Paying The Dreaded Ol’ Self

The self-employment tax is your Medicare and Social Security tax which totals 15.30%.

Dashers will not have their income withheld by the company to pay for these taxes, so you’ll need to pay them on your own. If you earn more than $400 as a freelancer, you must pay self-employed taxes.

If earnings were less than $400 in profit, they do not owe self-employment taxes but contractors must still file income taxes.

It is important to go through each form to spot wrong information like how much you earned. After you check your bank information and calculate all the deposits, if it is wrong on the 1099, contact DoorDash immediately.

You can use Bonsai’s free online 1099 tax calculator to see how much you’ll owe in taxes.

Why Does This Doordash Tax Calculator Measure Tax Impact

The bottom line is, your tax situation is unique. It’s probably different than it was last year.

I’ll give you my own example. My wife and I each brought five kids into our marriage. EACH. Insane, right? At the time, nine were still living with us . They’ve all grown up now, but you can imagine what we were thinking when the new $3,000 child tax credit was passed. That sure would have come in handy back in the day.

But that’s the thing. Claiming that many kids is a lot different than not claiming any. Being single is a lot different than married with kids. Delivering for Doordash, Grubhub, Uber Eats and others as a full time business is a lot different than doing this as a side hustle on top of a full time job.

There are so many factors that it’s really not possible to try to measure all of those things without overcomplicating things. Many of those factors are related to personal deductions and tax credits.

Instead of getting into the weeds of all those credits, deductions, and adjustments, I decided to create something that asks a very simple question:

How will my Doordash earnings impact my tax liability?

Doordash Taxes Schedule C Faqs For Dashers

Suppose you make an income with food delivery apps like DoorDash, UberEats, etc., that makes you an independent contractor. Because of this, the platforms will not deduct taxes from your pay. It means that you are responsible for paying your taxes. Its always wise to set aside a portion of your earnings for taxes. The form youll use to file taxes will not be a W-2 but a 1099 form. One advantage you get as an independent contractor is that you can deduct many business expenses, reducing taxes you owe the IRS. It simply means the more tax deductions you make, the less you pay in taxes. One of the most popular food delivery brands today is DoorDash. This article provides answers to some of the most frequently asked questions about DoorDash taxes. Lets begin.

You May Like: How To Calculate Quarterly Taxes

So Why Does Doordash Not Withhold Our Taxes

You would think it would make sense.

Eventually, the government may step in and force some way for Doordash and other food delivery apps to take money out for you. With more and more people joining the gig economy, it’s a possibility.

However, it’s just that it’s not all that easy.

That’s because as Doordash contractors we are technically taxed like a business. We’re taxed on profits, not the money we are paid. That’s what makes it complicated.

If you and I both received $10,000 from Doordash, that doesn’t mean we have the same taxable income. I could have $8,000 taxable income and you could have zero.

Why such a difference? Because my business expenses could be a lot lower. This is especially true when you consider the 57.5¢ per mile mileage deduction. If I’m driving only 3500 miles for that $10,000, and you’re driving 18,000 miles, my taxable income is closer to $8k and yours is at zero.

So how is Doordash or anyone to know what to deduct?

And that’s why we’re on our own.

Doordash Driver Earnings By Location

The employment site, ZipRecruiter, found that DoorDash delivery drivers who work in the following cities earn the most, on average.

- San Mateo, CA: $21.67 per hour

- Berkeley, CA: $20.94 per hour

- Daly City, CA: $20.88 per hour

- Richmond, CA: $20.33 per hour

- Stamford, CT: $19.80 per hour

- Bellevue, WA: $19.74 per hour

- San Francisco, CA: $19.57 per hour

- Brooklyn, NY: $19.44 per hour

- Lakes, AK: $19.36 per hour

- Knik-Fairview, AK: $19.33 per hour

Recommended Reading: How To Read My Tax Return

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case; often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

What’s The Difference Between Gross Earnings And Net Profits

Gross earnings refers to the money youve received from Doordash for your independent contractor work including fees and fares, bonuses and incentives, referral fees and tips. Gross refers to the total money coming in. This is in reference to gig delivery work. It gets a bit more complicated for businesses that buy and resell or manufacture items, as cost of goods sold is a factor as well.

Your taxable income as an independent contractor is your net profit. This is the amount thats left over after you deduct your business expenses. Your gross income minus your expenses is your net profit. That net profit is what you record as part of your overall income on your tax form.

Also Check: Are Taxes Due By Midnight May 17

Understanding How The Tax Process Works And How Your Doordash Income Fits Into It

Now that you know the two taxes involved in your Federal tax filing , let’s look at how it all works as part of figuring out the tax bill.

There are four major steps to figuring out your income taxes:

- Add up all of your income from all sources.

- Reduce income by applying deductions.

- Calculate your income tax and self-employment tax bill.

- Apply previous payments and credits to the tax bill and figure out if you pay in or get a refund.

There are a lot of nuanced details to this, but it pretty well describes what you’re doing when you fill out your taxes.

What Happens If You Dont Pay 1099 Taxes

Generally, you can expect the IRS to impose a late payment penalty of 0.5 percent per month or partial month that late taxes remain unpaid. If the 1099 income you forget to include on your return results in a substantial understatement of your tax bill, the penalty increases to 20 percent, which accrues immediately.

Also Check: How To Pay Back Taxes Online

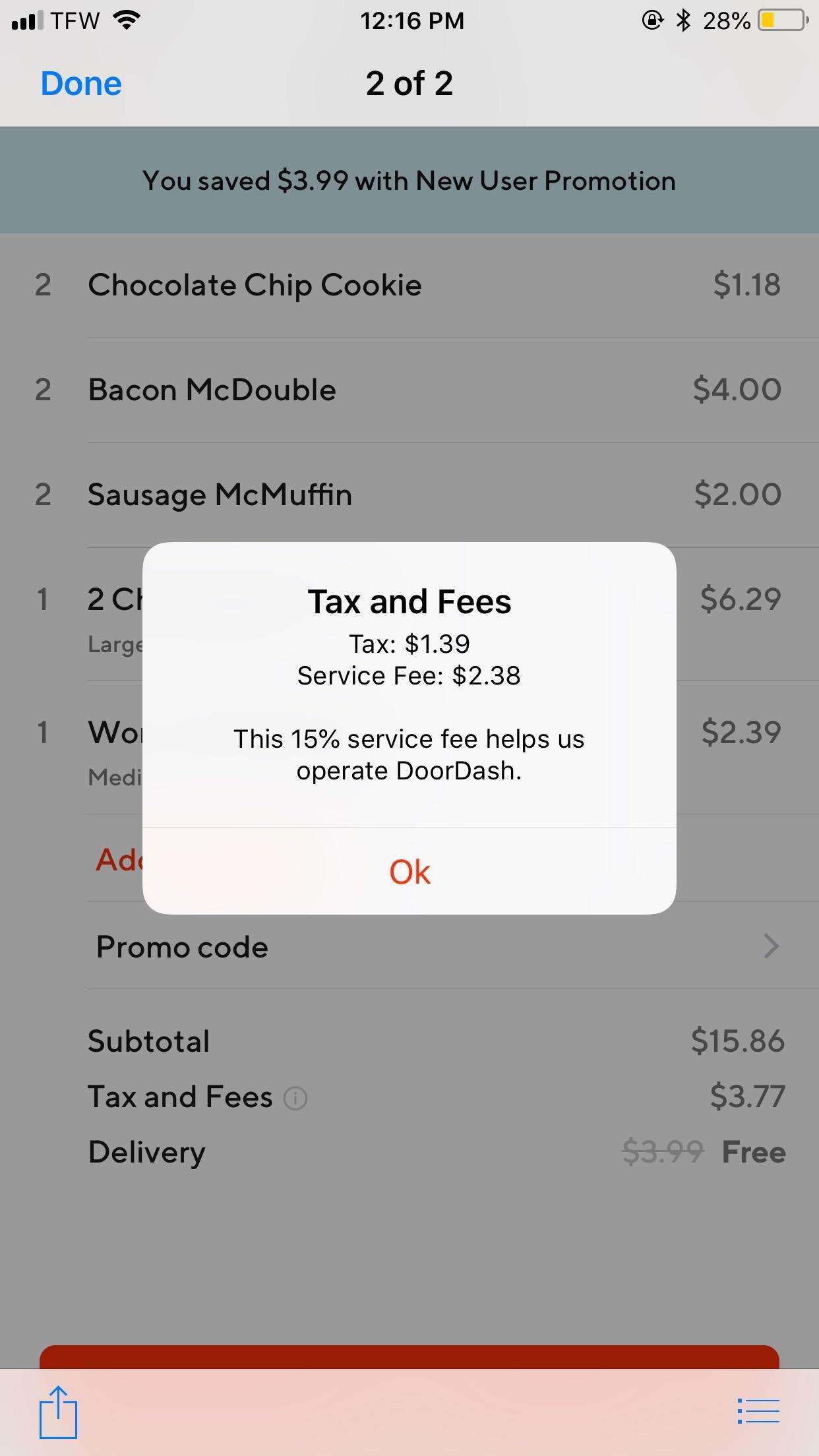

How Does Doordash Make Money On Free Delivery

Deliveries are fulfilled by DoorDashs own team of hired drivers, known as Dashers. The startup also takes a commission fee, usually of 20%, from restaurants for every order. According to Vator, Delivery Hero charges between 10% to 11% on each order, while GrubHub is said to take a 13.5% cut on average.

When You Will Receive A 1099

The majority of DoorDash personal delivery drivers will get this tax form for non-employee compensation. You’ll get a form from Doordash’s partners, Stripe and Payable.

The requirement to receive this form is if you earned more than $600 in the tax year for your services, youâll be sent a 1099-NEC form.

In 2020, the IRS has mandated that DoorDash report Dasher income on the new Form 1099-NEC rather than the Form 1099-MISC.

If you didnât select a delivery method on your account, DoorDash automatically mails and emails your 1099-NEC to the address on file by February 1.

Payable sent out the invitations to file online between January 9th and January 12th in 2020. Through your Payable account online, you can set the delivery preference.

The total earnings or payment information listed on this form do not account for your cash tips, but you’ll still need to report that.

Recommended Reading: How To Calculate Net Income After Taxes

Breakdown Of The Actual Expense Method

The actual expense method requires contractors to keep detailed records of their receipts for business-related expenses.

This method will allow you to deduct expenses like gasoline, car repairs, insurance, tire replacements, licenses and registration fees, etc.

Typically, tracking your receipts will result in a higher tax break. Calculate your tax deduction for both methods for yourself to see which one you give you the bigger write-off.

This Is Not Tax Advice

Understand that this is not professional or legal or any kind of tax advice. You should seek out your own tax professional if you need advice directly related to your individual situation.

In fact, if I were to give out any advice at all here, it’s exactly that: Get a tax pro. If you’re not real sure how things work with your taxes, it’s so easy to miss so many things. Find a good tax person who understands how it works for a 1099 contract worker and for the self-employed. You’ll find it’s worth the extra money.

I’ll repeat myself: this is not to provide tax advice. It’s to educate and inform. This is part of my series of articles on Doordash taxes. The purpose here is to provide the information to help you understand how taxes work. It is designed to give you an idea what to expect, and why things are like they are.

If you’re armed with knowledge, you’re better prepared for what comes at the end of the year. You have an idea whether you need to save each quarter.

Going forward, we’ll talk about the Doordash tax calculator. We’ll explain why we’re doing things this way and what this calculator will provide. The calculator won’t tell you will owe or if you’ll get a refund as a contractor for Doordash, Uber Eats, Grubhub, Instacart or others. But it will help you get a feel for how your income from those apps will affect your final tax bill.

Recommended Reading: Can I Pay Quarterly Taxes Online

What About Medical Insurance

You’re on your own. If you don’t have a primary job, you can find more details about health insurance for self-employed here.

DoorDash will send you announcements about partnerships with healthcare providers, but it is likely that you will get better pricing on your own. Shop around and find the best plan for you if you intend to be in the self-employed gig economy for a while.

Withholding And Tax Day

I mentioned that technically the tax bill is due the next year. As I write this, it’s 2020. Unless the government changes things around like they did this year, on April 15 next year your taxes for this year are due. .

You sit down, you figure out what you made. Then you sit down and figure out what your tax bill is. And then you pay the bill.

If you had to pay it all at once, that could become quite a shock. That’s part of why they take the money out early.

So now, essentially what’s happening when you figure out your taxes is this: You figure out your tax bill. You add up what you already paid for that bill, and add in whatever credits you might get to those payments.

If the total of payments and credits is less than the tax bill, you owe money. If the payments and credits end up being more than the tax bill. you get a refund.

We’ve gotten so used to that system that we’re often not even aware of our taxes. We don’t notice the money coming out of our pockets because it never got to our pockets in the first place.

And even on tax day, we usually don’t pay much attention to how much tax we are actually paying. All we care about is, how much was our refund or how much do we have to pay in?

Read Also: What Form Do I Need To File My Taxes Late

How Can I Change The Way I Will Receive My Doordash 1099

You can change the delivery preference any time up to one week before the due-date by using the payable app orfrom any browser. Follow our step by step tutorial:

Laws Havent Caught Up With The Gig Economy

The tax codes governing food delivery apps like Grubhub, DoorDash, and Postmates vary significantly state by state, and they are changing as local governments grapple with how to adapt old laws to the new gig economy.

Generally, some laws in states like California and New York have provisions that could call for sales taxes on delivery and service fees to be collected, according to Scott Groberski, a managing director in state and local tax groups at accounting and tax firm Grant Thornton. Still, its very much a gray area and would vary based on the specifics of the contracts between restaurants and food delivery providers.

With new technology, its extremely complicated determining whats taxable and whats not I think this is something that continues to evolve even as we speak, Groberski told Recode.

In California, for example, it depends if the company contracts with restaurants to provide a delivery service only or if it acts as a retailer of the food, according to Casey Wells at the California Department of Tax and Fee Administration.

Whether or not a food delivery app company is a retailer depends on the contracts it has with restaurants, Wells said, as well as if the app is marking up the price the restaurant normally charges for the food.

Wells declined to comment on whether or not the law would classify specific companies like DoorDash or Grubhub as retailers or not.

DoorDash declined to comment.

Recommended Reading: Does California Have An Inheritance Tax

How Do Taxes Work On Doordash

Keep in mind: DoorDash does not automatically withhold taxes. We calculate the subtotal of your earnings based on the date the earnings were deposited. The subtotal is not based on the date you completed the dash.

Do you get a 1099 from DoorDash? All Dashers who earn $600 or more within a calendar year will receive a 1099-NEC via Doordashs partnerships with Stripe and Payable.com. The 1099-NEC is used to report direct payment of $600 or more from a company for your services.

How much do you pay in taxes for DoorDash?

Do you have to pay back taxes for DoorDash? Disclaimer: As an independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. DoorDash does not provide a breakdown of your total earnings between base pay, tips, pay boosts, milestones, etc. Keep in mind: DoorDash does not automatically withhold taxes.

Does DoorDash report to IRS? Beginning with the 2020 tax year, the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC. Can I change my election for delivery preference? You can update your delivery preference for the 2021 tax season directly in your Payable account.

How You Can Earn Way More Than Average

While most people earn just a little extra cash driving for DoorDash, some drivers earn $40 or more per hour. Heres how they report to do it.

- Only accept large orders- DoorDash ranks you on your acceptance rate, but they wont stop you from driving without a warning first. Feel free to be picky about your orders, and find the largest orders. DoorDash customers tip based on a percentage system, so you want the biggest orders possible.

- Avoid high traffic areas- Traffic slows you down, and it makes parking nearly impossible. Try to avoid orders from the heart of downtown where its tough to figure out where to meet someone. You never want to pay for parking, because that will eat most of your profits.

- Drive during peak activity- Lunchtime and dinnertime offer great opportunities for Dashers. Dont bother working if nobody is ordering.

- Use multiple apps- Successful gig economy workers dont rely on a single app for their income. Become certified as an Uber, UberEats, Lyft, and DoorDash driver, so you can guarantee work any time.

There’s also a great DoorDash Reddit where you can learn from and find tips and tricks from other DoorDash drivers:;

You can also learn some things to avoid as well!

Don’t Miss: Where Do I Find My Tax Id Number

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.