Effect On Other Taxes

Increasing adjustments to income can also decrease other taxes because some surtaxes are calculated based on AGIs. The 3.8% net investment income tax is based in part on a person’s modified adjusted gross income over certain thresholds. You can avoid paying this tax if you can reduce your AGI below those thresholds.

Most tax preparation software is well-equipped to handle all these different scenarios, and you can always seek the help of a tax professional if you really don’t feel that you can handle it all yourself.

How To Calculate Modified Adjusted Gross Income

Written by: PeopleKeep TeamSeptember 22, 2020 at 2:52 PM

The Affordable Care Act offers premium tax credits to help eligible individuals and families purchase individual health insurance coverage through the Health Insurance Marketplace.

With the changes made through the American Rescue Plan, no American will ever pay more than 8.5%; of their household income for health coverage. The tax credits will cover the rest. The household income figure here is your modified adjusted gross income .

Your MAGI is a measure used by the IRS to determine if you are eligible to use certain deductions, credits , or retirement plans. The percentage of income you must pay for individual health insurance depends on how close you are to the federal poverty line based on modified adjusted gross income, not adjusted gross income . People whose modified gross income is less than 400% of the FPL are eligible for a premium tax credit Here’s a quick overview of how to calculate your modified adjusted gross income.

Note: Premium tax credits work with the qualified small employer health reimbursement arrangement , but you must report your HRA allowance amount to avoid tax penalties. They do not work with an individual coverage HRA . If your employer offers you an ICHRA allowance that allows you to purchase a plan that meets affordability criteria on the ACA marketplace or your state exchange, you lose your premium tax creditseven if you opt out of the ICHRA.

Adjustments To Income On Your Return

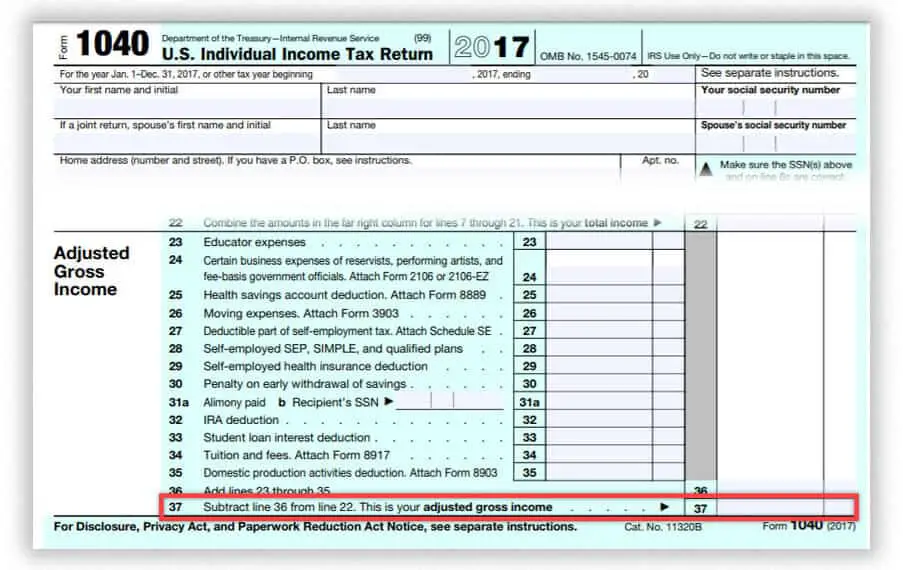

Your AGI appears on line 11 of the 2020 Form 1040, the return you’d file in 2021. The standard deduction or the total of your itemized deductions appears just after this, on line 12. You can claim the qualified business income deduction on line 13 if you’re eligible, then add this to your standard or itemized deductions. This results in your taxable income which appears on line 15.

The 2020 Form 1040 is different from the tax returns that were used in earlier years. The IRS has redesigned the Form 1040 several times since 2018. These lines correspond only with the 2020 return.

You May Like: Where To File Taxes For Free

How Does Agi Affect Credits And Deductions

Once you know your AGI, you can use it to find out if you can take advantage of certain tax credits and deductions to reduce your taxable income.

But keep in mind that some deductions and credits, including the child tax credit, may be based on your MAGI instead.

To calculate your MAGI, take your AGI and add back in the following adjustments:

- IRA deduction

Agi Includes Above The Line Expenses

AGI includes not only your total taxable income, but also allows you to reduce that income with the use of certain preferential deductions.

The greater the deductions, the lower your taxable income, the lower your tax will be.

Good deal? Absolutely!

- Allowable IRA deductions

- Student loan interest

One of the advantages of AGI deductions is that they apply whether or not you itemize your taxes.

We sometimes hear the terms above the line or below the line when it comes to income tax deductions, and here is where that term comes from. ;The line in this case, is the AGI total.

Above the line refers to deductions that are part of AGI, or more simply that appear on 1040 Page 1.

Below the line refers to deductions that appear on Schedule A, Itemized Deductions.

The differences between the two deductions are more significant than where they appear on the tax return.

Recommended Reading: What Is Schedule D Tax Form

Reporting On Form 1040

Gross income is reported on U.S. federal individual income tax returns type of income. Supporting schedules and forms are required in some cases, e.g., Schedule B for interest and dividends. Income of business and rental activities, including those through partnerships or S corporations, is reported net of the expenses of the business. These are reported on Schedule C for business income, Schedule E for rental income, and Schedule F for farm income.

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points; the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Read Also: Can You Refile Your Taxes

What Is Adjusted Gross Incomeand How Do I Calculate It

Your adjusted gross income is the amount of income for which youre required to pay taxes. Its a modification of your gross income, which is the total amount of money you earn in a year.

If you save for retirement in a qualified account, if youre self-employed, or if you meet a variety of other criteria, you dont have to pay taxes on your full gross income. Instead, you get to take above the line deductions, which means they actually reduce your taxable income. Adjusted gross income is the taxable amount youve earned during the year.

When you get ready to file your tax return, your AGI is the first item you need to figure out. Its the starting point for determining your tax bill, including the determining factor for which tax bracket you fit into, and whether you qualify for certain deductions and credits.

What Is Adjusted Gross Income And How Do You Calculate It

Adjusted gross income, or AGI, is extremely important for filing your annual income taxes. More specifically, it appears on your Form 1040 and helps determine which deductions and credits you are eligible for. Based on the amount of your AGI, you can then figure out how much youll owe in income taxes. For tax year 2020, yo can find your AGI on page 1, line 11 of the;IRS Form 1040.

As you take care of your taxes, make sure you have an adequate financial plan in place.;Talk to a financial advisor today.

Read Also: How Are Property Taxes Calculated In Texas

So What Is Adjusted Gross Income On Your W

The answer is its not. However, weve heard this question before as taxpayers ask for help with their taxes. Lets face it, tax terminology can get a little confusing. When it comes to talking about income, there are several terms that sound similar, but they have their own definitions and purposes. Understanding a bit more about these terms can help us better understand what Adjusted Gross Income is and what it isnt.

Things Worth Remembering If You Havent Filed 2020 Taxes

Some items and notes for those who havent filed taxes on income they earned or received in 2020:

- The tax filing deadline has been moved from April 15 to May 15, 2021. The deadline extension only applies to federal taxes.

- Income from stimulus checks is not taxable.

- Income for the first $10,200 of unemployment compensation is not taxable for people whose modified adjusted gross income is less than $150,000. Unemployment compensation over $10,200 is taxable.

- The penalties and fines that normally accompany taxes filed late, will not be applied as long as you meet the May 17 deadline.

- You can ask the IRS for a filing extension to Oct. 15 by filing form 4868 before May 17.

- Even if you receive an extension, you still must pay taxes owed by May 17.

Recommended Reading: Should I Charge Tax On Shopify

What Is Adjusted Gross Income

AGI is essentially your income for the year after accounting for all applicable tax deductions. It is an important number that is used by the IRS to determine how much you owe in taxes. AGI is calculated by taking your gross income from the year and subtracting any deductions that you are eligible to claim. Therefore, your AGI will always be less than or equal to your gross income.

What Is Annual Gross Income

For an individual, annual gross income equals the amount of money that you earned in a year before taxes. If you’re a business, your annual gross income would be your company’s revenue, less any business expenses.

Because it’s your gross income that reflects how much money you made during the year, it becomes an important figure in determining whether you will be required to file a tax return. According to the Internal Revenue Service , if you’re a U.S. citizen, whether or not you must file a federal income tax return depends on your gross income, your filing status, your age, and whether you are a dependent.1 For additional details on who is required to file a tax return, visit the IRS website at www.irs.gov.

Also Check: Are Debt Settlement Fees Tax Deductible

Agi Is Used As The Basis Line In Many Tax Calculations

AGI is mostly a tax term, but its one that has broad implicationsat least within the tax universe.

AGI is used as a base number for other calculations throughout the tax code, but there are two in particular that affect most taxpayers.

The first is as a baseline for itemized deduction reductions on Schedule A of the federal income tax return.

Certain itemized deductions only count when they exceed a certain percentage of AGI. ;Medical deductions are oneyou can only deduct them to the extent that they exceed 7.5% of AGI. ;Another is un-reimbursed employee business expenses and other miscellaneous deductionsthey can only be deducted to the extent that they exceed 2% of AGI.

The second major tax category that is affected by AGI is state income tax calculations.

Most states base taxable income on federal AGI, and often federal itemized deductions, but changes occur for those who dont itemize. ;States usually set different allowances for personal exemptions and for standard deductions. ;Some have deductions beyond their standard deductions as well.

But it all starts with federal AGI, and works its way down from there.

Schedule : Added Earnings

Form 1040 asks you to report some added earnings on Schedule 1. These include:

- Business income or loss as calculated on Schedule C

- Alimony received by divorce decree or agreement entered into prior to 2019

- Taxable credits, offsets, or refunds from state and/or local tax returns

- Rents royalty income as calculated on Schedule E

- Farm income or loss as calculated on Schedule F

- Capital gains or losses

- Unemployment compensation

- “Other Income,” which can include prizes and awards, gambling winnings, and earnings from an activity not engaged in for profit, such as money you made on your hobby.

The total of all these sources of income is arrived at on line 9 of Schedule 1 and transfers to line 8 of the 2020 Form 1040.

Also Check: Did The Tax Deadline Get Extended

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Agi And Qualified Deductions

Remember those above-the-line deductions I mentioned? Well, there are below-the-line deductions, too. On a tax return, its any deduction below the line where your AGI is entered.

In general, youll itemize deductions if they are greater than the standard deduction. Some commonly used itemized deductions include breaks for paying state and local taxes, property taxes, charitable contributions, mortgage interest, and sales tax. Some filers cant use the standard deduction:

- If you are married filing separately and your spouse itemizes

- If you change your accounting method and file a tax return that covers less than 12 months as a result

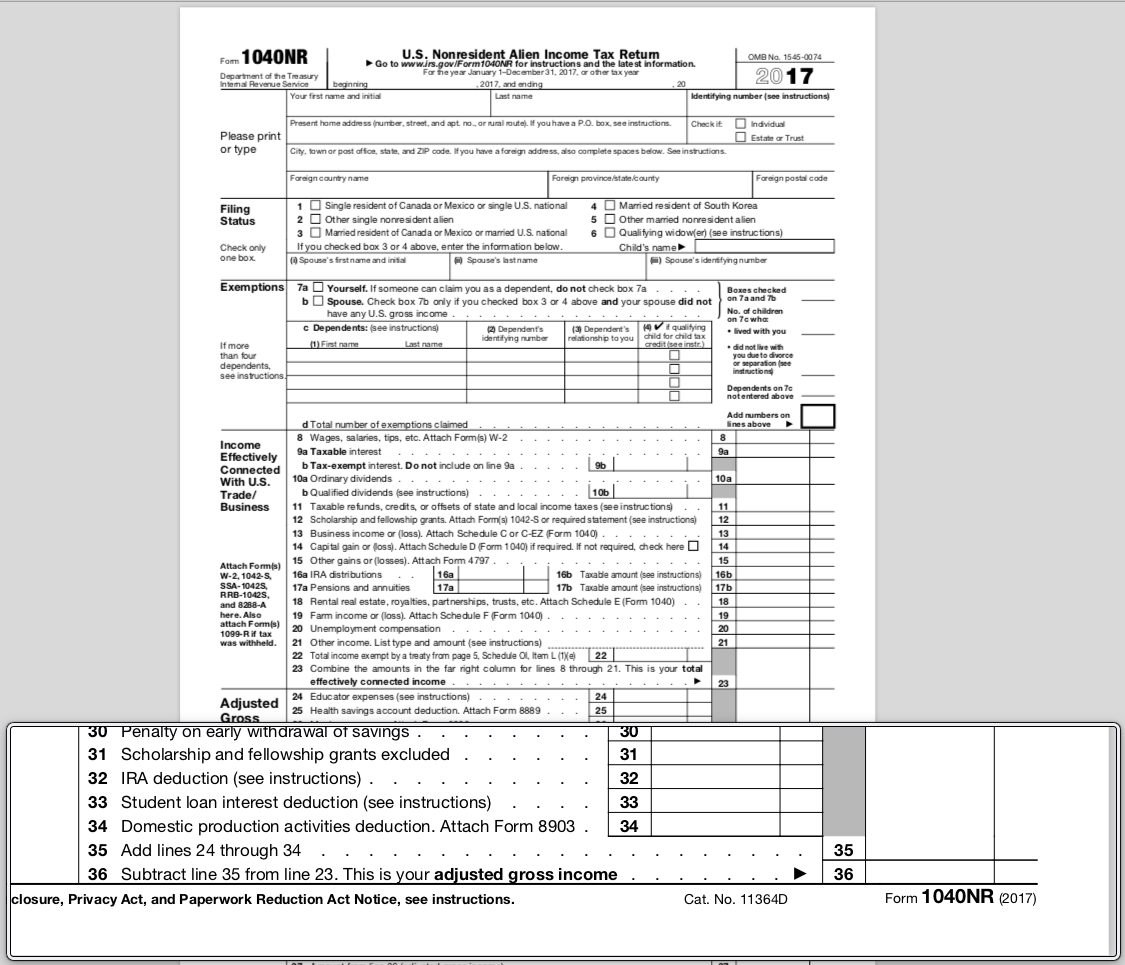

- If you are a nonresident alien or dual status alien during the year unless you married a U.S. citizen or resident alien and choose to be treated as a U.S. resident for tax purposes

- If you are filing taxes for an estate, trust, common trust fund, or partnership

Your qualified below-the-line deductions are subtracted from your AGI to help ease your tax burden. Taking time to explore every possible deduction helps and also prepares you to be in a position to take advantage of more deductions in the future.

Also Check: Are Donations To Churches Tax Deductible

How To Calculate Your Adjusted Gross Income

Your most recent tax return can be a great help in calculating your AGI. In fact, if you’re looking for your most recent AGI, it’s listed on your last tax return . If you need a more current number or your tax return isn’t handy, here’s a quick guide to calculating your adjusted gross income:

Add up your income. Total up all sources of taxable income. These include wages, self-employment income, unemployment benefits, tips, investment dividends, taxable interest, taxable alimony, royalties, capital gains, income from real estate investments and any other income that is not tax-exempt. What doesn’t qualify as gross income? The list of exceptions is relatively long. It includes life insurance benefits, some Social Security benefits, scholarships and some employee benefits.

Gather up your adjustments. Check out all the options for above-the-line deductions, which include student loan interest, tuition, retirement account contributions and educator expenses. Add up all the adjustments that apply.

Subtract your adjustments from your gross income to get your AGI.

Here’s an example of how this math works:Gross income:

Need To Know More About Adjusted Gross Income

Still have questions about Adjusted Gross Income? Our Tax Pros can help. Theyre dedicated to knowing the nuances of taxes and can help you understand your return.

Make an Appointment to speak with a tax pro today.

Related Topics

Learn more about Form 3921 and incentive stock option rules with the tax experts at H&R Block.

Recommended Reading: How To Pay Federal And State Taxes

How Your Agi Impacts Your Dependents

With the third stimulus check, your AGI is the main qualification for getting the money or not, due to a change in the rules and formula the IRS uses to calculate your payment total. If your AGI exceeds the limit, you won’t get a check. If it falls under $80,000 for single taxpayers , you’ll receive a full or partial check that includes up to $1,400 per dependent of any age you claim.;

Your AGI is also critical in your eligibility for the child tax credit. As with stimulus checks, your total will become lower on a sliding scale if you make a certain amount of money in 2021.

How To Calculate Agi From W

MISHKANET.COM” alt=”Where do i find my agi on my taxes > MISHKANET.COM”>

MISHKANET.COM” alt=”Where do i find my agi on my taxes > MISHKANET.COM”> - Pin

Do you want to claim your deductions and credits that are available on your tax return? To claim credits you first need to know your Adjusted Gross Income .

Want to figure out what AGI is and how can you calculate it? Then keep reading to find out!

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSUREFOR MORE INFO. Which means if you click on any of the links, Ill receive a small commission.;

Don’t Miss: How To Register For Tax Id

What Is Your Adjusted Gross Income

Adjusted gross income is the number you get after you subtract your adjustments to income from your gross income. The IRS limits some of your personal deductions based on a percentage of your AGI.

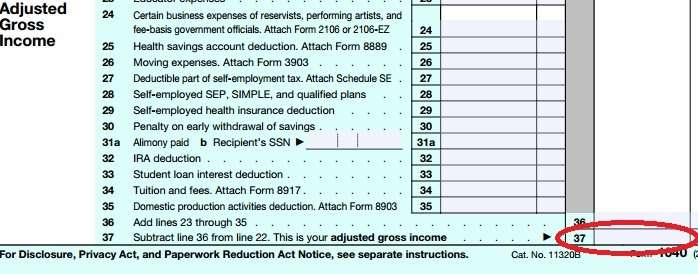

That’s why it’s so important. Your AGI levels can also reduce your personal deductions and exemptions. Many states also base their state income taxes on your federal AGI. The AGI calculation is at the bottom of Form 1040 in line 37.

How Does Agi Impact Deductions And Credits

Once youve calculated your AGI, you can further reduce your tax debt by itemizing deductions or taking the standard deduction based on your filing status. You can consult the tax program you use or your tax professional on which option is more advantageous. Your AGI will also reveal credits that can further drive down your tax burden or possibly boost your refund amount.

Your AGI will also help to determine your modified adjusted gross income , which will be equally as important when qualifying for certain deductions or credits. Your MAGI will also determine if contributions to an IRA are deductible. To learn more about MAGI, check out this helpful explanation from TurboTax, a leading self-directed tax software platform.

Read Also: How Do You Add Sales Tax