Below The Line Deductions

There are many deductions that are only available when you qualify to itemize. Many of these deductions will face separate limits that are determined by your AGI. For example, in most years, your annual charitable contribution deduction cannot exceed 50 percent of your AGI. However, in 2020, this limit has been increased to 100 percent of your AGI. A second example is your medical expense deductions you report as part of your itemized deductions. For 2020, these expenses are only deductible on the portion that exceeds 7.5 percent of your AGI.; Using your AGI as a limitation ensures that you cannot eliminate your entire tax bill through deductions.

How Do Tax Deductions Work

A tax deduction is directly impacted by the income tax bracket of the individual filing for these write-offs. Your tax bracket is dictated by the income you bring home every year- the more money you make, the more taxes you pay.

A deduction is only worth a specific percentage of a persons federal income tax return. This percentage hinges on the tax bracket of the filer. Check out this chart to discover how much tax deductions are worth to you:

A person with a gross income higher than $203,000 will pay more taxes than a person with an income under $46,000, but it also means the higher earner will gain a higher deduction percentage for the same expense.

Key Differences Between Deduction And Exemption

The major differences deduction and exemption are indicated below:

You May Like: How Are Property Taxes Calculated In Texas

Personal Income Tax Deductions In Canada

Canadas federal and provincial governments use income tax deductions or credits to reduce the tax for some taxpayers and to promote certain activities considered to be beneficial. Some deductions reduce the income subject to tax, while others reduce the amount of the tax directly. As a taxpayer, you should be aware of all the deductions that are available to avoid an overpayment of taxes and possibly increase your tax refund.

How Fidelity Charitable Can Help

Since 1991, we have been helping donors like you support their favorite charities in smarter ways. We can help you explore the different charitable vehicles available and explain how you can complement and maximize your current giving strategy with a donor-advised fund. Join more than a quarter million donors who choose Fidelity Charitable to make their giving simple and more effective.

Read Also: Are Taxes Due By Midnight May 17

How Does The Earned Income Tax Credit Work

Here are some quick facts about the Earned Income Tax Credit:

-

For the 2021 tax year , the earned income credit ranges from $1,502 to $6,728 depending on your filing status and how many children you have.

-

You can use either your 2019 income or 2021 income to calculate your EITC ;you might opt to use whichever number gets you the bigger EITC. Be sure to ask your tax preparer to run the numbers both ways.

-

You don’t have to have a child in order to claim the earned income credit.

-

The earned income tax credit doesn’t just cut the amount of tax you owe the EITC could also score you a refund, and in some cases a refund that’s more than what you actually paid in taxes.

» MORE:See if you also qualify for the Child Tax Credit

Claiming The Age Amount Tax Deduction

The age amount is a tax deduction is for low- to middle-income people who are over the age of 65. Seniors with high income who dont qualify for the tax deduction can transfer the age amount to a spouse or common-law partner.

Claiming the Age Amount

Many seniors find themselves on fixed income with rising health care costs. To help ease your tax burden, the government lets you claim the age amount tax deduction.

You can claim this tax deduction on line 301 of your tax return if you are at least 65 years old at the end of the tax year and your net income is less than the maximum amount . Similar to other tax credits and deductions, the maximum amount increases each year.

Similar to Old Age Security, the age amount is an income-tested tax deduction that has a claw-back amount. Your net income has to lower be than the maximum amount to qualify. If your net income is above $87,750, you would not qualify for the age amount because your income is too high. If your net income is more than $37,790 but less than $87,750, the age amount is calculated by taking a tax deduction of $7,494 minus 15 percent of your net income above $37,790. If your net income is $37,790 or less, you can claim the full amount of $7,494.

There is an age amount for provinces and territories, which you claim on your province or territorys Form 428.

Low-Income Seniors May Not Benefit

Transferring the Age Amount

References & Resources

Recommended Reading: Where Can I Find My Agi On My Tax Return

Why Does The Tax Code Include Tax Deductions

Ideally, income should only be taxed once and account for any losses. The tax code accommodates for this by allowing taxpayers to deduct income which has already been taxed or should not be counted for other reasons. For example, if a taxpayer invests in a stock worth $1,000 at the beginning of the year and at the end of the year the stock is only worth $800, the taxpayer has experienced a $200 loss. The tax code allows the taxpayer to deduct the $200 as a loss, since his year-end income for that stock is $800, not the $1,000 originally invested. The tax code provides this treatment in order to accommodate for investment, risk, and losses, and account for other taxes on the same income throughout the year.

Tax Deduction Under Section 80la

Deductions under Section 80LA can be availed by Scheduled Banks which have offshore banking units in Special Economic Zones, entities of International Financial Services Centres and banks which have been established outside India, in accordance to the laws of a foreign nation. These assessees are eligible for deductions equivalent to 100% of the income for the first 5 years, and 50% of income generated through such transactions for the next 5 years, subject to the rules of the land.

Such entities should have relevant permission, either under the SEBI Act, Banking Regulation Act or registration under any other relevant law.

You May Like: Can You Refile Your Taxes

Standard Deduction Or Itemized Deduction

If you choose the standard deduction, you will not need to complete more forms and provide proof for all of your deductions. Its more of the no questions asked deduction, with a flat dollar amount thats the same for most people. For the 2020 tax year, which will be the relevant year for April 2021 tax payments, the standard deduction is:

- $12,400 for single filing status

- $24,800 for married, filing jointly

- $12,400 for married, filing separately

- $18,650 for heads of households

If you choose an itemized deduction, you can pick and choose from various deductions. These include mortgage interest, student loan interest, charitable contributions, medical expenses and more. To itemize your deductions, youll need to fill out additional forms to list each one and provide records, receipts and other documents that validate them.

Both standard and itemized deductions reduce your taxable income.

So how do you decide which one to do? It all comes down to which method saves you more money. If your standard deduction saves you more money than your itemized deduction, take the standard deduction. Or vice versa.

Heres an example. You itemize the following deductions as a single individual: mortgage interest , student loan interest and charitable donations . These deductions add up to $8,200. In this case, you would want to take the standard deduction of $12,400 instead, because you would get $4,000 more deducted from your taxable income.

No Other Income Report Expenses Now And See The Benefits Later

What if your only income is from freelancing? You may not be able to reap the benefits of those expenses this year but include them on your tax return so your NOL will be reported. You can âCarry Forwardâ those losses to future years.

For example, letâs say you have a NOL of $1,000 in 2020. In 2021, business is booming and your income after expenses is $10,000. Your income tax owed could be around $1,000. But your NOL from 2020 gets carried over to 2021. Your income is actually $9,000 . Because of your NOL from 2020, you could save around $100 on income taxes.

Don’t Miss: Do You Have To File Your Unemployment On Your Taxes

What’s The Maximum Amount I Can Claim As A Charitable Tax Deduction On My Taxes

When you make a charitable contribution of cash to a qualifying public charity, in 2021, under the Consolidated Appropriations Act1, you can deduct up to 100% of your adjusted gross income.

1;The Consolidated Appropriations Act temporarily increases the individual AGI limit for cash contributions made to qualified public charities in 2021. The Consolidated Appropriations Act provisions do not apply to contributions to supporting organizations nor public charities that sponsor donor-advised funds, like Fidelity Charitable.

Assumption : Apply The Deduction In The 2017 Income Tax Return

To apply the deduction for maternity in the 2017 Income,

you must include the corresponding data in box 571,which you will find in the sectionCalculation of the Tax and Result of the Declaration.

As indicated by the Tax Agency itself, a window must be opened in which all the corresponding information must be included in order to calculate the amount of the deduction for maternity:

- It will be necessary to indicate in the corresponding section the months of 2017 in which the activity was carried out,regardless of whether it is self-employed or employed. In cases where you would have worked for the full year, you would have to check the box with an X.

- It will also be necessary to indicate the amount of the contributions corresponding to the Social Security or to the Mutua Alternativa if any,in each of the months of the year 2017. In the event that these contributions were equal to or greater than 100 euros, it would simply be necessary to mark the box established with an X, so it would not be necessary to enter them.

- If bonuses had been received for an advance payment of the deduction in 2017,the total amount obtained would have to be obtained.

Recommended Reading: When Is The Final Day For Taxes

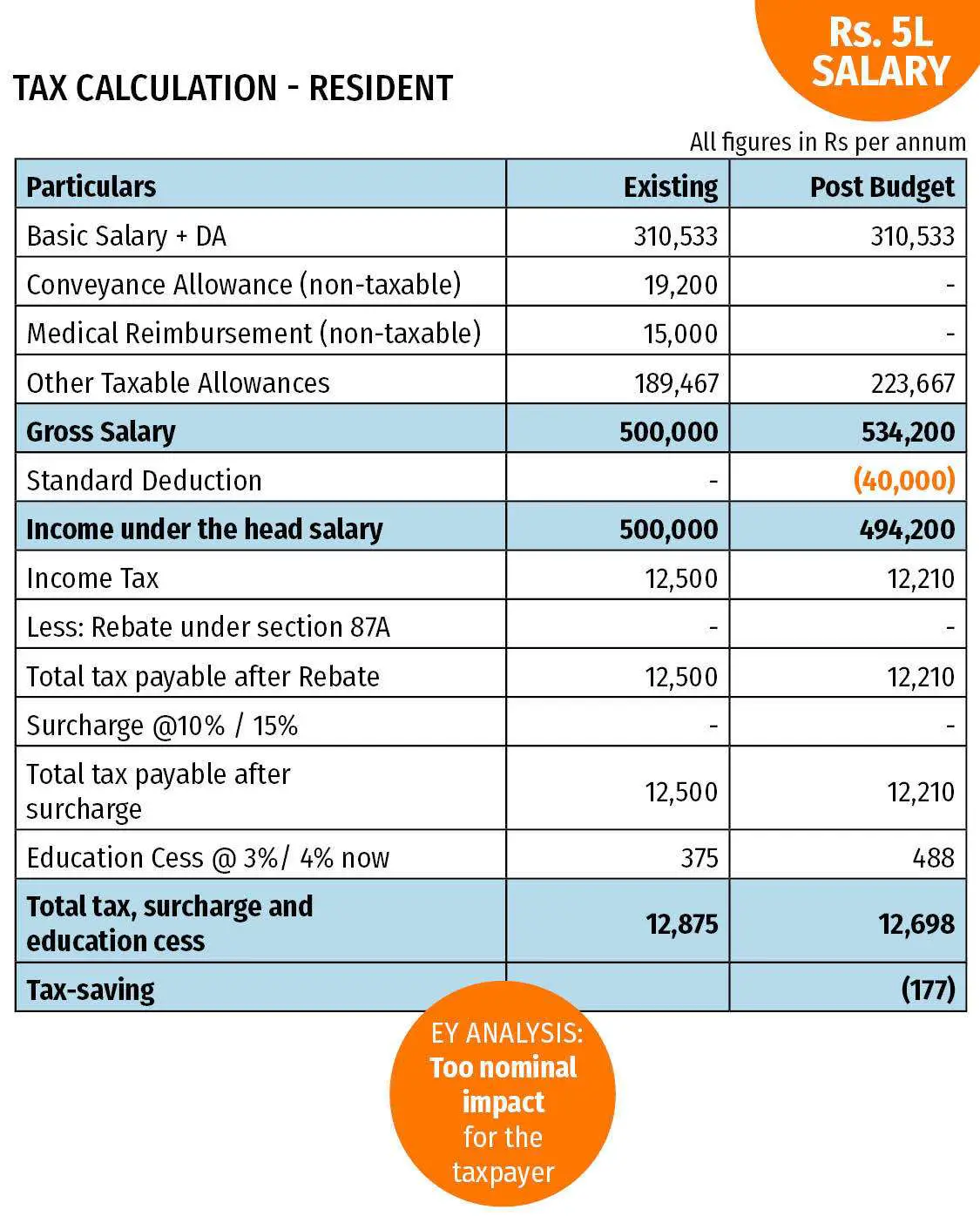

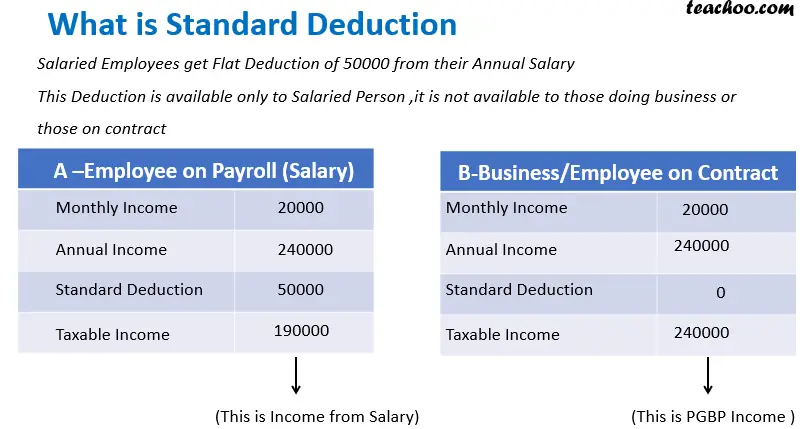

What Is The Standard Deduction For Ay 2020

Standard deduction means a flat deduction to individuals earning a salary or pension income. It was introduced back in Budget 2018 in lieu of transport allowance and reimbursement of miscellaneous medical expenses. It is allowable from the Income taxable under the head salary The tax benefits can be claimed irrespective of the actual amount spent on transport allowance and medical allowance.For the assessment year 2020-21, the standard deduction applicable to salaries individual and pensioners is Rs. 50,000/-. But if you are choosing to pay tax under the new tax regime then you can not avail of the standard deduction

Do I Qualify For Eitc

You qualify for EITC if:

-

You have earned income and adjusted gross income within certain limits; AND

-

You meet certain basic rules; AND

You either:

-

Meet the rules for those without a qualifying child; OR

-

Have a child who meets all the qualifying rules for you or your spouse if you file a joint return.

EITC has special rules for:

-

The amount of credit you may receive

Also Check: Can I File Old Taxes Online

Canada Pension Plan And Employment Insurance

These programs are run by the federal government and participation is mandatory. You may benefit in the future by receiving payments from these programs. For example, EI protects workers who become unemployed by paying out benefits to those who apply and qualify. If you retire after age 60, the CPP pays benefits to seniors who qualify.

In addition to the amounts that are deducted and withheld from your pay, your employer also makes contributions to EI and CPP on your behalf. The amount depends on how much you contribute.

What Is Standard Deduction 2021

The Indian Taxation System allows a flat deduction to salaried employees and taxpayers receiving a pension. This deduction amount stood at Rs. 40,000 in the financial year 2018-19, which was then increased to Rs. 50,000 in 2019. Additionally, taxpayers need not submit any disclosures or investment proofs to avail this deduction. As a result, taxpayers in India may choose either the pre-existing itemised deductions or a standard deduction of Rs. 50,000.;

Also Check: How To Pay Back Taxes Online

What Is Tax Deductions

Tax deduction refers to claims made to reduce your taxable income, arising from various investments and expenses incurred by a taxpayer. Thus, income tax deduction reduces your overall tax liability. It is a kind of tax benefit which helps you save tax. However, the amount of tax you can save depends on the type of tax benefit you claim.

Standard Deduction For Pensioners

A clarification was issued by the central board of direct tax clarifying the applicability of standard deduction on pensioners. In the clarification, CBDT mentioned that pension received by the taxpayers from an ex-employer is taxable under the head of salaries. Since the pension is taxable as a part of salary income the taxpayers will be entitled to standard deduction under form 16.

Read Also: Where To Find Real Estate Taxes Paid

Quebec Home Buyers Tax Credit

You may be entitled to a maximum $750 tax credit if you were resident in Québec on December 31, , and during that tax year,;either:

- you or your spouse bought a qualifying home for the;first time;and you intend to make it your principal residence ;;or

- you bought a qualifying home and intend to make it the principal residence of someone related to you who has a;disability. The residence must either:

- be more accessible for the disabled person or set up to help the person be more mobile or functional, or

- provide an environment better suited to the persons personal needs and care.

You can split the amount between everyone who is eligible to claim the credit for the same qualifying home.

For the complete list of conditions and to calculate the amount of the credit, use this form on the Revenu Quebec website, form;TP-752.HA-V,;Home Buyers Tax Credit.

Use our new;Free Canadian Tax Software;to help ensure you dont miss any of the deductions or credits you deserve. Its easy, fast, and 100% accurate, guaranteed. For more info on TurboTax Free,;.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax;Free, are available at www.turbotax.ca.

Tax Deduction Under Section 80p

Section 80P caters to cooperative societies, offering tax deductions on their income, subject to certain conditions. 100% deduction is permitted to cooperative societies which have incomes through cottage industries, fishing, banking, sale of agricultural harvest grown by members and milk supplied by members to milk cooperative societies.

Cooperative societies which are involved in other forms of business are eligible for deductions ranging between Rs 50,000 and Rs 1 lakh, depending on the type of work they are involved in.

Deductions which can be claimed by all cooperative societies are listed below.

- Income which a cooperative society makes by renting out warehouses

- Income derived through interest on money lent to other societies

- Income earned through interest from securities or properties

Recommended Reading: How To Reduce Income Tax

Kids And The Earned Income Tax Credit

If you claim one or more children as part of your earned income credit, each must pass certain tests to qualify:

-

The child can be your son, daughter, adopted child, stepchild, foster child or grandchild. The child also can be your brother, sister, half-brother or half-sister, stepbrother or stepsister or any of their children .

-

The child must be under 19 at the end of the year and younger than you or your spouse if you’re filing jointly, OR the child must be under 24 if he or she was a full-time student. There’s no age limit for kids who are permanently and totally disabled.

-

The child must have lived with you or your spouse in the United States for more than half the year.

Tax Deduction Under Section 80rrb

Section 80RRB offers tax incentives to patent holders, providing tax relief to resident individuals who receive an income by means of royalty on their patent. Royalty to the tune of Rs 3 lakhs can be claimed as deductions, subject to the patent being registered after 31/3/2003. Individuals who receive a royalty from foreign shores need to bring said amount to the country within a specific time period in order to be eligible for tax deductions on such royalty.

Don’t Miss: How Much Income To File Taxes