Can They Deliver This Form Another Way

The 1009 form is delivered to you by the method of your choice. You can change the delivery preference any time, as long as its a week before the due-date. This is how you can do it via your Payable account:

You should select a delivery preference at least seven days before the 1099 form needs to be sent. If you dont, its automatically sent to your home address, as stated in your account.

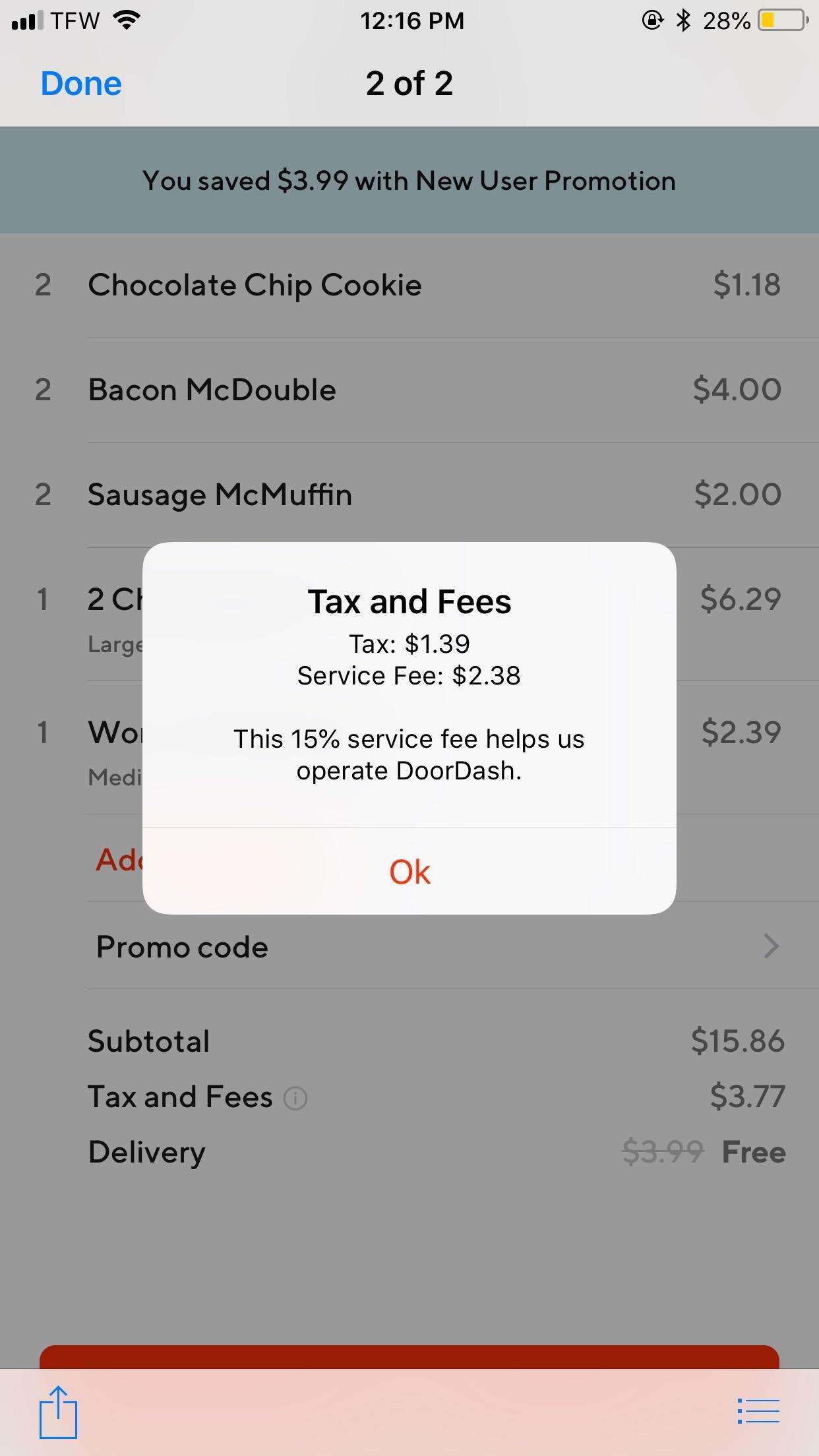

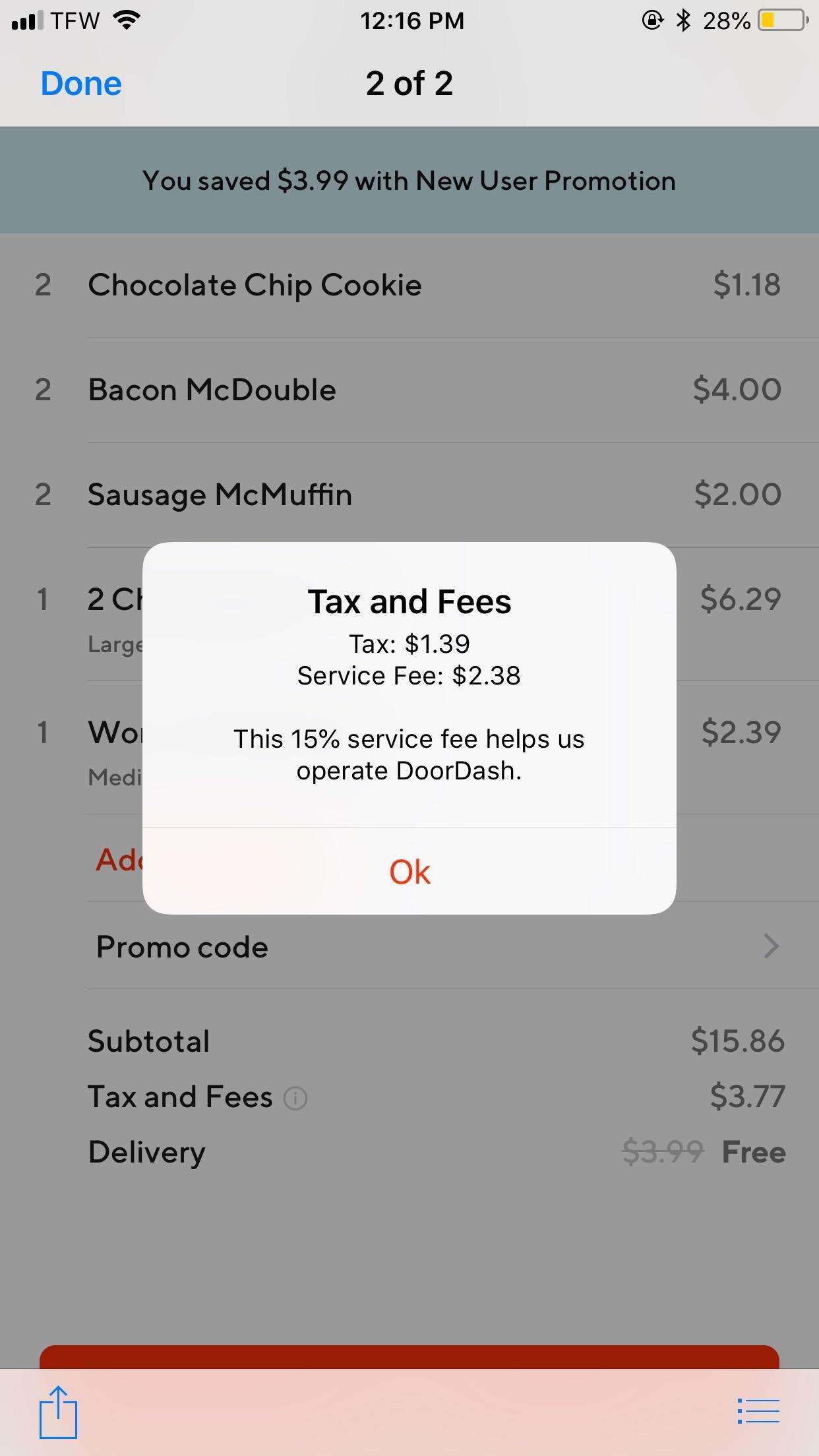

Taxes With Doordash: Calculating Expenses

The next thing to pay attention to when dealing with taxes with Doordash is to calculate your expenses.

You must know how much tax you have to pay, then you set aside your income to pay the tax. That way, when you have to pay taxes, you already have money devoted to paying your taxes.

And you dont have to borrow money to pay your taxes because it can be very detrimental to you.

Taxes arent the only expense you have to count. You must also calculate the cost of the vehicle, and the cost of fuel.

In addition, the cost of maintaining your smartphone when you have a problem must also be taken into account.

You must also calculate other expenses such as rent for housing, food costs so that there are no mistakes. It also aims to let you know how much you have to set aside to pay taxes and your expenses.

This information are ideas that are known to me regarding the taxes with Doordash policy. The best thing you can do if you want to take care of taxes is you go to a tax preparer to consult on this matter.

Doordash Taxes You Have To Pay

Since DoorDash does not withhold your taxable income for you, no matter the amount you make, you have to report the amount to the IRS. You may be wondering what exact taxes you have to pay as a self employed individual. The answer varies slightly from traditional employees who file a Form W2 instead of a 1099.

As a dasher, you are considered a classified nonemployee by the IRS. You are more of a gig economy worker, which gives you added flexibility to choose your hours and the company you work for, but you also have to pay slightly more taxes.

Both employees and non employees have to pay FICA taxes, which stands for the Federal Insurance Care Act. This includes Social Security and Medicare taxes, which as of 2020, totals 15.3%. The only difference is nonemployees have to pay the full 15.3% while employees only pay half, which is 7.65%.

As a self employed dasher, you are considered both the employer and employee by the IRS, so you pay both portions. The good news is you are allowed to write off the employer portion of your self employment taxes to help lower your bill when the tax season ends. Keep reading for more information on how to write off business expenses.

âHow Do I Find my Form 1099

If you earn more than $600 in payments during the last year from the DoorDash app, then you will receive a Form 1099-NEC Nonemployee Compensation from Payable. In the past they would send a 1099-MISC form, but the 1099-NEC is replacing that form as of the year 2020.

Don’t Miss: Do You Have To Claim Social Security On Taxes

An Exceptionally Good Deal For The Self

Theres another tax website that helps you prepare and file your federal and state taxes at absolutely no charge. It includes support for the Schedule C. In fact, you can prepare and file any of the IRSs most commonly used forms and schedules on the site. , an offshoot of the popular credit report monitoring site, Credit Karma, has been in operation for several years now.

Whats the catch? The site doesnt offer nearly as much guidance as its paid competitors, and its navigation system isnt overly helpful two big drawbacks for a personal tax preparation solution. If you can live with those things, though, its worth checking out. FreeTax USA charges $12.95 for state returns, but you can prepare and file your federal return for free. The site supports all major IRS forms and schedules, so you can use it to prepare a Schedule C. And overall, it offers more guidance and tax preparation tools than Credit Karma Tax does.;

How Do I File A 1099 Tax Return

Generally, a 1099 tax return is the same as a regular filing except that you need two additional forms. One is the Schedule C and the other the Schedule SE. The Schedule C is where youll report all of the important information about your business. Youll begin by placing your 1099 income information at the top of the form. As you work your way down the form, youll fill in your business expenses and deductions. At the bottom, youll use the information on the form to calculate your DoorDash profits and then copy that number onto your Form 1040.

The Schedule SE will walk you through calculating your self-employment tax. First, youll calculate your total self-employment tax and then record it on your Form 1040. Next, the form will help you determine your self-employment tax deduction, which you will also transfer onto your Form 1040. Many online tax preparation programs can walk you through both of these schedules, but some free packages wont. Make sure to choose software that can support the needs of the self-employed.

Don’t Miss: Did The Tax Deadline Get Extended

Does Doordash Take Out Taxes

Because Dashers are not employees, DoorDash does not withhold FICA taxes from their paycheck. Instead, Dashers are paid in full for their work, and must report their DoorDash pay to the IRS and pay taxes themselves when it comes time.

This sounds like a real drag, but actually its a blessing in disguise. This is because Dashers are essentially running their own one-man business, and that means they can deduct business expenses to lower their taxable income.

Gross earnings from DoorDash will be listed on tax form 1099-NEC as nonemployee compensation. This is the reported income a Dasher will use to file their taxes.

A 1099 form differs from a W-2, which is the standard form issued to employees. As such, it looks a little different. If youre a Dasher, youll be getting this 1099 form from DoorDash every year, just in time to do your taxes. Take note that companies are only required to issue a 1099 if the contractor performed more than $600 worth of work. However, major companies like DoorDash usually have these processes automated, and will likely issue a 1099 even if delivering food was a very part time side gig that did not generate more than a few hundred dollars over the course of the year.

You Will File Taxes On Your Doordash Income As A Business Owner

You may not be aware that you’re running a business.

There’s a good chance you don’t think you’re running a business.

Ready or not, the moment you signed that independent contractor agreement, you became a business owner. A lot of us in the gig economy are what you could call accidental business owners.

When you contract with Doordash as an independent contractor, you’re agreeing to provide a service as a business. It’s actually a business to business relationship.

What that means is you’ll be paying taxes as a business owner, not as an employee. For the vast majority of independent contractors, we’re sole proprietors. How that works is, we figure out what our business made, and then pay tax for those earnings on our individual taxes.

You’d be amazed at how many small businesses file their taxes the same way we have to. It’s called pass through taxation. Your profits from your business pass through to your personal return.

You’re one of those small businesses. Welcome to the club.

You May Like: How To Appeal Property Taxes Cook County

How Does Doordash Work

DoorDash is a food order delivery service. Customers place an order at one of dozens of restaurants, and then they agree to a delivery fee and tip. The app then pushes orders to Dashers who are logged into the app.

Once you accept an order, you drive to the restaurant, place the order, bring the order back to your car and deliver it to the customer.

All the directions for the delivery are inside of the DoorDash app.

You Have To Pay Doordash Taxes But There Are Lots Of Write

If youre a Dasher, these write offs certainly apply to you when it comes time to file your DoorDash taxes. But even if youre not a Dasher, you should certainly pay attention to these tax write-offsespecially if you are self-employed or participate in the gig economy.

Companies that provide an app facilitating peer-to-peer activities, like ridesharing and freelance work, all issue 1099 forms. If youre getting one, then you are operating as a sole proprietorship company, and you can write off the associated expenses that are needed to perform your work, which in turn can lower your annual tax payments.

If you have more questions about filing taxes as a gig worker/independent contractor, please join our free;Tax Tuesday;live stream. Its a great opportunity to get advice on sole proprietorship tax issues, straight from the Anderson Advisors experts themselves.

You May Like: How To Track Your Taxes

How Much Can You Make A Week With Doordash

In my experience, you can expect to earn anywhere from $10-$25 hourly. Over the course of a month in 2020, I earned an average of $183.51 weekly by working an average of 9 hours and 15 minutes. That means I made around $19.84 an hour. Below, you can see a breakdown of earnings from one of those weeks.

There Are Actually Two Different Taxes That Come Into Play

We don’t only have to worry about our Federal income taxes. We also have self-employment taxes.

Calculating the self-employment tax impact is actually pretty simple once you’ve figured out your profits. It’s a straight 15.3% on every dollar you earn. There are no tax deductions or any of that to make it complicated. No tiers or tax brackets. The only real exception is that the Social Security part of your taxes stops once you earn more than $142,800 .

Related: Understanding Top Dasher and its Requirements.

Income tax is, of course, a completely different story for delivery d. Your tax impact here is dependent on a lot of outside things. What kind of deductions do you have? Do you or your partner have other income? And then, as you earn more, you go from 12% taxes to 22% to 24% to 32%.

The two taxes are figured individually from one another. Self Employment taxes are based only on your business profits. For income tax, your business profits are added to any other income like W2, interest and investment income, etc., and then deductions and adjustments are applied to figure out the income tax.

Also Check: Can You Change Your Taxes After Filing

Employees: Deducting Vs Itemizing On Schedule A

Employee food-delivery drivers often spend their own money on the job, so you might be able to deduct certain work-related costs at tax time including:

- Phone bills

- Gas and mileage expenses

Deductions can lower the amount of your income that’s taxablewhich reduces your total tax bill and maximizes your refund.

Generally, you can either take a standard deduction, such as $6,350 if you’re filing 2017 taxes as a single person, or you can list each of your deductions separately. This method is known as itemizing. Itemized deductions are reported on Schedule A.

It may be worth itemizing expenses when they will exceed the standard deduction you’re allowed for your filing status. For example, if your itemized deductions totaled more than $6,350 in 2017, you might benefit more from itemizing.

Beginning in 2018, unreimbursed employee expenses are no longer deductible making it potentially more profitable to be an independent contractor rather than an employee.

Doordash 1099 Tax Basics

DoorDash, like other delivery services such as GrubHub, Postmates, and Instacart and ride-share services such as Lyft in the gig economy, employs delivery drivers as independent contractors.

No state or federal taxes are removed from payments from DoorDash to drivers, and, as independent contractors, drivers are responsible for paying these taxes each year.

As independent contractors, DoorDash dashers are treated more like business owners than employees.

As such, they must pay into Social Security and the Federal Insurance Care Act, or FICA.

After paying FICA taxes, also known as self-employment tax, DoorDash drivers pay federal and state income taxes.

The exact percentages vary depending on your income level, tax bracket, and state.

DoorDash dashers will receive form 1099-NEC forms annually that will note their incomes during the previous tax year.

While paying taxes can be painful, there are plenty of deductions that DoorDash delivery drivers can take to make the tax bill easier to bear.

You May Like: How To Calculate Sales Tax From Total

Taxes With Doordash: How To Manage It

October 31, 2020 By Ridelancer

Taxes With Doordash Currently, there are many online food delivery applications that you can use to make your life easier. The innovation was made in order people dont have to go to a restaurant and just stay at home. Now we will share about taxes with Doordash, one of the bigger players in the food delivery business in the US.

Doordash is one of the startup companies that serve food delivery. The has a food ordering application that has many users. This application was created and developed by Evan Moore, Stanley Tang, Tony Xu, and Andy Fang in 2013.

The application then developed rapidly and later became a startup company in the field of food delivery. Doordash is headquartered in San Francisco, California, and has nearly 8,000 employees. Doordash has served online food ordering in many cities in the United States, Canada, and Australia.

The number of cities served by Doordash reaches 700 cities in these 3 countries. However, Doordash has the largest operational area only in the United States and Canada.

Doordash Tax Guide: What Deductions Can Drivers Take

A side hustle like DoorDash can be a terrific way to make some extra cash. If self-employment is for you, you can also plunge headfirst into the gig economy and become a full-time delivery driver. Either way, its important to understand that although working as an independent contractor for DoorDash and other companies offers some tremendous benefits, it also comes with tax consequences. Its important to understand these tax issues so you dont accidentally run afoul of the IRS.

Don’t Miss: When Is Sales Tax Due

Employee Vs Independent Contractor

The way you file your tax return for this innovative and evolving line of work largely depends on whether your delivery company hires you as an employee or as an independent contractor.

On-demand food companies can contract with drivers to make deliveries or hire them as employees. For employees, they will withhold from each paycheck federal income taxes on their earnings.

Independent contractors, on the other hand, have to pay their own taxes as they go by estimating the tax they owe and sending the IRS recurring payments throughout the year. You can use TurboTaxs free tax estimator;to get an approximation of what you might owe.

The Equivalent Hour Pay Calculation

Gig economy platforms tend to focus on gross earnings the total amount deposited in a given week, including tips, and not accounting for mileage and other expenses. While this is a way to approach the advertised rates of earn up to $25/hour its not really an accurate indicator of the amount a worker can expect to have to live on.

The purpose of the equivalent hourly pay calculation is to account for the basic expenses incurred by gig workers and create a baseline of comparison between gig jobs and with conventional employment. This is the basis on which gig workers have made the demand to be paid at least $15 + expenses for all time with an active job.

This simple formula accounts for two key costs not accounted for in gross earnings. The first is the additional employer share of payroll taxes which are paid by independent contractors but not employees, which works out to 7.65% of pay. A second and much larger added expense is the cost of driving . The IRS mileage rate is a standard, widely-accepted, and comprehensive estimate of the full costs of driving a typical vehicle. While this mileage cost would be a large aggregate line item on a corporate financial report if the company owned the vehicles, the magnitude of the expense can be difficult for an individual worker to gauge it tends to be hidden on a job-by-job or day-to-day basis, but then shows up in a large repair or need to replace a vehicle far sooner than otherwise.;

Also Check: How To Buy Tax Lien Properties In California

What Costs Do You Cover

As a Dasher, you have to pay for all your business expenses. That includes data for your phone, gas, car insurance, wear and tear on your vehicle, and both sides of self employment tax.

If you decide to become a Dasher be sure to install an app like Everlance to keep track of all your expenses.

And when it comes to tax time, you need to make sure that you accurately report both your income and your expenses. If you don’t keep track of your expenses , you could be overpaying in taxes. You only pay taxes on your net earnings after expenses. So, DoorDash will send you a 1099-MISC, but then you need to self report your expenses like mileage on a Schedule C.

Check out our guide to the best tax software to find the best options for side hustlers.