Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Families That Don’t File Taxes Can Qualify

The IRS will automatically make the payments for those who filed their 2020 tax return or claimed dependents on their 2019 tax return. If you didn’t submit your tax return, the IRS won’t know to send you a payment .

If you’re a;nonfiler;and didn’t file a tax return this year and don’t plan to, the IRS has come up with an alternative. A “Non-filer Sign-up tool” allows families who don’t file taxes to submit an electronic form to let the IRS know how many kids they have and their ages so they can get the correct payment amount.;

While the tool is intended to help low-income families enroll in the program, it has been;criticized for not being entirely user-friendly. For example, it works better on a computer than a mobile device, and requires that you have access to an email address.;

Only one parent can receive the child tax money with shared custody.;

Income Tax Expense Vs Income Tax Payable

Income tax expense and income tax payable are two different concepts.

Income tax expense can be used for recording income tax costs since the rule states that expenses are to be shown in the period during which they were incurred, instead of in the period when they are paid. A company that pays its taxes monthly or quarterly must make adjustments during the periods that produced an income statement.

Basically, income tax expense is the companys calculation of how much it actually pays in taxes during a given accounting period. It usually appears on the next to last line of the income statement, right before the net income calculation.

Income tax payable, on the other hand, is what appears on the balance sheet as the amount in taxes that a company owes to the government but that has not yet been paid. Until it is paid, it remains as a liability.

Read Also: When Are Delaware State Taxes Due

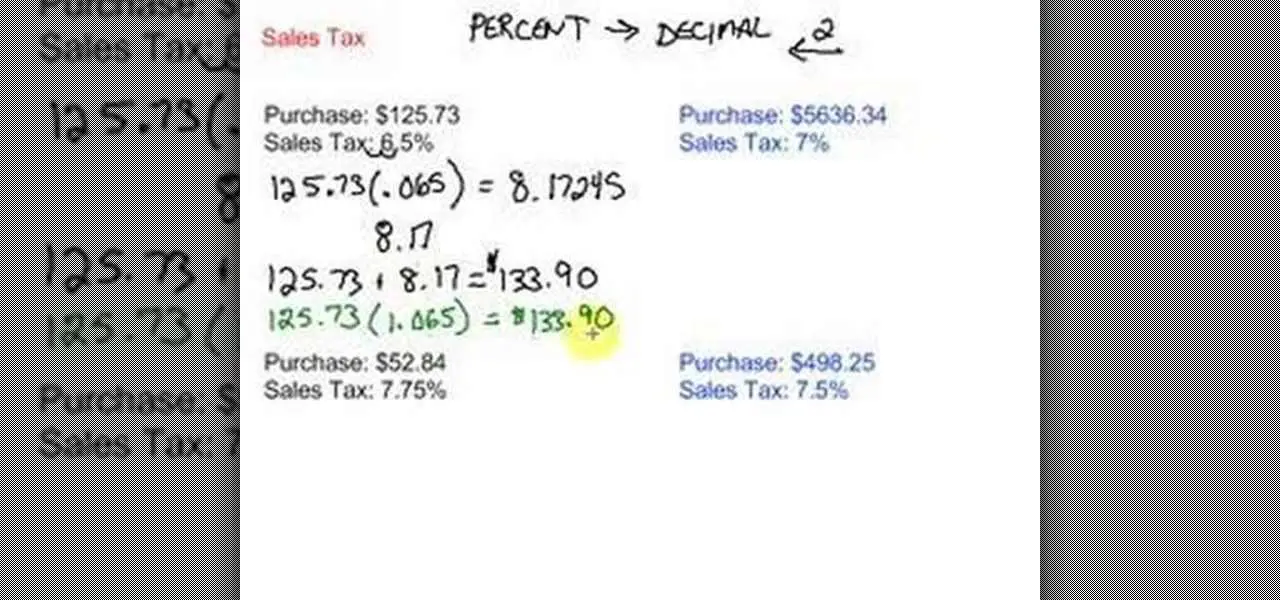

Calculating The Sales Tax Percentage Of A Total:

If we are given the total cost of an item or group of items and the pre-tax cost of the good, then we can calculate the sales tax percentage of the total cost. First, we need to subtract the pre-tax value from the total cost of the purchase. Next, we need to create a ratio of the sales tax to the pre-tax cost off the items. Last, we need to create a proportion where the pre-tax cost is related to 100% and solve for the percentage of the sales tax. Let’s start by working through an example. If a person pays $245.64 for groceries that cost $220.00 pre tax, then what is the sales tax percentage for the items.

First, subtract the pre-tax value from the total cost of the items to find the sales tax cost.

Next, create a ratio of the sales tax to the pre-tax cost of the items.

Last, create a proportion where the pre-tax value is proportional to 100% and solve for the percentage of sales tax.

Cross multiply and solve.

Isolate the sales tax percentage to the left side of the;equation by dividing each side by the pre-tax value.

Round to two decimal places since our answer;is in dollars and cents.

Last, we can check this answer by calculating the sales tax percentage of the total as seen previously.

First, we need to convert the sales tax percentage into a decimal by moving the point two spaces to the left.

Now, we need to multiply the pre-tax cost of this item by this value in order to calculate the sales tax cost.

Round to two decimal places since our total is in dollars and cents.

What Rate Should I Be Charged

If you buy an item from a business located in an unincorporated county area, you will generally be charged the county sales tax rate on your taxable items. If the same item is purchased in a city with an additional district tax, you will be charged that city’s tax rate. If you purchase an item from outside of California for use in the city and/or county where you live, you owe use tax on that purchase. If you have not saved your receipts from such purchases, the Use Tax Lookup Table calculates how much you owe, and you can enter it as a line item when you file your income tax returns.

Read Also: How Much Is New York State Sales Tax

Upcoming Tax Brackets & Tax Rates For 2020

Note: This can get a bit confusing. The filing deadline for the 2020 tax year is April 15, 2021. Which means you account for your 2020 tax bill in 2021. Add the fact that the IRS released the ground rules for 2021 taxes in October 2020, and your head is swimming in a pool so perplexing that a state of confusion can be excused.

But wait. Come springtime, will Washington ponder another filing delay in response to a new or ongoing national emergency? You never know.

What we do know is the rates and brackets for the 2020 tax year are set.

Here is a look at what the brackets and tax rates are for 2020 :

| Tax rate |

|---|

How To Calculate Land Transfer Tax

Land transfer taxes are calculated based on the purchase price of your property. Each province sets its own land transfer tax rates, as do some municipalities. Use the calculator above to find the land transfer tax based on your location, or keep reading to find out how land transfer tax is calculated where you live.

Also Check: What Does Agi Mean For Taxes

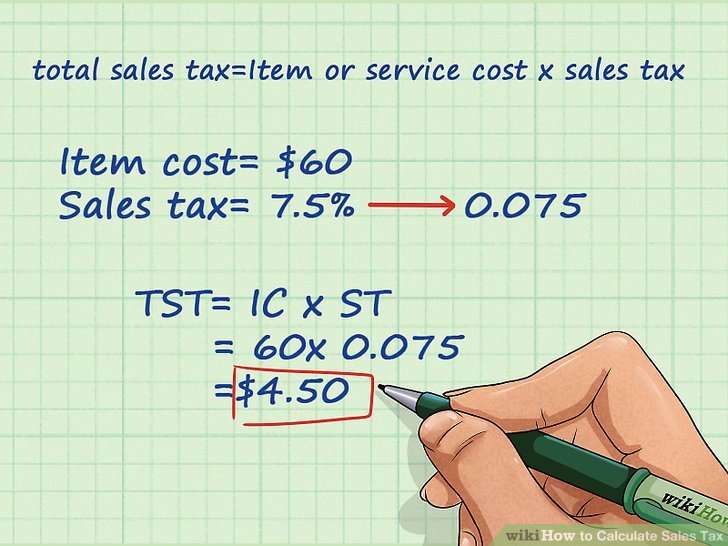

Calculating Sales Tax At Time Of Purchase:

In order to calculate the sales tax of an item, we need to first multiply the pre-tax;cost of the item by the sales tax percentage after it has been converted into a decimal. Once the sales tax has been calculated it needs to be added to the pre-tax value in order to find the total cost of the item. Let’s start by working with an example. If a magazine costs $2.35 and has a 6% sales tax, then what is the total cost of the item. First, we need to convert the sales tax percentage into a decimal by moving the point two spaces to the left.

Now, we need to multiply the pre-tax cost of this item by this value in order to calculate the sales tax cost.

Round to two decimal places since our total is in dollars and cents.

Last, add this value to the pre-tax value of the item to find the total cost.

Add 100 Percent To The Tax Rate

Add 100 percent to the sales tax rate. The 100 percent represents the whole, entire pre-tax price of the item in question; when you add it to the tax rate, you get a total percentage that represents the pre-tax price plus the tax. So if the sales tax in your area is 8 percent, you have:

100 + 8 = 108 percent

Also Check: How To Calculate Sales Tax From Total

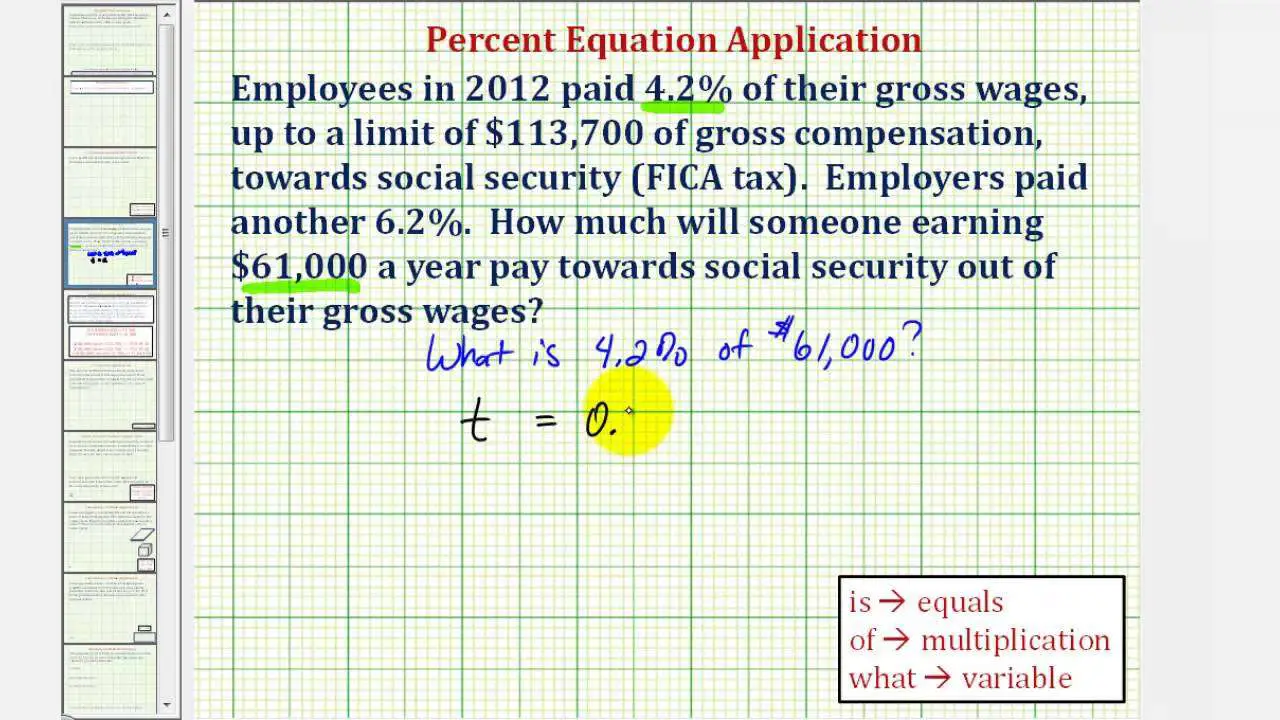

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are called brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2020 tax year, which are the taxes due in early 2021.

Quebec Land Transfer Tax10

Land transfer tax in Quebec is different outside of Montreal. The tax is collected and calculated at the municipal level. The base amount used in the calculation is first determined to be the greater of:

- The purchase price of the property

- The amount listed on the Deed of Sale

- The market value of the property determined by a municipal assessment roll increased by a comparative factor

Once the base amount is determined, land transfer tax in Quebec is then governed by the following scale:

| Value of property |

|---|

In Prince Edward Island , land transfer tax is calculated as follows:

- 1% of the greater of purchase price or property value

- In cases where the property value is less than $30,000, no transfer tax is charged

Also Check: What Is The Sales Tax In Arkansas

What Is Income Tax Payable

Income tax payable is a term given to a business organizations tax liability to the government where it operates. The amount of liability will be based on its profitability during a given period and the applicable tax rates. Tax payable is not considered a long-term liability, but rather a current liability,Current LiabilitiesCurrent liabilities are financial obligations of a business entity that are due and payable within a year. A company shows these on the since it is a debt that needs to be settled within the next 12 months.

The calculation of the taxes payable is not solely based on the reported income of a business. The government typically allows certain adjustments that can reduce the total tax liability.

Alberta Land Title Transfer Fees7

Alberta does not have a land transfer tax, however, it does charge a Trasfer of Land registration fee AND a mortgage registration fee.

Transfer of Land registration fee: This administration fee covers the actual name change of the land. There’s a base fee of $50 plus an additional $2 charge for every $5,000 of the fair market value of the property .

Mortgage registration fee: This administration fee covers the issueance of your mortgage. There’s a base fee of $50 plus an additional $1.50 charge for every $5,000 of the principal mortgage amount .

Read Also: How To Pay Federal And State Taxes

Calculating Effective Tax Rate

The effective tax rate is the overall tax rate paid by the company on its earned income. The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings before taxes. Tax expense is usually the last line item before the bottom linenet incomeon an income statement.

For example, if a company earned $100,000 before taxes and paid $25,000 in taxes, then the effective tax rate is equal to 25,000 ÷ 100,000, or 0.25. In this case, you can clearly see that the company paid an overall rate of 25% in taxes on income.

Example Of The Sales Tax Calculation

As an example, assume that all of the items in a vending machine are subject to a sales tax of 7%. In the most recent month the vending machine receipts were $481.50. Hence, $481.50 includes the amounts received for the sales of products and the sales tax on these products. The use of algebra allows us to calculate how much of the $481.50 is the true sales amount and how much is the sales tax on those products:

Let S = the true sales of products , and let 0.07S = the sales tax on the true sales. Since the true sales + the sales tax = $481.50, we can state this as S + 0.07S = 1.07S = $481.50. We solve for S by dividing $481.50 by 1.07. The result is that the true product sales amounted to $450. The 7% of sales tax on the true sales is $31.50 . Now let’s make sure this adds up: $450 of sales of product + $31.50 of sales tax = $481.50, which was the total amount of the vending machine receipts.

Don’t Miss: What Is The Date To Pay Taxes

Significance Of Effective Tax Rate

Effective tax rate is one ratio that investors use as a profitability indicator for a company. This amount can fluctuate, sometimes dramatically, from year to year. However, it can be difficult to immediately identify why an effective tax rate jumps or drops. For instance, it could be that a company is engaging in asset accounting manipulation to reduce its tax burden, rather than a managerial or process change reflecting operational improvements.

Also,;keep in mind that companies often prepare two different financial statements; one is used for reporting, such as the income statement. The other is used for tax purposes. Expenses that are allowed as deductions or for tax purposes may cause variances in these two documents. If a company is effectively utilizing tax deductions and credits, then its effective tax rate will be lower than a company that is not effectively using these strategies.

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

You May Like: Are Donations To Churches Tax Deductible

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

How Is Tax Withholding Determined On A W

As of Jan. 1, 2021, you determine your 2021 IRS paycheck tax withholding by tax return filing status, pay period paycheck income, and most importantly by the estimated number of dependents and estimated tax return based tax deductions, extra tax withholding, etc. Many taxpayers are at a loss as to how to complete the new W-4.

Read Also: How Do I Pay My State Taxes In Missouri

Net Investment Income Tax

Under certain circumstances, the net investment income tax, or NIIT, can affect income you receive from your investments. While it mostly applies to individuals, this tax can also be levied on the income of estates and trusts. The NIIT is levied on the lesser of your net investment income and the amount by which your modified adjusted gross income is higher than the NIIT thresholds set by the IRS. These thresholds are based on your tax filing status, and they go as follows:

- Single: $200,000

- Qualifying widow with dependent child: $250,000

- Head of household: $200,000

The NIIT tax rate is 3.8%. The tax only applies for U.S. citizens and resident aliens, so nonresident aliens are not required to pay it. According to the IRS, net investment income includes interest, dividends, capital gains, rental income, royalty income, non-qualified annuities, income from businesses that are involved in the trading of financial instruments or commodities and income from businesses that are passive to the taxpayer.

Income Statements And Rate Of Taxation

Income statements offer a quick overview of the financial performance of a given company over a specified period of time, usually annually or quarterly. On an income statement, you can view revenues from sales, cost of goods sold , gross margin, operating expenses, operating income, interest and dividend expenses, tax expense, and net income. The income statement is the benchmark financial statement for determining the profitability of a company.

A company does not provide its actual percentage rate of taxation on the income statement. Still, you can figure out the effective tax rate by using the rest of the information on the income statement.

Don’t Miss: When Is The Final Day For Taxes

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.