licensing or training is required for someone to call themselves a tax preparer. In general, when your preparer has more specialized training and professional credentials, you can expect to pay more. At the same time, hiring someone with professional credentials means that they have to adhere to the standards of their licensing organization, which protects you from unscrupulous and fraudulent preparers.

What Is A Tax Preparation Course

A tax preparation course will teach you how to prepare federal income taxes. You typically dont need any experience to take these courses except a high school education and basic math knowledge.

After completing a beginning tax preparation course, registering with the IRS as a tax return preparer, and receiving a preparer tax identification number , youll be ready to begin your career as a tax preparer.

Read Also: When Is The Last Day You Can File Your Taxes

Advisory Services Fine Print

A la CarteA la Carte fee ranges are approximates. 85% of our clients fit into these fee ranges, but there are outliers. We have a handful of clients with over 30 rentals their individual tax return is north of $3,000. We also are assuming one state if your business spans the galaxy then additional fees will be discussed with you prior to payroll setup or tax preparation. Typically each state is around $250 to $350 for tax preparation since it affects both your business and individual tax returns .

Prorated FeesSome more things to consider- when a partial year remains, our usual annual fee is pro-rated to not charge you for services you didnt use . However, a large chunk of our annual fee is tax preparation which is typically a built-in fixed amount of $2,000 . Whether we onboard you in January, July or December, we have to prepare a full year tax return. This increases the monthly fee for the remaining months of 2022 but the monthly fee will later decrease in January of 2023 to reflect the amounts above. Yeah, we make it sound like 2023 is just around the corner.

Tax ReturnsYou can prepare your own individual tax return as well but the benefit WCG preparing both individual and business tax returns is that we slide things around depending on income limitations, phaseouts, alternative minimum tax , Section 199A deduction optimization, pass-through entity tax deductions , etc. Having our arms around both can yield some good tax savings!

Tax Attorney Or Lawyer

After completing their education and passing a state exam, attorneys may choose to specialize in different areas, including tax preparation and filing. A tax attorney may be especially helpful when there are complicated cases or you suspect you may need to legally defend yourself against the IRS or state tax department.

Don’t Miss: How Much Do You Make To Have To File Taxes

How Qualified Do You Want Your Professional To Be

The average tax preparer will charge less than a high-quality advisor with loads of experience. But when it comes to the IRS and your money, the stakes can be high, depending on your specific situation.

Now, dont get us wrong. We want you to save money just as much as you do. But when hiring expertslike tax pros, doctors and mechanicswere all for spending more cash to get the job done right. Paying an extra $100300 on the front end may be worth it in the long run if the expert is thorough, accurate and ends up saving you a ton. Remember, were talking about estimates here, so adjust your professional expectations accordingly.

How Do Tax Preparers Set Their Prices

Some professionals have hourly fees, set fees or minimum fees based on how complex your income tax return is.

Whether you will be charged hourly or pay a set fee depends on your preparer. Some professionals will charge you a flat fee for each specific form they must file for you, and they should give you the rates for those forms ahead of time. Other preparers will talk to you and get an idea of what they think filing your taxes will require and provide you with a set fee upfront.

Finally, some tax preparers will give you an hourly rate and charge you for each hour they used in preparing, calculating and filing your taxes. Here are the average hourly rates for individual tax preparation services:

You May Like: What Is The Corporate Tax Rate

What Does A Tax Preparer Need To Prepare Tax Returns

Tax preparers need to efficiently and securely access and manage confidential information for their clients. As a result, most preparers look for software to manage their workflow effectively and efficiently.

Tax software should help preparers in the following ways:

- Learn. You cant know everything. There will always be knowledge gaps and questions from clients that you didnt anticipate. Professional tax software should increase your know-how, the ability to fill knowledge gaps with trusted and meaningful information for your daily work. Something to unstuck you when you dont know how to proceed.

- Research. Every client is different. And that means every answer you provide will need to be tailored to their specific questions and concerns. A tax research software solution can help get the answers when you need to go deeper and retrieve more information.

- Operate. Tax preparation requires a significant amount of day-to-day organization. You need tools to do the work and produce all the necessary forms. From document management solutions to e-filing assistance, tax software should make your operational duties easier, more productive, to do your job with confidence every time.

How Much Does It Cost To File Taxes

The cost of hiring a CPA depends on a number of factors, including the forms being filed, their level of experience, and the state in which youre filing. Some CPAs bill hourly, per form, or according to the service being provided. When looking at the cost of filing taxes only, it usually wont break the bank. And, hiring an accountant to prepare and file your business taxes can be counted as a business expense, and therefore count towards your tax deductions.

Recommended Reading: What Are The Income Tax Brackets

Best For Advanced: Advanced Tax Preparation By The National Tax Training School

National Tax Training School

Why We Chose It

For those experienced with preparing basic tax returns, the Advanced Tax Preparation course by National Tax Training School can teach tax pros how to prepare more complex tax returns. Plus, Enrolled Agent exam prep is included.

-

Learn how to prepare complex tax returns

-

Access to a tax expert mentor for a year

-

Job placement services arent provided

-

Can take a year to complete the program

If you know how to prepare basic tax returns and want to continue to advance in your career, the Advanced Tax Preparation course by National Tax Training School is a great option. Youll learn how to provide a full suite of tax services , and Enrolled Agent exam prep, which is typically offered as a separate program, is included.

This online course is self-paced. Its possible to complete it in a couple of months, but it could take a year. In addition to online materials, youll be given a hard copy to use as a reference guide and youll be assigned a course mentor who can support you with tax-related issues for up to a year.

Upon graduation, youll earn a certificate identifying you as a Professional Tax Consultant. If you want to become an Enrolled Agent, youll be ready to sit for the exam upon graduation. Getting licensed as an EA can be a great way to accelerate your tax preparation career.

How Do You Get A Refund

When you complete your income tax forms, you will determine the balance remaining. One of three things will happen:

- You might have an even account

- You could owe money to the IRS

If you do owe, you will generally need to submit the amount along with your filing. You may be able to work out a payment plan if necessary in future years, business owners and freelancers may be expected to pre-pay quarterly.

If you are owed a refund, most people choose to provide direct deposit information to receive their refund directly to their bank account, although you can also still receive a mailed check.

Make sure to keep a copy of your tax return after it isfiled. You may need to refer to it in case of any questions, and it can alsohelp to document your income and expenses. In addition, it can help you or yourtax professional to prepare future filings as well.

At Picnic Tax, our skilled online accountants help you to navigate the process of filing and paying your taxes. Their expertise can be particularly important when you have multiple streams of income and still want to maximize your refund. To learn more about how Picnic Tax can help you file your taxes in 2020, contact us today.

Recommended Reading: How To File Pa State Taxes

How To Do Your Taxes: A Step By Step Guide For 2021

When you work as an employee at a job with a regular paycheck, you will generally have taxes taken out before you ever receive your pay, and an income tax filing can help you get a refund and fulfill your responsibilities.

If youre new to filing your taxes in the United States, youmay be confused or uncertain about your next steps. Whether youre starting outin the working world, always had your taxes handled by your family or are newin the country, there is a lot to learn about your annual income tax filing.Here are some key tips that can guide you as you get ready to handle your taxfilings in 2020.

When you work as an employee at a job with a regular paycheck, you will generally have taxes taken out before you ever receive your pay, and an income tax filing can help you get a refund and fulfill your responsibilities.

On the other hand, if you run a business, work in the gig economy or freelance, you may need to pay some taxes for the 2019 year. In either case, keeping these things in mind can help to ensure your filings are complete, appropriate and provide the maximum savings you need.

Tax Software Can Get The Job Done For Most People

The IRS has a deal with tax software companies to provide basic tax preparation and filing for free. Through the IRS Free File program, people with an adjusted gross income of less than $72,000 a year can qualify for free help with their federal, and sometimes state, returns.

If you earn more than $72,000, you can use online forms from the IRS for free. The IRS forms are similar to preparing paper forms, but they will do the math for you. Or you can pay for tax software. Also, there are software options that are free for everyone with no income cap.

There are many different flavors of tax preparation software. The online interface for TurboTax, for example, has packages ranging from free federal tax filing up to $110, plus an additional charge of around $40 for state tax forms. Each tax platform has different strengths and weaknesses.

Tax software is easy to use. You fill out your return by answering a series of questions. The questions prompt you to look for income and deductions that you might have missed. You input the data, and the program performs the tax calculations. If you have questions, some of the services even provide helplines. Once you’ve completed your forms, you can easily e-file with the IRS.

If you want to prepare your own taxes using filing software, I recommend taking a couple of different online apps for a free test drive. Choose one that has all the forms you need plus an interface you feel comfortable with.

Recommended Reading: How Much Is Inheritance Tax In Nj