Salaries Wages And Benefits

You can deduct gross salaries and other benefits you pay to employees.

Do not include:

- salaries and wages such as direct wage costs or subcontracts

- drawings of the owners of the business

- salaries or drawings of the owners of the business since salaries or drawings paid or payable to you or your partners are not deductible

The Canada Pension Plan; is for all workers, including the self-employed. Employers, employees and most self-employed individuals must contribute to the CPP. The CPP can provide basic benefits when you retire or if you become disabled. When you die, the CPP can provide benefits to your surviving spouse or common-law partner and your dependent children under 25. For more information on contribution and benefits, visit;Service Canada.

Quebec workers including the self-employed are covered under the Quebec Pension Plan;.

As the employer, you can deduct your part of the following amounts payable on employees’ remuneration:

- CPP or QPP contributions

- Provincial parental insurance plan premiums, which is an income replacement plan for residents of Quebec

- workers’ compensation amounts for your employees

You report each salary by the end of February on a T4;slip, Statement of Remuneration Paid, or T4A;slip, Statement of Pension, Retirement, Annuity and Other;Income.

You can deduct the salary you pay to your child, as long as you meet all these conditions:

For more information, see guide;RC4120, Employers’ Guide; Filing the T4;Slip and Summary.

How Does Family Tax Recovery Services Optimize Your Refund

“Bulletin Board April 19 Posted on April 19, 2016 Bulletin Board is the Dioceses bi-weekly e-bulletin for clergy and lay leaders. To subscribe to Bulletin Board, sign up online. Ten-year tax reviews offered Family Tax Recovery Services is offering 10-year tax reviews to identify possible refunds or credits that individuals and families may have missed when “

Tax Privacy And Security Tips

One understandable concern weve heard from readers is the desire to know how these tax tools protect your privacy and financial information. The good news is, the government has been taking steps to make sure that doing your taxes online is more secure. For example, last year, the IRS mandated multi-factor authentication for all online tax-prep tools . We also looked at the privacy and security policies for the tax software we tested and asked the companies for information on how they safeguard customer data. The answer: All of them encrypt the data when its stored on their systems and follow the IRSs standards for electronically sending returns securely.

The bad news is that the nature of the internet means theres no such thing as 100% secure tax filing, and tax-prep services are especially common targets for hackers. We looked into software breaches from previous years at TurboTax and H&R Block and found that the breaches were caused by credential stuffingidentity thieves used passwords and usernames stolen from other services to log in to the tax software. The best thing you can do to protect yourself is to follow strong security practices, which includes never reusing the same password for different accounts. A password manager can help you create a strong, unique password for all of your accounts. Other recommendations:

You May Like: How To Review My Tax Return Online

Saad Sultan Is A Lifesaver

I first found Prior Tax online when I had to file a lot of past returns due to a hardship in my family. Saad Sultan was the one who I was connected with when I requested the CPA review feature. Not only did he make the process of filing several old returns fairly painless, he helped me to file an Offer in Compromise which was successful and saved me thousands of dollars. He got me back on track and current with all my filing obligations, and I will continue to use him for all things tax related. Saad is pleasant, professional, understanding, and got things done in a timely manner. He answered tons of my questions and had a lot of patience. Highly recommend!

I am so grateful for Saad Sultan, the CPA with Prior Tax. He is an amazingly patient, detail orientated, accurate, and very kind person/CPA. I completely recommend him.

Income $72000 And Below:

- Free federal tax filing on an IRS partner site

- State tax filing

- Guided preparation simply answer questions

- Online service does all the math

- Free electronic forms you fill out and file yourself

- No state tax filing

- You should know how to prepare paper forms;

- Basic calculations with limited guidance

Also Check: How Much Income To File Taxes

Who Should Use Freetaxusa

FreeTaxUSA is a good option if you fall into one of these categories:

- Earn a small income and cant afford large purchases

- Are comfortable filing your own taxes

- Dont need one-on-one tax advice

- Desire to use one of the oldest online tax software programs

You will want to avoid FreeTaxUSA if youre uncomfortable preparing your own tax return. If you have a basic tax return, other programs let you file one free state tax return too.

Finally, the self-employed or those with the most complex tax situations may appreciate using a CPA.

A tax professional can help you find niche-specific tax deductions and credits other than the 350+ most common items.

Plus, a CPA can help you navigate tax forms that are hard-to-understand.

Who Should Take Advantage Of A Past Business Tax Return Review

In our experience, small business owners can benefit from a free past business tax return review. However, if you have any of these situations, it is likely you need a past tax return review:

- You own a business.

- Do-It-Yourself tax preparer. You have used a tax software to prepare your taxes.

- You took your paperwork to an H&R Block tax preparer.

You May Like: How Much Money Is Taken Out Of Paycheck For Taxes

Why Should You Do It

How would you know if the software did your calculations correctly? How would you be certain if it applied deductions applicable to your situation correctly? You cant. However, we are tax experts. We will do a thorough review of your past business tax returns to try to find software errors or incorrect data, so your past business tax returns give you comprehensive tax benefits. If we find errors, we will advise you on how we can correct them. We care enough about you and your business that we want to get you all the missing money you deserve.

How Do Most Australians Do Their Tax Return

The ATO confirms that most taxpayers prefer to use a tax agent like Etax to lodge their tax return. The majority of tax returns are done this way.

This is in spite of ATO marketing and media suggesting we should do it ourselves with ATO MyGov and myTax.

Why doesnt everyone go it alone with myTax? Because most people choose to get tax help from someone whos on their side.

You can get the confidence of tax agent support and checking, with online convenience, at Etax ;the leading online tax experts in Australia. Plus, the low once-per-year fee is also tax deductible!

Read Also: How To Reduce Income Tax

What You Need To File Prior Tax Year Returns

To file back taxes, youll need to find all the relevant documents that show your income, such as W-2 forms and 1099s. If you cant find these forms, try asking your employer for a copy or reach out to the IRS for a free tax transcript. Youll also need the various documents that provide proof of your eligibility for the credits and deductions that you want to claim.;

Once youve located the necessary documents, youll need to fill out your tax return, starting with Form 1040. As these change each year, always make sure the form you have is for the tax year youre filing for.;

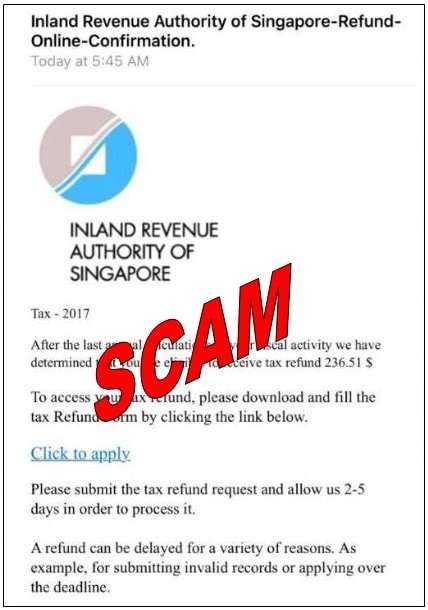

Scams Targeting Tax Professionals

Increasingly, tax professionals are being targeted by identity thieves. These criminals many of them sophisticated, organized syndicates – are redoubling their efforts to gather personal data to file fraudulent federal and state income tax returns. The Security Summit has a campaign aimed at tax professionals: Protect Your Clients; Protect Yourself.

Unsolicited email claiming to be from;the IRS, or from a related component such as EFTPS, should be reported to the IRS at;.

For more information, visit the IRS’s Report Phishing webpage.

Also Check: How Much Does H&r Block Cost To File Taxes

Download The Tax Forms You Need

Go to the IRS website to for the year you need to file. Forms can change from year to year, so be sure youre using the correct one. For example, the IRS significantly revised Form 1040, which is the main form for individual income taxes, in 2018. The new form replaced the old 1040, 1040EZ and 1040A versions, and moved a lot of information off the form and onto additional schedules.

How To File Prior Year Tax Returns

Whatever your reason for having previously neglected to file a return – and regardless of your reason for wanting to do so now – ;there are a number of ways to file prior year tax returns. Contacting the IRS will usually be your first step, so that you can find out exactly what you need to provide and for which years. If you have several past-due returns to file, you might have to file returns for the current year and past six years, although your particular circumstances and what the IRS decides will ultimately determine how far back you should file.

You May Like: How To Get Tax Exempt Status

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Our partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose adjusted gross income is $72,000 or less qualify for any IRS Free File partner offers.

- Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

About IRS Free File Partnership with Online Tax Preparation Companies

The IRS does not endorse any individual partner company.

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Income and Receipts

Other income

ACA Filers

File Electronically

Contact Information

Settle Your Irs Tax Debt And Pay Less

IRS debt happens. Everyone experiences unexpected events in life that can lead to big tax bills. Perhaps you underestimated your withholding amount. Or maybe your gig economy job brought you more income than you expected.

Whatever the case, there are legit ways to settle your IRS tax debt for less. Read on to find out options that may help you.

Need help from a tax professional? Check out Sovlable that will give you multiple options to get you the best company for your situation.

Read Also: How To Pay Back Taxes Online

How To Avoid Irs Imposter Scams

There are things you can do to protect yourself from an IRS imposter scam.

Do:

-

Beware if someone calls claiming to be from the IRS. The IRS will always contact you by mail before calling you about unpaid taxes.

-

Ask the caller to provide their name, badge number, and callback number. Then call TIGTA at to find out if the caller is an IRS employee with a legitimate reason to contact you. If you confirm that the caller is from the IRS, call them back. Otherwise, report the scam call to TIGTA.;

-

Become familiar with what fraudulent IRS email messages look like. Review a sample IRS phishing email.

-

Verify the number of the letter, form, or notice on the IRS website.

-

Be suspicious of threats. The IRS wont threaten to have police arrest you for not paying a bill.

Dont:

-

Dont give in to demands to pay money immediately. Be especially suspicious of demands to wire money or pay with a prepaid debit card.

-

Dont trust the name or phone number on a caller ID display that shows IRS.Scammers often change the name that shows on caller ID using a technique called spoofing.

-

Dont click on any links in email or text messages to verify your information.

Does Taxfreeusa Have A Mobile App

FreeTaxUSA currently doesnt offer a mobile app, yet its website is mobile-friendly. A mobile app is a nice touch in todays world.

Since FreeTaxUSA doesnt support W-2 snapshot uploads, it may only be an inconvenience if you want live chat support.

You can make the mobile website work if you have a simple return or file with the free plan. But honestly, no complex return is fun to prepare with only with a mobile app.

Overall, FreeTaxUSA may not be your best option if you plan on filing your taxes with a smartphone.;

Don’t Miss: Can I Pay Quarterly Taxes Online

Plans And Pricing Of Fileyourtaxescom

Compared to most companies,;FileYourTaxes.com;has a very confusing pricing structure. You really need to understand forms and schedules to understand the exact cost of the plan.

A user, found that he used 7 unique Schedules or Forms beyond the included W-2 forms of his prior-year return.

7 forms should be more than the average filer, but expect to add at least 2-3 forms if youre an investor, a side hustler or trying to claim a credit .

Heres the calculation:

| Additional Cost for Each Form or Schedule | $4 |

Gather All Your Documents

Whenever you file a return, youll need all the forms that show your income for the tax year youre filing for. So if, for example, youre filing a return for the 2018 tax year, youll need any W-2s, 1099s, interest statements and other types of income statements that apply to that year.

Hopefully, you saved those documents in a tax records file. If youre missing information, you can request a wage and income transcript from the IRS for a previous year. The transcript will show all the information returns the IRS received on your behalf for that tax year, such as W-2s, 1099s, 1098s, IRA contributions you made and more.

And, if youre claiming certain deductions or tax credits, youll need to have all the necessary documentation, such as receipts for medical expenses or mortgage interest you paid during the tax year.

Recommended Reading: How To File Taxes With No Income

What’s It Like To Use An Online Tax Service

Along the way, personal tax preparation websites provide a lot of support. After all, how helpful would they be if they just displayed replicas of the actual IRS forms and schedules on the screen and asked you to fill them in using the IRS instructions?

Instead, some of these solutions, such as H&R Block and TurboTax, provide state-of-the-art user experiences. They’re designed to make what is an unpleasant task more palatable. They use color, graphics, design, and layout to present screens that are lively and attractive, rather than dull and lifeless like the actual forms.

The step-by-step data entry path they provide generally works quite wellas long as you work your way through your whole return without a lot of backing up or lurching forward . Jackson Hewitt, for example, asks whether you’d like to complete your 1040 by using its comprehensive interview; this option takes you through the entire process in one long Q&A session. It asks you about every tax topic that might apply to you.

The other alternative, one that every online service offers, involves selecting the topics that apply to you. You choose these from the lists they provide for income, deductions, credits, and taxes. When you select one, the sites walk you through mini-interviews to get the information they need. Then, they return you to the main list to choose another topic, and so on, until you’re finished.

Beware Fake Irs Letter Scam

July 12, 2020 10:00am byGuest Author

Before we get into the specifics of this fraud, some reminders:

The IRS will never call you to initiate an examination or audit. If you receive a call from someone supposedly from the IRS out of the blue, just hang up.;

The IRS does not use automated robocalls to demand tax payments or to suspend your Social Security number hang up and block the number if you receive a robocall from someone saying they are the IRS The IRS does not communicate via email never open an attachment or click on a link from an unknown or suspicious source claiming to represent the IRS

Now, about the above letter:

I was alarmed this week when a friend shared a seemingly innocent-looking CP2000 notice from the Internal Revenue Service in Austin. The CP2000 is how the IRS notifies taxpayers of a change to their tax account. The letter concerned a prior-year income tax change in the amount of $325.00. It contained the IRS logo in the upper left addressed from the Austin Processing Center, and a quick search confirmed that Internal Revenue does run a legitimate payment processing center in Austin, Texas.;

To your average John Q. Taxpayer, it probably looks like the real thing. Heres a three-page example of the letter from 2016:

Trouble is the letter is a complete fake. A fraud. It represents a continued evolution of many IRS-related scams that are increasingly sophisticated in time.

Read Also: How To Pay Taxes For Free