How Do I Apply For The Irs Fresh Start Program

There are several guidelines you must follow when applying for the IRS Fresh Start program. First, taxpayers must file all of their back and current tax returns. The IRS does not allow for the request of payment plan options with outstanding tax returns. Additionally, taxpayers must file all future tax returns on time while enrolled in the Fresh Start program. First, the taxpayer must fill out and submit the IRS Form 9465. Enrolling in the program can be time-consuming and confusing. For that reason, its beneficial to work with a tax resolution specialist. A tax professional can ensure that you enroll successfully in the payment plan of your choice.

What Is The Irs Hardship Program

The federal tax relief hardship program is designed for individuals who arent in a position to pay their tax debt. Another term used to describe the IRS hardship program is Currently not Collectible. In other words, the government places a hold on any collection activities on your account. This means that the IRS will not be able to seize your property or take money from your paycheck. Essentially, the government will stop attempting to collect back taxes from you. However, you will still owe back taxes. Additionally, the government will remind you every year of how much you owe. However, the IRS hardship program doesnt stop IRS penalties and interest. Even though you are in the program, the IRS will continue to charge you penalties and interest. Therefore, while youre in the IRS hardship program, its a good idea to come up with a tax relief plan.

Request A Short Extension

To allow taxpayers to pay their tax debt in full, the IRS will give taxpayers up to 120 days to pay their balance. If you anticipate that youll be able to save up enough to pay your back taxes in full in just a few months, then this may be a convenient payment method for you.

You wont have to pay a fee when you request this extension, but if you do receive a short-term extension, the IRS will still charge interest on your debt. Youll also incur a monthly penalty of 0.5% until you pay your full balance.

Read Also: Do Doordash Drivers Pay Taxes

When Does Netfile Open For 2021

NETFILE opens on Monday, February 22, 2021, for filing personal tax returns for the 2020 tax year. To file online, you must use CRA-certified tax-filing software products that use the NETFILE web service. You can also file previous tax years back to 2015, but returns for tax years earlier than 2014 must be done on paper.

We Know How The Irs Works

As former Senior IRS Collection Agents, Landmark Tax Groups professionals know how the IRS works AND how to protect you and your assets. Request a consultation with one of our ex-IRS agents today.

If you would like us to review YOUR IRS tax case, contact Landmark Tax Group right now for an expert consultation!

Read Also: Freetaxusa Legit

Pay Less Than You Owe With Offer In Compromise

If you have the resources to pay a partial amount of your IRS tax debt, theres still hope. You can apply for the IRS government payment plan called an Offer in Compromise to resolve the remaining amount. Depending on your financial capacity and upon acceptance, the IRS significantly reduces the total debt that you can pay. This reduced amount can be paid in a lump sum or in fixed monthly payments.

There is a catch with the Offer in Compromise program though. It isnt always easy to qualify for an OIC. The IRS considers your ability to pay, income, expenses, and asset equity when determining your eligibility for an OIC. While it can be a life-changing tax resolution for many people, the IRS doesnt give an Offer in Compromise easily.

Here are some common reasons for ineligibility:

- You havent filed all required tax returns

- You havent made any required estimated tax payments

- Youre currently in an open bankruptcy proceeding

- You own a business with employees and havent submitted all required tax deposits

- You could pay your tax debt in a lump sum or through an installment agreement and/or equity in assets

But dont let any catches deter you from seeking back taxes help. If youre concerned you may not qualify for an OIC, consult a tax professional to see what IRS forgiveness options might be available to you.

What Are Installment Agreements

Installment agreements are payment plans made directly with the IRS to pay your back taxes over a set period. Generally, these plans are paid in monthly installments. The type of installment agreement youll be able to get depends on the details of your situation, such as how soon youll be able to pay your balance and how much you owe.

Also Check: Do You Pay Taxes On Plasma Donations

What Is The Most Common Uk Tax Code

From 2022 to 2025 you are likely to find the 1257L tax code the most common tax code. The company vehicle can be used by anyone with one employer without any taxes or unpaid taxes. W1, M1, or X form the base for emergency tax codes in Luxembourg 1257L. The P45 may be used while hiring a new employee without an emergency code.

Pay As Quickly As Possible

If you owe tax that may be subject to penalties and interest, dont wait until the filing deadline to file your return.

Send an estimated tax payment or file early and pay as much tax as you can.

Even if you choose to file an extension, any taxes owed are still due on the filing deadline. Therefore if you dont pay by April 17, you are subject to those extra penalties and fees.

Recommended Reading: Do You Have To Do Taxes For Doordash

If You Got Too Much Money From The Irs You Might Have To Repay Some Of The Monthly Child Tax Credit Payments You Received This Year

The IRS sent the final round of 2021 child tax credit payments on December 15. Overall, eligible families received up to $1,800 in total monthly payments for each child five years old or younger and up to $1,500 for each kid 6 to 17 years old. If you have a large family, that adds up to a pretty hefty chunk of change. But what if the IRS sent you too much money do you have to pay it back? Wellmaybe.

The law authorizing the monthly child credit payments specifically says that any excess amounts must be paid back when you file your 2021 tax return if your income is above a certain amount. There are exceptions to this rule for middle- and lower-income families, but they’re limited. Plus, the way the monthly payments were calculated, overpayments could be fairly common. So, this could be a big issue for a lot of families.

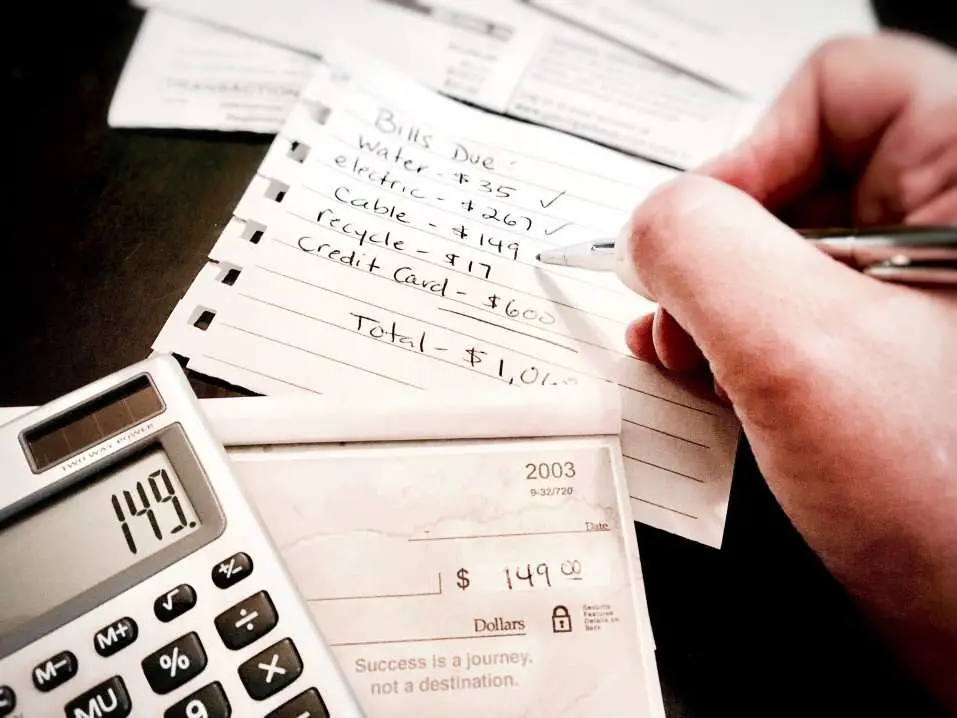

Determining Collection Financial Standards

Your leftover income after paying necessary living expenses is how much the IRS will expect you to pay every month. You can complete IRS Form 433-A or Form 433-F to make these calculations, but the IRS might not allow all your expenses. It can disregard an expense that is unnecessary or higher than average.

The IRS will compare your actual spending to averages that vary by region to take into account that some areas have higher costs of living than others. These expense averages are called “collection financial standards.”

The IRS will assume that you need to spend only up to the amount specified by the collection financial standards. Anything over and above that amount is considered to be discretionary rather than necessary.

For example, your mortgage might be $3,000 a month. But if the standard in your area is only $1,500, the IRS will most likely add $1,500 back to its calculation of your monthly disposable income.

Don’t Miss: 1040paytax Customer Service

How To Get Money From Your Corporation In A Tax

This article was published more than 4 years ago. Some information may no longer be current.

My friend James owns a manufacturing company and was interviewing for a warehouse manager position.

One candidate a balding gentleman excused himself after five minutes and returned to the interview room wearing a hair piece. Sort of odd. I guess some people just don’t plan ahead very well. Turns out he didn’t get the job.

Failing to plan ahead when it comes to your income taxes can be even more costly. Last week, I shared some tax issues related to those who own a corporation. This week, I want to share a primer on how to get money from your company in a no- or low-tax manner. Here are the top ideas to consider.

1.Take repayment of shareholder loans. If you’ve loaned money to your corporation, you can take repayment of that loan with no tax implications, so consider taking repayment to meet your cash needs. You can create a shareholder loan owing to you if you transfer assets to your corporation for any reason, which can generally be done without triggering tax .

It’s a good idea to pay out these dividends periodically because it’s possible that your CDA balance could disappear later if, for example, your company realizes capital losses.

6.Reimburse yourself for expenses. If you’ve paid for any business expenses out of your personal pocket, be sure to have your corporation reimburse you for these. You won’t face tax on the amounts.

The Canadian Press

What Happens If You Pay Taxes Late

Throughout the year, you must make estimated tax payments to the IRS, either from automatically withholding them from your paycheck or by manually paying them . When you file your tax return, you’ll discover whether your estimated tax payments were enough to cover what you should’ve paid, or if you paid too much. The former results in a tax bill, and the latter results in a refund.

If you owe taxes, you can make a payment as soon as you’re ready. But if you don’t make a payment, the IRS will send you a notice. And if don’t pay that bill, you’ll receive at least one more notice.

In the meantime, the unpaid taxes will start accruing both penalties and interest. Interest starts accruing on the due date stated on the notice, compounding daily to the unpaid balance. The interest rate has hovered between 3% and 5% in recent years currently, it is 5%. That means if you owe $1,000, you’ll be charged a little more than $4 per month for every month you’re late paying your taxes.

You’ll also pay penalties in addition to the interest. Failure-to-pay penalties are 0.5% per month, up to a maximum off 25%, of the unpaid balance.

If you continue avoid paying your tax bill, the unpaid amount could come out of future tax refunds if you’re owed any. Beyond that, the IRS can place a lien on your property and assets. The lien could later become a levy, which means the IRS will seize your property to pay your bill.

Read Also: How To Write Off Miles For Doordash

Is It Possible To Pay Nothing In Taxes

A tax deduction works by lowering your taxable income, so you pay less in taxes. If you want to avoid paying taxes, youll need to make your tax deductions equal to or greater than your income. For example, using the case where the IRS interactive tax assistant calculated a standard tax deduction of $24,800 if you and your spouse earned $24,000 that tax year, you will pay nothing in taxes. Remember this refers to federal taxes you may be subject to local and state taxes.

If the deductions you qualify for arent enough to completely eliminate your tax bill, youll need to plan on making less money the following year. Dont think that moving outside of the U.S. will help you avoid paying taxes according to the IRS, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live.

Its always best to consult with a tax professional who can help you reduce or eliminate your tax bill without getting in trouble for tax fraud.

Cats Can Be Worth Big Money

The cost of caring for the cats began to mount for Van Dusen, so when she filed her 2004 tax return, she tried to write off $12,068 for cat-rescue items like food, vet bills, paper towels and more. After the IRS informed her that those expenses counted as personal ones and she couldnt deduct them, she sued the IRS. Following a long battle, Van Dusen proved her cat care was charity, resulting in the IRS finally granting deductions for most of her claims.

Read Also: How Do Doordash Taxes Work

‘currently Not Collectible’ Status

If you can’t pay your taxes and your living expenses, within reason, you can ask the IRS to put your account in whats called “Currently Not Collectible” status. You need to request this delay in collection, and the IRS may ask you to complete a Collection Information Statement to prove your finances are as bad as you say they are. You’ll need to supply information about your monthly income and expenses on that form.

Here are some things to know about this form of tax relief:

-

It’s temporary the IRS may review your income annually to see if your financial situation has improved.

-

Being deemed “Currently Not Collectible” doesn’t make your tax debt go away.

-

The IRS can still file a tax lien against you.

|

Pricing: $49.99 to $109.99, plus state costs. Free version? Yes. |

What If I Owe New Back Taxes

Lets say you filed taxes in 2020 and turns out you owe. What happens if you are currently in an IRS hardship program? In that case, the new taxes will not be automatically included in the IRS hardship status. The IRS treats each new tax year separately. Therefore, your 2010 taxes will be treated completely differently from your 2021 taxes. In other words, the IRS can still pursue you for the new 2020 taxes, but not the 2010 taxes. Should you find yourself in a situation like this, its often recommended that you pay off the new taxes. If you are unable to pay your new taxes, you can also place them in the IRS hardship program. However, it can be difficult to do this if every year you owe taxes.

Read Also: Do I Have To File Taxes For Doordash

What Do Tax Topic 152 Tax Topic 151 And Irs Error Messages Mean

Although the IRS’ Where’s My Refund tool will generally show one of the three main statuses — Received, Approved or Sent — for your refund, there are a wide variety of messages and notices that some users may see.

One of the most common is Tax Topic 152, a generic message indicating that you’re likely getting a refund, but it hasn’t been approved or sent yet. The notice simply links out to an informational topic page on the IRS FAQ website explaining the types and timing of tax refunds.

During the 2022 tax season, many Reddit tax filers who filed early received the Tax Topic 152 notice from the Where’s My Refund tool accompanied by a worrisome message: “We apologize, but your return processing has been delayed beyond the normal time frame. You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible.”

The purported delay could be an automated message designed for taxpayers claiming the child tax credit or earned income tax credit. Due to additional fraud protection steps, the earliest filers with those credits can receive their refunds will be March 1. Several Reddit users commented that the message eventually cleared and they received notifications their refunds were sent.

Other Consequences For Paying Taxes Late

If you don’t pay taxes, sometimes the IRS will summon you to a local office to confirm your information. You may be asked to bring your tax documentation and file a tax return in person.

If you owe at least $51,000, the government won’t issue you a passport or renew your passport.

In some cases, the IRS may transfer your account to a private collections company. While nobody likes dealing with government bureaucracy, collections companies are typically much more unpleasant to work with and use far more aggressive tactics to get you to pay up.

Read Also: Florida Transfer Tax Refinance

Drunken Driver Turns Dui Into Tax Deduction

Some people have all the luck or incredible persistence. Justin Rohrs managed to slide his truck off an embankment in 2005, only to be slapped with a DUI for driving intoxicated. Despite the circumstance under which his car was damaged, he decided to file an insurance claim for his truck for $33,629. After his insurer denied his claim, he attempted to claim his vehicle loss as a tax deduction.

At first, the IRS wasnt having any of it. Rohrs took the matter to the U.S. Tax Court, claiming that he deserved a casualty loss deduction for his damaged truck. Shockingly, the judge agreed and allowed him to take the deduction.

Will I Go To Jail For Tax Evasion

Although the law allows for it, the IRS generally doesn’t prosecute tax evasion. Many people who go to jail for tax evasion owed hundreds of thousands or millions of dollars in back taxes. Others intentionally filed fraudulent returns, or committed other tax crimes like hiring undocumented laborers to work “under the table.”

There is no statute of limitations on tax fraud, but if you weren’t operating a crime ring or underreporting your income, then you’ve simply made the same mistake thousands of Americans make every year.

Taxes can be a frustrating part of civil society, and it’s easy to make a mistake when dealing with large numbers and confusing math â just let the IRS know, and you’ll probably be safe from prison.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

Also Check: Taxes On Doordash