Why We Need A Corporate Income Tax

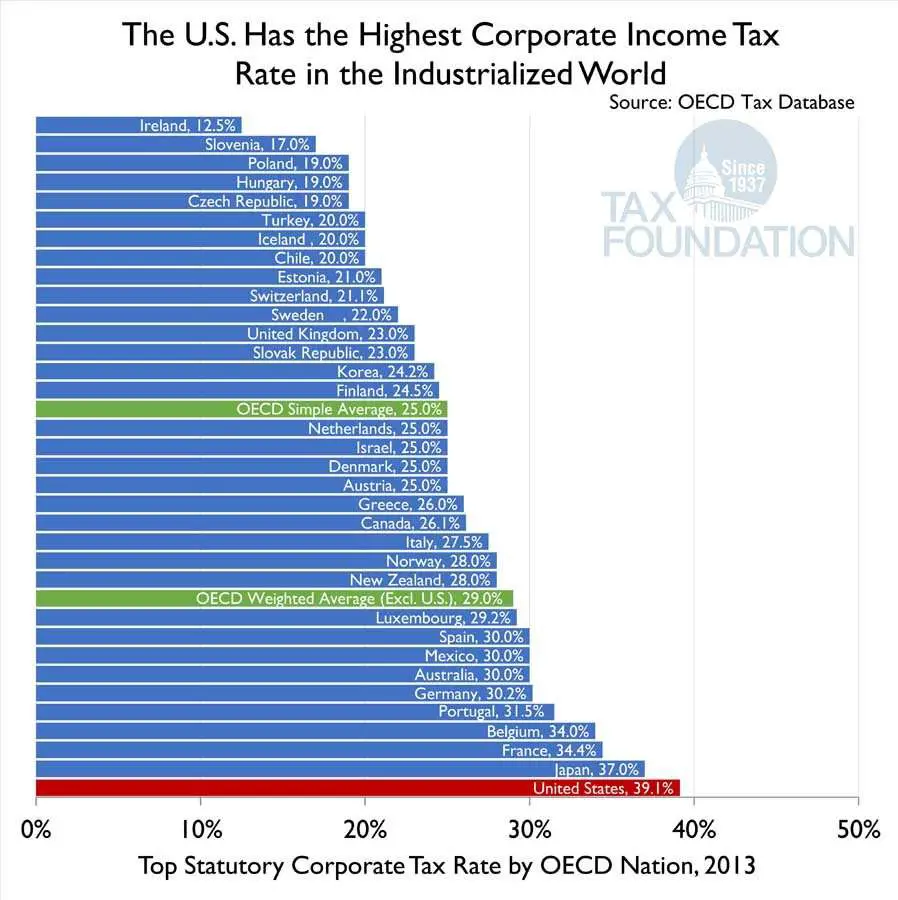

Corporate tax reform has been discussed with varying degrees of intensity since the advent of the corporate income tax in 1909. Over the past few years, there has been heated debate over the statutory corporate income-tax rate, which has stood at 35 percent since 1993. Many people point out that the statutory corporate tax rate is one of the highest in the industrialized world.1 Some, such as President Obama, advocate revenue-neutral corporate tax reform with a reduction in the statutory corporate tax rate and elimination or modification of corporate tax expenditures. Others argue for simple rate reduction or even outright elimination of the corporate income tax.

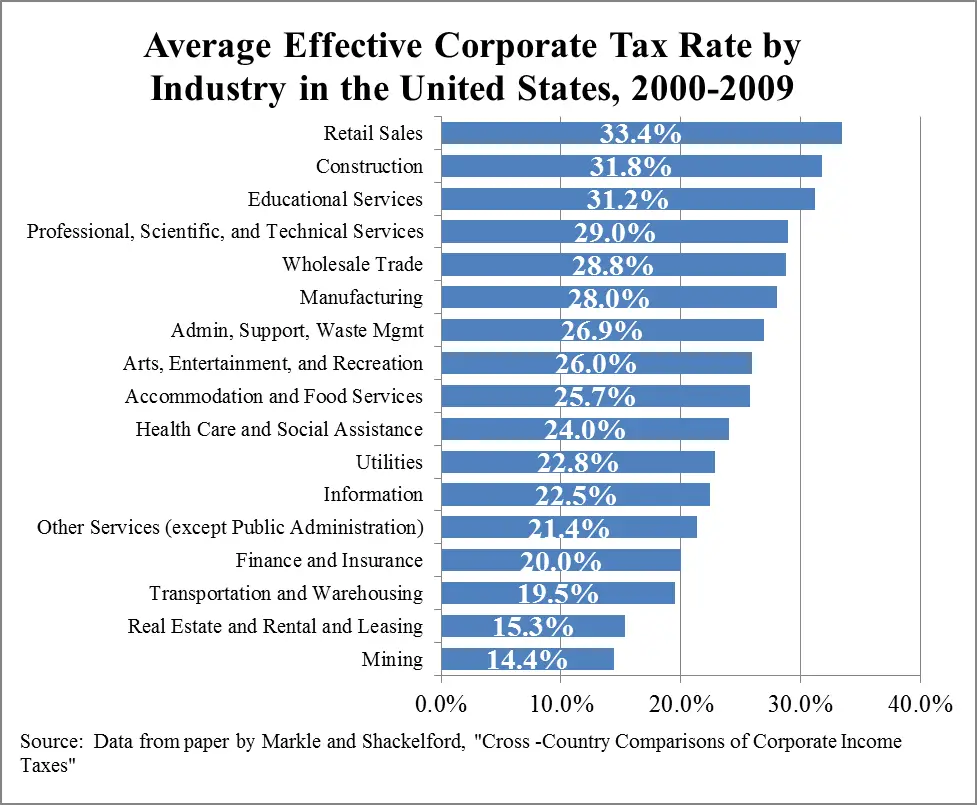

While the U.S. statutory corporate income-tax rate is generally higher than the tax rate in other advanced countries , the effective tax rate is about the same as in other OECD countries . For example, PricewaterhouseCoopers estimated that the U.S. effective corporate tax rate, averaged over 2006 to 2009, was 27.7 percent, while the average effective tax rate for 21 OECD countries was 23.5 percent.2 This OECD average, however, gives equal weight to the tax rates of all countries, large and small. If the tax rates are weighted by GDP, the average effective tax rate was 27.2 percent over the 20062009 period.

Federal Corporate Tax Rate

Currently, the federal corporate tax rate is set at 21%. Prior to the Tax Cuts and Jobs Act of 2017, the tax rate was 35%.

The corporate tax rate applies to your businesss taxable income, which is your revenue minus expenses.

Example

Lets say you have annual revenues of $250,000 and expenses of $55,000.You want to figure out how much you owe in federal taxes.

First, subtract your expenses from annual revenues:

$250,000 $55,000 = Taxable Income

Next, multiply the federal corporate tax rate of 21% by your taxable income:

$195,000 X 0.21 = $40,950

You would owe $40,950 in federal corporate taxes.

Impact On Countries That Rely On Corporate Tax For Fdi Job Creation

The G7 proposal has caused concern for countries that rely on corporate tax cuts to bolster their investment attractiveness. Irelands Finance Minister Paschal Donohoe admitted that the deal could have a very meaningful effect on corporate tax policy in Ireland. The countrys 12.5% corporate tax rate has helped attract numerous US multinational tech companies and according to IDA Ireland makes it one of the most attractive global investment locations.

In addition, countries such as the Netherlands, Luxembourg and Hong Kong that place corporate tax at the centre of their FDI proposition may be forced to reassess their strategy for appealing to investors.

Without these tax incentives, it can be argued that smaller, less-populated countries will be unable to compensate for the market size and resources enjoyed by larger, wealthier countries such as the US and China. Corporate tax is a tool to encourage FDI that every country can use whereas market size is generally determined by geographic size something that locations are largely powerless to change.

Recommended Reading: Do You Have To File Your Unemployment On Your Taxes

Income Tax Rates For Pass

The federal small business tax rate for pass-through entities and sole proprietorships is equal to the owners personal income tax rate. For the 2019 tax year, personal income tax rates range from 10% to 37% depending on income level and filing status. For example, a single filer who reports $100,000 in net business income will pay a 24% tax rate.

Its important to note, however, as of the 2018 tax year, sole proprietors and owners of pass-through entities can deduct up to 20% of their business income before their tax rate is calculated. In the above example, the tax filer could deduct up to $20,000 from the net business income. Then, theyd only have to report $80,000 in income, reducing their tax rate to 22%.

There are limits, however, on this small business tax deduction based on income and type of business. In general, you must earn less than $157,500 or $315,000 to qualify for the full deduction. Additionally, professional service businesses, such as law firms and doctors offices, typically cant claim the full deduction either.

Corporation Tax On Chargeable Gains

If you sell or dispose of a business asset, youll need to pay Corporation Tax on any profits .

When working out your chargeable gain, you can use Indexation Allowance Rates to reflect the increase in value of the asset between the time it was acquired and 31 December 2017. From 1 January 2018 Indexation Allowance is frozen. Where assets acquired before 1 January 2018 are disposed of on or after that date, the Indexation Allowance will be calculated using the Retail Prices Index or factor for December 2017, irrespective of the date of disposal of the asset.

Also Check: When Are Alabama State Taxes Due

Biggest Tax Avoiders Could Be Off The Hook

Experts have warned that some of the biggest tax-evading companies may escape the new rule due to a large loophole. In its current phase, the new deal would only apply to companies with a profit margin exceeding 10%, which could let some companies off the hook.

is the worlds largest online retailer, with a market cap of $1.8trn and sales of $386bn in 2020, a $106bn increase on 2019. However, its profit margin in 2020 was only 6.3% as its business model focuses on reinvesting heavily and gaining market share. In May 2021, it was revealed that the companys Luxembourg-based subsidiary paid zero corporation tax in 2020 despite recording a sales income of 44bn.

Coffee giant Starbucks could also be unaffected by the new deal due to its low profit margins . The US chain received £4.4m in tax credits from the UK government in 2020 due to temporary closures brought on by the pandemic despite its parent company making a $1.2bn profit during the same time.

However, several companies whose past tax practices have been widely criticised, such as Apple, which recorded a net profit margin of 20.9% in 2020, and LOreal , would fall under the remit of the proposal.

Base Erosion And Anti

P.L. 115-97 created a new US federal tax called the base erosion and anti-abuse tax’ . P.L. 115-97 targeted US tax-base erosion by imposing an additional corporate tax liability on corporations that, together with their affiliates, have average annual gross receipts for the three-year period ending with the preceding tax year of at least USD 500 million and that make certain base-eroding payments to related foreign persons during the tax year of 3% or more of all their deductible expenses apart from certain exceptions. The most notable of these exceptions are the NOL deduction, the new dividends received deduction for foreign-source dividends, the new deduction for foreign-derived intangible income and the deduction relating to the new category of global intangible low-taxed income , qualified derivative payments defined in the provision, and certain payments for services.

The BEAT is imposed to the extent that 10% of the taxpayers modified taxable income exceeds the taxpayers regular tax liability net of most tax credits. The above percentages are changed to 11% and 6%, respectively, for certain banks and securities dealers.

A base-eroding payment generally is any amount paid or accrued by the taxpayer to a related foreign person that is deductible or to acquire property subject to depreciation or amortisation, or for reinsurance payments. The category also includes certain payments by expatriated entities subject to the anti-inversion rules of Section 7874.

Read Also: Can You File Past Taxes On Turbotax

Advantages Of A Corporate Tax

Paying corporate taxes can be more beneficial for business owners than paying additional individual income tax. Corporate tax returns deduct medical insurance for families as well as fringe benefits, including retirement plans and tax-deferred trusts. It is easier for a corporation to deduct losses, too.

A corporation may deduct the entire amount of losses while a sole proprietor must provide evidence regarding the intent to earn a profit before the losses can be deducted. Finally, profit earned by a corporation may be left within the corporation, allowing for tax planning and potential future tax advantages.

Google Taxes Will Be Gone By The End Of The Year

Some nations, frustrated at the absence of any global consensus on corporation tax during the Trump administration, had decided to take local measures against at least some tax-dodging global corporations. Big Tech companies tend to come in for especially intense criticism on this front, for all that they are no more prone to international tax evasion than other large multinationals.

As a result, a few governments have brought in digital services taxes levied directly on the tech giants local revenues so-called Google Taxes. The UK for one has stated that it is committed to removing its digital service tax once an effective international corporation tax deal is in place, so we can expect Britains Google tax to be discontinued shortly.

We could expect that regardless, however, no matter what the UKs preferred stance might be and we can expect all the other nations with Google taxes to get rid of theirs too.

Thats because Joe Biden has another big stick that hes not afraid to use. In June, the Office of the US Trade Representative, which reports directly to the president, announced tariffs to be levied on imports from all nations with digital service taxes, and a 180-day countdown before the tariffs will be implemented.

So whatever else happens in the new global tax world, we feel reasonably confident in saying that digital services taxes will soon be a thing of the past.

Related Companies

Read Also: Are Donations To Churches Tax Deductible

Blended Tax Calculation For 2018 Filing

If your corporation’s tax year began before Jan. 1, 2018, and it ended after Dec. 31, 2017, you would need to figure and apportion your tax amount by blending the rates in effect before Jan. 1, 2018, with the rate in effect after Dec. 31, 2017. The IRS has a worksheet to help you with this calculation.

Some Corporations Pay Nothing In Taxes

- General Electric, Boeing, Priceline.com, Verizon and 22 other profitable Fortune 500 firms paid no federal income taxes from 2008 through 2012, according to Citizens for Tax Justice.

- 111 profitable Fortune 500 firms paid zero federal taxes in at least one of those five years.

- General Electric, one of the most notorious corporate tax dodgers, got $3.1 billion in refunds on $27.5 billion in profits from 2008 to 2012. The company paid less in federal income taxes in five years than a single American family pays in one year.

Don’t Miss: What Age Do You Have To File Taxes

How Corporations Avoid Paying Taxes

How do corporations avoid paying taxes? First, S corporations are the most common type of corporation.These pass-through firms pay no corporate taxes. Instead, they pass corporate income, losses, deductions, and credits through to their shareholders. The shareholders are then taxed on these profits or losses at their individual income tax rates.

Some global corporations don’t welcome the tax change. They’ve become so adept at avoiding U.S. taxes that it became a competitive advantage. They made more money in U.S. markets than foreign competitors because of their knowledge of the tax code.

Determining Your Small Business Tax Rate

At the end of the day, understanding and meeting your tax requirements are some of the most complicated parts of running a business. There are a number of reasons why business taxes are so complexâthere are a variety of taxes to consider, your small business tax rate will differ based on your entity type, and there are deductions and credits to incorporate as well.

Therefore, the best thing you can do for your business is to work with a qualified tax professional, like a CPA, enrolled agent, or tax attorney. Their expertise can help you understand the types of taxes your business is responsible for and make sure you are paying the correct small business tax rate.

Article Sources:

Also Check: What Receipts Can I Claim On My Taxes

Disadvantages Of A Partnership:

| The biggest disadvantage of a partnership is unlimited liability. The partners are jointly liable for all debts and other liabilities of the business. If the business is sued, all the business and personal assets of the partners are at risk. An exception to this is a Limited Partnership. Limited Partners, who contribute capital but do not participate in the management of the business, will have their liability limited to the amount of capital that they have contributed. The partners who participate in the management of the business are called General Partners, and will still have unlimited liability. |

| If the business is profitable, it will usually be paying higher taxes than if it was incorporated as a Canadian controlled private corporation . See this same topic above under proprietorships. |

| The death or retirement of a partner will not end the partner’s liability for debts and obligations of the partnership that were incurred prior to the death or retirement. Also, if a partner retires and does not make the retirement publicly known, he/she could still be held liable for obligations incurred by the partnership after the retirement. |

Nations Agree To 15% Minimum Corporate Tax Rate

Most of the world’s nations have signed up to a historic deal to ensure big companies pay a fairer share of tax.

A hundred and thirty six countries agreed to enforce a corporate tax rate of at least 15% and a fairer system of taxing profits where they are earned.

It follows concern that multinational companies are re-routing their profits through low tax jurisdictions.

Countries including Ireland had opposed the deal but have now agreed to the policy.

UK Chancellor Rishi Sunak said the deal would “upgrade the global tax system for the modern age”.

“We now have a clear path to a fairer tax system, where large global players pay their fair share wherever they do business,” he said.

The Organisation for Economic Cooperation and Development , an intergovernmental organisation, has led talks on a minimum rate for a decade.

It said the deal could bring in an extra $150bn of tax a year, bolstering economies as they recover from Covid.

Yet it also said it did not seek to “eliminate” tax competition between countries, only to limit it.

The floor under corporate tax will come in from 2023. Countries will also have more scope to tax multinational companies operating within their borders, even if they don’t have a physical presence there.

The move – which is expected to hit digital giants like Amazon and Facebook – will affect firms with global sales above 20 billion euros and profit margins above 10%.

Don’t Miss: How Do I File Colorado State Taxes

How Corporation Taxes Work

A corporation, or C Corp, is a type of business structure where owners enjoy limited liability protection. Corporations are considered separate legal entities, meaning they are separate from their owners. Owners are not responsible for their corporations actions and debts.

But because corporations are separate legal entities, they are subject to double taxation. This means that the company itself pays taxes on its earnings and the owner also pays taxes. In other business structures , taxes pass through to the owner so they only pay taxes on earnings once.

If you own a corporation, you must report its profits and losses on Form 1120, U.S. Corporation Income Tax Return. And, report your personal income on your individual tax return.

Corporations are generally taxed at both the federal and state level. When a corporation pays taxes on its taxable income, it must pay at a rate set by both the federal and state levels.

If you structure as a corporation, you must know the corporation tax rates.

Corporate Tax Rates By State 2021

Forty-four American states levy a corporate income tax, ranging from 2.5 percent in North Carolina to 12 percent in Iowa. Four statesNevada, Ohio, Texas, and Washingtonimpose a gross receipts tax on sales and receipts instead of a corporate income tax, while Delaware, Pennsylvania, Virginia, and West Virginia levy a gross receipts tax in addition to a corporate income tax. South Dakota and Wyoming are the only states that do not levy a corporate income or gross receipts tax.

Thirty-four states and the District of Columbia have single-rate corporate tax systems, while the remainder have rates that vary by income bracket. Iowa has the highest top statutory corporate tax rate at 12 percent, followed by New Jersey , Pennsylvania , and Minnesota . Meanwhile, eight statesArizona, Colorado, Kentucky, Mississippi, North Carolina, North Dakota, South Carolina, and Utahhave top rates at or below 5 percent.

Even in states with high corporate tax rates, however, these taxes collect relatively little revenue, since companies are able to engage in extensive tax planning to reduce their income. Corporate income taxes account for an average of just 3.38 percent of state tax collections and 2.24 percent of state general revenue.

The federal corporate tax is based on a percentage of the income that a company or corporation generates within the United States. The corporate tax rate in the U.S. ranges based on income bracket from 15 percent to 35 percent.

You May Like: How To Calculate Payroll Tax Expense

Corporate Tax In The United States

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% due to the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

Some corporate transactions are not taxable. These include most formations and some types of mergers, acquisitions, and liquidations. Shareholders of a corporation are taxed on dividends distributed by the corporation. Corporations may be subject to foreign income taxes, and may be granted a foreign tax credit for such taxes. Shareholders of most corporations are not taxed directly on corporate income, but must pay tax on dividends paid by the corporation. However, shareholders of S corporations and mutual funds are taxed currently on corporate income, and do not pay tax on dividends.