How Much Can I Contribute In 2023

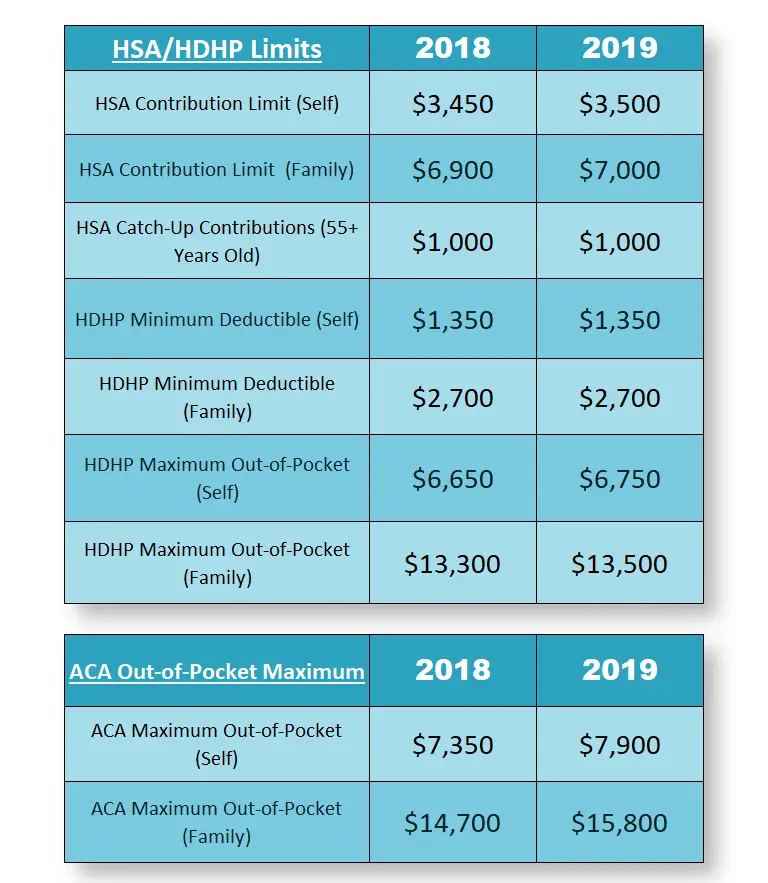

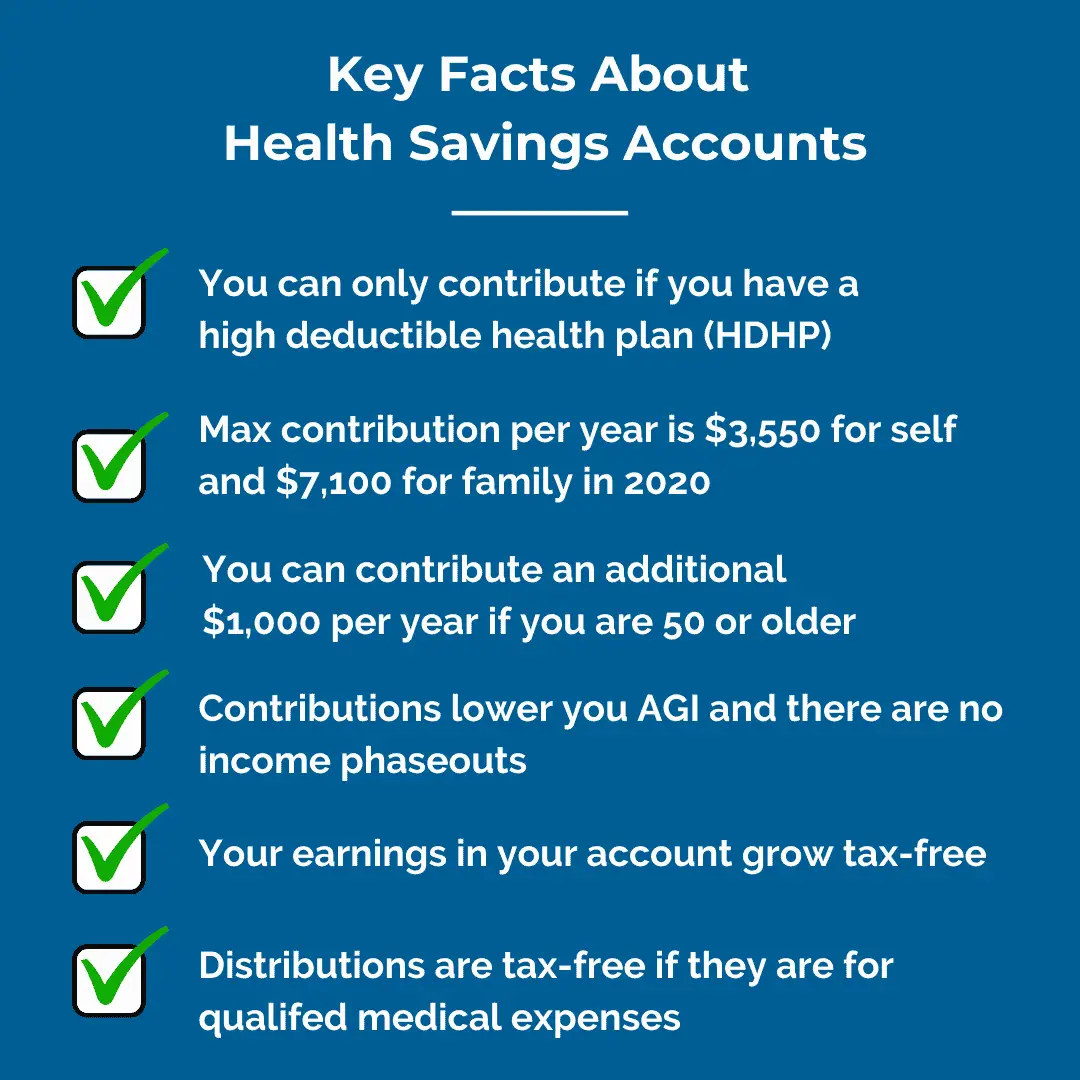

Just like with traditional IRAs and Roth IRAs, theres a limit to how much you can actually contribute to your HSA. Heres what you can expect for 2023:

Individuals: $3,850 |3

Families: $7,750 | 4

If youre over the age of 55 and want to catch up on your contributions, the IRS allows you to make an extra contribution of $1,000 each year.

Hsas Offer Powerful Tax Benefits For Employers

When it comes to tax advantages, HSAs have the unique power to be a win-win for employees and employers. What that means is that while employees are able to leverage the triple tax advantage HSAs offer, employers are also able to benefit from substantial HSA tax advantages.

For employers, HSA tax benefits come from a few avenuesoffering your HSA program through a cafeteria plan that allows your employees to make pretax contributions, having your employees actively participate and contribute to their HSAs and contributing to your employees HSAs as their employer.

If you need a refresher on what it means to set up and maintain a Section 125 cafeteria plan that offers pretax HSA deferrals, Bend has you covered. If not, lets dig a little deeper into how HSAs benefit an employer from a tax perspective.

How It All Adds Up

Your HSA is yours for lifethere is no use-it-or-lose-it rule, and the balance rolls over from year to year. With a careful balance of saving and spending, even with a modest rate of return on any investments, you have the opportunity to grow your account over time.

See how much your savings could add up over the next 20 years with our HSA balance and tax savings calculator..

1About Triple Tax Advantages: You can receive federal tax-free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA. If you receive distributions for other reasons, the amount you withdraw will be subject to federal income tax and may be subject to an additional 20% tax. Any interest or earnings on the assets in the account are federal tax free. You may be able to claim a federal tax deduction for contributions you, or someone other than your employer, make to your HSA. State tax consequences for HSAs may vary. Bank of America recommends you contact qualified tax or legal counsel before establishing an HSA.

Recommended Reading: How Do I Submit My Tax Return Online

The Deductibility Of Hsa Contributions

If you have HSA-qualified health insurance, you probably already know that you can deposit tax-free money into a health savings account to save for future medical expenses or even for retirement. But “tax-free” can mean different things depending on how you make your HSA contributions.

You can contribute to an HSA as long as you have coverage under an HSA-qualified high-deductible health plan . And, you can’t also have another disqualifying health plan, such as most FSAs and other full-coverage health insurance plans.

Some people make their own contributions directly to an HSA, while others make their contributions via their employers. The employer then uses a salary reduction arrangement to take out pre-tax money from the employee’s pay and send it to the HSA on the employee’s behalf.

In both cases, there’s no federal income tax on the HSA contributions . But some HSA contributions are still subject to payroll taxes. Let’s take a look at how it works.

Income tax vs. payroll tax

First, let’s get to a very common question: What’s the difference between income tax and payroll tax?

Income tax is paid entirely by the employee, and is usually designated on your W-2 as “withholding” or simply “federal tax.” And in most states, there’s an additional line for state withholding/tax.

Payroll taxes, which fund Social Security, Medicare, and unemployment insurance, are paid partly by the employee and partly by the employer.

What Makes An Hsa A Good Idea

As an HSA owner you’ll likely do better than break even each year if you are in good health. With the savings on your insurance premiums, you should be able to accumulate a sizeable nest egg. And, unlike flexible spending accounts , HSA funds are not subject to a “use it or lose it” policy. Anything you don’t spend one year carries over to the next year. After all, it’s your money. Your HSA funds may be put into investments approved for IRAs, such as bank accounts, annuities, certificates of deposit, stocks, mutual funds, and bonds.

Also Check: Can I File Taxes Without My Spouse Present

Social Security Cola 2023

Income limits for taxing Social Security benefits are not adjusted for inflation. However, the Social Security retirement benefits you receive do get a cost-of-living adjustment that can increase your income.

For 2022, that adjustment was 5.9%, which was a record high. But the Social Security COLA for 2023 is higheri.e., 8.7%. Thats important because even though this represents a substantial raise for many Social Security recipients, depending on the amount of your other taxable income, up to 85% of your Social Security may be taxable.

Are Social Security benefits taxable? Again, the major increase in the 2023 Social Security COLA could impact your taxes depending on the circumstances surrounding your other taxable income. So, you might have to pay taxes on some portion of your Social Security benefit.

The Social Security Benefit Statement that you receive from the federal government shows the amount of benefits you received in the previous year, which might help you to determine whether your benefits are subject to tax.

Let Our Tax Professionals Help You Use Hsa As A Tax Planning Strategy

Opening and funding a health savings account can be a cost-effective way to save money for both medical expenses for you and your family and some money every tax year by reducing your taxable income and reducing your tax burden. Because the money rolls over and may be disbursed tax-free after you reach the age of 65, unused funds may also help you have a comfortable retirement.

Do you need help determining your HSA tax benefits? Contact our income tax advisors. We’re here to help!

About David Cash

David or Dave is your stereotypical accountant who enjoys what he does. Dave has done some of just about everything in public accounting from financial statement auditing to tax compliance to pension design and administration.

Recommended Reading: What Is My Pay After Taxes

How Do I Get Reimbursed From An Hsa Account

The short answer is, send in a receipt to your HSA provider and you’ll get reimbursed for the expense.

There are many companies offering HSA accounts, and their procedures vary. The best HSA providers make it easy for you to open an account, pay money into it, keep on top of your available balance, and get money out of it.

Filling Gaps In Health Plans

Remember that you can also use the account for expenses that aren’t covered by your health insurance plan. For example, if your medical plan doesn’t cover dental or vision care, HSA funds can still be used for those bills.

There are a few things that an HSA cannot be used for. You can’t use it to pay insurance premiums. Other ineligible expenses include over-the-counter items like toothpaste, toiletries, and cosmetics, as well as most cosmetic surgeries. A vacation to a healthier climate would also not qualify.

Over-the-counter costs that don’t require a prescription are generally not allowed. That includes nicotine gum or patches as well as toothpaste and toiletries.

If you’re 64 or younger and withdraw funds for a non-qualified expense, you’ll owe income taxes on the money, plus a 20% penalty. If you’re 65 or over or are disabled, you’ll still owe taxes on the amount but will be spared the penalty.

So, frankly, after age 65, you can essentially withdraw HSA funds for anything.

Don’t Miss: How To File An Amended Tax Return Turbotax

When Must Contributions Be Made To An Hsa For A Taxable Year

Contributions for the taxable year can be made in one or more payments at any time after the year has begun and prior to the individuals deadline for filing the eligible individuals federal income tax return for that year. For most taxpayers, the deadline is April 15 of the year following the year for which contributions are made.

How The Cares Act Affects Hsa

The CARES Act became law in 2020 and was designed to provide financial assistance to people affected by the COVID-19 pandemic. Some relevant changes to the HSA rules included the following:

Since many individuals and families relied on remote and telehealth during the pandemic, the decision was made to relax the standards for both HDHP coverage and HSA spending to allow people to access the funds when necessary.

Read Also: What Documents Do You Need For Tax Return

You Cant Invest Your Fsa Funds

One of the lesser-known benefits of an HSA is that you can invest those funds into good growth stock mutual funds. Because FSA funds have a 12-month lifespan, you lose the investment opportunityand the tax benefitswith an FSA. Without the investment piece, choosing an FSA means losing out on tax-free interest and earnings.

Money In Your Account Can Be Invested

Account-holders who invest some of the assets in their accounts tend to have significantly higher average balances, according to the Employee Benefits Research Institute $22,496, compared with $2,296 for non-investors. Investors also had higher contribution amounts than non-investors .

A 55-year-old who contributes the maximum amount to an HSA every year until age 65 could see a balance of $60,000 from total contributions of about $42,000, assuming a 5% rate of return, the EBRI notes.

An aggressive, high-earning 45-year-old saving the maximum, including catch-up contributions when eligible, could see a balance of $150,000 at age 65. If the rate of return is 7.5%, which is feasible, the balance rises to $193,000.

Of course, an HSA is not intended primarily as a retirement savings vehicle. It’s there so that you can cover out-of-pocket medical costs from year to year. But it’s worth considering, as each unexpected medical bill arrives, whether you should tap into your HSA or leave it for a possible greater need down the road.

You May Like: What Is Total Tax Liability

You Fund Your Own Hsa

If you are self-employed, or your employer doesnt offer an HSA tied to an HDHP, you will be in charge of setting up your own HSA account. In this scenario, your contributions will be made from regular after-tax money youve got sitting in a bank account. Dont worry, you will still be able to deduct your contribution, but it requires an additional step when you file your federal tax return: fill out IRS Form 8889 and your contribution will be deducted from your taxable income.

Fsa Annual Contribution Limits Are Lower

In 2023, you can contribute up to $3,050 into an FSA.8 Because FSAs are only available through employers, its possible your employer could set the limit lower than $3,050. With an HSA, however, an individual can contribute up to $3,850 or $7,750 for a family in 2023. The closer you get to those maximum contributions, the less you have to report as taxable income.

Also Check: Where To File My Taxes

Is There A Catch

No catch. Money you put in your HSA is your money to keep-even if you change employers or health plans. There’s no “use it or lose it” like with a Flexible Spending Account .

HSA funds are there for you to spend as you need and save if you don’t. And, any dollars you don’t spend carry over year after year. Medical expenses tend to only increase as we get older, so setting funds aside now makes sense.

Hsa Vs Flexible Savings Account

The HSA is often compared with the Flexible Savings Account . While both accounts can be used for medical expenses, some key differences exist between them:

- FSAs are employer-sponsored plans.

- Only employed individuals can sign up for FSAs.

- Unused funds in the FSA during a given tax year cant be rolled over and are forfeited once the year ends.

- Your elected contribution amount for an FSA is fixed, unlike HSA contributions.

The maximum contribution for an FSA for the 2022 tax year is $2,850 .

Don’t Miss: Do Dependents Have To File Taxes

Health Savings Account Rules And Limits

There are plenty of benefits if you have a high-deductible insurance plan

Does your health insurance come with deductibles in the four figures? If so, you’re probably eligible to establish a Health Savings Account . Used in combination with a High-Deductible Health Plan , funds deposited in an HSA can go towards paying medical bills until the plan’s deductible is met and your healthcare coverage kicks in.

HSAs were established in 2003 as part of the Medicare Prescription Drug, Improvement, and Modernization Act. These savings accounts have become an increasingly popular option for consumers seeking to manage their healthcare costs. They also work as a tax-advantaged savings tool as well.

Qualified Distributions Are Excluded From Gross Income

Distributions from your HSA that are used exclusively to pay for qualified medical expenses for you, your spouse, or tax-qualified dependents are excludable from your gross income. Your HSA funds can be used for qualified expenses and will continue to be free from federal taxes and state taxes for most states even if you are not currently eligible to make contributions to your HSA.

Also Check: How Do I Pay Tax As Self Employed

Can You File Federal Tax Returns For Free If You Want To Deduct Hsa Contributions

Tax-filing services like H& R Block have service tiers starting at a free filing option. However, these free filing options typically only include the most basic tax forms, so you might have to pay extra for a level of service that processes Form 8889 and deducts HSA contributions. Depending on your income, you may qualify for IRS Free File, which may allow you to process your tax return for free.

Ner With Bend To Experience The Next Generation Hsa

Whether you already have an established HSA program or are just starting down the path, do your homework and consider partnering with an HSA innovator like Bend HSA. With Bend, HSAs are easy for employers and employees to set up and maintain. And because Bend takes a proactive approach to helping employees identify eligible expenses and increase their pretax payroll contributions as they learn more about how to better manage their HSA, growth in employee contributions only further boosts your bottom line. Bend provides you with all the tools you need to be successful, including a FICA tax savings widget and much more.

Read Also: How Fast Can You Get Your Tax Refund

How Much May Be Contributed To An Hsa

Two types of contributions may be made to HSAs: regular and catch-up. The annual contribution limit for an HSA for individual coverage is $3,850 in 2023. The annual limit for family coverage is $7,750. For individuals between 55 and 64, additional “catch-up” contributions to an HSA are allowedâ$1,000 in 2023. The maximum contribution limits will be adjusted for inflation in future years, rounded to the nearest $50.

If I Dont Have A 5498

Log in to the Member Website. Click Resources on the left menu. Then click View Statements on the right side of the Resources page. Click Account Summary under the Accounts tab, and then click HSA Contributions By Tax Year.

Note: You’re responsible for verifying the accuracy of the applicable IRS maximum each year based upon your situation.

Read Also: Do I Have To Give My Ex My Tax Returns

What Are Tax Deductions

Before diving into your health savings account , it helps to understand what tax deductions are and how they save you money.

The first step is adding all the income you received for the year. After that, the IRS allows you to subtract certain items to reduce how much of your income is taxable.

Next, you choose one of two options: itemize or take the standard deduction. 2017’s tax law changes nearly doubled the standard deduction. Because of this, itemizing wont necessarily offer you the biggest discount.

The good news is, your HSA deduction stays intact regardless of which option you choose. Thats because its not part of your itemized deductions and subtracted during the first step.

There are several scenarious to take into an account if you have an HSA:

Reporting Your Health Saving Account On Your Taxes

Whether your employer makes HSA contributions on your behalf or you make them directly, you must report the HSA and all HSA contributions and disbursements to the Internal Revenue Service using Form 8889. You may also use Form 8889 to calculate the amounts you must include in your reported income and to determine your HSA eligibility. If you are not eligible, then your contributions will not be tax-deductible.

Here are some important things to keep in mind when you complete Form 8889:

The rules for reporting HSA contributions and disbursements are simple to understand, and they shouldn’t complicate your income tax return. The HSA deduction can help you reduce your regular income tax burden and make it easier to pay your qualified expenses.

Also Check: Where To Find Real Estate Taxes Paid

Taking The Tax Deduction

The entire amount deposited is tax-deductible on returns for that year, even for filers who do not itemize deductions.

Contributions by an employee directly from paychecks are made with pretax dollars, reducing their gross income. Employer contributions are deducted from taxable income by the employer, so they do not need to be itemized by the employee.