B Tax Computation Method

For taxable years beginning on or after January 1, 2002, if you are a nonresident or a part-year resident, you determine your California tax by multiplying your California taxable income by an effective tax rate. The effective tax rate is the California tax on all income as if you were a California resident for the current taxable year and for all prior taxable years for any carryover items, deferred income, suspended losses, or suspended deductions, divided by that income. Use the following formula:

Prorated tax = CA taxable income à Tax on total taxable income ÷ Total taxable income

How Capital Gains Taxes Work

Only assets that have been “realized,” or sold for profit, are subject to capital gains tax. This means that you won’t incur taxes on any unsold, or “unrealized,” investments that are, say, sitting in a brokerage account untouched. This is a good thing for long-term investors, as it allows an asset to grow in value over time without being taxed until the point of sale.

Holding on to an investment for a longer term can also have tax benefits once you cash out. That’s because long-term capital gains tax rates, at 0%, 15% or 20%, are generally more favorable than short-term rates, which follow ordinary tax brackets.

-

Capital gains taxes are also progressive, similar to income taxes.

-

Taxes owed on capital gains are generally due for the tax year of the sale. For example, if you sell stock A for a $10,000 profit in 2022, be prepared to pay when you file in 2023.

-

You can use investment capital losses to offset gains. For example, if you sold a stock for a $10,000 profit this year and sold another at a $4,000 loss, youll be taxed on capital gains of $6,000.

-

The difference between your capital gains and your capital losses for the tax year is called a net capital gain. But if your losses exceed your gains, you have what’s called a “net capital loss,” and you can use it to offset your ordinary income by up to $3,000 . Any additional losses can be carried forward to future years to offset capital gains or up to $3,000 of ordinary income per year.

What Is Income Tax

Income tax is a type of tax you pay to the government on income earned from a job or your investments, such as shares and ETFs. Income tax is worked out based on what you earn in a financial year such as from 1 July 2021 to 30 June 2022 and any tax deductions or tax offsets you can claim during that time.

You May Like: How To File Missed Tax Returns

How Tax Brackets Work

As mentioned earlier, the United States follows a progressive income tax system. In that scheme, not all income is treated equally.

Which, as long as we lack an appetite for a flat tax plan, makes a certain amount of sense as we shall attempt to demonstrate.

When someone talks about being in the 24% bracket, then, that doesnt mean all of their taxable income endures the same 24% bite, but instead only their taxable income above a certain amount .

This is the headache-inducing beauty of the American system of marginal rates.

What Is The Luxury Car Tax

The luxury car tax is a tax on cars with a total value above a threshold which is set by the ATO. It applies to sales of cars that are two years old or less. A cars value is determined by the retail price, including GST and any customs duty, dealer delivery and extra items applied to the car before delivery.

Also Check: When Is It Time To File Taxes

Change Of Residency From California

If you are a former California resident, your installment proceeds from the sale of property located outside California that you sold while you were a California resident are not taxable by California.

Example 6

In June 2007, while a California resident, you sold a parcel of real property located in Washington in an installment sale. On March 1, 2010, you became an Ohio resident, and on June 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

The capital gain income is not taxable by California because the property was not located in California. The interest income is not taxable by California because you were a nonresident of California when you received the proceeds.

Example 7

In March 2008, while a California resident, you sold a parcel of real property located in California in an installment sale. On June 1, 2010, you became a Washington resident, and on August 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

The capital gain income is taxable by California because the property you sold was located in California. The interest income is not taxable by California because you were a nonresident of California when you received the proceeds.

Example 8

Determination

How Does The Cpp Work

You will contribute towards the CPP from your employment earnings from age 18 to 70. The CPP Investment Board then invests CPP funds. Once you retire, you will then receive a monthly retirement pension that is equal to a certain percentage of your lifetime average earnings.

The base CPP benefit provides a monthly pension of up to 25% of your contributory earnings for the best 40 years of earnings. With changes enhancing CPP contributions, the monthly pension amount can rise to up to 33.33% of your contributory earnings. This pension amount counts as income, and so you must pay income tax on your CPP benefit.

The earliest that you can receive your retirement pension is when you turn 60 years of age. If you have a disability, you may receive the CPP disability benefit if you are under the age of 65, or the CPP post-retirement disability benefit if you have already started to receive your CPP retirement pension.

If you start receiving your pension between 60 and before you turn 65, your pension amount will be permanently reduced at a rate of 0.6% for every month before age 65, for a maximum reduction of 36%.

Every month after age 65 permanently increases your pension amount by 0.7%, up to a maximum of 42% when you turn 70.

You May Like: Do You Need 1099 To File Taxes

Simple Annual Overview Of Deductions On A $1000000 Salary

Lets start our review of the $10,000.00 Salary example with a simple overview of income tax deductions and other payroll deductions for 2022. The table below provides the total amounts that are due for Income Tax, Social Security and Medicare. We will look at each of these and a periodic split as we go through the salary example.

| What? | |

|---|---|

| Salary After Tax and Deductions | $9,259.12 |

It is worth noting that you can print or email this $10,000.00 salary example for later reference. There is a lot of detailed information which is worth reading and using as a reference, particularly if you file your own tax return without using a tax return software provider and/or accountant.

Save this Salary Tax Calculation for later use

Tax Rules Are Based On Your Business Structure

Because tax rules differ based on business structure, its important that small businesses consult with an attorney and accountant to determine how their businesses should be classified.

Your business will likely fall into one of four structures:

- Sole proprietorship: A sole proprietor is someone who owns an unincorporated business by him or herself.

- Partnership: In a partnership, individuals are taxed on their share of business net income.

- Limited liability corporation: LLCs are taxed on their share of business net income. Multiple-member LLC’s are taxed as partnerships.

- Corporation: Corporations are the only entities that pay federal taxes on their own based on net earnings. They are currently taxed at a flat 21% rate.

Don’t Miss: What Are The Different Tax Forms

Change Of Residency To California

If you are a California resident who sold property located outside California on the installment basis while a nonresident, your installment proceeds while a California resident are now taxable by California.

Example 4

On July 1, 2009, while a nonresident of California, you sold a Texas rental property in an installment sale. On May 15, 2010, you became a California resident and on August 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

Your capital gain income and interest income received on August 1, 2010, are taxable by California because you were a California resident when you received the proceeds.

Example 5

On September 1, 2008, while a nonresident of California, you sold stock in an installment sale. On June 1, 2010, you became a California resident and on October 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

Your capital gain income and interest income received on October 1, 2010, are taxable by California because you were a California resident when you received the proceeds.

Internal Revenue Code Terminology

Gross salary is the amount your employer pays you, plus your income tax liability. Although the tax itself is included in this figure, it is typically the one used when discussing one’s pay. For example, John gets paid $50/hour as an administrative director. His annual gross salary is $50/hour x 2,000 hours/year = $100,000/year. Of this, some is paid to John, and the rest to taxes.

W-2 wages are the wages that appear on the employee’s W-2 issued by his employer each year in January. A copy of the W-2 is sent to the Internal Revenue Service . It is the gross salary less any contributions to pre-tax plans. The W-2 form also shows the amount withheld by the employer for federal income tax.

W-2 wages = gross salary less less less

Total income is the sum of all taxable income, including the W-2 wages. Almost all income is taxable. There are a few exemptions for individuals such as non-taxable interest on government bonds, a portion of the Social Security income , etc.

Adjusted gross income is Total Income less some specific allowed deductions. Such as alimony paid , permitted moving expenses, self-employed retirement program, student loan interest, etc.

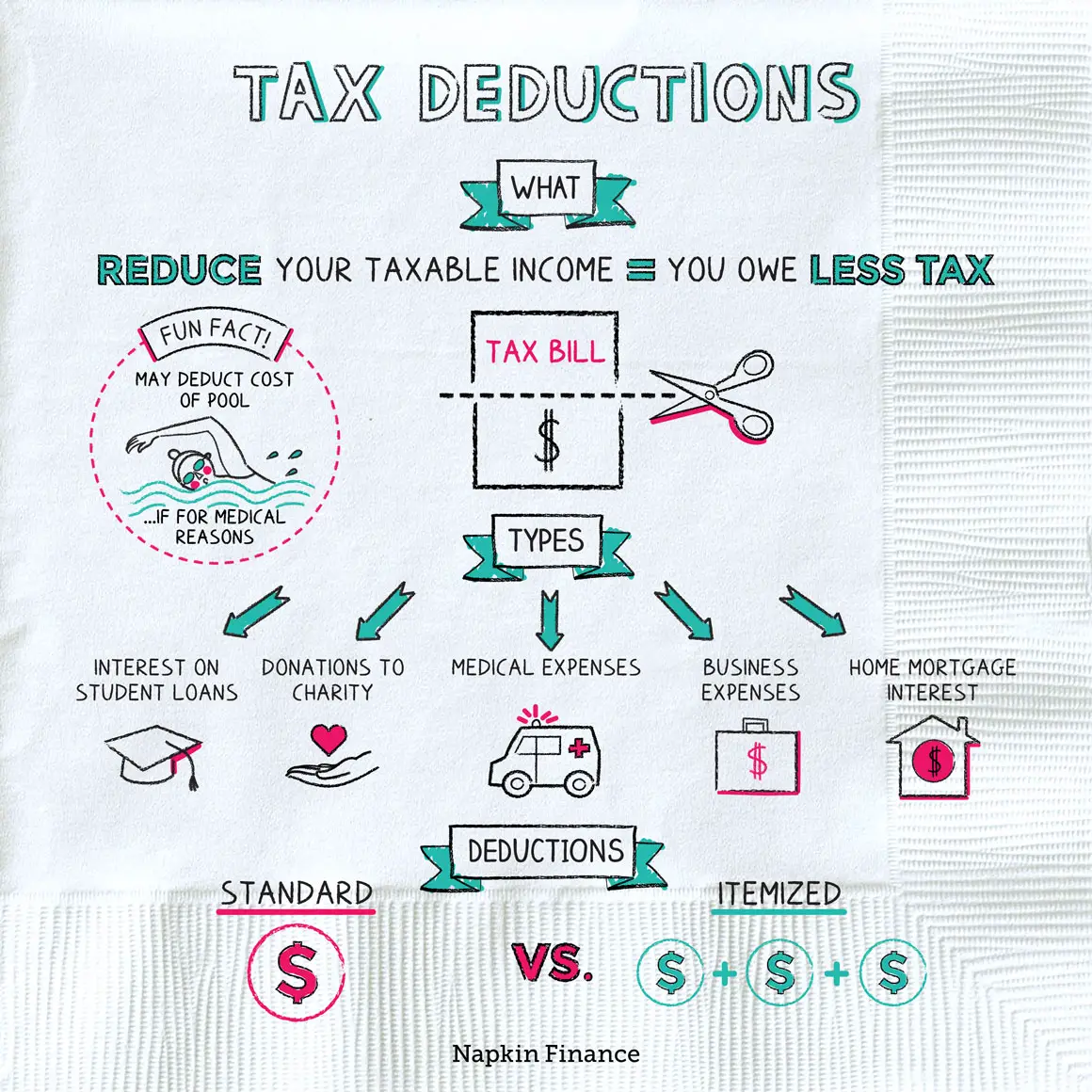

Itemized deductions are other specific deductions such as mortgage interest on a home, state income taxes or sales taxes, local property taxes, charitable contributions, state income tax withheld, etc.

Read Also: What Time Is The Deadline To File Taxes

Use The Sales Tax Deduction Calculator

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A .

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 .

Enter your information for the tax year:

- Sales tax paid on specified large purchases

W-2, 1099 or other income statements

Receipts for specified large purchases

ZIP code of your address and dates lived

What Is The Tax

The tax-free threshold is an amount of money you can earn each financial year without needing to pay tax. According to the Australian Taxation Office the taxfree threshold is $18,200. This means if youre an Australian resident for tax purposes, the first $18,200 of your income each financial year is tax-free and you only pay tax if you earn above this amount.

You May Like: How To Grieve Property Taxes

How Much Taxes Do They Take Out Of A 1000 Dollar Check

Paycheck Deductions for $1,000 Paycheck For a single taxpayer, a $1,000 biweekly check means an annual gross income of $26,000. If a taxpayer claims one withholding allowance, $4,150 will be withheld per year for federal income taxes. The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62.

What percent of tax is taken out of checks?

Overview of Federal Taxes

| $246 |

State And Local Tax Brackets

States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal governments.

California has the highest state income tax at 13.3% with Hawaii , New Jersey , Oregon , and Minnesota rounding out the top five.

Five states and the District of Columbia have top rates above 7%, with Illinois scheduled to join them if Gov. J.B. Pritzker gets his way.

Seven states Florida, Alaska, Wyoming, Washington, Texas, South Dakota and Nevada have no state income tax.

Tennessee and New Hampshire tax interest and dividend income, but not income from wages.

Not surprisingly, New York City lives up to its reputation for taxing income with rates ranging from 3.078% to 3.876% remarkably, the Big Apple is not the worst. Most Pennsylvania cities tax income, with Philadelphia leading the way at 3.89% Scranton checks in at 3.4%. Ohio has more than 550 cities and towns that tax personal income.

You May Like: When Can We Start Filing Taxes For 2021

How Tax Brackets Add Up

In 2020, the IRS collected close to $3.5 trillion in Federal taxes paid by individuals and businesses individuals accounted for about 53.6% of that total.

The agency processed more than 240 million individual and business returns a whopping 81.3% of returns were filed electronically. Of roughly 148 million individual tax returns, 94.3% were e-filed.

Individuals and businesses claimed more than $736.2 billion in refunds. The vast majority of these totals more than $664 billion went to individuals.

How Much Tax Do I Owe

Depending on your income level you can pay anywhere from $0 to 20 percent tax on your long-term capital gain. Additionally, capital gains are subject to the net investment tax of 3.8 percent when the income is above certain amounts.

With the Tax Cuts and Jobs Act signed into law in December 2017, long-term capital gains rates are applied based upon ordinary income amounts. The brackets are:

| $459,751 and above | $517,201 and above |

Example: Say you bought ABC stock on March 1, 2010, for $10,000. On May 1, 2018, you sold all the stock for $20,000 . You now have a $10,000 capital gain .

If youre single and your income is $65,000 for 2018, you would be in the 15 percent capital gains tax bracket. In this example, that means you pay $1,500 in capital gains tax . That amount is in addition to the tax on your ordinary income.

One caveat does exist with the sale of personal residences. You may not have to pay tax on up to $250,000 gain from the sale of your home. That rule applies if you owned and lived in the house for at least two of the last five years or if you meet certain exceptions.

In the case that youre married, you can exclude up to $500,000 in gain from the sale of the home as long as you meet the requirements.

Don’t Miss: When Are My Taxes Coming

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

How Much Taxes Do I Have To Pay On $20 000

If you make $20,000 a year living in the region of California, USA, you will be taxed $2,756. That means that your net pay will be $17,244 per year, or $1,437 per month. Your average tax rate is 13.8% and your marginal tax rate is 22.1%.

What percentage of your paycheck goes to taxes?

Overview of California Taxes

Also Check: How To Set Up Tax Payment Plan

How To Find Your Own Tax Bracket

There are numerous online sources to find your specific federal income tax bracket. The IRS makes available a variety of information, including annual tax tables that provide highly detailed tax filing statuses in increments of $50 of taxable income up to $100,000.

Other websites provide tax bracket calculators that do the math for you, as long as you know your filing status and taxable income. Your tax bracket can shift from year to year, depending on inflation adjustments and changes in your income and status, so its worth checking on an annual basis.

What You Should Know Before You Sell

If youre thinking about selling assets, such as stock, its best to plan ahead. A little planning now can save you lot of capital gains tax later when you file your return.

Consider these options:

Dont sell before the profit qualifies as long-term. Plan the sale of an asset thats gone up in value to be a long-term gain. Make sure to hold the asset long enough to qualify for long-term status. For most assets, thats more than one year. Dont be too hasty to sell when the year is up. The IRS guides say you must own the asset for more than one year. If its exactly one year when you sell, theres a good chance they could classify it as a short-term sale.

Dont hang on to losing investments just to avoid taking a loss. Consider selling assets at a loss to offset capital gains. Remember that sound investing generally trumps tax avoidance.

There are worse things than owing taxes. Losing money or keeping your money in something that doesnt go up in value is one of them.

Give stock that has gone up in value to charity. Call it a loophole if you like, but heres a great tax break. If you donate stock to charity, you get a tax deduction for the amount its worth now. Also, you dont have to pay capital gains tax on it.

Dont sell all at once. Even if youre not normally in the higher income tax bracket, one large sale can place you there for the year if youre not careful. You might want to sell some stock one year and wait until January to sell some more.

You May Like: When Should I Get My Tax Refund 2021