Irs Fees Interest And Late Penalties

You should know that the IRS does charge a fee for setting up installment agreements and will charge interest on your unpaid balance. You might also be charged a late penalty until the tax debt is paid in full.

Thats why its best to make your monthly payment amount as large as possible to minimize the amount of interest and penalties you need to pay.

One exception is if you qualify for low-income taxpayer status. If so, your installment agreement setup fee may be waived or reimbursed depending on your payment method.

Starting A Payment Plan

To start a payment plan, you must do ALL of the following:

- Complete, sign and return the Five Year Payment Plan Contract to the Tax Collector’s Office prior to the deadline.

- Pay at least 20% of the total amount, plus all other current year taxes due and a $94 fee.

NOTE: Starting a payment plan will not stop a foreclosure action by a mortgage holder or holder of a Deed of Trust. It is your responsibility to contact your bank or mortgage company about a separate payment plan. Also, a payment plan does not stop your property from being foreclosed on for delinquent debt service obligations under the Improvement Bond Act of 1915 and/or the Mello-Roos Community Facilities Act of 1982.

To remain in good standing, you must:

- Pay at least 20% of the redemption amount, plus all interest, all current year taxes, and the $81 maintenance fee by April 10th each following year.

Each year after the plan’s start, the total amount paid must be equal to or greater than 20% of the original redemption amount, plus all interest that has accrued on the unpaid balance. The unpaid balance of your installment plan, plus accrued interest, may be paid in full at any time before the fifth and final payment would be due.

What Are The Benefits Of Paying My Taxes On Time

By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and for failing to pay taxes they owe by the deadline.

If you’re not able to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. There’s also a penalty for failure to file a tax return, so you should file timely even if you can’t pay your balance in full. It’s always in your best interest to pay in full as soon as you can to minimize the additional charges.

You May Like: Where Can You Do Your Taxes For Free Online

Paying Your Taxes Over Time

In 2022, the deadline to file your 2021 taxes is Apr. 18. And even if you’re afraid you won’t be able to afford paying your taxes, it’s better to file and set up a payment plan than to avoid filing entirely. This could lead to interest and penalties.

So if you get the dreaded news of owing Uncle Sam, here are your options of extended payment plans:

How To Set Up An Irs Payment Plan Through Taxact

Nobody likes unpleasant surprises when it comes to taxes. And if you unexpectedly find yourself owing the IRS hundreds or thousands of dollars that you dont have, its normal to feel the panic start to set in. But we can help.

If you cant afford to pay your entire tax bill upfront, you arent alone. And you have options! Read on to see how TaxAct® can help you set up a tax payment plan with the IRS that fits within your budget.

Recommended Reading: How To Get My Unemployment Tax Form

What Happens If I Dont Pay My Tax Bill

When you dont pay your taxes, the government can issue a legal claim against your property called a tax lien. If you fail to pay your federal taxes without setting up an installment agreement, the IRS may take action by sending you a notice of federal tax lien.

If you continue to neglect to pay off tax debt, the IRS can also levy your property to settle the debt. This allows the IRS to garnish wages, seize and sell your property, or take the money in your bank accounts. Thats why its imperative to make payment arrangements with the IRS if you cant pay your bill right away.

What Are The Fees Associated With A Tax Payment Plan

There is a one-time fee the IRS will charge when you want to know, “How do I set up payments to the IRS?” As of 2020, the initial fee to start a payment plan is $31 when you set up an account online. The fee is different if you plan to pay via mail, phone, or in-person. The fee increases to $107 if you choose either of these options. There is a second fee you need to be aware of as well.

You will need to pay another $149 if you decide to set up an IRS tax payment plan without direct deposit online. This fee also increases if you decide to opt out of direct deposit via phone, mail, or in-person. It’s a $225 charge. You must never miss a payment when you finish creating your IRS tax payment plan. If you mail your monthly payment in, it’s best to send it to the IRS 7-10 days before the due date.Send your check or money order by certified mail as proof you submitted payment on time. The IRS does not recognize First Class Mail postmarks as a form of proof.

Read Also: What To Send When Filing Taxes By Mail

You Can Create An Irs Tax Payment Plan On Your Own

If you want to know “How do I set up a payment plan with the IRS” or “How do I set up payments to the IRS,” you need to know what information and form you need to provide. Setting up a tax payment plan isn’t hard, but you may make a mistake and owe more money than you should. You can avoid this by keeping track of what you make with pay stubs. Contact us if you need help creating them or simply check out our FAQ page to get you started!

- 1. Enter Your Information

- 2. Select Your Favorite Theme

- 3. Download Your Stub!

Taxact Is Here To Help

Owing back taxes isnt an ideal situation, but we want you to know that you have options. Theres no need to break the bank and pay the full amount if you cant afford it. If you find yourself with an unmanageable tax bill this tax year, e-file with TaxAct to conveniently request an IRS installment payment plan when filing your federal tax return.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

Recommended Reading: How To Track Your State Tax Refund

Alternatives To An Irs Payment Plan

You can ask the IRS to delay collection if you’re unable to pay any of your tax debt at all. The debt won’t go away if the IRS approves your request, but your account will be reported as “currently not collectible.” Interest and late payments will still continue to accrue.

You may also be eligible for an offer in compromise in which the IRS agrees to settle your debt for a reduced amount. This isnt an option if youre currently in bankruptcy, however. Use the IRS Offer in Compromise Pre-Qualifier screening tool to determine whether this could be an option for you.

Can I Set Up A Payment Plan For My Taxes

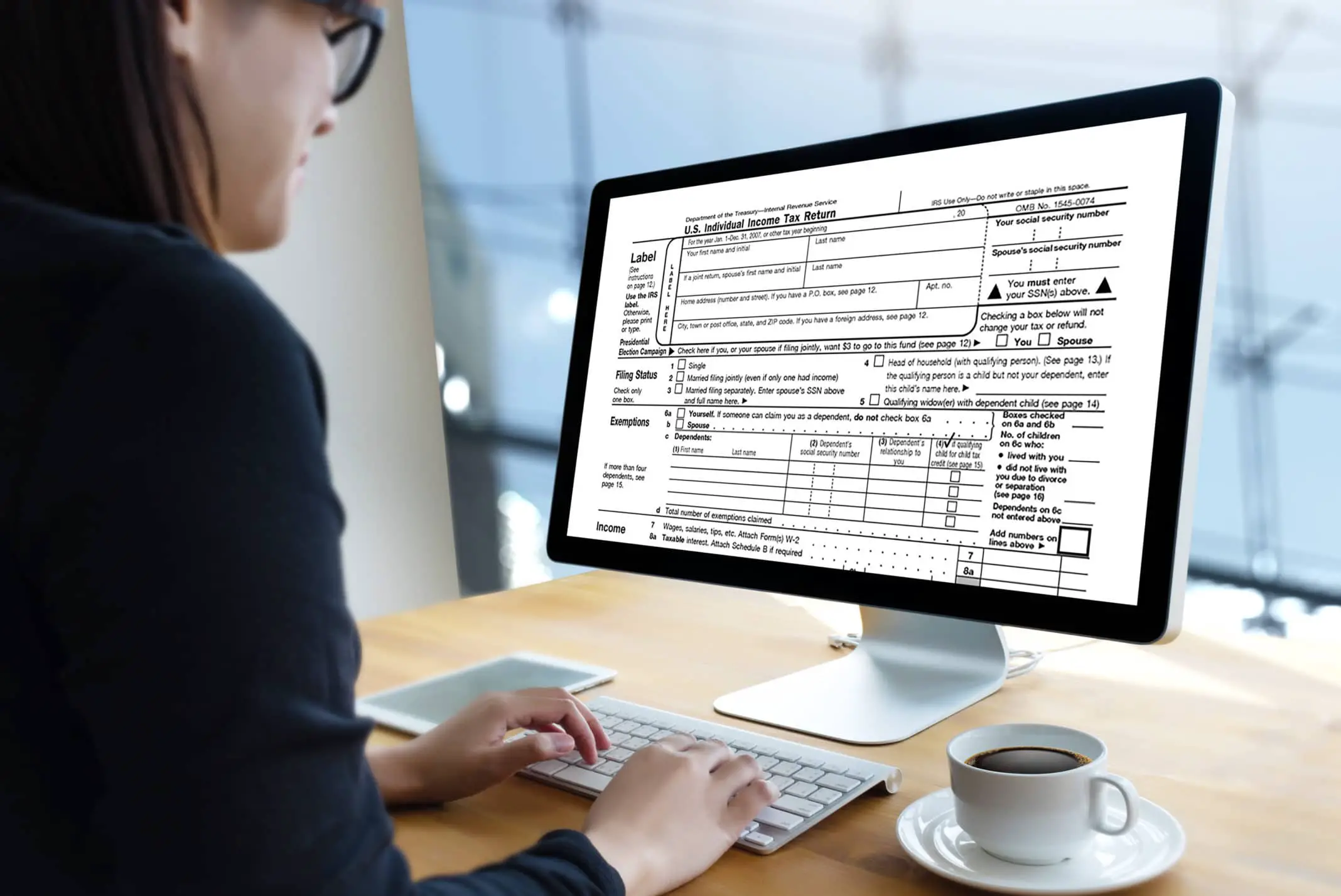

The IRS will let you pay off your federal tax debt in monthly payments through an installment agreement.

If you haven’t filed yet, step through the File section of TurboTax until you reach the screen How do you want to pay your federal taxes? Select the installment payment plan option, Continue, and follow the onscreen instructions.

If you already filed, or you’re unable to find this option in TurboTax, you can apply for a payment plan at the IRS Payment Plans and Installment Agreements webpage .

State Payment Plans

Most states offer some kind of installment payment plan as well, although the procedure varies from state to state.

The easiest way to obtain the info you need is to simply search the internet using the phrase state tax payment plan . You can try to contact your state Department of Revenue for details.

Related Information:

You May Like: Can I File For Another Extension On My Taxes

If Your Company Is In Tax Debt

HMRC will discuss your companys finances with you.

Theyll ask you to make a verbal proposal, explaining how youll pay your tax bill as quickly as you can. An adviser will ask questions about your proposal to make sure it is realistic and affordable for you.

You must reduce your debt as much as possible before entering into a Time to Pay arrangement. You can do this by releasing assets like stock, vehicles and shares.

HMRC may ask company directors to:

- put personal funds into the business

- accept lending

- extend credit

How Do I Manage My Plan To Avoid Default

In order to avoid default of your payment plan, make sure you understand and manage your account.

-

Pay at least your minimum monthly payment when it’s due.

-

File all required tax returns on time and pay all taxes in-full and on time .

-

Your future refunds will be applied to your tax debt until it is paid in full.

-

Make all scheduled payments even if we apply your refund to your account balance.

-

When paying by check, include your name, address, SSN, daytime phone number, tax year and return type on your payment.

-

Contact us if you move or complete and mail Form 8822, Change of AddressPDF.

-

Confirm your payment information, date and amount by reviewing your recent statement or the confirmation letter you received. When you send payments by mail, send them to the address listed in your correspondence.

There may be a reinstatement fee if your plan goes into default. Penalties and interest continue to accrue until your balance is paid in full. If you received a notice of intent to terminate your installment agreement, contact us immediately. We will generally not take enforced collection actions:

-

When a payment plan is being considered

-

While a plan is in effect

-

For 30 days after a request is rejected or terminated, or

-

During the period the IRS evaluates an appeal of a rejected or terminated agreement.

Also Check: How Long Can The Irs Pursue Back Taxes

Bottom Line: Payment Arrangements With Irs

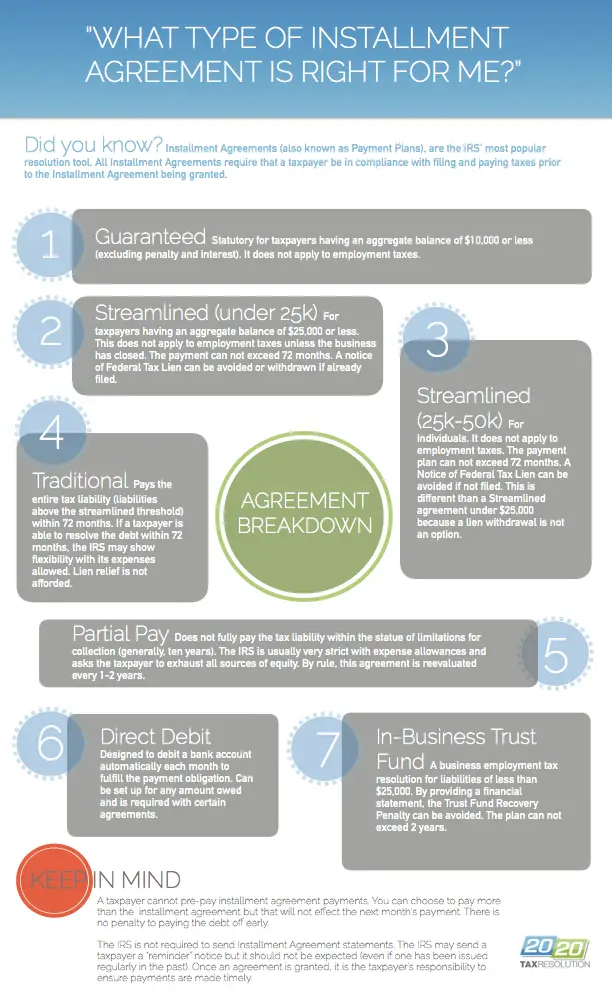

The IRS wants to recoup as much tax debt as possible and works with you if you cant pay all at once. Whether you owe less than $10,000 or more than $100,000, theres a payment plan for you to settle your tax debt. Its always in your best interest to set up a payment plan with the IRS to avoid garnishments, levies and liens.

Who Is Eligible For An Irs Payment Plan

You dont need to call the IRS to get on a payment plan. You can apply online for a short- or long-term plan if you meet the following criteria:

Long-term payment plan: You owe $50,000 or less in combined tax, penalties and interest, and youve filed all your tax returns.

Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

Recommended Reading: Do You Have To File Taxes On Social Security Income

What Happens When I Request A Payment Plan

When you request a payment plan , with certain exceptions, the IRS is generally prohibited from levying and the IRSs time to collect is suspended or prolonged while an Installment Agreement is pending. An IA request is often pending until it can be reviewed, and an IA is established, or the request is withdrawn or rejected. If the requested IA is rejected, the running of the collection period is suspended for 30 days. Similarly, if you default on your IA payments and the IRS proposes to terminate the IA, the running of the collection period is suspended for 30 days. Last, if you exercise your right to appeal either an IA rejection or termination, the running of collection period is suspended by the time the appeal is pending to the date the appealed decision becomes final. Refer to Tax Topic No. 160 – Statute Expiration Date and Tax Topic No. 202 Tax Payment Options.

How To Set Up A Payment Plan For Your Taxes With Hmrc

The government is helping businesses by allowing you to defer tax payments.

The overview:

HMRC has a dedicated phone line to agree payment plans for taxes:

- The number you need to call is . The line is open between 8am and 4pm Monday to Thursday .

- A director or owner of the business has to call to discuss payment with HMRC.

- You will need to explain why you need to delay payment of your taxes, e.g. cancelled contracts, travel plans or staff absences due to self-isolation.

- Please make sure that all of your tax filings are up to date.

Deferred VAT payments

Businesses that deferred VAT payments due between 20 March 2020 and 30 June 2020 were able to either:

- Join the online VAT deferral new payment scheme by 21 June 2021 to spread payments of deferred VAT over smaller, interest-free instalments.

You might be charged a 5% penalty or interest if you did not pay in full or make an arrangement to pay by 30 June 2021.

What non-VAT payment plans HMRC agree to:

Every situation is different, and what HMRC agrees for you will depend on your current situation and your history with them. There are no rules to go by. However, a number of our clients have been able to:

- Defer PAYE for three months.

- Spread Corporation Tax payments over a year.

The information to have handy when calling HMRC:

A few practical points:

Here are the usual questions HMRC like to ask and some reasons why:

Read Also: Where To Find The Agi On Tax Return

Option : Monthly And Balance Plan

Up to 10 monthly prepayments are withdrawn from your bank account on the first day of each month from August through May and the greater of prepayment amount, or the balance withdrawal, each year on the second business day of:

There’s no withdrawal each year in June.

- Take the current year’s tax levy.

- Subtract the home owner grant amount .

- Subtract any payments and credits.

- Divide by the number of remaining instalments .

-

Your first payment date and number of payments depend on when we get your application.

Application received Pay all outstanding taxes including the main tax notice before submitting your application.

Pay all outstanding taxes including the advance tax notice before submitting your application.

-

Enrolment after August will require your monthly instalments in the first year to increase.

Since the prepayment amount is based on the prior year’s property taxes, additional withdrawals on the due date may be necessary in February and/or July to cover any outstanding balances.

Any credits will be used to reduce next year’s instalments.

Interest

You receive interest on your monthly payments that’s credited to your tax account every month.

The interest rate is either the current Bank of Canada prime business rate minus 3%, or 0.25%, whichever is higher.

The rate is set twice per year before February 1 and August 1.

Am I Eligible For A Waiver Or Reimbursement Of The User Fee

Waiver or reimbursement of the user fees only applies to individual taxpayers with adjusted gross income, as determined for the most recent year for which such information is available, at or below 250% of the applicable federal poverty level that enter into long-term payment plans on or after April 10, 2018. If you are a low-income taxpayer, the user fee is waived if you agree to make electronic debit payments by entering into a Direct Debit Installment Agreement . If you are a low-income taxpayer but are unable to make electronic debit payments by entering into a DDIA, you will be reimbursed the user fee upon the completion of the installment agreement. If the IRS system identifies you as a low-income taxpayer, then the Online Payment Agreement tool will automatically reflect the applicable fee.

Don’t Miss: How Do I Apply For An Extension On My Taxes

Is It Possible To Review And Change Tax Payment Plans

The IRS is aware you may want to change or review what you complete after you learn “How do I set up payments to the IRS?” You can review your plan as many times as you need. If you need to alter something in your plan, you can do so. You have the option to call the IRS to get updates, or if you have an account online, you can view your payment history and correct the balance on your tax account.There will be a $10 fee you must pay for those changes to take effect online. The fee is $89 for those who choose to revise their IRS tax payment plan by mail, phone, or in-person.

Additional Charges And Program Removal

- Additional charges that fall outside of the regular tax instalment schedule, such as supplementary and/or omitted property tax bills, fire charges, Workplace Safety Insurance Board, Toronto Police Service, Municipal Licensing Standards charges or past due utility bill amounts added to the tax roll, cannot be paid through this program at this time. If you do not pay these additional charges separately, you will be removed from the program and returned to the regular six instalment plan.

- You will be removed from the program if a payment does not clear through your financial institution, if you make or send duplicate payments, if you have an unpaid balance, or if there is an ownership change recorded for your property.

Read Also: How Many Years Of Tax Records To Keep