Claiming Too Many Work Expenses

In order for a deduction to be eligible, it must be ordinary and necessary to your line of work. A professional income who sells their art for income could claim paint and paintbrushes because those purchases were ordinary and necessary. However, a lawyer who pains for fun and does not make income from their work, cant make the same claim to deduct the expenses of their art supplies.

When claiming an expense for your career consider if the purchase was absolutely necessary for you to perform your work duties.

Organizing Your Tax Records

If you have an efficient record-keeping system, it can make finding information a lot easier. The IRS has no particular standards or requirements for how you organize and file material, neither do state taxing authorities their only concern is that when they want to see a document, you’re able to deliver it promptly.

IRS Publication 552 offers detailedadvice on which records to keep, whether they’re hard copy or in electronic form.

If you use a TurboTax CD or download product, your tax return will be stored on your computer. It’s a good idea to also print a copy for your records and keep a backup file on an external drive or disc.

If you use TurboTax Online to prepare your taxes, we’ll keep a secure copy of your tax return for you to access online.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

How Long Should You Keep Your Tax Returns

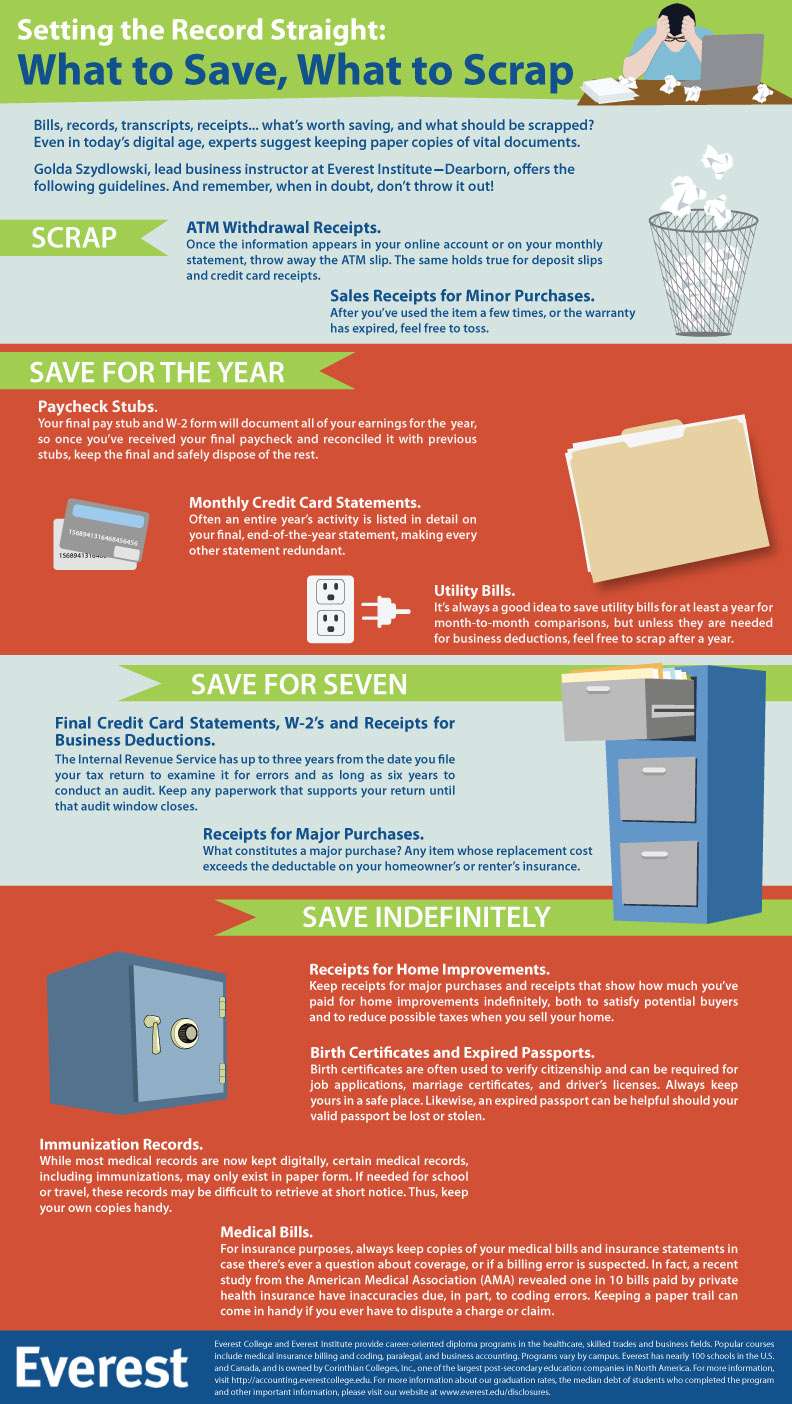

Once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original return.

You can also keep them for two years if you are calculating from the date you paid the tax, whichever comes later. However, if you file a claim for a loss from securities or bad debt deduction, then you should plan to keep your records for at least seven years.

You May Like: How To Get Tax Preparer License

Regular Statements Pay Stubs

Keep either a digital or hard copy of your monthly bank and credit card statements for the last year. Its a good idea to keep your digital copies stored online if you choose to go paperless. You should also hold on to pay stubs so that you can use them to verify the accuracy of your Form W-2 when tax season arrives.

How To Store Your Files

There are many ways to store important documents. Weltman says its a good idea to use a fireproof safe or password-protected electronic file for documents such as bank and investment statements, estate-planning documents, pension information, pay stubs, and tax documents.

She also says you may want to invest in a safe deposit box for papers that cant be easily replaced. These include original birth and death certificates, Social Security cards, passports, life-insurance documents, and marriage and divorce decrees.

For electronic files, McBride says to consider backing them up to the cloud. Its a good idea to make sure the storage provider uses encryption technology. You can also store copies of your files in folders on an external hard drive that is password-protected.

Read Also: Protesting Property Taxes In Harris County

How Long Should You Keep Business Asset Records

Business owners typically deduct costs for property and equipment that are used for the business, which reduces their tax bills. Owners might also claim deductions for the depreciation of property or equipment, or they might amortize costs like franchise fees. Because these types of records are usually part of your tax return, you should follow the same rules for tax records, counting the year that you disposed of the property as the start of the period of limitations. Keep deeds for property and titles to vehicles among these records.

When you sell one business property and buy another in an exchange such as a 1031 Exchange, you will want to retain the records on the property you sold as well as the property you acquired until the period of limitations runs out on the new property.

Dispose Appropriately And Responsibly

Disposing of records is not as simple as separating recyclables from other types of refuse. Just because the retention period has passed, it does not mean that the practitioner’s duty to protect the confidentiality of client data has also expired. Proper disposal of records is key.

When it comes to destruction and sanitization of paper and electronic records and media, consult best practices defined in reputable sources such as the National Institute of Standards and Technology’s Special Publication 800-88, Guidelines for Media Sanitization, or ISO 27001 A.8.3.2, Disposal of Media.

Many third-party service providers specialize in the collection and destruction of records based on regulatory or technological standards. However, using a vendor does not eliminate the practitioner’s responsibility to maintain the confidentiality of client data. If an outside vendor is used, due diligence must be performed on the vendor’s processes for keeping the data confidential. Consult the article “Professional Liability Spotlight: Due Diligence With CPA Firm Subcontractors,”JofA, June 2015, which discusses a firm’s legal and professional responsibilities related to third parties.

Don’t Miss: 1040paytax Com Legitimate

Generally Speaking For Three Years

The IRS says you need to keep your records âas long as needed to prove the income or deductions on a tax return.â In general, this means you need to keep your tax records for three years from the date the return was filed, or from the due date of the tax return .

Letâs say you filed your 2020 tax return two months ahead of the deadline, on February 10, 2021. That means youâd need to keep the receipts, tax records, and any other documentation related to the return until April 15, 2024âthree years after the deadline for your 2020 tax return.

Consider Creating An Irs Online Account

The coronavirus has caused many changes and taxpayers that have questions are picking up the phone to contact the IRS. The agency is urging people to refrain from making phone calls which further slows down systems. They are recommending that people visit IRS.gov and create an online account which will provide them with information about their taxes.

Other options to consider include free assistance at Volunteer Income Tax Assistance and Tax Counseling for the Elderly which has locations across the country.

You May Like: Do You Get A 1099 From Doordash

Your Tax Documentswhat To Keep And Shred

Whether you use old-fashioned manila filing folders, a flash drive or cloud storage, tax and personal finance authorities agree on the importance of saving tax documents and records. In addition to using the information for preparing your next income tax return, it may come in handy years from now.

“Your tax data is helpful and often required in many non-tax financial situations,” says TaxAct spokesperson Jessi Dolmage. “For instance, insurance companies, lenders and creditors often use tax information to verify income and asset value. Form W-2s can provide proof of income if your Social Security benefits are less than what they should be.”

Information to save for your next tax return

Organizing and saving information throughout the year will cut tax return preparation time and can even save you money. Save any information related to:

- Income from wages, dividends, interest or business: Forms W-2, 1099, and K-1, bank statements, brokerage statements

- Deductions and credits : Receipts, invoices, mileage logs, bank or credit card statements, canceled checks

- Home and property: Closing statements, invoices, proof of payment, insurance records, receipts for improvements

- Investments: Forms 1099 and 2439, brokerage statements, mutual fund statements

“One of the key advantages of going digital is that your tax information is better protected from natural disasters,” says Dolmage. “Saving electronically also means you can access the information anywhere from a mobile device.”

How Long Should I Retain Documentation

One of the most dreaded, but satisfying, parts of spring cleaning is discarding long-neglected household items. Unfortunately, determining an appropriate retention period is not as straightforward as checking the expiration date of food items to clear out a refrigerator. How long records should be retained depends on a variety of factors including, but not limited to:

Given the factors described above, a CPA firm may identify different retention periods for different clients and/or services. As a practical matter, it is recommended that CPA firms select the longest retention period and apply it consistently to all records to reduce the administrative complexities associated with maintaining records.

Also Check: Csl Plasma Taxable

How To Store Documents

You can keep your tax documents in a fireproof safe or a banks safe deposit box. But to conserve space, consider scanning all of your tax-related documents and saving them to an external hard drive or on a cloud service. As long as you can reproduce the documents and they are legible, the IRS accepts electronic copies.

If You Have Records Connected To Property

The standard three year period of limitations applies to any deductions you make related to your property But sometimes the length of time between when you dispose or sell your property and when you no longer need to keep those documents can be longer than 3 years.

Say you dispose of a property by selling it during the 2018 tax year, report the financial gain on your 2020 tax return, and file your tax return right on the tax deadline of April 17, 2021. That means youâd need to keep records connected to the property until April 17, 2024 .

These records usually include deeds, titles, and cost basis records .

Also Check: How To Buy Tax Lien Certificates In California

How Long Should You Keep Human Resources Files

Depending on your business and the state where you are located, you might have many types of HR records that fall under the jurisdiction of different government agencies.

Generally, you will need to keep the most common types of forms and documents, like employment and job application records, family leave documents, performance reviews, and benefit election documents, for three to five years, depending on the record and the state where your business is located.

Workers’ compensation records. Requirements and laws for retaining records on employees who are injured in the workplace vary by state, and you should check with the responsible state agency for guidelines on keeping these records. On the federal level, the Occupational Health and Safety Administration requires businesses to retain records on workplace injuries for five years.

Discrimination claims. Requirements for claims about discrimination also vary by state and the type of discrimination Federal agencies, including the Equal Employment Opportunity Commission and the U.S. Department of Labor, also have recordkeeping requirements for discrimination claims.

Employee pension and retirement plans. Pension and retirement plans might fall under both IRS and Employee Retirement Income Security Act rules. You might want to permanently keep records for employees who receive pension or retirement plan benefits from your company plan to protect yourself if the employee files a claim many years after retirement.

Why Is Record Retention Important

“If it’s not documented, it didn’t happen.” This phrase is often cited by peer reviewers and others to convey the importance of documenting procedures performed or judgment applied to support a CPA firm’s deliverable. Appropriate record retention can help:

- Facilitate future engagements: Workpapers may include the practitioner’s understanding of client processes or tax carryover information, which can be helpful in the execution of future engagements for the same client.

- Respond to requests from regulators, authorities, and inspectors: Appropriate documentation facilitates the response to audits and inquiries from regulators, taxing authorities, or quality inspections such as peer review.

- Defend against a professional liability claim: The records of a CPA firm, or lack thereof, can be its best friend or worst enemy in the event of a professional liability claim. Engagement workpapers are often critical to the defense of professional liability claims, helping to support the scope of the engagement, services delivered, and work product issued by the firm.

Also Check: Doordash Taxes How Much

Are The Records Connected To Property

Generally, keep records relating to property until the period of limitations expires for the year in which you dispose of the property. You must keep these records to figure any depreciation, amortization, or depletion deduction and to figure the gain or loss when you sell or otherwise dispose of the property.

If you received property in a nontaxable exchange, your basis in that property is the same as the basis of the property you gave up, increased by any money you paid. You must keep the records on the old property, as well as on the new property, until the period of limitations expires for the year in which you dispose of the new property.

Is There Any Reason To Keep Old Tax Returns

Yes! It is required that you keep your old tax returns for at least three years in most cases. In some situations, you need to keep your returns for even longer. In addition to your returns, you need to keep all the supporting documents that went along with those returns. If the IRS decides to audit your returns, then you will need all that documentation as proof that you filed your returns correctly.

Read Also: Is Giving Plasma Taxable Income

Why Is It Important To Keep Business Documents

The CRA requires business documents to be kept for a minimum of 6 years but why is this important? These documents are necessary when completing your taxes. Many of these documents can/must be used as supporting documentation for tax purposes.

Keeping important business documents for 6-7 years is required in case your business is audited or to review your tax returns. During a review or an audit, documents from the last 6 years may be required. Records can come in paper or electronic form as long as they include all supporting documentation .

Not keeping proper records can result in audits and possible legal action. From 2008-2009, 370,360 audits and reviews took place. Of those audits, 164 cases went to Canadas public prosecution office . Running a small business or self-employment can be especially problematic, as inexperience can often lead to accidents, misinformation, and even mistakes. That is why it is so important to learn which documents you must keep on file and learn effective organization and filing skills before an audit takes place.

How Long Should I Keep Tax Records

The general rule is to keep all tax records for at least three years because of the IRS statute of limitations. It is important to keep your records for three years because, according to the tax code, if you do not file a claim for a refund that you are entitled to, you have three years from the date you filed the original return or two years from the date you paid the tax, to file the claim. In addition, the IRS normally has three years from the filing date or due date of the return to assess an additional tax if your income was not accurately reported.

Read Also: Pastyeartax.com Review

Records Related To Property

When your tax return includes information related to property, keep those records until the statute of limitations typically three years runs out for the year in which you sell or otherwise dispose of the property.

For example, if you bought a car in 2010, use it as part of your business and then sell it in 2020, you should keep all of those car-related tax records until the statute of limitations expires for your 2020 tax return.

In addition, keep your old property records until the statute runs out on the tax year you dispose of the new property if you exchange the property for another property to which you transfer your cost basis.

For example, say you use a 1031 exchange to sell a rental property and invest the proceeds tax-free into a new rental property. Your basis in the new property is dependent on your basis in the old rental property. As a result, keep the old rental property records until the statute runs on the tax year that you sell the replacement property.

Deductions: All the Tax Write-Offs You Dont Know About

What Should I Do With Electronic Records

Whether a record is paper-based or electronic, the firm’s record-retention policy should be applied consistently. Electronic documents evidencing work performed should be saved in both client and engagement files rather than as attachments to emails. All relevant client service information should be maintained in the engagement workpapers and other official firm files or storage media.

Additional care should be applied to emails. If necessary to demonstrate procedures performed or conclusions reached, email correspondence with clients or peers should be retained as part of the client engagement files, not in a team member’s email folder or on an email server.

Many a professional liability claim defense has been thwarted by an email in which the tone was taken out of context. As such, firms may exercise additional judgment by applying a separate retention period for emails to help guard against this risk. Consult the article “Professional Liability Spotlight: How Social and Digital Media Can Be a #majorrisk,”JofA, March 2016, which discusses the risks that CPAs may encounter with electronic communication and how using it appropriately can help to avoid potential liability exposure.

Also Check: How Does Doordash Work For Taxes

How Long Should You Keep Your Tax Records In Case Of An Audit

It depends on your specific tax situation for a given tax year. In most cases, you will need to keep your returns for at least three years. However, there are some instances where you must keep the returns for up to 7 years or even indefinitely! The IRS period of limitations explains exactly how long you must keep your returns for each specific situation. If you are unsure, you can always ask your CPA or simply keep the returns indefinitely.