How 2021 Sales Taxes Are Calculated In Arkansas

The state general sales tax rate of Arkansas is 6.5%. Cities and/or municipalities of Arkansas are allowed to collect their own rate that can get up to 3.5% in city sales tax.Every 2021 combined rates mentioned above are the results of Arkansas state rate , the county rate , the Arkansas cities rate . There is no special rate for Arkansas.The Arkansas’s tax rate may change depending of the type of purchase. Some of the Arkansas tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Arkansas website for more sales taxes information.

How Is Sales Tax Calculated

Your business exact street address is used to determine sales tax rate.; In this instance, 8.5% is the minimum rate.; However, the rate for your business may vary.; The Arkansas Department of Finance and Administration has a Sales & Use Local Tax Lookup Tool that will provide you with the rate based on your specific address.; ;;

Are Services Subject To Sales Tax In Arkansas

The state of Arkansas does not usually collect any sales taxes on the vast majority of services performed. An example of taxed services would be one which manufactures or creates a product.This means that a graphic designer would not be required to collect sales tax, while a someone working in the creation of clothing may be required to collect sales tax.

You can find a table describing the taxability of common types of services later on this page.

Read Also: How To File 2 Different State Taxes

Is The Arkansas Sales Tax Destination

Arkansas is a destination-based sales tax state, which meansthat sales tax rates are determined by the location of the buyer when the transaction is completed. This means that, for orders placed via the internet/mail by a customer within Arkansas from a Arkansas vendor, the vendor must collect a sales tax rate applicable at the buyer’s address . This can significantly increase the complication of filing your sales tax return, because different sales tax rates must be charged to different buyers based on their location.

Fayetteville Arkansas Sales Tax Rate

fayetteville Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

Fayetteville, Arkansas sales tax rate details

The minimum combined 2021 sales tax rate for Fayetteville, Arkansas is . This is the total of state, county and city sales tax rates. The Arkansas sales tax rate is currently %. The County sales tax rate is %. The Fayetteville sales tax rate is %.

South Dakota v. Wayfair, Inc.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Arkansas, visit our state-by-state guide.

COVID-19

The outbreak of COVID-19 may have impacted sales tax filing due dates in Fayetteville. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Arkansas and beyond.;AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Don’t Miss: How To Buy Tax Lien Properties In California

Early Vote Heavily Against Little Rock Sales Tax Increase

The polls are closed on the vote to raise the sales tax in the city of Little Rock and the Pulaski County Election Commissionhas released the early vote tallies. Among 8,375 early and absentee ballots cast, the split was 61 to 39 against.

Thats bad news for Mayor Frank Scott Jr. and those who favored the Rebuild the Rock plan. The early vote is often fairly predictive.

Its a large early vote turnout. Ten years ago, when Little Rock voters last approved a tax increase, 22,000 voted, with only 3,200 of them voting early or absentee.

Shawn Camp, former interim director of election for Pulaski County, said in July that he expected between 6,000 and 11,000 votes in the election.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Arkansas sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to;try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Also Check: What Is Schedule D Tax Form

Local Sales And Use Taxes

In addition to the state sales and use tax, local sales;;use taxes may be levied by each city or county. However, businesses may apply to the Arkansas Department of Finance and Administration for a refund of local taxes. Single transaction means any sale of tangible personal property or taxable service reflected in a single invoice, receipt or statement for which an aggregate sales or use tax amount has been reported or remitted to the state for a single, local taxing jurisdiction. These taxes are collected by the state and distributed to the cities and counties each month.

Are Shipping & Handling Subject To Sales Tax In Arkansas

Arkansas has very simple rules when it comes to taxes on shipping. Essentially, if the item being shipped is considered to be taxable in Arkansas, then the shipping is seen as being taxable as well. If the item being shipped is not legally taxable, then the shipping charge should not be taxed. If the shipment involves multiple items, some taxable and some not, the seller is required to tax only the percentage of the shipping charge applying to the taxable items. It must also be noted that any charges which are billed to the purchaser by a carrier who is not the seller are excluded from this tax.

Read Also: Is Past Year Tax Legit

Misplacing A Sales Tax Exemption/resale Certificate

Arkansas sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the Arkansas Department of Finance and Administration may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Other Taxes And Fees Applicable To Arkansas Car Purchases

In addition to state and local sales taxes, there are a number of additional taxes and fees Arkansas car buyers may encounter. These fees are separate from the sales tax, and will likely be collected by the Arkansas Department of Motor Vehicles and not the Arkansas Department of Finance and Administration.

Title Fee: Registration Fee: Plate Transfer Fee:

Average DMV fees in Arkansas on a new-car purchase add up to $321, which includes the title, registration, and plate fees shown above.

Recommended Reading: What Is Tax Liabilities On W2

How To Calculate Arkansas Car Tax

If you wish to pay Arkansas car tax, you have to first calculate the amount thats due. Each state calculates car tax based on different criteria. As a general guideline, if you purchase a new or used vehicle in Arkansas, youre liable to pay the state auto sales tax amount. This sales tax is not charged at the time of vehicle purchase. It is charged when the vehicle title and registration process is initiated. To find out how the tax is calculated, bear in mind the following guidelines.

Calculating Arkansas Car Sales Tax:

- To begin with, a vehicle has to be registered with the DMV no later than 30 days from the day it was purchased.

- The sales tax is calculated on the total amount of the sale . This holds true for private car sales or vehicles purchased from car dealers in Arkansas.

- The percentage of sales tax charged is generally 6 percent of the total sales price. However, if the total sales price of the vehicles is less than $2,500, no sales tax will be charged.

- Apart from car sales tax, car owners are also liable to pay motor fuel tax. The tax for every gallon of fuel is 22.5 cents per gallon of diesel and 21.5 cents per gallon of gasoline.

- You may use the help of an online Arkansas car tax calculator, to find out how much you really owe. A good website to research for this purpose is the unofficial DMV website , DMV.org.

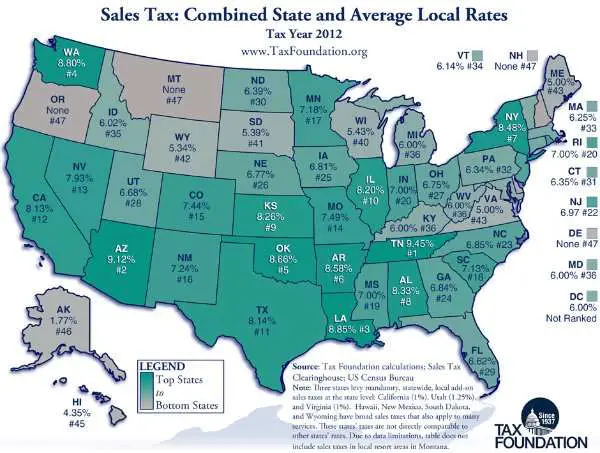

Arkansas Ties For No 1 In Sales

A consumer buying items around Tennessee and Arkansas won’t notice much difference in the overall sales taxes paid.

Thanks to rounding, Arkansas and Tennessee have the highest combined state and local sales-tax rates among the 50 states, according to the Washington-based Tax Foundation.

Arkansas’ rate is 9.47%, consisting of a 6.5% state sales tax and a 2.97% average local sales tax as of July 1, while Tennessee’s 9.47% is made up of a 7% state sales tax and a 2.47% average local sales tax, the foundation reported earlier this month.

“Technically, AR is still #2, if we go out to the third digit, so it’s the same as in the past,” the foundation’s vice president of federal and special projects Nicole Kaeding said in an email last week to the Arkansas Democrat-Gazette. “It’s just if we round that you’re now tied for #1.”

Without rounding, Arkansas’ combined sales tax is 9.465%, while Tennessee’s is 9.469%, said Garrett Watson, the foundation’s director of special projects.

The nonprofit foundation describes itself as the nation’s leading independent tax-policy research organization that has monitored fiscal policy at federal, state and local levels since 1937, according to its website.

HIGHWAY TAXES

Taxes for highways led to a big jump in Arkansas’ sales-tax ranking in 2013.

OTHER STATES

A year ago, Arkansas’ combined sales-tax rate ranked third in the nation at 9.42%, Watson said.

Local sales taxes are collected in 38 states, according to the foundation.

Recommended Reading: How To Track Your Taxes

Bentonville Arkansas Sales Tax Rate

bentonville Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

Bentonville, Arkansas sales tax rate details

The minimum combined 2021 sales tax rate for Bentonville, Arkansas is . This is the total of state, county and city sales tax rates. The Arkansas sales tax rate is currently %. The County sales tax rate is %. The Bentonville sales tax rate is %.

South Dakota v. Wayfair, Inc.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Arkansas, visit our state-by-state guide.

COVID-19

The outbreak of COVID-19 may have impacted sales tax filing due dates in Bentonville. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Arkansas and beyond.;AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Arkansas State Rate For 2021

6.5% is the smallest possible tax rate 6.875%, 7%, 7.5%, 7.625%, 7.75%, 7.875%, 8%, 8.125%, 8.25%, 8.5%, 8.625%, 8.75%, 9%, 9.125%, 9.25%, 9.375%, 9.5%, 9.625%, 9.75%, 9.875%, 10%, 10.25%, 10.375%, 10.5%, 10.625%, 10.75%, 11%, 11.25%, 11.375% are all the other possible sales tax rates of Arkansas cities.11.5% is the highest possible tax rate

The average combined rate of every zip code in Arkansas is 8.551%

Don’t Miss: How To Register For Tax Id

Springdale Arkansas Sales Tax Rate

springdale Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

Springdale, Arkansas sales tax rate details

The minimum combined 2021 sales tax rate for Springdale, Arkansas is . This is the total of state, county and city sales tax rates. The Arkansas sales tax rate is currently %. The County sales tax rate is %. The Springdale sales tax rate is %.

South Dakota v. Wayfair, Inc.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Arkansas, visit our state-by-state guide.

COVID-19

The outbreak of COVID-19 may have impacted sales tax filing due dates in Springdale. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Arkansas and beyond.;AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Penalties For Late Filing

Arkansas charges a;late filing penalty;of 5% per month or partial month up to a maximum of 35% of the tax that is reported on the tax return. If the late filing penalty has been assigned to the taxpayer, the late payment penalty will not be applied.

Arkansas also charges a;late payment penalty;that is equal to 5% per month up to 35% of the tax that is unpaid. If the late payment penalty has been assigned to the taxpayer, the late filing penalty will not be applied.

Also Check: What Can I Write Off On My Taxes For Instacart

Arkansas Sales Tax Nexus

Businesses with;nexus;in Arkansas are required to register with the Arkansas Department of Finance and Administration and to charge, collect, and remit the appropriate tax.Generally, a business has ;nexus in Arkansas when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.Arkansas nexus for out-of-state sellersAffiliate nexusIf your business has ties to businesses in Arkansas, including affiliates, it may have nexus under the states affiliate nexus law .Out-of-state sellers of tangible personal property or taxable services are presumed to be engaged in business in the state and must register and collect and remit Arkansas sales tax when;any one;of the following applies:

Referrals, including online referrals, from in-state entities may also trigger nexus for an out-of-state business if;both;the following conditions are met:

- The out-of-state seller enters into an agreement with one or more residents whereby the residents, for a commission or other consideration, directly or indirectly refer potential purchasers to the seller, by a link on an internet website or otherwise.

- Cumulative gross receipts from sales by the seller to purchasers in Arkansas who are referred to the seller by such agreements exceeds $10,000 during the preceding 12 months.

- ABOUT

- MondayFriday 4:30 a.m.4:30 p.m. PT

- RESOURCES

Contact The Arkansas Department Of Finance And Administration

The Arkansas Sales Tax is administered by the Arkansas Department of Finance and Administration. You can learn more by visiting the sales tax information website at www.dfa.arkansas.gov.

Phone numbers for the Sales Tax division of the Department of Finance and Administration are as follows:

- Local Phone: 682-7104

Read Also: Can You File Missouri State Taxes Online

Failure To Collect Arkansas Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

Arkansas Sales Tax Calculator

You can use our Arkansas Sales Tax Calculator to look up sales tax rates in Arkansas by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Arkansas has a 6.5% statewide sales tax rate,but also has 266 local tax jurisdictions that collect an average local sales tax of 2.12% on top of the state tax. This means that, depending on your location within Arkansas, the total tax you pay can be significantly higher than the 6.5% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Arkansas:

Recommended Reading: How To Find Out Who Claimed You On Their Taxes

Rules And Regulations For The State Of Arkansas

Sales Tax Law:

Arkansas law currently levies a sales tax on precious metals purchases in the state of Arkansas.

The state of Arkansas requires NPMEX to collect sales taxes on all products sold by NPMAX and delivered to an Arkansas address.

Sales taxes in Arkansas are calculated at checkout on the NPMEX.COM website based on the taxability of products sold by NPMEX in Arkansas set forth above, and the specific tax rates established by the taxing jurisdiction of the delivery address in Arkansas.

Capital Gains Tax:

Gold and silver are subject to capital gains taxation when exchanged for Federal Reserve notes or when used in barter transactions.

Please Note: The above is not a comprehensive description of sales tax laws and requirements in the state of Arkansas. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in the state of Arkansas that relate to the readers transactions with NPMEX. If you would like to research the sales tax laws and requirements in the state of Arkansas, we suggest you visit the Arkansas department of revenue located at .

Buying Gold and Silver in Arkansas

Buying precious metals from online dealer NPMEX has some major advantages. Though NPMEX is physically located in Erie Colorado, we ship all over the United States, every day.

Benefits to buying gold & silver online at NPMEX.com: