Tax Rates For Previous Years

To find income tax rates from previous years, see the Income Tax Package for that year. For 2018 and previous tax years, you can find the federal tax rates on Schedule 1. For 2019, 2020 and later tax years, you can find the federal tax rates on the Income Tax and Benefit Return. You will find the provincial or territorial tax rates on Form 428 for the respective province or territory . To find the Quebec provincial tax rates, go to Income tax return, schedules and guide .

Will I Pay The Amt In 2021

To determine whether you pay the AMT, the IRS first calculates your tentative minimum tax, which is based on your income minus the AMT exemption, before any deductions are applied.

In 2021, the AMT exemption for individuals is:

-

$57,300 for people with filing status married filing separately

-

$73,600 for people with filing status single or head of household

-

$114,600 for people with filing status married filing jointly or qualifying widower

In 2022, the AMT exemption for individuals will be:

-

$59,050 for people with filing status married filing separately

-

$75,900 for people with filing status single or head of household

-

$118,100 for people with filing status married filing jointly or qualifying widower

If you owe more using the tentative minimum tax calculation than the regular tax calculation , then you have to pay AMT on the excess.

Use the following table to determine your tax rate according to the AMT. The income ranges represent your income minus the AMT exemption plus a handful of AMT-specific tax deductions.

Canada Revenue Agency: Big Changes Coming To Your 2021 Income Tax Bracket

The CRA has revised the 2021 income tax bracket to adjust for inflation and income. See how this change will impact your federal tax bill.

Last year was very different for everyone. The pandemic affected different businesses differently. Many people lost their jobs or took pay cuts, while some got significant hikes in salary. While this was a one-off year, it didnt stop the Canada Revenue Agency from introducing the new income and inflation-adjusted income tax bracket for 2021. See how this change will impact your salary and tax bill.

Recommended Reading: Taxes On Plasma Donation

Sample Train Tax Table Computations

How to compute income taxes under the new TRAIN law?

The Bureau of Internal Revenue explained this in Revenue Regulation No. 8-2018 which the BIR released in 2018. The formula to follow is simple. The income tax due, under the graduated income tax rates of TRAIN, is:

INCOME TAX DUE = a +

where: a = Basic Amount of Annual Income b = Additional Rate and c = Of the Excess over

What Are Some Other Inflation Adjustments I Should Look Out For

We mentioned earlier that the IRSâs tax brackets apply to your taxable income, which is what you get when you apply certain adjustments and deductions to your revenue.

One other way that the IRS helps guard against bracket creep is by adjusting the values of deductions to keep up with inflation. Here are the main ones you should look out for:

Also Check: Are Raffles Tax Deductible

The Cras 2021 Income Tax Bracket

While the CRA has maintained the income tax rate, it has increased the income tax bracket. The table below shows the federal tax rate. The CRA has increased the minimum income tax bracket to $49,020 in 2021 from $48,535 last year.

| 2020 Taxable Income | |

| Over $216,511 | 33% |

What do these revised tax brackets mean to you? If your job suffered from the pandemic and you didnt get a good salary hike this year, you will benefit from a lower income tax bill. However, if you received a nominal income hike, your income tax bill wont surge significantly. The CRA has not only revised the income tax brackets but also the various tax credits it offers to Canadian residents. For instance, the CRA revised the basic personal amount tax credit to $2,071 in 2021 from $1,984 in 2020.

Income Tax Computations Under Train

To recap, heres the graduated income tax tables under TRAIN to be implemented from 2018 until 2022.

The new income tax rates are to be computed as follows:

| Range of Taxable Income | |

|---|---|

| BIR & | PinoyMoneyTalk.com |

So, for example, an employee with taxable income of P300,000 per year, will fall under the income bracket P250,000-P400,000. The income tax due is computed as follows:

- a = Basic Amount of Annual Income = Zero

- b = Additional Rate = 20%

- c = Of the Excess over P250,000 = P50,000

- INCOME TAX DUE = 0 + = P10,000

Thus, an employee earning taxable income of P300,000 per year will pay income tax amounting to P10,000 under TRAIN.

With tax due of P10,000 on annual income of P300,000, the effective income tax rate charged to this taxpayer is 3.33%.

How about someone making P1 Million a year? Whats the income tax payable? Same formula to follow.

Using the table guide above, we can see that the taxpayer falls under the tax bracket P800,000-P2,000,000. Thus, the tax due is:

- a = Basic Amount of Annual Income = P130,000

- b = Additional Rate = 30%

- c = Of the Excess over P800,000 = P200,000

- INCOME TAX DUE = P130,000 + = P190,000

The salaried employee earning P1 Million will thus pay income tax of P190,000 under the new TRAIN tax tables.

Paying P190,000 income tax on taxable income of P1 Million, the taxpayer is therefore charged an effective income tax rate of 19%.

Recommended Reading: Pastyeartax

What If I Moved

Provincial taxes are based on your province of residence as of December 31 of any given tax year. If you were living in Ontario on December 31, 2020, you will be subject to Ontario income tax.

The income tax you pay is based on your net income after all eligible deductions are withdrawn. In a progressive tax system such as the one in Canada, different amounts are taxed at different rates depending on what tax bracket the amount falls into. Here are the tax rates for Ontario:

Irs Provides Tax Inflation Adjustments For Tax Year 2021

IR-2020-245, October 26, 2020

WASHINGTON The Internal Revenue Service today announced the tax year 2021 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. Revenue Procedure 2020-45 PDF provides details about these annual adjustments.

Also Check: Do You Have To Pay Taxes On Plasma Donations

How To Identify Your Tax Bracket

How much tax you’ll pay is determined by where you live in Canada, and how much income you declare from all sources. Importantly, your provincial rate is determined by the province you are living in on December 31 of the tax year. So, if you move from Ontario to Nova Scotia in July, and you find yourself living in Nova Scotia on December 31, you would fall under the Nova Scotia provincial tax rates.

The Bottom Line: As Your Income Grows You May Face A Higher Marginal Tax Rate

How much you pay in federal income taxes each year is based on your taxable income, tax bracket and the marginal tax rate attached to your bracket. You can exert some control over how much you pay in taxes each year by taking advantage of tax credits and deductions. And owning a home is one source of deductions, including mortgage interest and property taxes.

If you are interested in reducing your yearly tax bill, learn more about tax deductions for first-time homeowners.

You May Like: Louisiana Paycheck Tax Calculator

Whats Going On With The Child Tax Credit Debate

A pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

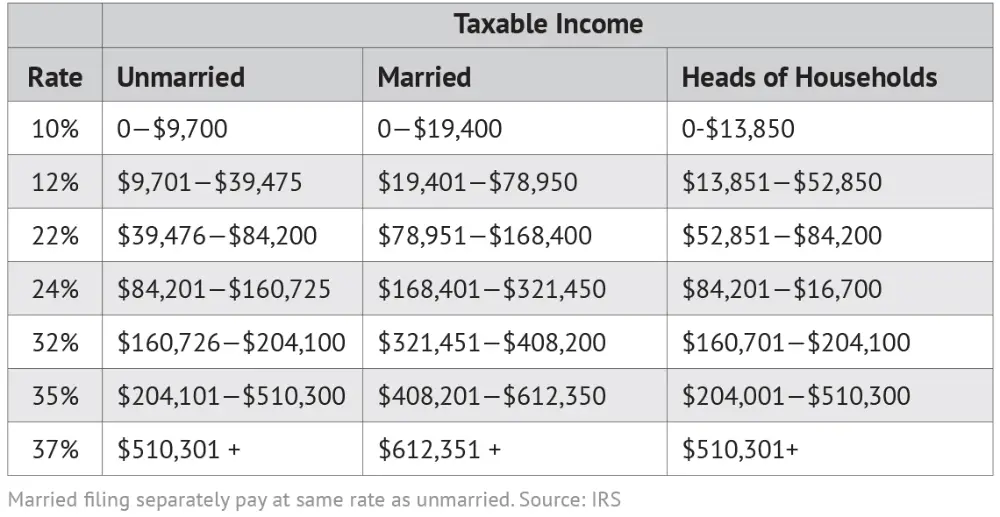

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets the federal corporate income tax system is flat.

A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

The standard deduction reduces a taxpayers taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

An individual income tax is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

Increased Allowances: Fringe Benefits Msas And Estates

The monthly limit for qualified transportation and qualified parking fringes is set at $270 for 2021 and $280 for 2022.

The maximum salary reduction for contributions to health flexible spending accounts is $2,750 for 2021 and $2,850 for 2022. The maximum carryover amount of unused amounts for cafeteria plans is $550.

The thresholds and ceilings for participants in medical savings sccounts are:

- Between $2,400 and $3,600 with a maximum out-of-pocket expense of $4,800 for 2021 for self-coverage

- Between $4,800 and $7,150 with a maximum out-of-pocket expense maximum for family coverage of $8,750 for 2021

- Between $2,450 and $3,700 with a maximum out-of-pocket expense of $4,950for 2022 for self-coverage

- Between $4,950 and $7,400 with a maximum out-of-pocket expense maximum for family coverage of $9,050 for 2022

For a decedent dying in 2021, the exemption level for the estate tax is set at $11.7 million. That amount increases to $12.06 million. The annual gift tax exclusion is $15,000 for 2021 and $16,000 for 2022.

You May Like: Buying Tax Liens In California

How To Get Into A Lower Tax Bracket

Americans have two main ways to get into a lower tax bracket: tax credits and tax deductions.

Tax credits are a dollar-for-dollar reduction in your income tax bill. If you have a $2,000 tax bill but are eligible for $500 in tax credits, your bill drops to $1,500. Tax credits can save you more in taxes than deductions, and Americans can qualify for a variety of different credits.

The federal government gives tax credits for the cost of buying solar panels for your house and to offset the cost of adopting a child. Americans can also use education tax credits, tax credits for the cost of child care and dependent care and tax credits for having children, to name a few. Many states also offer tax credits.

While tax credits reduce your actual tax bill, tax deductions reduce the amount of your income that is taxable. If you have enough deductions to exceed the standard deduction for your filing status, you can itemize those expenses to lower your taxable income. For example, if your medical expenses exceed 10% of your adjusted gross income in 2021, you can claim those and lower your taxable income.

Leverage The Cra Changes To Boost Your Tfsa Portfolio

In this dynamic economy, you will see periods of a good income hike, no hike, and sometimes pay cut. Just relying on salary is not sufficient. You need to have multiple sources of income and investment income through the Tax-Free Savings Account . The CRA allows you to contribute $6,000 in 2021 from your taxable income in TFSA. The CRA does not tax the investment income you earn in a TFSA.

As the world is changing at a faster pace, so are the investing themes. The 2021 theme is clean energy. Automotive stocks have not done well in the past few years, as the overall car demand is slowing. But within the automotive market, electric vehicle sales are rising. IHS Markit expects global EV sales to surge about 70% in 2021. This surge will come from the pent-up demand in 2020 and the U.S. president Joe Bidens investment in EV and EV infrastructure.

Magna International, the third-largest global automotive supplier, will benefit from this EV wave. The 63-year-old Canadian manufacturing giant has entered several joint ventures with tech companies and automakers to build EVs for them. It has also invested in some companies like Alphabets Waymo and Fisker. Magna stock will grow as EV sales gather momentum.

Read Also: Pay Taxes On Plasma Donation

State And Local Tax Brackets

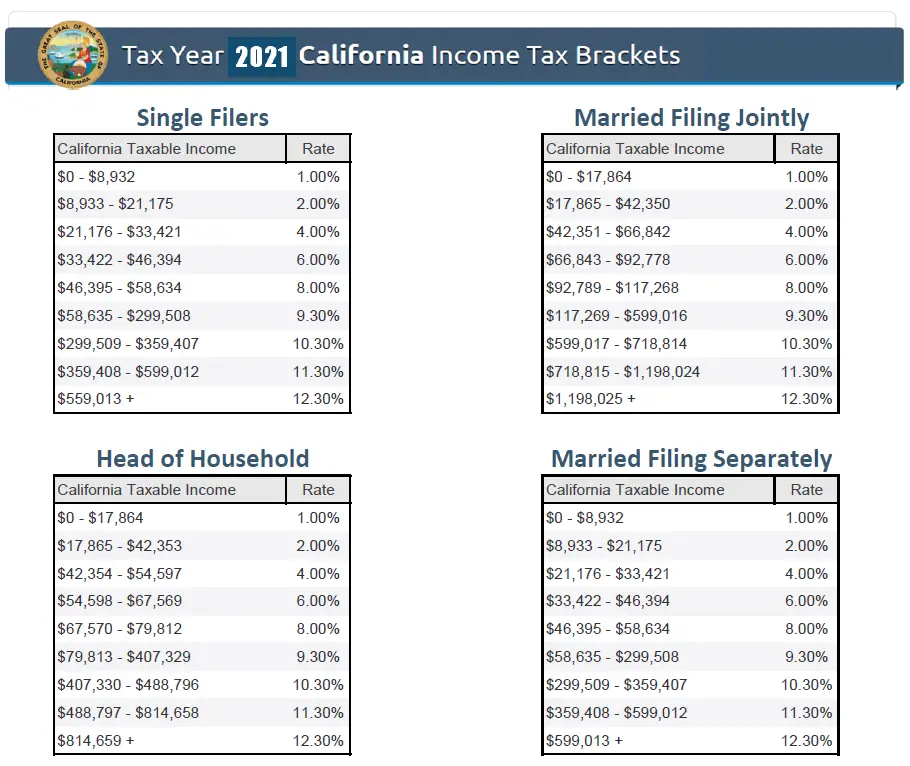

States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal governments.

California has the highest state income tax at 13.3% with Hawaii , New Jersey , Oregon , and Minnesota rounding out the top five.

Five states and the District of Columbia have top rates above 7%, with Illinois scheduled to join them if Gov. J.B. Pritzker gets his way.

Seven states Florida, Alaska, Wyoming, Washington, Texas, South Dakota and Nevada have no state income tax.

Tennessee and New Hampshire tax interest and dividend income, but not income from wages.

Not surprisingly, New York City lives up to its reputation for taxing income with rates ranging from 3.078% to 3.876% remarkably, the Big Apple is not the worst. Most Pennsylvania cities tax income, with Philadelphia leading the way at 3.89% Scranton checks in at 3.4%. Ohio has more than 550 cities and towns that tax personal income.

Why Do Tax Brackets Change Every Year

If you compare this yearâs tax brackets to the ones from previous years, you might notice theyâve all been slightly adjusted. Why is that?

It all has to do with inflation. Every year the IRS tweaks the tax brackets to prevent âbracket creep,â which is what happens when inflation pushes you into a higher tax bracket.

If you havenât looked up your bracket since 2017, thereâs a major tax reform you should look out for. The Tax Cuts and Jobs Act passed in December of 2017 changed the way the IRS calculates inflation, which will mean smaller annual inflation adjustments down the road.

That increases your chances of getting bumped up into a higher tax bracket every year. If you just barely avoided entering a higher tax bracket this year and think you might be a borderline case next year, make sure to follow the IRSâs inflation adjustment announcements closely.

You May Like: Do You Have To Pay Taxes On Plasma Donations

How Tax Brackets Add Up

In 2020, the IRS collected close to $3.5 trillion in Federal taxes paid by individuals and businesses individuals accounted for about 53.6% of that total.

The agency processed more than 240 million individual and business returns a whopping 81.3% of returns were filed electronically. Of roughly 148 million individual tax returns, 94.3% were e-filed.

Individuals and businesses claimed more than $736.2 billion in refunds. The vast majority of these totals more than $664 billion went to individuals.

Should You Itemize Or Take The Standard Deduction

Heres what the choice boils down to:

-

If your standard deduction is less than the sum of your itemized deductions, you probably should itemize and save money. Beware, however, that itemizing usually takes more time, requires more forms and you’ll need to have proof that you’re entitled to the deductions.

-

If your standard deduction is more than the sum of your itemized deductions, it might be worth it to take the standard deduction .

Note: The standard deduction has gone up significantly in recent years, so you might find that it’s the better option for you now even if you’ve itemized in the past.

|

Pricing: $49.99 to $109.99, plus state costs. Free version? Yes. |

Recommended Reading: Protesting Harris County Property Tax

Example Of Tax Calculation

Meet a fictional chap named John who lives in British Columbia. John has been contributing to a Wealthsimple RRSP to reduce his taxable income. After his RRSP contribution and other tax deductions and tax credits, he has taxable total income of $55,000. Here’s what his tax calculation might look like:

John’s Federal tax billThe first $49,020 is taxed at 15% , which works out to $7,353. He has $5,980 remaining, that amount will be taxed at a higher rate of 20.5% which works out to $1,225.9. This means his total federal tax owing is $7,353 + $1,225.9 = $8,578.9

John’s provincial tax bill Remember, John’s provincial rate is based on his province of residence as of December 31 of the calendar year. John’s first $42,184 will be taxed at 5.06%, which works out to $2,134.51. The remaining $12,816 will be taxed at 7.7% which works out to $986.83. His total provincial tax is $3,121.34.

John’s total tax billJohn’s combined federal and provincial taxes owing is $8,578.9 + $3,121.34 = $11,700.24.

What Are Tax Brackets

Tax brackets were created by the IRS to determine how much money you need to pay the IRS annually.

The amount you pay in taxes depends on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above.

Don’t Miss: Doordash 1099 Nec

Irs Tax Brackets 202: Married People Filing Jointly Affected By Inflation

The key information you need to know

The inflation adjustments for 2022 announced by the IRS on November 10, 2021, will see some changes when you file in 2023 due to higher inflation in 2021.

More than 60 tax provisions are affected by this, and the adjustments are done annually by the IRS to avoid pushing taxpayers into higher tax brackets because of inflation.