How Long Do You Need To Keep Tax Records For

The IRS states you need to keep your records “as long as needed to prove your income or deductions on a tax return” this means you need to keep your tax records for three years from the date your return was submitted. For example, if you file your 2018 tax return a few months ahead of the deadline, this means you need to keep all receipts, tax records, and all additional documentation related to the return until April 15, 2022 — three years after the 2018 deadline.

What If I Have Claimed Investment Losses Or Bad Debt Write

Sometimes your financial investments don’t go as planned, and you take a significant loss on a stock, business investment, or loan to your deadbeat uncle that never gets paid back.

The silver lining is you get to claim this loss to offset your income on your tax return. However, per the IRS, filing a claim of loss for bad debt or a worthless investment triggers a seven-year period of limitations. In this situation, you’ll want to make sure to keep your tax records for at least seven years in case of an IRS audit.

Other Circumstances For Extended Statutes Of Limitations

In some circumstances, the statute of limitations is longer than three years. For example, if you dont report income that youre required to report, and it exceeds 25% of the income shown on that years tax return, the IRS has six years to audit your return.

In addition, not filing or filing a fraudulent tax return allows the IRS to audit you indefinitely. So keep any tax records for those years permanently.

Don’t Miss: What Does Locality Mean On Taxes

What Is The Cra Statute Of Limitation On Tax Debt

Paying off tax debt is difficult, but so is understanding various tax laws and Canada Revenue Agency rules. In fact, fully understanding the ins and outs of CRA processes and rules is often more complicated than filing and paying taxes. One situation that many have trouble understanding is the CRA statute of limitations. This refers to how far back the CRA can go when looking into prior year returns, collecting tax debt, and conducting audits . A big fear that many have is the CRA conducting an investigation into returns from many years ago and then demanding you pay a significant tax debt that you werent even aware of owing.

This is why the CRA statue of limitations is so important. It gives you peace of mind and calms your concerns.

There are several reasons why people want to know more about the CRA audit time limit and reassessment time limit. For instance, there are some cases where a person knows that they owe a tax debt for several years, but they ignore it, hoping that the Canada Revenue Agency wont find it. In other cases, a person files their taxes and thinks everything is fine, only to be hit with a CRA reassessment many years later.

Either scenario brings up the same question: How far back can the CRA go when looking at income taxes and tax debt?

A Good Grasp Of Tax Law Can Help Your Business Succeed

When determining how long to keep your business records, it is safe to assume that most must be kept for at least 6 years. However, there are certain exceptions that you may be required to keep for longer.

If you are well aware of your tax obligations, you will be prepared in the event that the CRA or Revenu Québec ask to see your records.

If you have any questions about tax laws and regulations in Quebec and Canada, feel free to contact the tax accountants at T2inc.

Also Check: When Did I Last File Taxes

How Long To Keep Tax Returns: 7 Questions To Consider

How long to keep tax returns is one of the most asked questions in personal finance.

Did you know the average American spends 13 hours every year preparing federal tax returns? For small business owners, that figure almost doubles to 24 hours!

It’s always a relief once taxes are filed for the year. But what do you do with all the paperwork afterward? How long should you keep your tax returns and records?

For most people, three years is a good time frame, but it could be much longer in many situations. Plus, it can often be a good idea to hold onto records longer than the required time for other non-tax reasons.

Keep reading to find out exactly how long you should keep your tax records in your situation. The answer may surprise you!

State Vs Federal Statute Of Limitations

The IRS handles federal taxes, so it’s important to follow their guidelines when determining how long to keep tax records for your federal return. What about state and local taxes? Individual states can set their own period of limitations for tax audits. If you live in a state that can audit your taxes after the federal time period expires, you should still keep your tax records.

For example, most states require business tax records to be kept for three years from the filing date or payment date, but Arizona, Kentucky, Michigan, New Jersey, Ohio, Texas, Washington and Wisconsin require businesses to keep their tax records for four years from the filing date. Minnesota wants businesses to keep tax records for three and a half years. If you filed in Maine but understated your business income by more than 50%, you should keep those records for at least six years.

Don’t Miss: How Much Is Tax In Georgia

What To Do When The Statute Of Limitations Is Up

As tempting as it may be to toss everything once the IRS says you dont need to keep it, you might want to think twice. You might need to keep your records for other reasons. Your insurance company or creditors may require that you hold onto things for a little longer.

One of the benefits of keeping electronic records is that you dont have to store piles of receipts in a filing cabinet. Archive your old records so that you can access them years into the future, anytime you need.

Mistakes On Tax Returns And Audits

If you discover that a mistake has been made on your tax forms, you have up to three years to submit an amended return. Use Form 1040-X to enter the corrected information and submit a hard copy via the mail. To amend state taxes, fill out the federal Form 1040-X and attach it to your state’s amendment form .

If the IRS catches a mistake, such as a missing or incorrect Social Security number, you could face a fine. Take care to review your original tax return thoroughly before submission. Get an early start during tax season so you don’t feel rushed and accidentally enter incorrect information, and keep all pertinent tax documents well organized so your calculations are easy to confirm.

You May Like: Where To File Va State Taxes

How Far Back Can Cra Reassess

If you have filed your taxes and paid what you owe , one of the last things you want is for the CRA to come back and reassess your return. When the CRA reassess a tax return, it can determine that you owe more than you originally paid and/or what was originally stated when the CRA conducted its initial assessment.

When you first file your tax return, the CRA does an initial review. It then sends out a Notice of Assessment that contains a lot of information about your tax situation, including how much you owe. However, this may not be the last time the CRA will look at your tax returns. The CRA is able to go back and conduct a more in-depth review. If it finds anything that should be changed or that it believes is incorrect, the agency will issue a Notice of Reassessment. This replaces the initial Notice of Assessment.

However, there are limits to how far back the CRA can reassess a tax return . In general, the agency can go back and reassess a return for three years after the date on the initial Notice of Assessment. For example, if you file your 2015 tax return in April 2016 and receive your Notice of Assessment in June 2016, the agency can reassess this return until June 2019 . However, there are exceptions to this rule.

According To The Irs What Is The Period Of Limitations

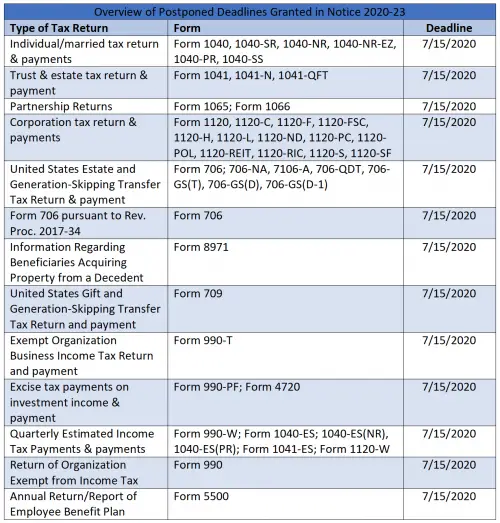

The period of time when you are still able to amend your tax returns to claim a tax credit, or refund, is called the period of limitations, according to the IRS. During this time, the IRS may still assess you with additional tax liabilities. Specific examples of this are listed later in the article. Unless stated otherwise, a time period of limitations refers to years after the taxes were filed. Tax returns that were filed early are considered filed on the tax deadline, usually around April 15th. For 2020, this will be July 15th. However, the time period of limitations for returns filed on extension will be years from the actual date the taxes were filed.

Keep copies of your filed tax returns indefinitely. Having access to copies of your older tax returns may help in preparing future tax returns and making computations if you need to file an amended return. With the help of scanning and cloud storage, I dont see many reasons to delete older tax returns. I think we could all save a lifetime of tax returns on our computers without putting a dent in our storage limits.

Period of Limitations that apply to income tax returns via the IRS website

1. Keep records for three years if situations , , and below do not apply to you.

2. Keep records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later if you file a claim for credit, or refund, after you file your return.

Read Also: What States Are Tax Free

Storing Tax Records: How Long Is Long Enough

Federal law requires you to maintain copies of your tax returns and supporting documents for three years. This is called the “three-year law” and leads many people to believe they’re safe provided they retain their documents for this period of time.Storing tax records: How long is long enough?

However, if the IRS believes you have significantly underreported your income , or believes there may be indication of fraud, it may go back six years in an audit. To be safe, use the following guidelines.

Business Records To Keep… Special Circumstances

| Caution: Identity theft is a serious threat in today’s world, and it is important to take every precaution to avoid it. After it is no longer necessary to retain your tax records, financial statements, or any other documents with your personal information, you should dispose of these records by shredding them and not disposing of them by merely throwing them away in the trash. |

Business Documents To Keep For One Year

- Correspondence with Customers and Vendors

- Duplicate Deposit Slips

- Purchase Orders

- Receiving Sheets

Business Documents To Keep For Three Years

- Employee Personnel Records

- Employment Applications

- Savings Bond Registration Records of Employees

- Time Cards For Hourly Employees

Business Documents To Keep For Six Years

Business Records To Keep Forever

While federal guidelines do not require you to keep tax records “forever,” in many cases there will be other reasons you’ll want to retain these documents indefinitely.

How Long Should You Keep Business Tax Records And Receipts

Reliable record keeping allows businesses to prepare financial statements that help business owners keep tabs on their expenses. However, many companies aren’t sure how long tax records and receipts need to be saved in the era of paperless transactions and cloud-based systems. Record keeping is a dull subject matter, but it’s an essential task as if you make the wrong choices, you face litigation and problems with the IRS. Understanding how long you should keep these records will help you avoid these problems.

You May Like: How To Get Tax Exempt Status

Determining Expiration Of The Statute Of Limitations

Typically, the statute of limitations for the IRS to audit your tax return is generally three years. For an income tax return, the period of limitations is three years. But the IRS says its wise to keep your tax returns even longer. For example, if the IRS audits you, youll have the documents you need to protect yourself from an audit. The statute of limitations starts running on the later of the due date for your tax return or the date on which you file your taxes.

How To Request The Permission To Destroy Your Records Before The End Of Their Retention Period

If you want to destroy your books of account and records earlier than the retention period specified in How long to keep your records, you first must get written permission from the CRA.

To get this permission, you or your authorized representatives can do either of the following:

- apply in writing to your tax services office

If you destroy paper or electronic records without the CRA’s permission, you may be prosecuted.

The CRA’s permission only applies to records you have to keep under legislation it administers. The CRA is not authorized to approve the destruction of records you have to keep under other federal, provincial, territorial, or municipal laws.

You May Like: How Much Federal Tax Should I Pay

What Is Adequate Evidence

In general, receipts, canceled checks and bills will be enough to document your expenses. These documents should help you establish the date, place, amount and reason for the expense.

For example, evidence for your hotel stay should include the name and location of the hotel, the dates you stayed and the cost of the stay, with separate charges for things like meals and telephone calls.

If you are keeping evidence for a meal, youll want to have a receipt that shows the name and location of the restaurant, the number of people served, the date of the meal and the cost.

Along with all documentation, you should also make note of the written explanation of the business purpose. Yes, the IRS wants to be sure that the lunch you had with clients had a business purpose and wasnt just for fun so make note of why it was important to have that meal.

Why Is Keeping Tax Records Important

What happens if you dont hang on to tax records?

In the best case scenario, absolutely nothing. But in the worst case scenario, you may wind up owing more money.

Thats because, if youre ever asked for supplemental documentation to back up whats in your federal or state income tax returns, youll need to provide some proof. Without that proof, you could be charged more money since youre technically claiming things that arent able to be proven.

You might not necessarily get accused of filing a fraudulent return, but you could end up spending more money than youd like. So, whether you do your taxes yourself or use a tax prep service, make sure to keep those records somewhere safe.

Read Also: What Is Sales Tax Deduction

Accounting Records That Companies Must Keep Longer

While the retention period for accounting and tax records is 6 years as a rule, there are other documents that should be kept as long as a company is in business.

For example, you should always keep your deeds, board of directors meeting minutes, share certificates and transfers, and any other documents that can be used to justify ledger entries.

When a corporation is dissolved, these documents must be kept for at least two years following the date of dissolution.

Receipts To Keep For Taxes

Will you or wont you be the victim of an IRS audit? Theres no way to know, so your best bet is to ensure you have any payroll or tax documents that you might be asked for on hand.

Keep receipts for business purchases for three years. The IRS might have a question about business expenses on your income tax return, so youll want to be able to prove the purchase was business-related. This will also come in handy if you claim a deduction or depreciation for equipment.

Also, hang on to payroll and employee income records for tax purposes. You may need to prove that an employee worked for you the number of hours they claimed.

If you have a tax deduction for bad debt, keep those records for seven years.

And remember: it never hurts to keep business records and income tax returns longer than the required time.

Also Check: How Much Should I Withhold For Taxes 1099

The Eight Small Business Record Keeping Rules

Always keep receipts, bank statements, invoices, payroll records, and any other documentary evidence that supports an item of income, deduction, or credit shown on your tax return.

Most supporting documents need to be kept for at least three years.

Employment tax records must be kept for at least four years.

If you omitted income from your return, keep records for six years.

If you deducted the cost of bad debt or worthless securities, keep records for seven years.

Go paperless, store everything electronically, and always make backups.

Expenses that are less than $75 or that have to do with transportation, lodging or meal expenses might not require a receipt. But you still need to tell the IRS where and when the expense occurred, and what it was for.

Even if you donât need a document to do your taxes, you might need it for something else. When it doubt, keep it.