Llc Tax Tips For Business Owners

Its easy to feel overwhelmed by all the tax responsibilities an LLC might have. Fortunately, there are a few ways to lower your tax burden and make tax filing easier.

Here are some tips for LLC tax filing:

-

Take advantage of any tax deductions and tax credits that your LLC is eligible for.

-

Review business tax deadlines in advance, and note relevant due dates.

-

Hire a certified public accountant or tax professional to assist you with tax filing.

-

Talk with your CPA or tax professional about the potential benefits of electing corporation tax status for your LLC.

-

Understand your state and localitys tax requirements.

Porter says that understanding your LLCs tax setup in the beginning is important. Common mistakes are not engaging a CPA that is familiar with the tax rules surrounding LLCs. Its much easier and cheaper in the long run to set up the LLC correctly the first time and make the valid elections for the LLC to be taxed as the business owner wishes.

Consider Electing Corporate Taxation

If you will regularly need to keep a substantial amount of profits in your LLC , you might benefit from electing corporate taxation. Any LLC can choose to be treated like a corporation for tax purposes by filing IRS Form 8832, Entity Classification Election, and checking the corporate tax treatment box on the form.

Starting in 2018, all regular “C” corporations are taxed at a flat 21% rate on all their profits. This rate is lower than the top three individual income tax rates, ranging from 32% to 37%, which would otherwise apply to LLC owners at various income levels. Thus, LLC owners can save money on their overall taxes by choosing to be taxed as a C corporation. However, these potential savings can prove elusive because money distributed from a C corporation to its owners is subject to double taxationâfirst the 21% corporate tax must be paid and then the shareholders must pay individual income tax on their dividends at capital gains rates, which range up to 23.8%. However, retained earnings are not subject to double taxation. In addition, electing corporate taxation can allow an LLC to offer owners and employees various tax-advantaged fringe benefits, stock options, and stock ownership plans, none of which are subject to double taxation.

How To Calculate Self

To calculate your self-employment tax, the first step is knowing your net earnings from self-employment. To calculate your net earnings, subtract your business expenses from business revenues.

If the result is less than the Social Security wage base, the calculation is simple. If your net earnings are more than the Social Security wage base, your calculation will have a few additional steps. Weâll show you how to calculate your tax either way.

You May Like: How Much Can You Get Back In Taxes

Gst/hst When You Buy A Business

For GST/HST purposes, if you buy a business or part of a business and acquire all or substantially all of the property that can reasonably be regarded as necessary to carry on the business, you and the vendor may be able to jointly elect to have no GST/HST payable on the sale by completing Form GST44, Election Concerning the Acquisition of a Business or Part of a Business. You cannot use this election if the seller is a registrant and you are not a registrant. In addition, you must buy all or substantially all of the property, not only individual assets.

For the election to apply to the sale, you have to be able to continue to operate the business with the property acquired under the sale agreement. You have to file Form GST44 on or before the day you have to file the GST/HST return for the first reporting period in which you would have otherwise had to pay GST/HST on the purchase.

Even when you use the election, GST/HST will still apply to a taxable supply of a service made by the seller; a taxable supply of property made by way of lease, licence, or similar arrangement; and, if the buyer is not a GST/HST registrant, a taxable sale of real property.

How To Pay Yourself In A Partnership

IRS recognizes partnerships similar to sole proprietorships. But, in the case of partnerships, a group of persons rather than a single person have a claim on the revenue or business profits.

This means each partner has a share in business earnings depending upon the percentage of share stated in the partnership agreement.

Since partnerships are similar to sole proprietorships, partners can also receive an owners draw based on each partners share in capital and business profits.

Furthermore, each partner includes his share of income in his personal income tax return. Thus, he is required to pay income tax and self-employment taxes.

Recommended Reading: How To Do Taxes Freelance

Llcs Taxed As Corporations

What if you decide that your LLC will be taxed as a corporation instead? Well, youll approach your taxes a bit differently.;

There are two types of corporations when it comes to taxes:;

- C Corp ;

- S Corp

There are big differences between these types of corporate taxation, and you can elect to have your LLC taxed either way.

Side note: To be taxed like a corporation, you need to file a document called an election with the IRS. You can do this at any time.;;

When you opt to have your LLC taxed as a corporation, you must become your LLCs employee if you actively work in the business.;;

What does this mean for you?;

Understand How To Reduce Your Business Taxes By Deducting Your Business Expenses

How tax savvy a businessperson you are has a great effect on how much money is in your pocket at the end of the year. You probably know that the tax code allows you to deduct costs of doing business from your gross income. What you are left with is your net business profit. This is the amount that gets taxed.

So knowing how to maximize your deductible business expenses lowers your taxable profit. To boot, you may enjoy a personal benefit from a business expenditure — a nice car to drive, a combination business trip/vacation, a retirement savings plan.

However, to benefit from the business deductions available to you and avoid trouble with the IRS, you need to understand when an expense is deductible.

Don’t Miss: How To File 2 Different State Taxes

More S Corp Considerations

Before you jump on board with the S Corp, there are a few more things to think about.;

First, while the self-employment tax savings is significant, its just one part of the taxes youll be paying. You still have to pay income taxes on the salary and profit that you earn.;

Depending on where you live, this can vary. Dont forget to add the payroll taxes or self-employment taxes youll owe in either an S Corp or sole proprietorship arrangement to the income taxes youll owe . Some taxpayers fail to include this in their calculations, and its a big number to pay attention to.

Another crucial factor is what the IRS calls a reasonable salary. That $50,000 we mentioned in our example above assumes that $50,000 is a reasonable wage to pay you for your hours worked and duties performed. Theres no one-size-fits-all guidance for calculating your S Corp salary, and youll have to determine what is reasonable for your situation.;

The IRS wants to be sure this perk isnt exploited by underpaying your salary and claiming most of your income as S Corp profits. If your reported salary seems too low, especially compared to your profits, the IRS may flag you. Researching similar job positions and their salaries could prove beneficial here.;

Employer And Employee Taxes For Your North Carolina Llc

If you pay employees, there are some slightly different tax implications. Speak to your accountant to get clear guidance for your own unique situation.

All employers must collect and withhold payroll tax from their employees when they receive their salaries. You would normally withhold 7.65 percent of the taxable salary that you pay to your employees.

You may also choose to withhold federal and North Carolina state income tax on the wages you pay to employees. Speak to your accountant for more information.

Regardless of whether you withhold federal and North Carolina state income tax, your employees may need to file their own tax returns.

You may also need to pay insurance for any employees, like employee compensation insurance or unemployment tax. There will also be other requirements you have for employees.

- Federal self-employment tax

- North Carolina state tax

Most North Carolina LLCs will pay estimated taxes four times a year. Speak to your accountant for more information.

Also Check: How To Look Up Employer Tax Id Number

How To Pay Yourself In A Multi

Before choosing a tax structure for their business,;multi-member LLC;owners must first;determine how profits will be shared and distributed between LLC members.

Once members have agreed upon ownership percentages, they can choose a pay structure for the business that includes:

- distributions that by default pass through to the owners’ individual tax returns, or

- reasonable salaries and distributions as LLC S corp employees

Paying Yourself From A Limited Liability Company

Payment method: Owners draw

You must form an LLC according to your states laws, and the rules for LLCs differ slightly by state.

In the eyes of the IRS an LLC can be taxed as a sole proprietorship, a partnership, or a corporation. The rules explained above will apply to how Patty should pay herself as an LLC if shes taxed as a sole proprietor or partnership.

Also Check: How To File Past Years Taxes

How To Pay Taxes On Your Owners Draw

As a sole proprietor, you pay income tax on all of your profits, regardless of how much you actually draw. Even if you leave your profits in the business, youâre still responsible for paying tax on your earnings.

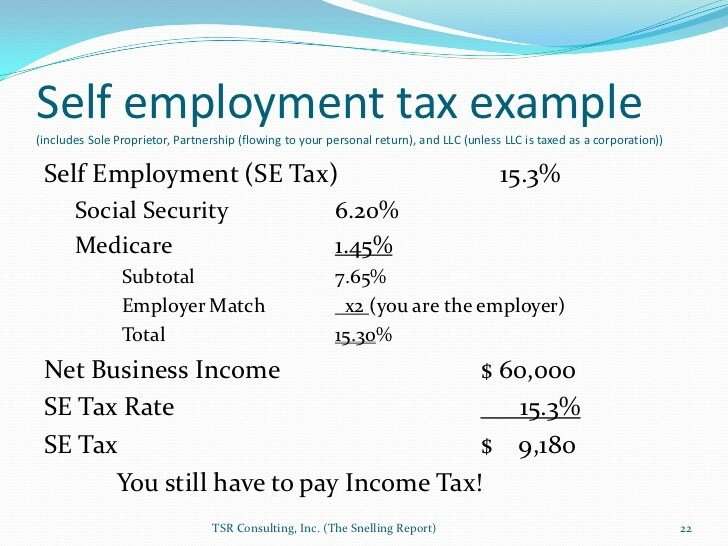

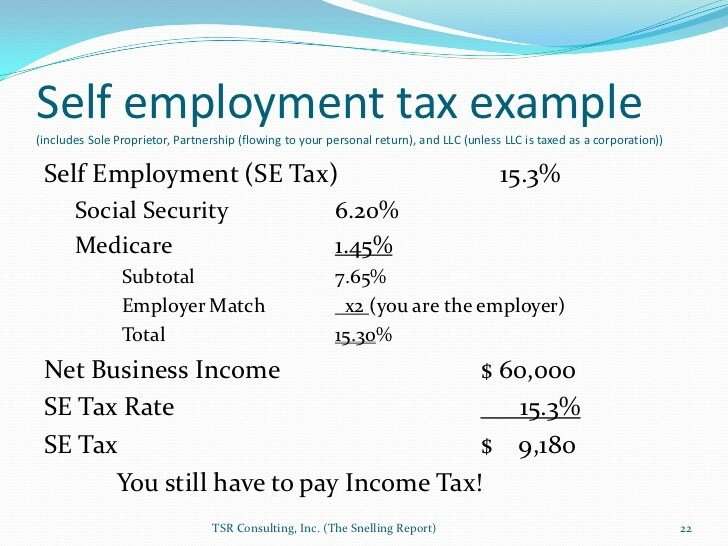

In addition to federal, state, and local income taxes, you also need to pay self-employment taxes on your draw. Similar to the FICA taxes that get withheld from an employeeâs paycheck, self-employment taxes consist of money paid for Social Security and Medicare. The self-employment tax rate is 15.3%.

Almost all businesses make quarterly tax payments. To learn how to withhold these, check out our guide on how to calculate and pay estimated tax.

How Can An Llc Avoid Self Employment Tax

If you operate an LLC that is a disregarded entity, then you will have to pay Social Security and Medicare taxes on your share of the companys entire net profits. But if you operate an LLC that is taxed as an S corporation, you will have to pay such taxes only on the compensation you pay yourself and not on the rest of the business profits.

Therefore, it could be beneficial to operate an LLC that is taxed as an S corp. For example, lets say that you operate a two-person LLC that is taxed as a partnership . Now lets assume that you make $400,000 in profits in any given year. You will have to pay self employment tax on 50% of $400,000, or $200,000. Now lets assume that you operate an LLC that is taxed as an S corp, and you are your partner both earn reasonable salaries of $80,000/year. You and your business will have to pay Social Security and Medicare taxes only on a portion of your compensation. Therefore, the remaining amount of your salary will be earned tax-free.

If you need help learning about the tax implications for self employed people and LLC members, or if you are thinking about establishing a single-member LLC, you can post your legal need;on UpCounsels marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Recommended Reading: How To File Federal Taxes For Free

Do I Need To Pay Self Employment Tax For Rental Property Income

Rental property income is not considered wages unless you qualify as a real estate professional.

-

More than half of the personal services you perform in all trades or businesses during the tax year are performed in real property trades or businesses in which you materially participate.

-

You perform more than 750 hours of services during the tax year in real property trades or businesses in which you materially participate.

Rental Real Estate Income and Expenses of a Partnership or an S Corporation,

What The Future Holds

With this string of recent cases decided in its favor, the IRS now has more tools to attack strategies for reducing LLC members’ self-employment tax liability, and it is likely to become more aggressive in attacking what it perceives as abusive strategies in this area going forward. Indeed, recent Chief Counsel memorandums suggest that the IRS is willing to use management control or participation, or both factors in combination, to stop LLC members who attempt to avoid self-employment tax on their distributive shares.

LLC members wanting to avoid self-employment tax may want to consider a few options. First, they may want to avoid member-manager status perhaps by carving managerial rights out into a separate interest or by avoiding member-managed structures entirely. Second, LLC members providing services should consider opportunities for segregating their involvement into separate interests or separate entities . Interestingly, in doing these things, LLC members would essentially be complying with the proposed regulations issued in 1997. Finally, members may want to instead consider forming an S corporation to better manage self-employment taxes in situations where the S corporation eligibility requirements are satisfied and state law permits the business to be organized in corporate form.

Also Check: What Does Locality Mean On Taxes

New Mexico Sales Taxes For Llcs

If you sell physical products or certain types of services, you may need to collect sales tax and then pay it to the SC Department of Revenue. New Mexico sales tax is collected at the point of purchase. Sales tax rates do vary depending on the region, county or city where you are located.

You will typically need to collect New Mexico sales tax on:

- Tangible, personal property and goods that you sell like furniture, cars, electronics, appliances, books, raw materials, etc.

- Certain services that your business might provide

Most states do not levy sales tax on goods that are considered necessities, like food, medications, clothing or gas.

How To Elect S Corporation Status

In order to obtain the S Corporation benefits, they need to be applied for after the Corporation has been formed, using IRS Form 2553. A LLC has 75 days to make the application.

Other businesses that already exist can elect to change their business form to an S Corporation for tax purposes at the start of each year. Certain criteria will have to be met in order to be accepted under this status, and there are some rather strict rules that must be applied to continue to qualify. The qualifications include the following:

- There are no more than 100 shareholders.

- All shareholders must be U.S. citizens no non-resident aliens allowed.

- Only one class of stock is permitted; all shareholders must receive the same benefits.

- Other corporations or partnerships cannot be shareholders, but some estates, trusts, and exempt organizations may be permitted.

Don’t Miss: What Tax Bracket Are You In

How Do Llc Taxes Work

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesnt pay taxes on business income. The members of the LLC pay taxes on their share of the LLCs profits. State or local governments might levy additional LLC taxes. Members can choose for the LLC to be taxed as a corporation instead of a pass-through entity.

There are several types of LLC taxes. The federal government, as well as state and local governments, levy these taxes. All LLC members are responsible for paying income tax on any income they earn from the LLC as well as self-employment taxes. Depending on what you sell and whether you employ anyone, you might also be responsible for paying payroll taxes and sales taxes. To complicate things even more, an LLC can opt to be taxed as a different business entity.

In this guide, well cover the entire range of LLC taxes, what youll be responsible for, and options for reducing your tax bill. Understanding your tax burden in advance can help you make smarter financial decisions.

Is Owning An Llc Considered Self Employment

Unless the owner elects corporate tax status, owning an LLC is self-employment. Since pass-through taxation is generally beneficial, most LLCs retain their default tax status as disregarded entities or partnerships.

Bottom line: Even if you’re signing your own paycheck, you’re not self-employed if you’re deducting payroll taxes from it. And even if you’re a tiny cog in a global enterprise, if your income is reported on Form 1099, you’re self-employed.

Recommended Reading: How To Figure Out Tax Percentage

What Are My Self

As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly.

Self-employed individuals generally must pay self-employment tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax .

Before you can determine if you are subject to self-employment tax and income tax, you must figure your net profit or net loss from your business. You do this by subtracting your business expenses from your business income. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of Form 1040 or 1040-SR. If your expenses are more than your income, the difference is a net loss. You usually can deduct your loss from gross income on page 1 of Form 1040 or 1040-SR. But in some situations your loss is limited. See Pub. 334, Tax Guide for Small Business for more information.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR;instructions.