Filing Business Tax Or Other Amended Returns

Most business and fiduciary taxpayers are able to simply:

- Adjust the amounts shown on the original return and

- Submit a revised return to DOR online through MassTaxConnect

Corporate excise filers can file amended returns electronically through third-party tax preparation software whether the amendment increases or decreases the tax due. Fiduciary filers may also be able to file amended returns using third-party software.

To learn more about third-party software options, read “DOR e-filing and payment requirements.”

Keep in mind that some taxpayers are required to file amended returns electronically.

Refer to TIR 16-9 to see if the electronic filing and payment requirements apply to you.

Filing electronically is always the quickest option, but if you are not required to file electronically you still have the option to check the amended return oval on your paper return and file it the way you usually do.

Disadvantages Of An Amended Tax Return

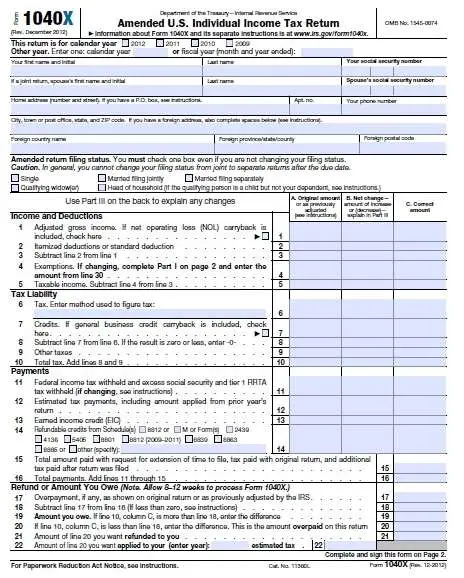

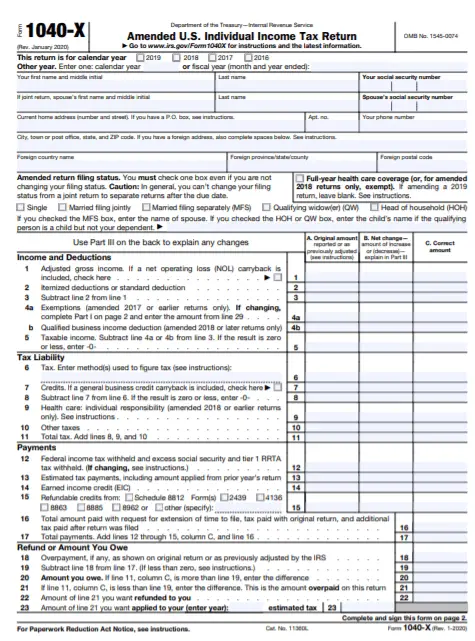

The drawback of filing an amended tax return is that Form 1040-X cannot be submitted electronically for every tax year, although the IRS has recently started accepting e-filed amended returns for tax year 2019. If filling out the form manually, the taxpayer has to mail the printed-out document to the IRS Service Center that processed the original tax form. The IRS manually processes amended returns, and the process can take 16 weeksor even longer, if the amended return is not signed, is incomplete, has errors, requires additional information, needs clearance by the IRS bankruptcy department, has been routed to another specialized area, or has been affected by identity fraud.

There is, however, a three-year statute of limitations for issuing tax refund checks. Therefore, the taxpayer must file any amended returns that will result in a tax refund within three years after the date they filed the original tax return. An amended return filed to account for additional income or overstated deductions does not fall under any such statute and can be filed at any time.

-

You can correct errors on an amended tax return.

-

You can claim a refund you were owed even if you didn’t file for it.

-

You can correct for circumstances that changed since you originally filed.

-

Form 1040-X cannot be filed electronically for all tax years.

-

Processing an amended return can take 16 weeks or longer.

-

There is a three-year statute of limitations for collecting tax refunds.

Common Reasons Why You Need To Amend A Return

| Reason | |

|---|---|

|

|

| Update credits |

|

| Update deductions |

|

| Report federal income tax adjustments | You amended your federal tax return or recently audited by the IRS |

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

If You Or Your Parent Did Not File A 1040x

Sometimes the IRS makes minor internal corrections while processing tax returns. In these cases, you will not have an amended 1040X tax return. You will need to provide additional information to the Office of Student Financial Aid:

Option 1:

- 2020 Record of Account Transcript.

Option 2:

One of the following:

- Any letter or notice from the IRS indicating the changes the IRS made to the individual’s 2020 tax return data items OR

- A 2020 Tax Account Transcript, which shows any amended tax data items

AND one of the following:

- A 2020 Tax Return Transcript or any other tax transcript showing the tax data from the original tax return OR

- A signed and dated copy of the 2020 Form 1040 and Schedules 1, 2, and 3 that were filed with the IRS or other relevant tax authority.

Does An Amended Return Result In Fees Or Penalties

The IRS does not charge a fee for amended returns.

You may have to pay interest and late payment penalties on any additional tax that you owe if youre amending and paying after the original return due date. However, this will almost always be less than the interest, failing to pay, and accuracy penalties the IRS will impose if you dont amend and it discovers you owe additional tax.

Read Also: Have My Taxes Been Accepted

Keep An Eye On The Calendar

Generally, the IRS audits only returns from the previous three tax years though there are major exceptions. So although it might be tempting to wait and see if the IRS will catch you in an error, it might be cheaper to fess up sooner rather than later.

The IRS charges interest and penalties on outstanding tax liabilities going all the way back to the original due date of the tax payment. So the longer you wait to fix a mistake, the more expensive that mistake can get.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Taxpayers who received unemployment compensation in 2020 may want to amend their tax returns.

getty

Many taxpayers learned that unemployment benefits are taxable the hard way earlier this year when they filed their 2020 income tax returns. It came as such a blow to so many people, after what was a horrible year in so many other ways, that Congress included a tax exemption for the first $10,200 of unemployment insurance in the American Rescue Plan passed in March 2021. Unfortunately, that law was passed after many taxpayers had already filed their tax returns. As panic set in, the IRS asked taxpayers not to file amended returns, but to wait for an automatic adjustment that would come in the summer. The adjustments were made and the final few batches of refunds are currently being delivered to affected taxpayers. This is great news, but it is not the end of the story.

Recommended Reading: What Does Locality Mean On Taxes

Should I Amend My Return For A Small Amount

If you believe the IRS owes you money, its generally up to you to decide how much youre willing to let the IRS keep to avoid amending.

If you believe you owe more, keep in mind that the IRS may figure it out eventually. You may owe years worth of interest and penalties when the IRS finally audits your return.

Want To Know How To File An Amended Tax Return

Today, were going to walk through, step by step, how to do it.

Lets dive right in!

As an accounting firm, weve filed our fair share of amended tax returns. And, we wanted to make this post so there is less confusion and stress surrounding the topic.

In todays post, well be going over when to amend your taxes and the 5 steps to actually amend your taxes.

Additionally, well also discuss how to track your amendment, and 5 tips to get your amendment right the first time.

Don’t Miss: How To Buy Tax Lien Certificates In California

How To File An Amended Tax Return

To file an amended return, you must submit a copy of your original tax return and any additional information related to the changes you made to the existing return. Its important to fix all errors on your tax return, even if it means that youll end up owing money to the IRS.

Here are situations for filing an amended return:

Incorrect Personal Information

Social Security numbers or the previous tax return sometimes call for an amendment.

Wrong Tax Filing Status

You may have filed as head of the household but dont qualify as such.

Wrong Number of Dependents

One of the reasons to amend tax return is a wrongfully listed number of dependents, especially if it affects the number of tax breaks, such as the Child Tax Credit, Earned Income Tax Credit , or the Health Coverage Tax Credit .

Forgotten or Wrongly Reported Income

Additional income also has to be reported. In case youve forgotten, for example, dividend income, you need to refile federal tax to avoid fines and penalties. You should also know that cryptocurrencies are taxable property and must be reported. If you have cryptocurrencies, it might be advantageous to use great crypto tax software to help you report them on your return.

Incorrect Tax Form

Individuals sometimes file their taxes on the wrong formthis needs to be rectified by filing the correct form.

Forgotten Deductions or Credits

Can Tax Preparation Software Help You File An Amended Tax Return

TaxAct is one of the few online tax solutions that allows you to create an amended return. You can generate a Form 1040-X by editing your original return and then selecting the amended return option at the end. If you used other tax software, you can enter your original return then enter the changes to create a 1040-X.

Most other tax software either doesnt handle amended returns or charges a much higher fee than originally filing your return. If you still have access to your original software, another option is to redo your tax return using that software. You cant file what the tax software gives you since its a Form 1040, but you can compare the new 1040 to your original tax return and use it to fill out Form 1040X by hand.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Extra Refunds For Taxpayers In Community Property States

Taxpayers who received UI and who live in community property states also may be seeing magic money from the IRS appearing in their bank accounts. This was due to late guidance that created another automatic adjustment. UI is considered community income in community property states. That means if one spouse on a joint return received $25,000 in UI and the other spouse received less than the exclusion amount each taxpayer was allowed to exclude a full $10,200. Depending on the couples effective tax rate, the savings could be from a little over $1,000 to a few thousand dollars! Again, the IRS is automatically adjusting returns but it is prudent if you filed a joint return in a community property state and received over $10,200 in UI to review your direct deposits and ensure that you got the benefit of the maximum exclusion amount available to you . Again, patience is recommended, but an amended return could be indicated.

How Much Does It Cost To Amend A Tax Return

There are no charges or fees for filing Form 1040X for amended returnsthe only expense is the postage fee when mailing the documents. So part of knowing how to amend taxes includes you printing out the form, signing it, and sending it via post. But if it turns out that you owe money to the IRS, youll need to pay interest and late fees on the money you owe.

NOTE:If you receive an advanced premium tax credit through the marketplace, you must file Form 8962. If you dont know how to do this, you can use high-quality business tax software to guide you through the process.

Also Check: How Much Does H& r Block Charge To Do Taxes

Amending Slips On Paper

If you choose to file your amended return on paper, clearly identify the new slips as amended slips by writing “AMENDED” at the top of each slip. Make sure you complete all the necessary boxes, including the information that was correct on the original slip. Send two copies of the amended slips to the employee.

Send one copy of the amended slips to any national verification and collections centres with a letter explaining the reason for the amendment.

Do not file an amended T4A Summary.

Notes

If you notice errors on the T4A slips before you file them with us, you can correct them by preparing new information slips and removing any incorrect copies from the return. If you do not prepare a new slip, initial any changes you make on the slip. Be sure to also correct the T4A Summary.

If you file more than 50 information returns for a calendar year, you must file them electronically. For more information on how to file electronically, go to Electronic filing methods.

How To Amend A Tax Return: Step

Amended tax returns are filed to rectify mistakes on previously filed taxes. Amending a tax return is not a complicated process, but you need to be careful not to miss anything when filing for an amendment. But if you go through all the required steps the first time you file for an amendment, youll have no additional responsibilities regarding the amendment process, and you wont have to refile tax returns.

Don’t Miss: Reverse Ein Lookup Irs

Manual Review For Some Returns

Taxpayers who filed returns after the ARP became law were allowed to exclude up $10,200 in unemployment insurance per taxpayer and many did. UI is entered on Line 7 of Form 1040, Schedule 1. To claim the exclusion taxpayers entered a negative amount on Line 8 with unemployment compensation exclusion or UCE entered in the description field. Taxpayers who self-prepared their returns, however, may have forgotten to include the description. The IRS requires manual review of any tax return with a negative amount on Line 8 and nothing in the description field. Consequently, many such returns are in a pile somewhere awaiting their turn for manual review. Taxpayers who filed their returns and included the exclusion but who have not received their refunds should verify that they included the description. If they did, the return is likely to be released in the last wave of automatic adjustments. If not, they should continue to be patient while their return is undergoing manual review.

How Do I Use The Where’s My Refund Tool To Check The Status Of My Tax Refund

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund through the IRS2Go mobile app.

You May Like: Where’s My Tax Refund Ga

How To File An Amended Tax Return With The Irs

OVERVIEW

Did you make a mistake on your tax return or realize you missed out on a valuable tax deduction or credit? You can file an amended tax return to make the correction. Filing an amended tax return with the IRS is a straightforward process. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Apple Podcasts | Spotify | iHeartRadio

Mistakes happen even on tax returns. That’s why the IRS allows taxpayers to correct their tax returns if they discover an error on a return that’s already been filed. Here’s what you need to know about filing an amended tax return.

How To Add A T4a Slip

After you file your T4A information return, you may discover that you need to send us additional T4A slips. If you have original T4A slips that were not filed with your return, file them separately either electronically or on paper.

If the total number of T4A slips you file is more than 50 slips for the same calendar year, you have to file the additional slips over the Internet.

Also Check: Www Michigan Gov Collectionseservice

When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

Effects Of The Ui Exclusion On Adjusted Gross Income

The UI exclusion is what tax professionals call an above the line adjustment. In other words, it lowers the taxpayers adjusted gross income . But the IRS is using a simplified calculation to compute the refund amount. They are taking the amount of allowable exclusion and multiplying it by the taxpayers tax bracket and refunding the resulting amount. For example, a taxpayer who was entitled to but did not take the full $10,200 exclusion and who is in the 12% tax bracket would receive a refund of $1224. Thats great, right?

Yes and no. Yes, because you will automatically receive any additional refund amount related to unexcluded UI income. No, because in many cases lowering AGI also affects other calculations used on the tax return. To re-calculate every AGI-related item on every affected tax return would have been impossible for the IRS even under the best of circumstances. Unfortunately, the simplified calculation used to make the adjustments and issue the refunds could have resulted in other possible tax benefits being overlooked. For example, lowering AGI can potentially

Don’t Miss: How To Buy Tax Lien Properties In California