Why You Can Write Certain Deductions Off On Your Taxes

For a business expense to be considered deductible, it needs to be ordinary as well as necessary.

Ordinary expenses refer to costs that are both common and acceptable in the industry, while necessary expenses are those that are helpful and appropriate for your trade. Note that an expense can be considered necessary even if its not indispensable.

Still, every deduction comes with its own rules and limitations.

These are necessary to provide guidelines on how much you can deduct and when. In general, you can deduct a business expense in full if its not a capital expense and meets the ordinary and necessary criteria.

One thing to note, though, is that while some tax deductions remain the same year after year, others change while new ones come up every so often. It’s therefore essential to keep checking for fresh additions or changes to existing deductions.

You might need to hire a tax professional to help you claim the deductions if youre not comfortable using tax software or following IRS guidelines. This is because the different deductions appear on specific tax forms, so you ought to know exactly where to file them.

Now, let’s explore the various business expenses you might qualify to write off from your taxes next.

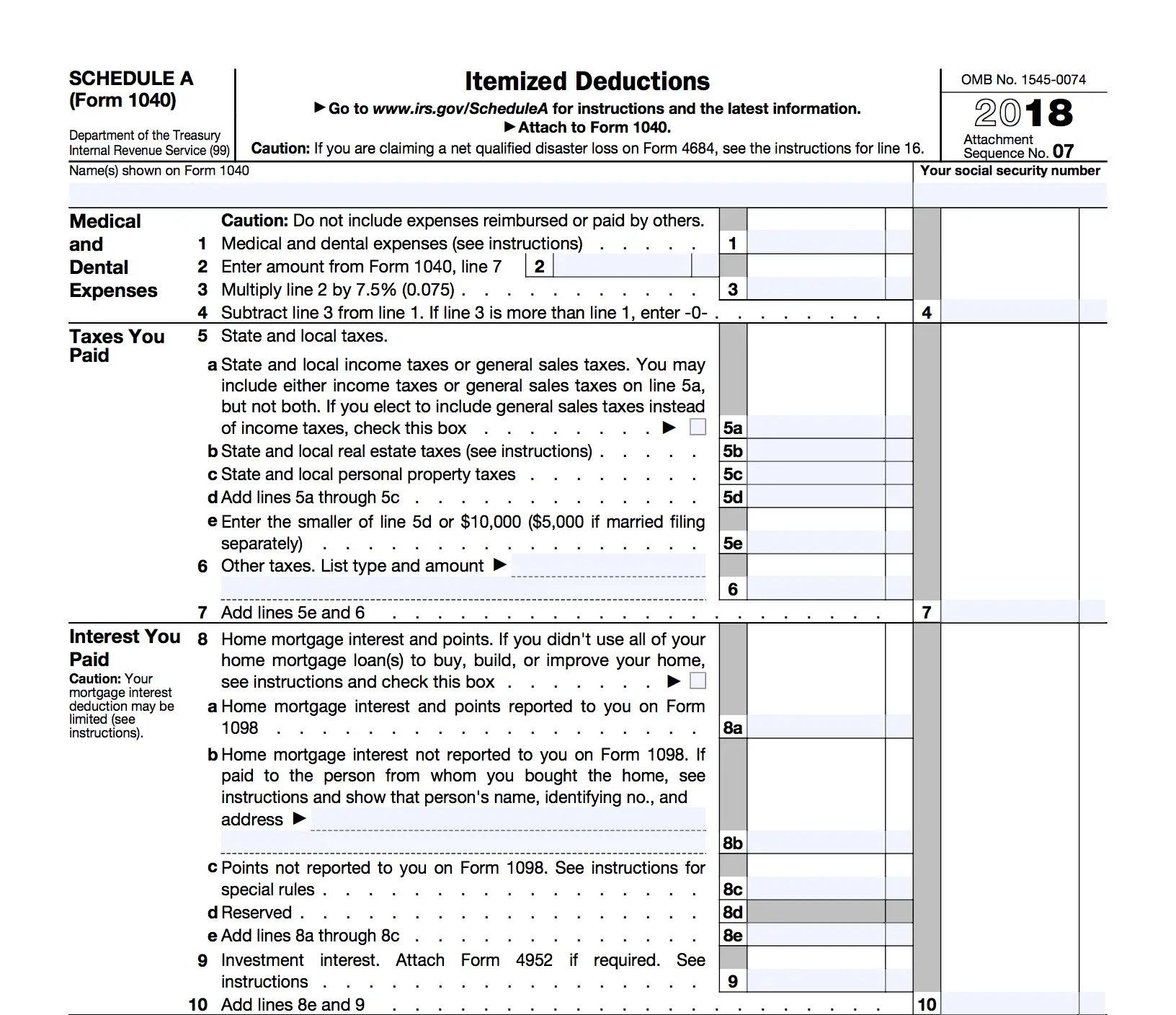

Types Of Itemized Tax Deductions

The Internal Revenue Service determines what qualifies as an itemized deduction and the IRS may also cap how much of your expenses you can claim.

There are several qualified expenses that you can itemize, but you must be able to show records for the expenses you are claiming as deductions.

Seven of the Most Common Itemized Tax Deductions

There are other, less common tax deductions such as personal property tax deductions or sales tax on certain qualified purchases. Moving and business related expenses may qualify for deductions in certain cases.

You should also check with your state tax agency to find out what state or local tax deductions you may qualify for when filing your state income tax return.

A tax professional or tax preparation software can help you find these less common deductions.

Contributions To A Health Savings Account

Health savings accounts form tax-exempt accounts that you can use to reimburse or pay for specific medical expenses. These contributions are made with after-tax dollars, which makes the deduction unavailable for donations made directly from your paycheck.

For contributions made into your account, you can claim a tax deduction of up to $2,700 every year.

Contribution limits vary depending on your age, high-deductible health plan, and when you become eligible. If you qualify for the tax deduction, claim it on Schedule 1.

Don’t Miss: How Much Are Annuities Taxed

State Local And Foreign Income Tax Deduction

You can claim foreign, local, and state income taxes as itemized deductions, which include state and local sales taxes as well as real estate taxes. Thus, you can write off mortgage interest and insurance premiums paid for your home during the tax year.

Other expenses that could make allowable tax deductions are local or state personal property taxes, but only if the said amounts are based on property value. Property tax and state income tax have their upper limit capped at $10,000.

Cons To Itemized Deductions:

- Theres still significantly more work involved. Even with a good tax software, properly filing your itemized deductions can take plenty of accounting, paperwork, and digging up old receipts. Youll also need to keep those receipts in a safe place in case youre audited by the IRS about your deductions.

- There are tons of restrictions to track. You can only deduct up to $10,000 worth of state and local taxes. Medical expenses must exceed 7.5% AGI. Mileage reimbursement for medical reasons is $0.16/mile, but only $0.14/mile for charity and volunteering. These are just three examples of the hundreds listed by the IRS, which is why working with a CPA or a good tax software is strongly recommended.

- You may end up with a smaller deduction. You may go through all the rigamarole of preparing your itemized deduction only to discover that your total amount falls short of the $12,550 standard deduction. Oh, well. At least youll sleep well knowing you didnt leave money on the table.

- Tax software may charge more for itemized deductions. Your preferred tax software may upcharge you for helping you fill out Schedule A Form 1040. If youre dead set on itemizing your deduction, try to hunt down this fee, since it could make the overall cost close to working with an actual CPA .

Don’t Miss: When Is Tax Refund 2021

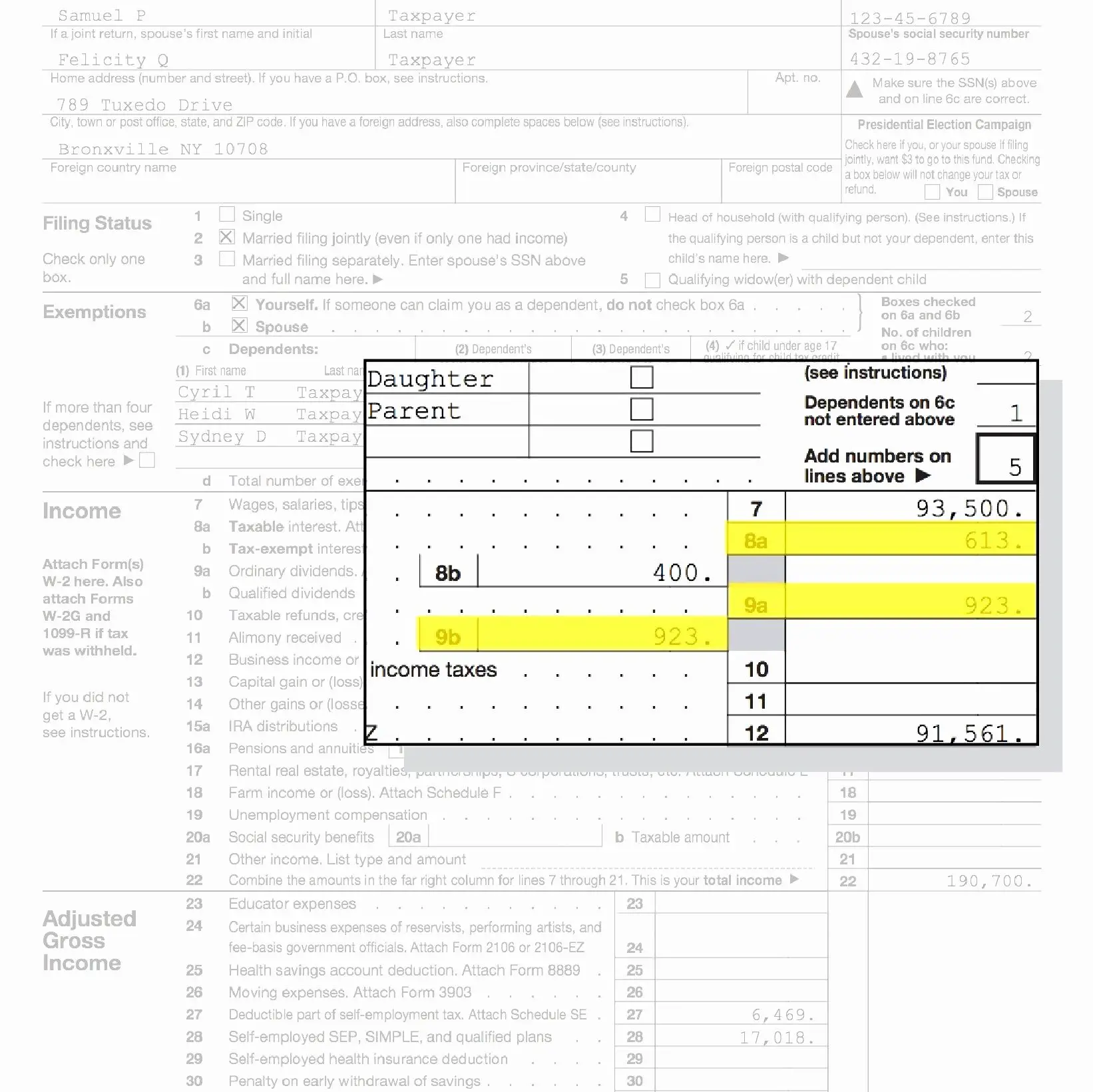

Don’t Unnecessarily Report A State Income Tax Refund

There’s a line on the tax form for reporting a state income tax refund, but most taxpayers who get refunds can simply ignore it, even though the state sent the IRS a copy of the 1099-G you got reporting the refund. If, like most people, you claimed the standard deduction on your previous federal return, the state tax refund is tax-free.

However, even if you itemized deductions on your last return , part of your state tax refund still might be tax-free. It’s taxable only to the extent that your deduction of state income taxes the previous year actually saved you money. If you would have itemized even without your state tax deduction, then 100% of your refund is taxable because 100% of your write-off reduced your taxable income. But if part of the state tax write-off is what pushed you over the standard deduction threshold, then part of the refund is tax-free. Don’t report any more than you have to.

Child And Dependent Care Credit

Affording childcare can be one of the more difficult challenges parents face. That’s where the child and dependent care credit comes in especially this year, because the credit was improved for 2021 to help families struggling during the pandemic.

For previous years, if your children were younger than 13, you were eligible for a 20% to 35% non-refundable credit for up to $3,000 in childcare expenses for one child or $6,000 for two or more. The percentage decreased as income exceeded $15,000. However, for the 2021 tax year, the maximum credit percentage jumps from 35% to 50%, up to $8,000 in expenses for one child and $16,000 for multiple children qualify for the credit, the phase-out doesn’t start until income hits $125,000, and the credit is fully refundable.

The credit can also help pay for the costs of caring for other dependents, too. For example, expenses related to care for an elderly parent living with an adult child qualify for the credit if the parent is claimed as a dependent on the child’s tax return.

Also Check: What Is Needed To File Taxes

Charitable Contributions Tax Deduction

Contributions of cash or property to a qualified tax-exempt organization of the Internal Revenue Code) may be deductible. To get a benefit, youâll first need to itemize your contributions. Be sure to keep any related receipts or documentation that you receive from the benefiting organization throughout the year, and for any gifts greater than $250, youâll need a letter of acknowledgement from the charity.

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Also Check: How Early Can You File Taxes 2021

How To Itemize Your Deductions

In order to itemize your tax deductions, youll need to:

Now, a good tax software can help you with all three steps.

Typically how it works is the software will automatically try and determine which deduction standard or itemized is right for you by asking some simple questions.

The process for entering itemized deductions is never short but it can be simple with the right tools.

Casualty And Theft Losses

Any casualty or theft loss incurred as a result of a federally declared disaster can be reported on Schedule A. Unfortunately, only losses in excess of 10% of the taxpayerâs AGI are deductible after subtracting $100 from the loss amount. If a taxpayer incurs a casualty loss in one year and deducts it on their taxes, any reimbursement that is received in later years must be counted as income. Taxpayers must complete Form 4864 and report the loss on Schedule A.

Also Check: How To Get Out Of Paying Back Taxes

What Is The Standard Deduction

The standard deduction is a flat amount that the IRS allows you to deductâno matter how many deductible expenses you have. The standard deduction available to you depends on your filing status.

For the 2022 and 2023 tax years, the available standard deductions are as follows:

| Filing Status | |

|---|---|

| $19,400 | $20,800 |

For 2017 tax returns, the standard deduction was just $6,350 for single people and $12,700 for married couples filing joint returns. The new tax law nearly doubled the standard deductions for all filing statuses, so many more people will see a lower tax bill with the standard deduction than they would get from itemizing.

With the higher standard deductions, taking steps to lower your tax bill might be a little more complicated than it was before. Pre-paying your state and local taxes or making a donation to charity might not be enough to push you over the higher standard deduction hurdle. And if you live in a high-tax state, your combined state income taxes and property taxes may have already reached the $10,000 limit.

You Can Deduct Your Mortgage Interest

If you took out a mortgage to purchase your home, be on the lookout for Form 1098, which will be mailed to you and can be found in your mortgage payment portal. This form breaks down what portion of your mortgage payments went toward interest, property taxes, mortgage insurance and, if applicable, points or loan origination fees. All of these can be tax deductible if the homebuyer itemizes their deductions, says Colin Smith, a CPA who has a practice in the Cleveland, Ohio area and runs CPAExam Maven, which helps aspiring accountants prepare for CPA exams.

Most tax filers take the standard deduction when theyre doing their taxes, but about 25 percent will itemize and its often homeownership that puts you above the threshold to do so, explains Kari Brummond, an accountant and content strategist with TaxCure.com.

For tax year 2022 , the standard deduction is $12,950 for single filers and $25,900 for married filers, Brummond points out. Alternatively, you can itemize, which just means that you add up all of your qualifying expenses and you claim that amount instead of the standard deduction.

You should only itemize if your total exceeds the standard deduction, she says. To see if your new home qualifies you to itemize, add up your mortgage interest, property tax, amounts paid for discount points, and private mortgage insurance .

Don’t Miss: How To Find Property Tax

Federal Tax Deductions For Charitable Donations

You may be able to claim a deduction on your federal taxes if you donated to a 5013 organization. To deduct donations, you must file a Schedule A with your tax form. With proper documentation, you can claim vehicle or cash donations. Or, if you want to deduct a non-cash donation, you’ll also have to fill out Form 8283.

Medical And Dental Expenses

As we mentioned previously, to benefit from claiming itemizing medical expenses, your total out-of-pocket medical and dental expenses must exceed 7.5% of your AGI in 2023.

For Mark and Sara, that means they would need more than $7,500 in expenses to benefit from deducting medical expenses. Mark and Sara have health insurance, are generally healthy, and donât have any major medical or dental procedures scheduled for 2023, so they estimate they wonât have more than $7,500 in medical expenses for 2023.

Itemized medical expenses: $0

Read Also: Do You File Social Security On Taxes

Vehicle And Travel Expenses

While you generally cant claim expenses for getting to and from your regular workplace, there are some work-related vehicle and travel expenses you may be able to claim.

These may include:

- Where your work requires you to attend multiple workplaces or locations

- Car expenses where you need your car to perform your work duties

- Accommodation expenses when youre required to travel for work

You can find out more about vehicle and travel expenses you can claim on the ATO website.

You Can Tap Your Ira Without Penalties

If you need to gather up more money for your down payment, dipping into your retirement fund is an option. Many first-time buyers dont know that they can tap their IRAs or Roth IRAs and avoid penalties, Smith says. First-time homebuyers buyers can withdraw up to $10k from their IRA without incurring the 10 percent early-withdrawal penalty, and those with Roth IRA accounts can withdraw 100 percent of their contributions penalty-free after five years.

These options give new homeowners lots of flexibility in how they finance the purchase of their home or make repairs, he says.

Read Also: How To Apply For Tax Exemption

Topic No 501 Should I Itemize

There are two ways you can take deductions on your federal income tax return: you can itemize deductions or use the standard deduction. Deductions reduce the amount of your taxable income.

The standard deduction amount varies depending on your income, age, whether or not you are blind, and filing status and changes each year see How Much Is My Standard Deduction? and Topic No. 551 for more information.

Certain taxpayers can’t use the standard deduction:

- A married individual filing as married filing separately whose spouse itemizes deductions.

- An individual who files a tax return for a period of less than 12 months because of a change in his or her annual accounting period.

- An individual who was a nonresident alien or a dual-status alien during the year. However, nonresident aliens who are married to a U.S. citizen or resident alien at the end of the year and who choose to be treated as U.S. residents for tax purposes can take the standard deduction. For additional information, refer to Publication 519, U.S. Tax Guide for Aliens.

- An estate or trust, common trust fund, or partnership see Code Section 63.

You should itemize deductions if your allowable itemized deductions are greater than your standard deduction or if you must itemize deductions because you can’t use the standard deduction.

Who Cannot Use The Standard Deduction

Generally, the standard deduction is available to anyone who doesnt itemize, although there are a few exceptions. You cannot claim the standard deduction if:

- You are married and file separately from a spouse who itemizes deductions

- You were a nonresident alien or dual-status alien during the tax year

- You file a return for less than 12 months due to a change in your accounting period

- You file as an estate or trust, common trust fund, or partnership

Also Check: Are Membership Dues Tax Deductible

What Can I Take A Tax Deduction For

In order to take a tax deduction for a charitable contribution, you’ll need to forgo the standard deduction in favor of itemized deductions. That means you’ll list out all of your deductions, expecting that they’ll add up to more than the standard deduction.

The most common expenses that qualify are:

- Mortgage interest

Standard Deduction Vs Itemized Deductions

Claiming the standard deduction is certainly easier. To itemize, you need to keep track of what you spent during the year on deductible expenses like out-of-pocket medical expenses and charitable donations. You also need to maintain supporting documentation, such as receipts bank statements medical bills acknowledgment letters from charitable organizations and tax documents reporting the mortgage interest, real estate taxes, and state income taxes you paid during the year. Then you need to determine whether your available itemized deductions exceed the standard deduction for your filing status.

That might sound like a lot of work, but it can pay off if your total itemized deductions are higher than the standard deduction.

For 2022, the standard deduction numbers to beat are:

- Single taxpayers: $12,950

- Heads of household: $19,400

Those are the numbers for most people, but some get even higher standard deductions. If you’re 65 or older or blind or both, you may increase your standard deduction by the amount listed below.

| Single or Head of Household | 65 or older |

| 65 or older and blind | $3,500 |

| One spouse 65 or older or blind | $1,400 |

| One spouse 65 or older and blind | $2,800 |

| One spouse 65 or older, both spouses blind | $4,200 |

| Both spouses 65 or older | $2,800 |

| Both spouses 65 or older, one spouse blind | $4,200 |

| Both spouses 65 or older, both spouses blind | $5,600 |

Here are a few questions to help you decide whether itemizing deductions might be beneficial for you.

Read Also: How To File An Amended Tax Return Turbotax

When To Itemize Vs Take The Standard Deduction

Since the Tax Cuts and Jobs Act, the number of American taxpayers taking the standard deduction has risen from roughly 68% to 90%.

Its not just because its wayyy more convenient its also because most Americans dont have $12,550 of itemized deductions.

That being said, maybe youre the 1 in 10.

Speaking bluntly, old rich people often itemize their deductions because they pay so much in state and local property taxes.

But if youre under 30 and still working towards financial independence, the two most common reasons I can think of for itemizing your deductions are if you had high medical bills and interest payments.

Take a second to consider how much you spent in the categories you can itemize. If its anywhere near $12,550, youd probably know right away.

If its only a few grand, the standard deduction will save you the most money.